Darren Krett

Tuesday 23 January 2024

OPTION PLAYS FOR TESLA EARNINGS

0

Comments (0)

Darren Krett

Tuesday 2 April 2024

Share on:

Post views: 10557

Categories

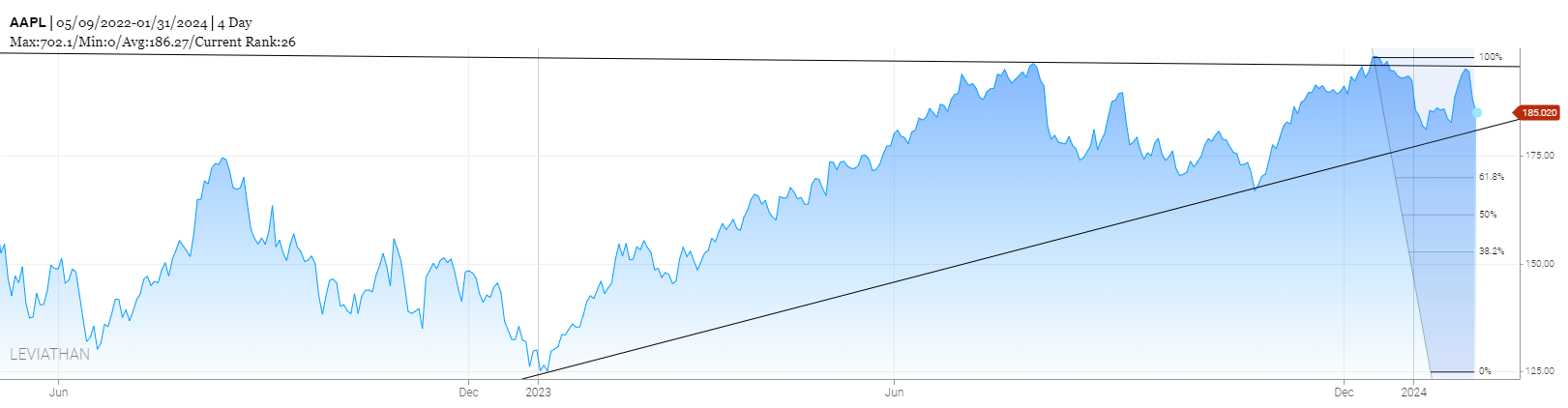

Blog

After Tesla sales plunged more than expected...well, TBH it doesn’t look too hot, from a technical perspective anyway. Currently a test of the low seen in April last year at around $152 is easily achievable, its whether it would follow through to retest that 2023 low at around $103

.

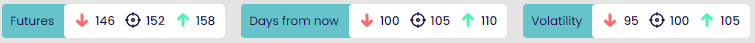

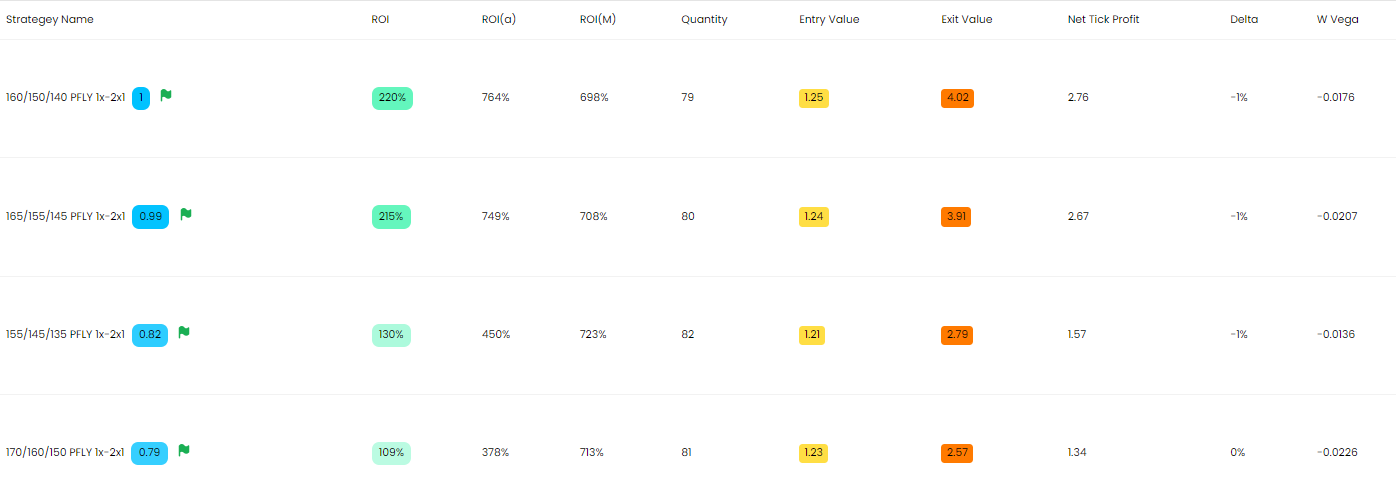

First looking more to a July expiry and looking and a fairly close target price, given the recent trend

BB1 generated a fairly small vanilla list for me, so may as well go with this one

160/150/140 put fly

160/150/140 put fly

With the upper strike here being pretty close to where we are , you are going to have to wait a bit to make money on this one

.

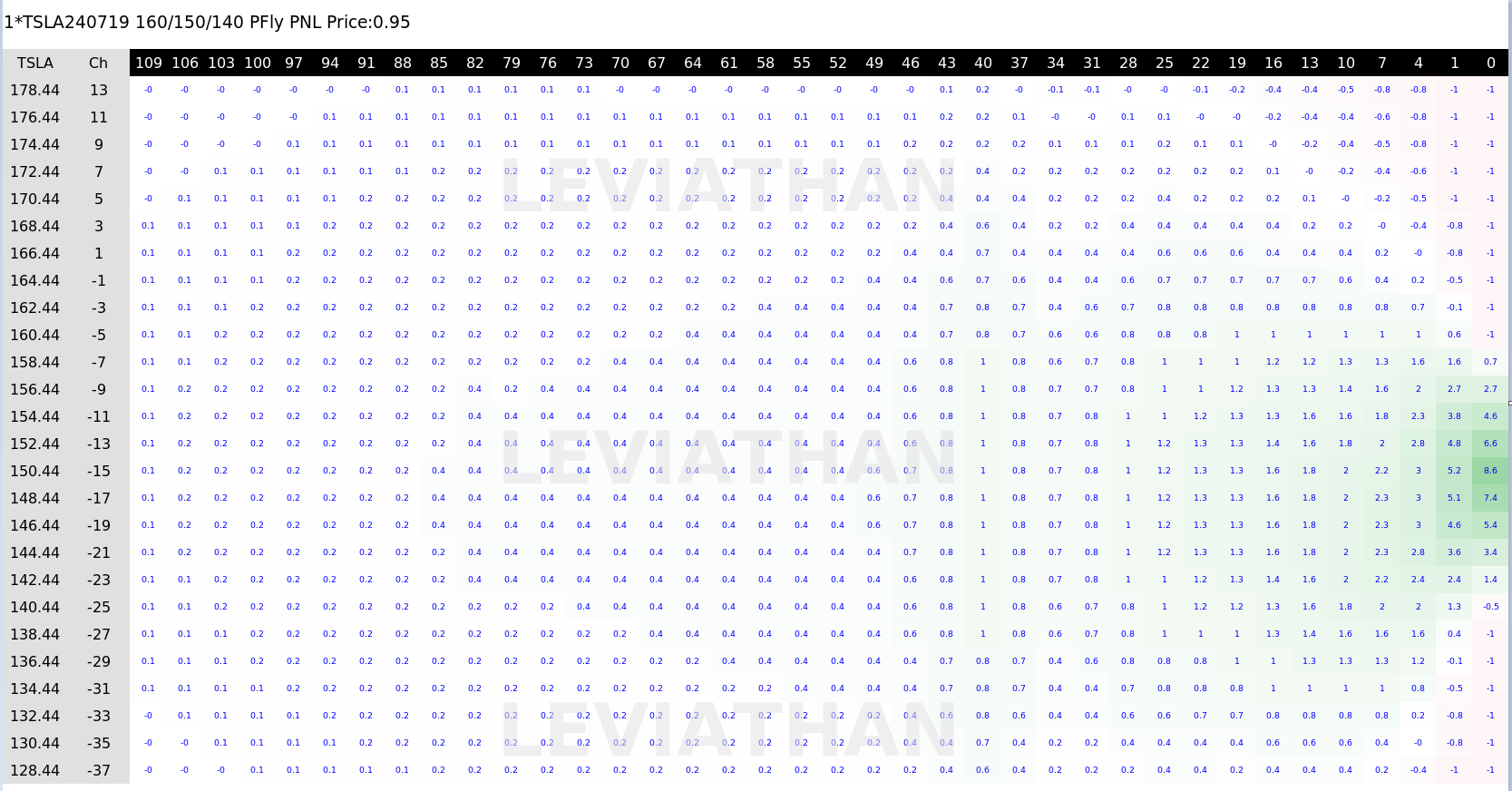

Going a little further out, 133 days and looking at the lower target there are some better returns to be had so I can give it a good or at least, better chance;

down to $103?

down to $103?

This is the new BB1 list and I am going to choose the put spread at the top of the list as I can buy more of it given we are evaluating as returns on every $1000 invested..it has all the good things going for it

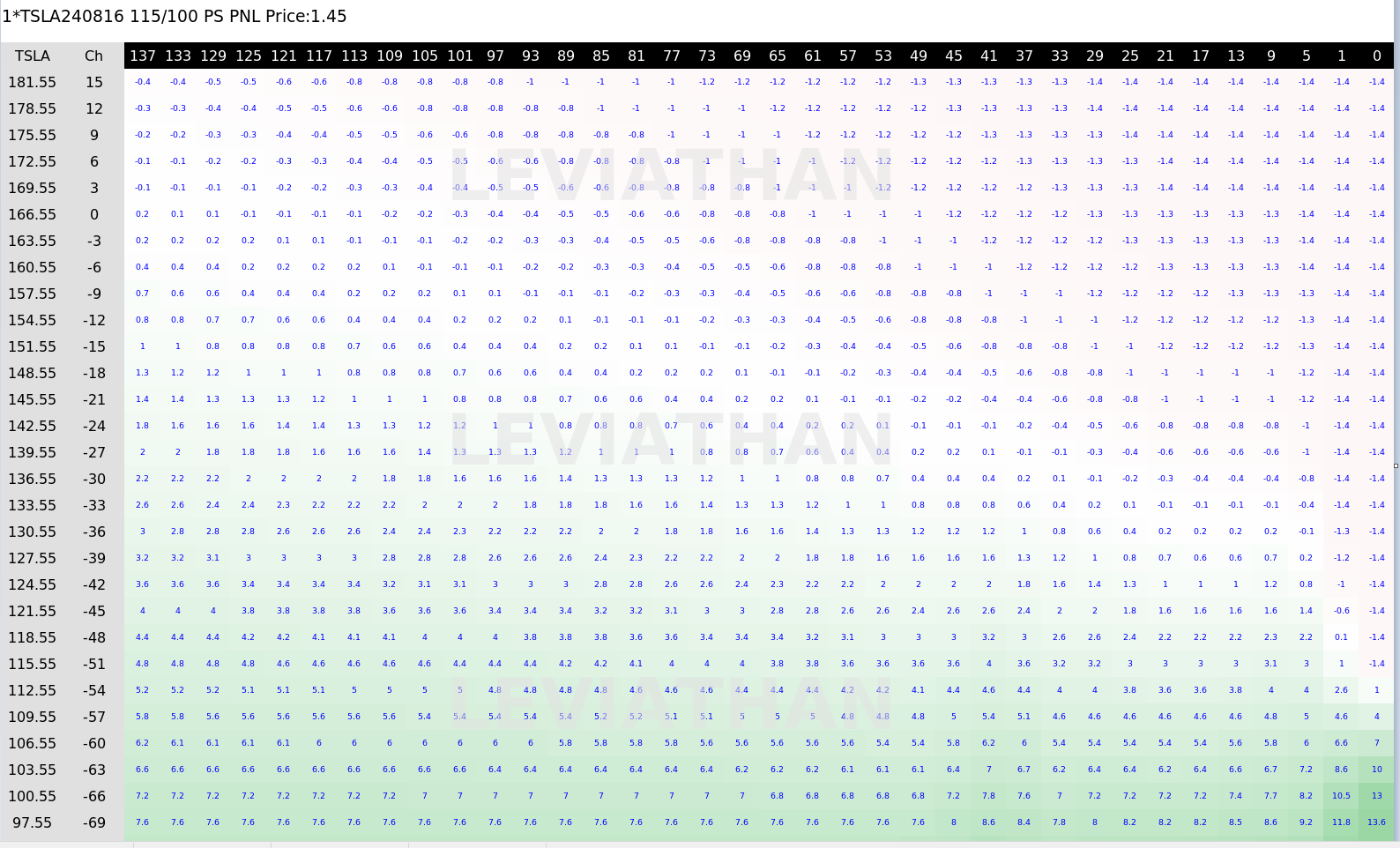

115/100 put (bear) spread

115/100 put (bear) spread

…I prefer this one purely because it has wider strikes than the first on the list and it also monetizes quickly , so I wont have to wait too long if my direction is right

.

Now given we are looking at a longer timeframe anyway , things can change, so lets look at the upside now.

The top of the range we have the trendline come in , currently at around $244 so lets look at this scenario

Well it is tempting me with some very good returns on this list, but I am again choosing the one that has the closest strike to where we are

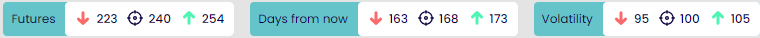

210/240/270 call fly

210/240/270 call fly

.

Now even though the closer we get to the target date and price , the more you’ll make, it still monetizes to the upside pretty quickly so could easily be a “double your money” type trade even if we just head towards $200…IF we go up that is

.

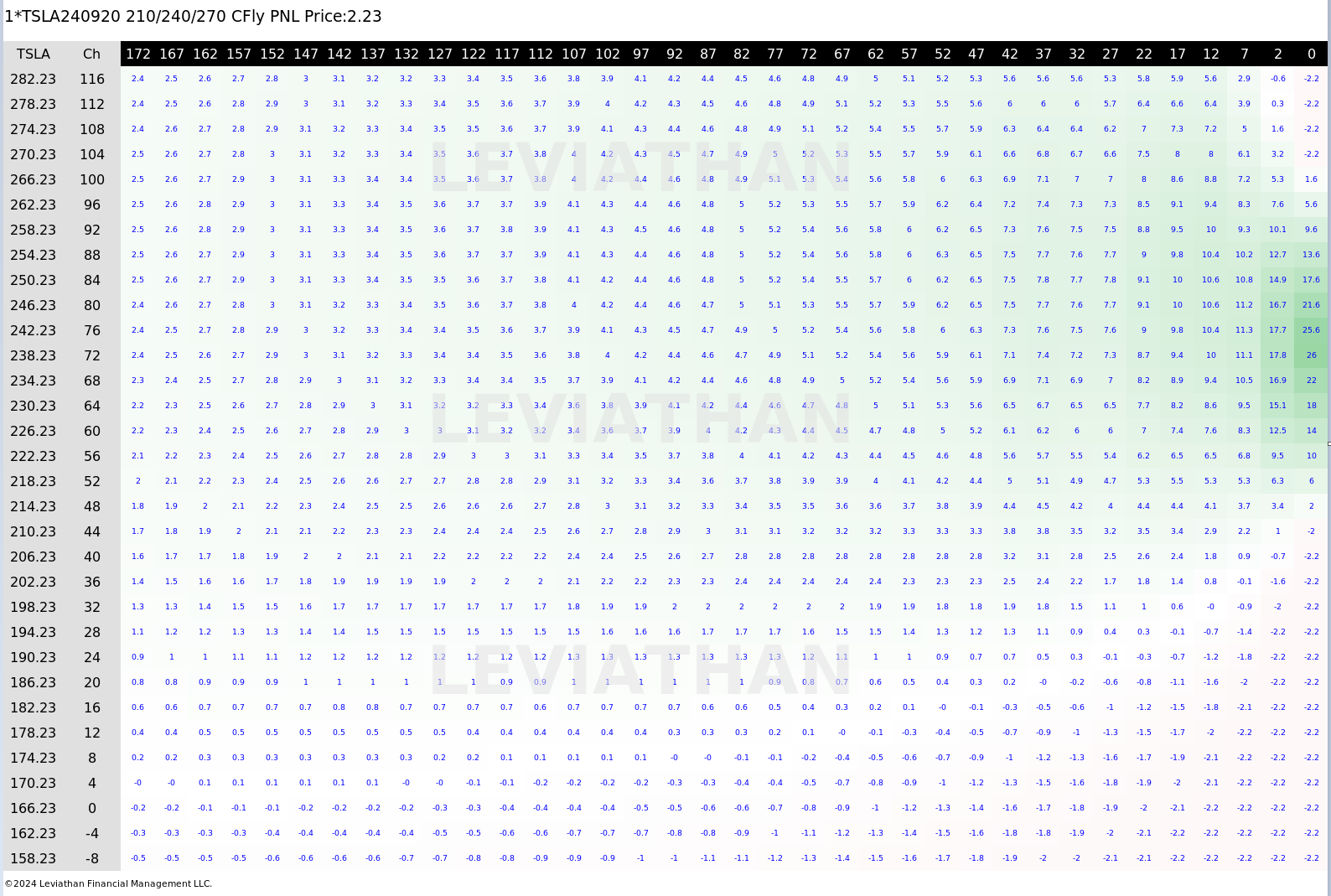

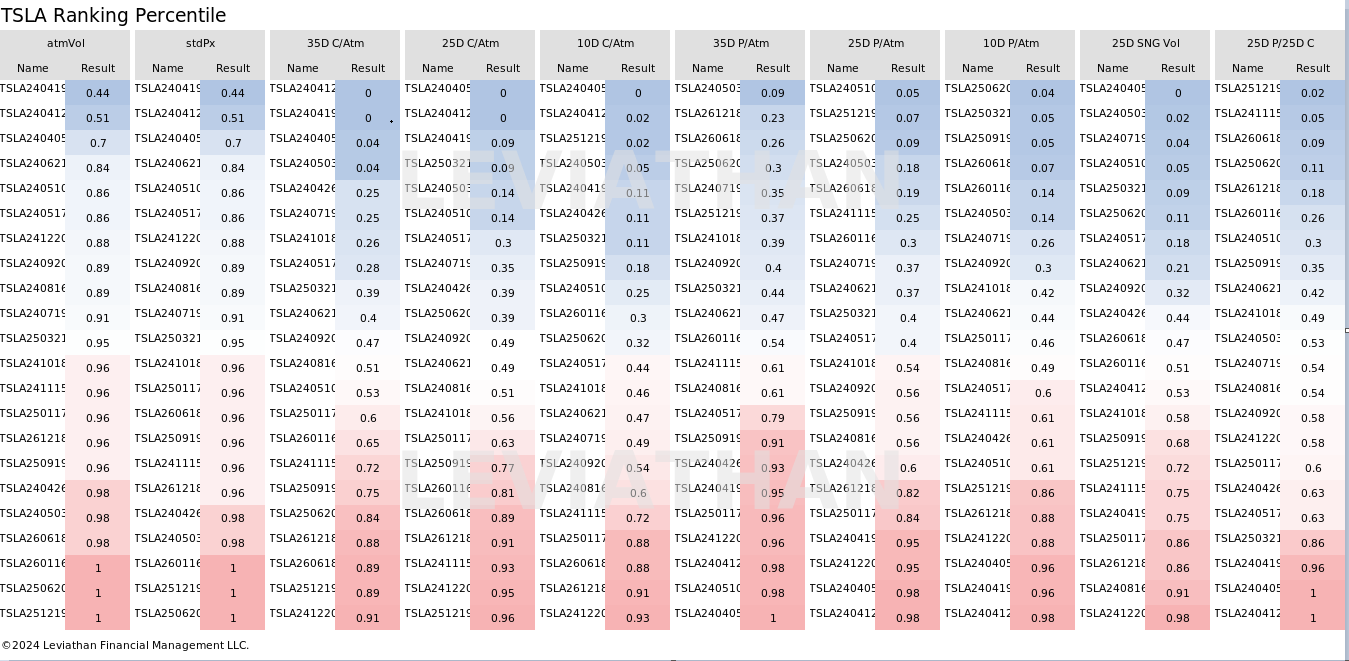

Seems to be a lot of call writing to cover long stock positions here

.

Seems to be a lot of call writing to cover long stock positions here

…

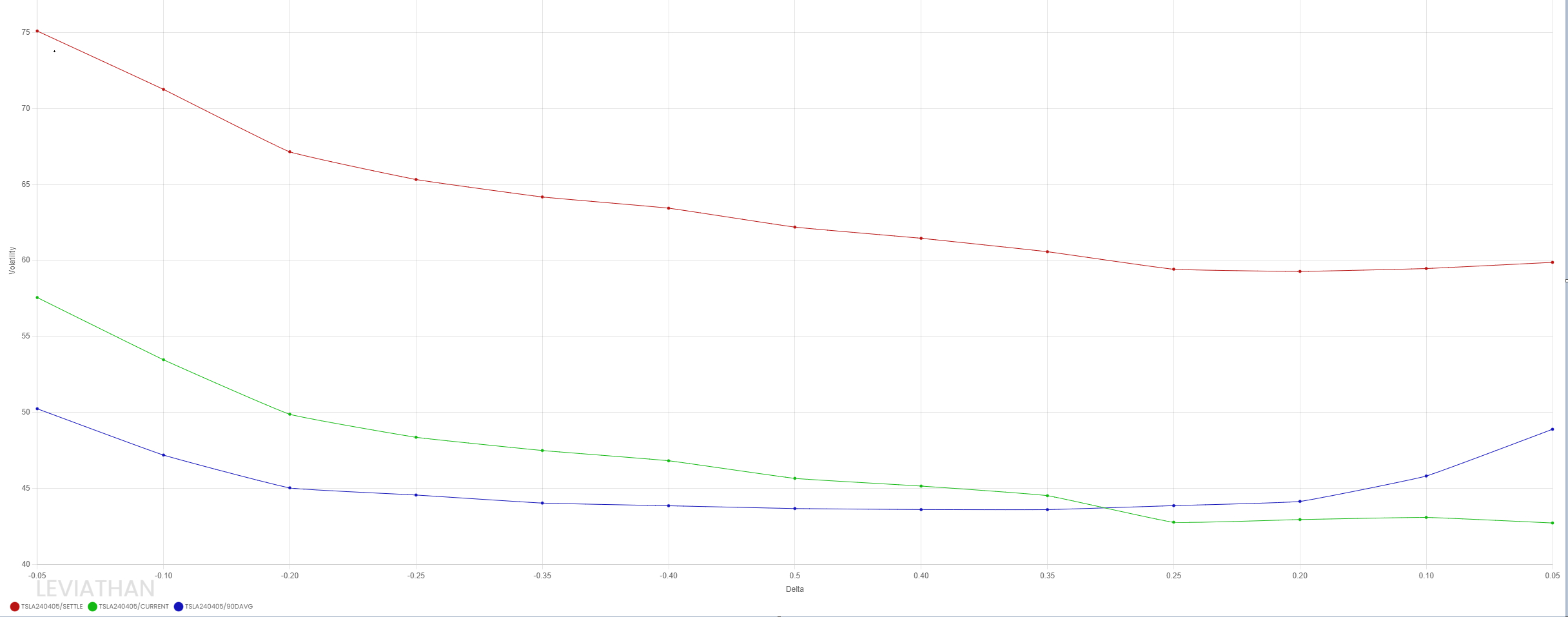

With the calls RV in there very low percentile, relative to the ATM, not too surprising given the recent moves…

…

With the calls RV in there very low percentile, relative to the ATM, not too surprising given the recent moves…

.

So there seems to be some downside risk here, so depending on how bearish you are, either of the 2 trades above can help to alleviate some of your risk and then while we are all in panic mode you can take advantage of a potential rebound with a limited risk.

As always, remember it is better to be lucky than good, happy hunting!

.

So there seems to be some downside risk here, so depending on how bearish you are, either of the 2 trades above can help to alleviate some of your risk and then while we are all in panic mode you can take advantage of a potential rebound with a limited risk.

As always, remember it is better to be lucky than good, happy hunting!

Darren Krett

Tuesday 23 January 2024

0

Comments (0)

Darren Krett

Wednesday 31 January 2024

0

Comments (0)