Darren Krett

Wednesday 31 January 2024

Apple earnings option plays

0

Comments (0)

Darren Krett

Wednesday 20 March 2024

Share on:

Post views: 8939

Categories

Blog

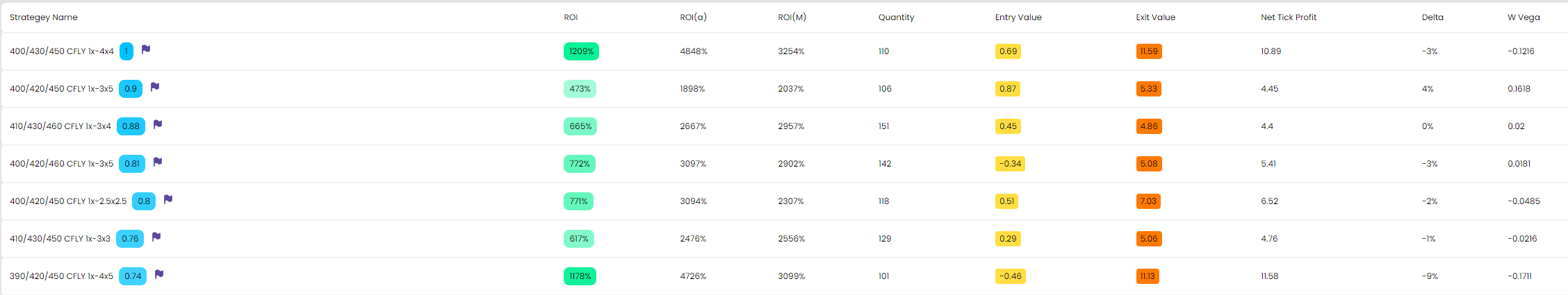

This afternoon I did start off with actually looking at NIKE but after running a BB1 on each I felt there were better opportunities here (if you want the NKE data the DM me and I will email it to you)

Kind of like the chart formation too here, break to the upside and it'll be a charge to the old highs, whereas a downmove should target the bottom of the channel.

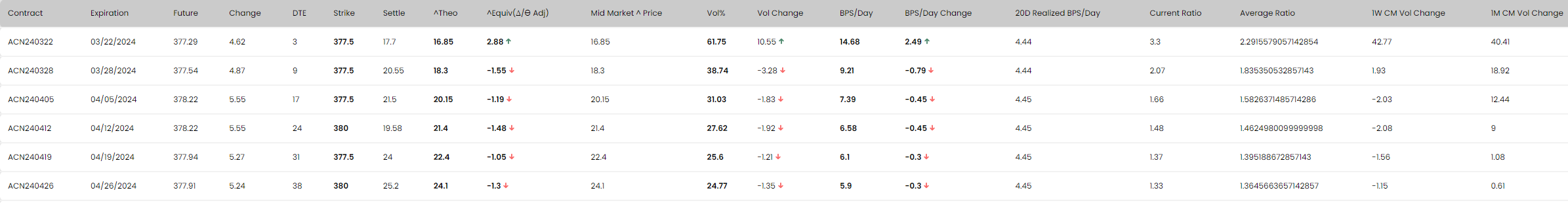

Starting off with the upside

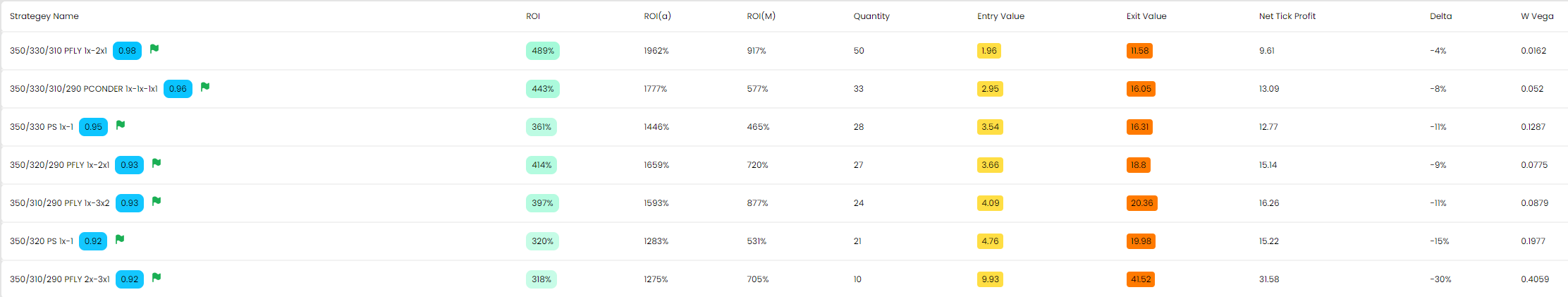

$415 area, while giving myself a fairly wide range to make money in and BB1 came up with the following;

$415 area, while giving myself a fairly wide range to make money in and BB1 came up with the following;

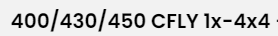

Now I really like that top trade. It is a bit of a funky ratio fly, but we are not going to look to hold it all the way, so we can mitigate the risk a bit by making sure we get out before we get even close to expiry (not that we ever look at trades to expiration when we do these evaluations anyway)

Now I really like that top trade. It is a bit of a funky ratio fly, but we are not going to look to hold it all the way, so we can mitigate the risk a bit by making sure we get out before we get even close to expiry (not that we ever look at trades to expiration when we do these evaluations anyway)

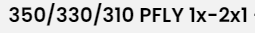

A lot of green on the heatmap and to get in at around 70 cents really limits our losses if the direction is wrong.

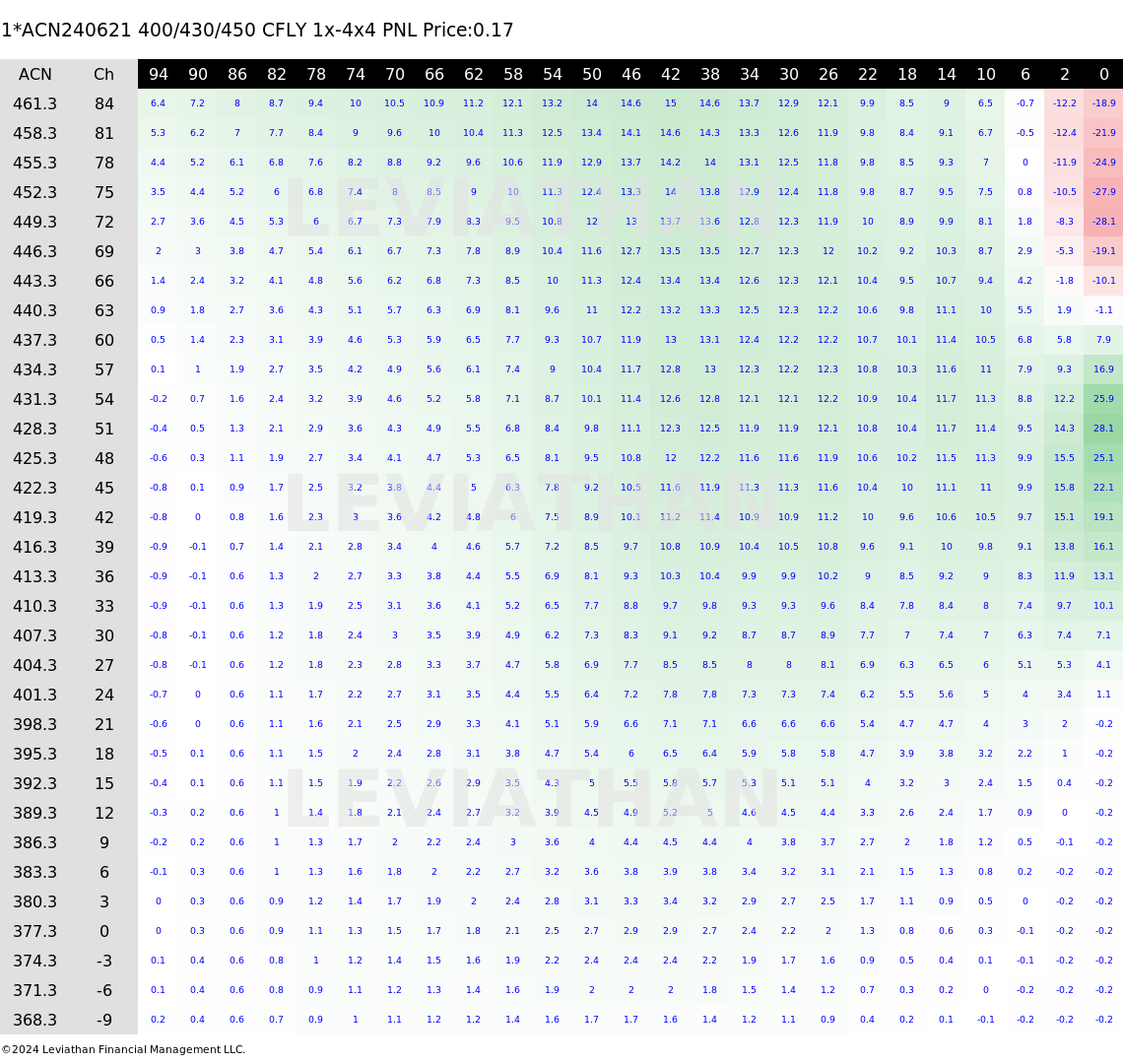

It is also right at the lowest point it has been on an RV basis for the last 2 years.

Now for the downside, looking at the bottom of the channel , which comes in around $329

It is also right at the lowest point it has been on an RV basis for the last 2 years.

Now for the downside, looking at the bottom of the channel , which comes in around $329

Just going with BB1's advice here and picking the put fly out. At well under $2 the returns here could be great

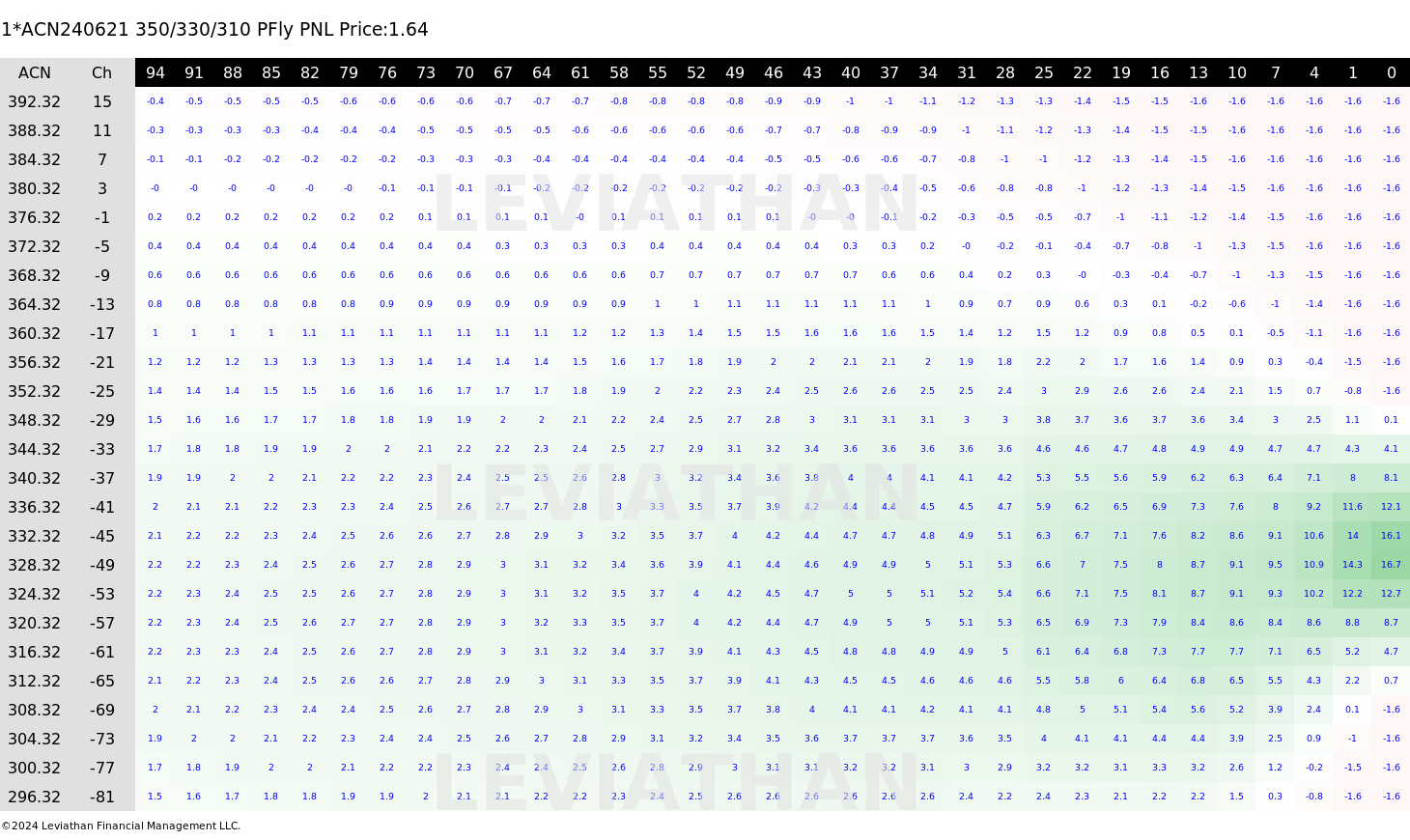

So the expected range tomorrow is $14.68 with the average being around $6.50ish

So choose a direction and then do one of these trades and as always, remember better to be lucky than good, happy hunting!

So choose a direction and then do one of these trades and as always, remember better to be lucky than good, happy hunting!

Darren Krett

Wednesday 31 January 2024

0

Comments (0)

Darren Krett

Sunday 3 March 2024

0

Comments (0)