Darren Krett

Wednesday 31 January 2024

Apple earnings option plays

0

Comments (0)

Darren Krett

Sunday 3 March 2024

Share on:

Post views: 9080

Categories

Blog

Hi everyone,

To start off this week we have Gitlab. Now I quite like this formation and see no reason why the trend shouldn't continue to retest some of those old Fib levels

So I have decided to run 2 upside targets, the first, looking for a May expiration

So I have decided to run 2 upside targets, the first, looking for a May expiration

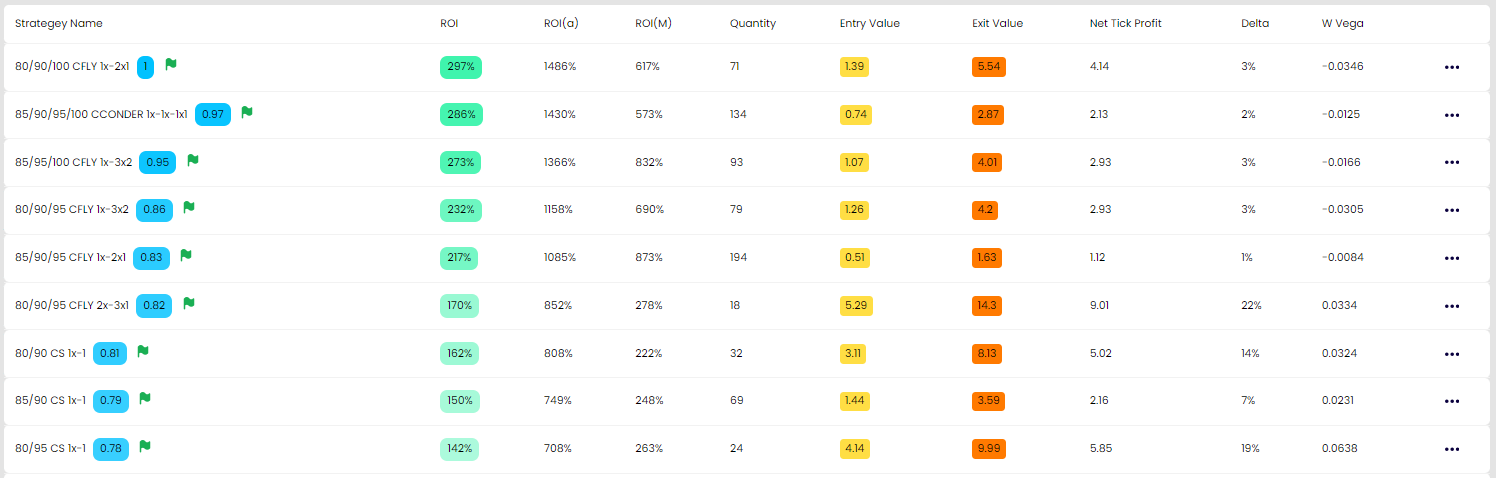

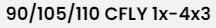

Looking for $91 but giving myself some wiggle room between $87 and $95 at around 75 days out. BB1 came up with the following list;

In this instance I have chosen the 2nd one on the list, just because it has a slightly larger landing pad

In this instance I have chosen the 2nd one on the list, just because it has a slightly larger landing pad

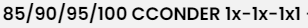

It sits in its 30th percentile so a little undervalued too.

It sits in its 30th percentile so a little undervalued too.

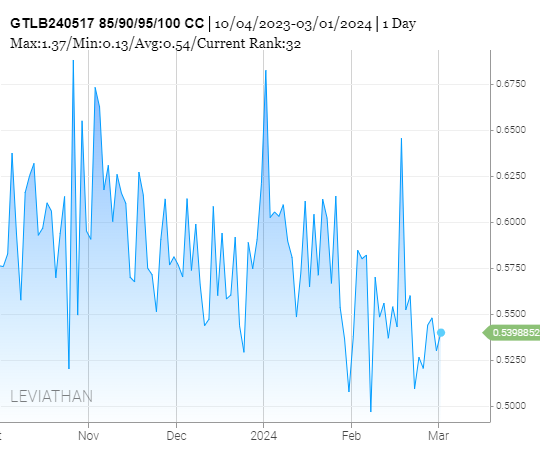

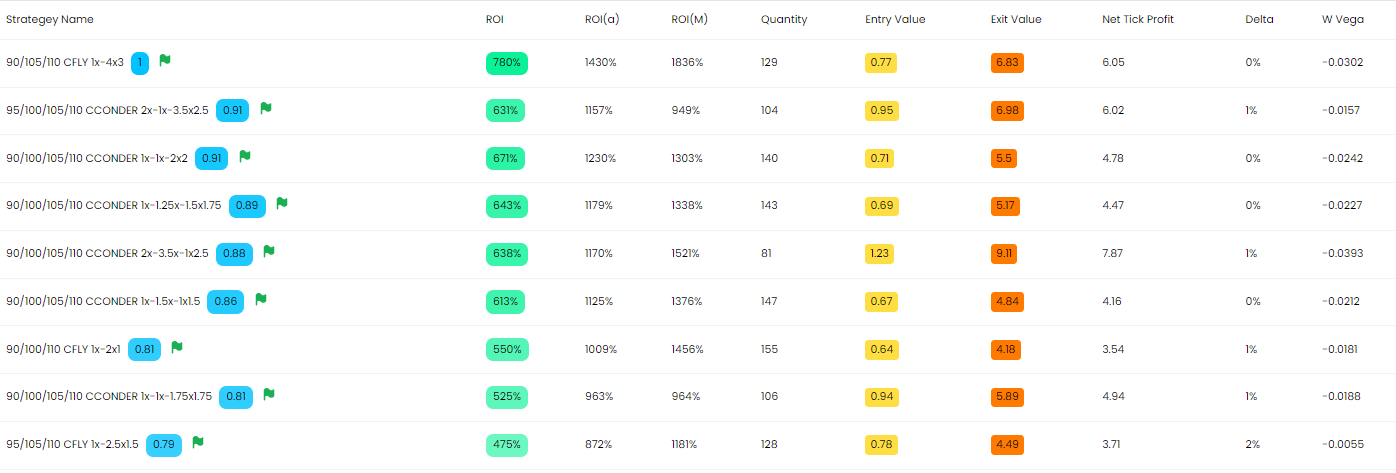

Looks good on the heatmap....

Looks good on the heatmap....

The 2nd run I did was to target a little higher, at the $104 area but giving myself a lot longer timeframe...well I say "a lot", September...

200 days to run

200 days to run

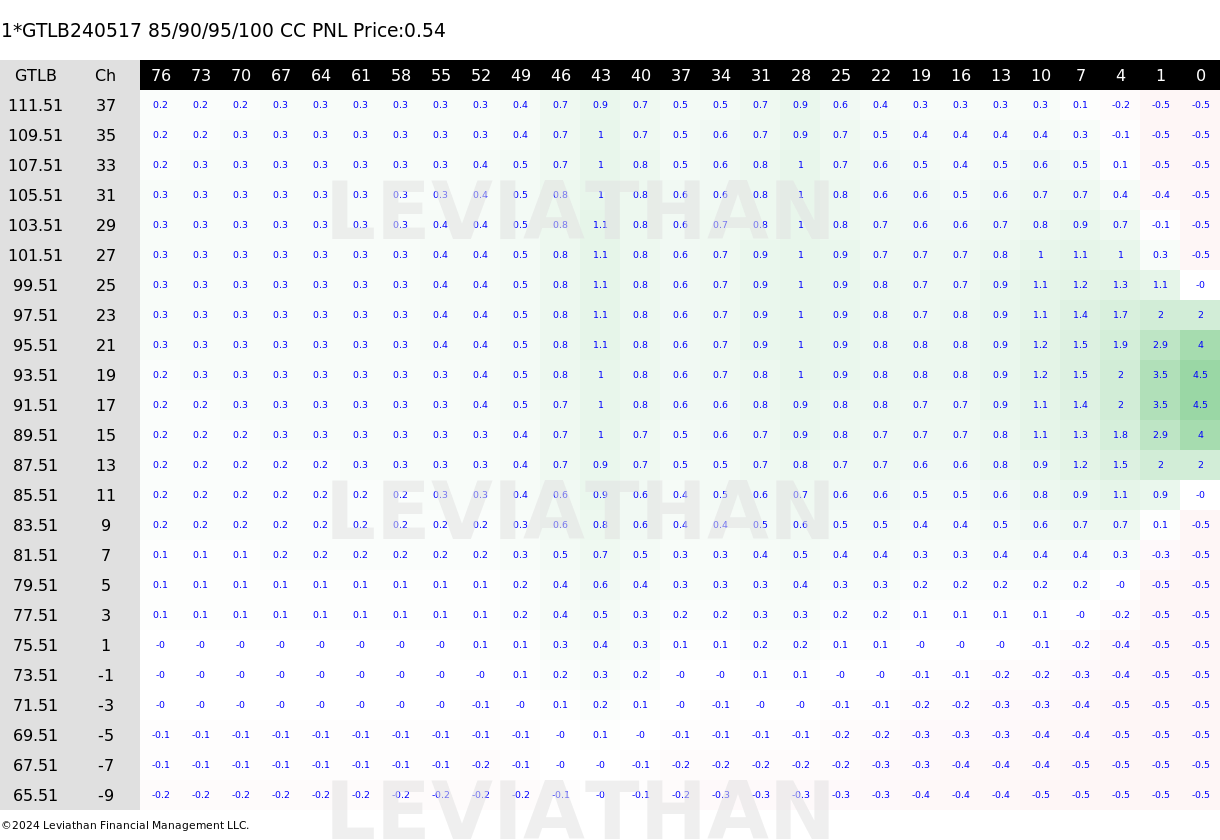

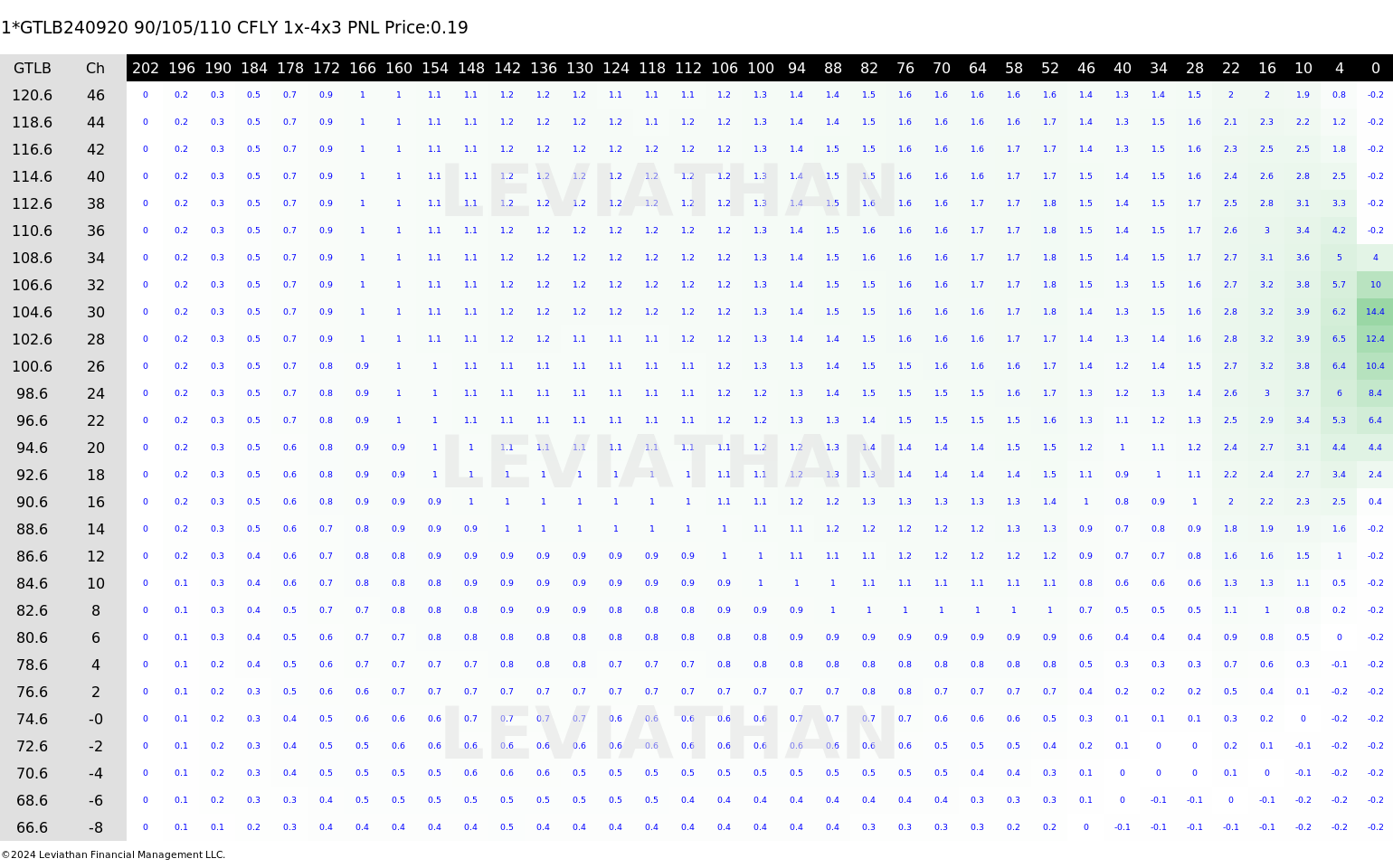

On this one I have gone for a more unconventional FLy but given it is top of the overall list

On this one I have gone for a more unconventional FLy but given it is top of the overall list

Has a lovely looking heat map, even a good return if you get the direction right early

Has a lovely looking heat map, even a good return if you get the direction right early

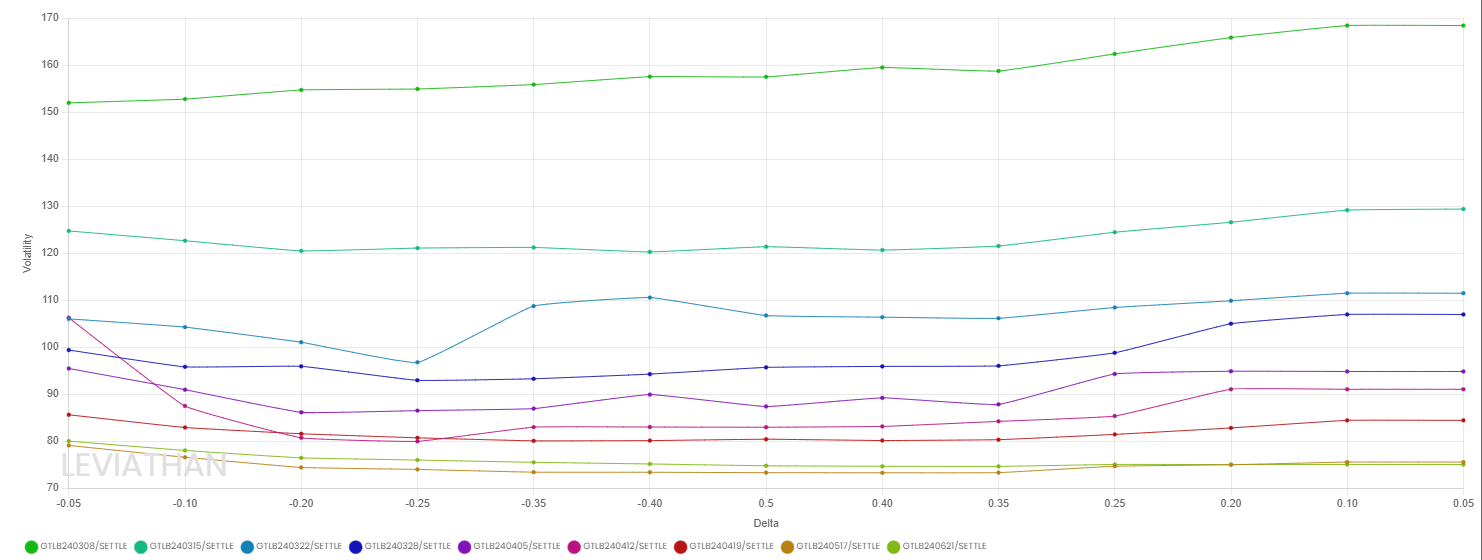

A quick mention to any of you wishing to purchase any OTM options with a shorter expiration, look at the table below...that is why you get crushed on an IV dump, the front moths will lose all that premium over the backs in an instant

A quick mention to any of you wishing to purchase any OTM options with a shorter expiration, look at the table below...that is why you get crushed on an IV dump, the front moths will lose all that premium over the backs in an instant

and remember, always rather be lucky than be good.

and remember, always rather be lucky than be good.

Darren Krett

Wednesday 31 January 2024

0

Comments (0)

Darren Krett

Monday 19 February 2024

0

Comments (0)