Darren Krett

Sunday 3 March 2024

Option plays for GitHub (GTLB) earnings and beyond

0

Comments (0)

Darren Krett

Tuesday 2 April 2024

Share on:

Post views: 12957

Categories

Blog

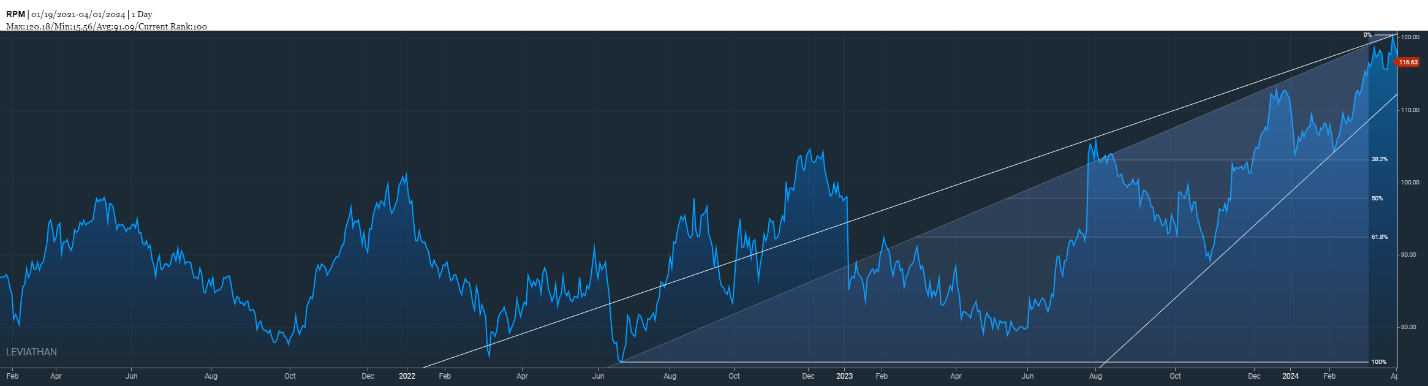

Full disclosure, I don’t know too much about RPM but I also don’t care… it doesn’t really matter what my view on the stock actually is, I can look at the chart and remain completely agnostic as to the prospects of this firm. The object here is to find the BEST risk/reward option trades if I am either bullish or bearish.

In this case , it does look a little tired and could quite easily retrace some of this rise, so I am tilting towards a bearish strategy targeting between the 50% & 38.2% FIB retracement area that comes in around $99

Giving this one a bit more time too and focusing on an August expiration to get there

Giving this one a bit more time too and focusing on an August expiration to get there

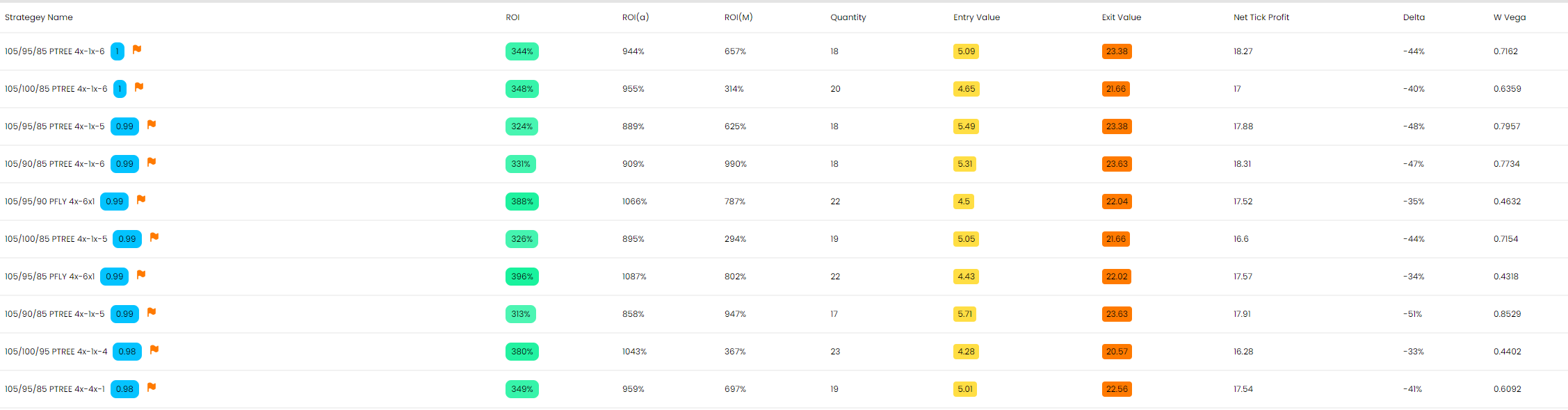

BB1’s initial list has a lot of put trees in there

BB1’s initial list has a lot of put trees in there

I am going to avoid these, given that it isn’t a closed off strategy. I want to KNOW what I can lose.

I am going to avoid these, given that it isn’t a closed off strategy. I want to KNOW what I can lose.

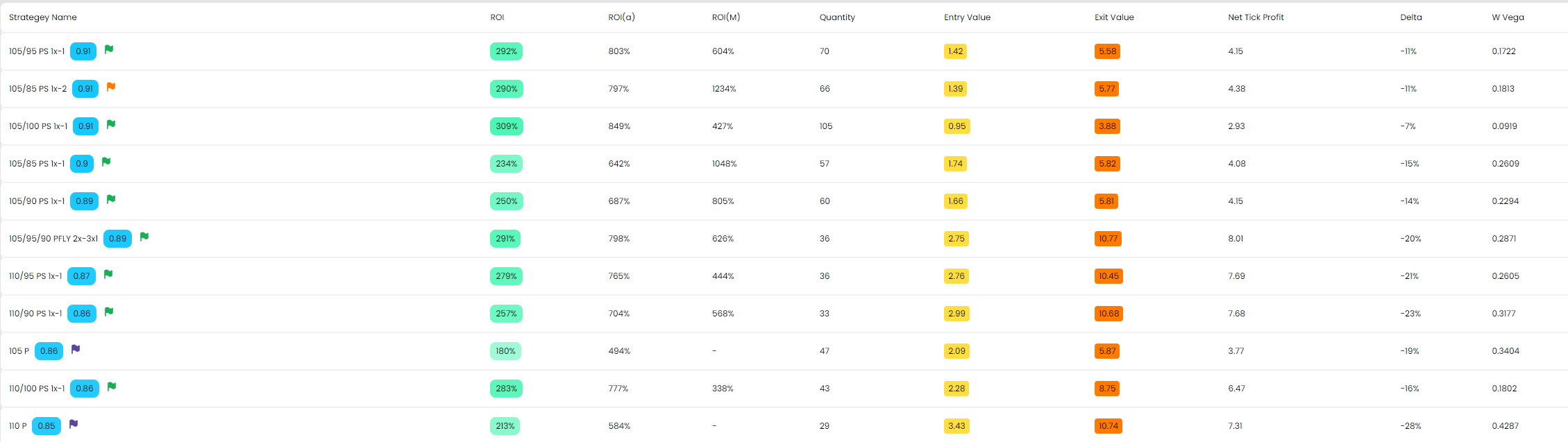

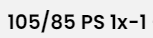

On the vanilla list I much prefer some of the ones on here….specifically this particular put spread (bear spread)

On the vanilla list I much prefer some of the ones on here….specifically this particular put spread (bear spread)

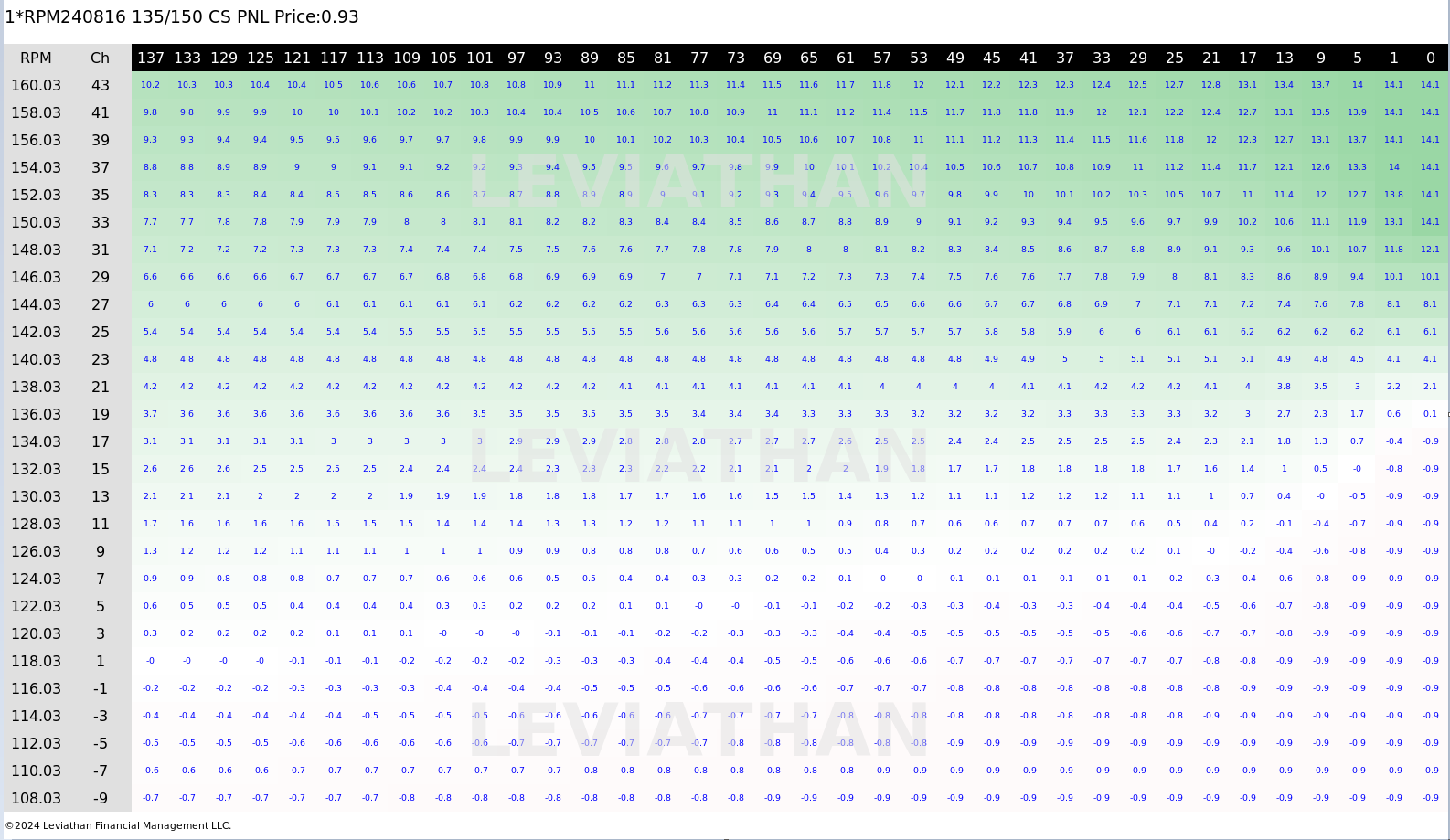

If you have read any of my other “bits” then you’ll know we don’t look to run these trades to expiration, so the analysis looks to be out (in this case) at least a week before expiry, more likely a lot earlier.

If you have read any of my other “bits” then you’ll know we don’t look to run these trades to expiration, so the analysis looks to be out (in this case) at least a week before expiry, more likely a lot earlier.

Just love how quickly it monetizes on the downside and if you can get in for $1.50 then it’s a great downside play…

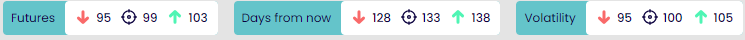

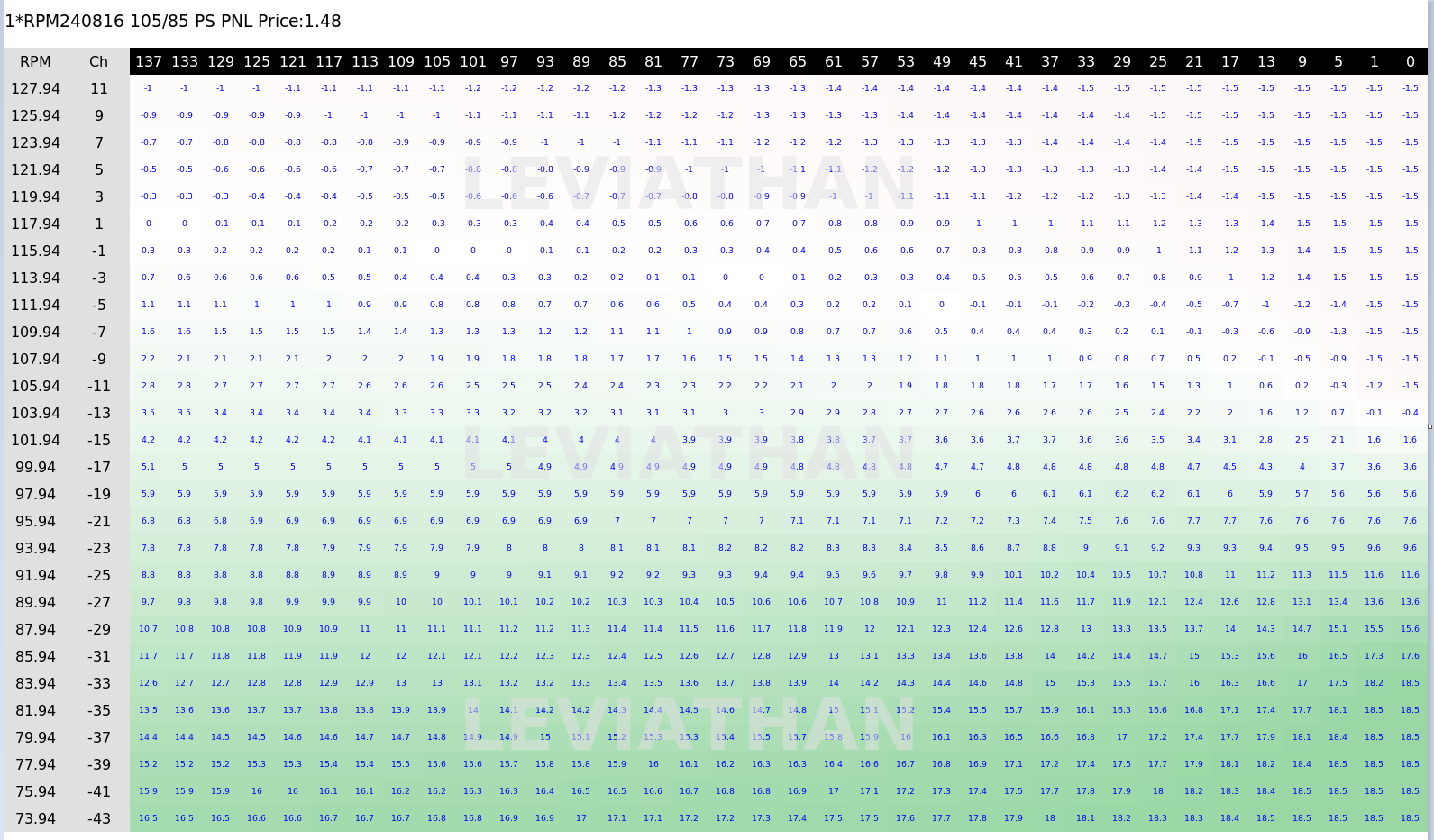

r/options - Option plays for RPM International (RPM) earnings and beyond Not a huge amount built in for the release when the normal expected move is around $1.75 while $2.32 is built in for the report.

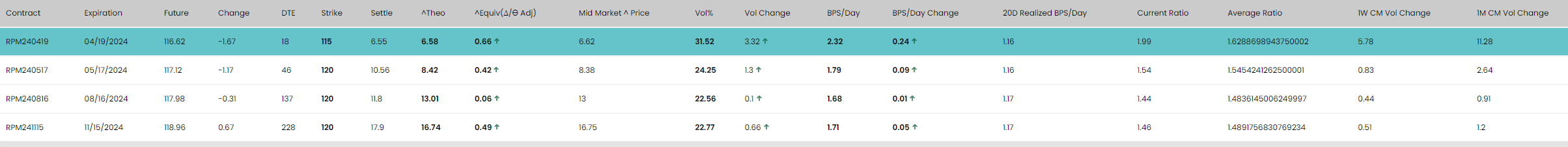

now the wings are very high though, even when comparing the 1 year average skewness at this point in the cycle, which is why the vertical spreads are looking so good to BB1.

now the wings are very high though, even when comparing the 1 year average skewness at this point in the cycle, which is why the vertical spreads are looking so good to BB1.

Now, what about the upside?

Targeting a $140 area and giving it the same amount of time as the bearish trade there are some cheap punts to be had.

Targeting a $140 area and giving it the same amount of time as the bearish trade there are some cheap punts to be had.

Now opting for a call spread (bull spread)

Now opting for a call spread (bull spread)

A lot of green here too and I want to get the widest strikes out of that list and this particular one at only 95 cents offers great value if that’s your view….

So, one bullish and one bearish trade….PICK ONE NOT BOTH! But Im afraid I will have to leave that choice to you.

And remember, it is always better to be lucky than good. Happy hunting everyone.

Darren Krett

Sunday 3 March 2024

0

Comments (0)

Darren Krett

Wednesday 20 March 2024

0

Comments (0)