Tyler Krett

Wednesday 6 September 2023

Watchlist

0

Comments (0)

Darren Krett

Wednesday 31 January 2024

Share on:

Post views: 25781

Categories

Blog

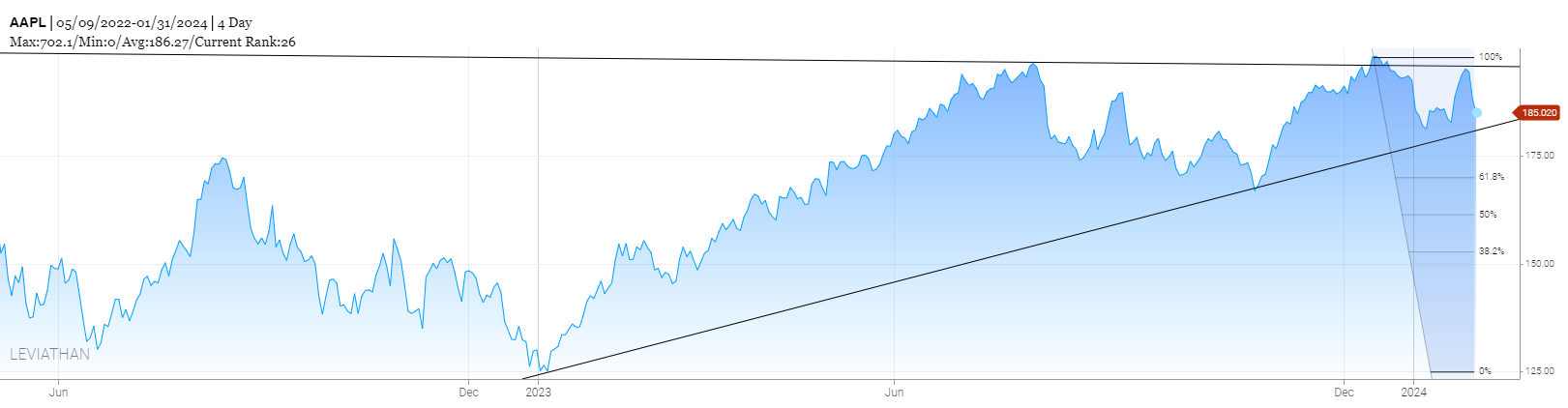

Well TBH, looking at the chart, it really could go either way, but I am just showing you the best risk/reward trades out of a billion different iterations...

could go either way

could go either way

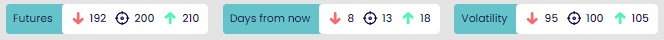

If you're on the iPhone train then there is a good chance that a better-than-expected report could send APPL up to challenge the $200 area, so with that in mind, these are the inputs into BB1, basically targeting $200, but I want to cover a range of $192 to $210 and I'm willing to give it around 2 weeks

target parameters

target parameters

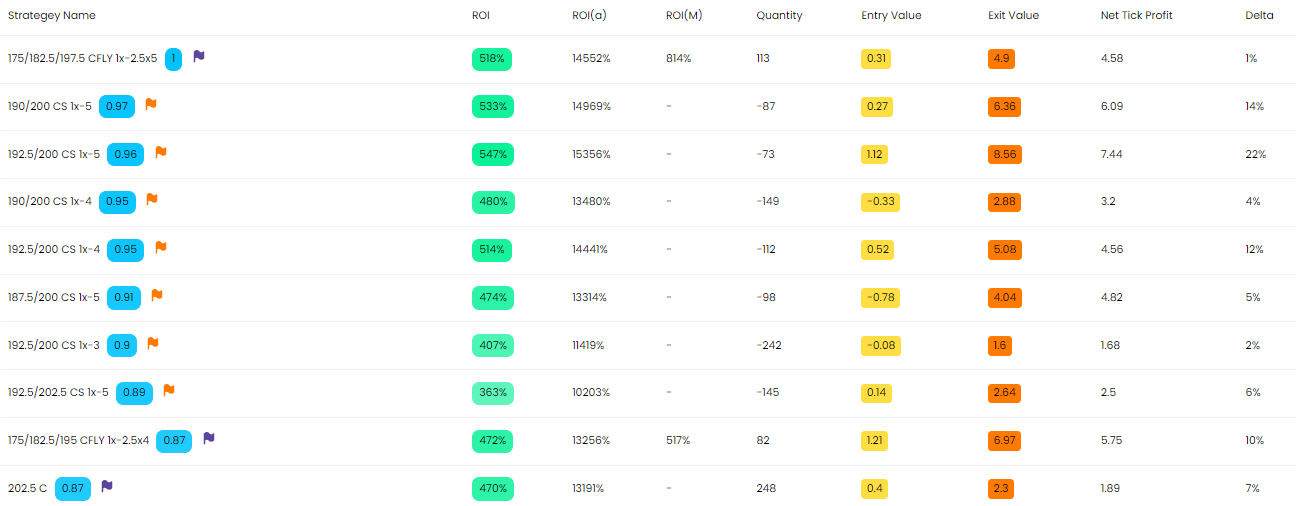

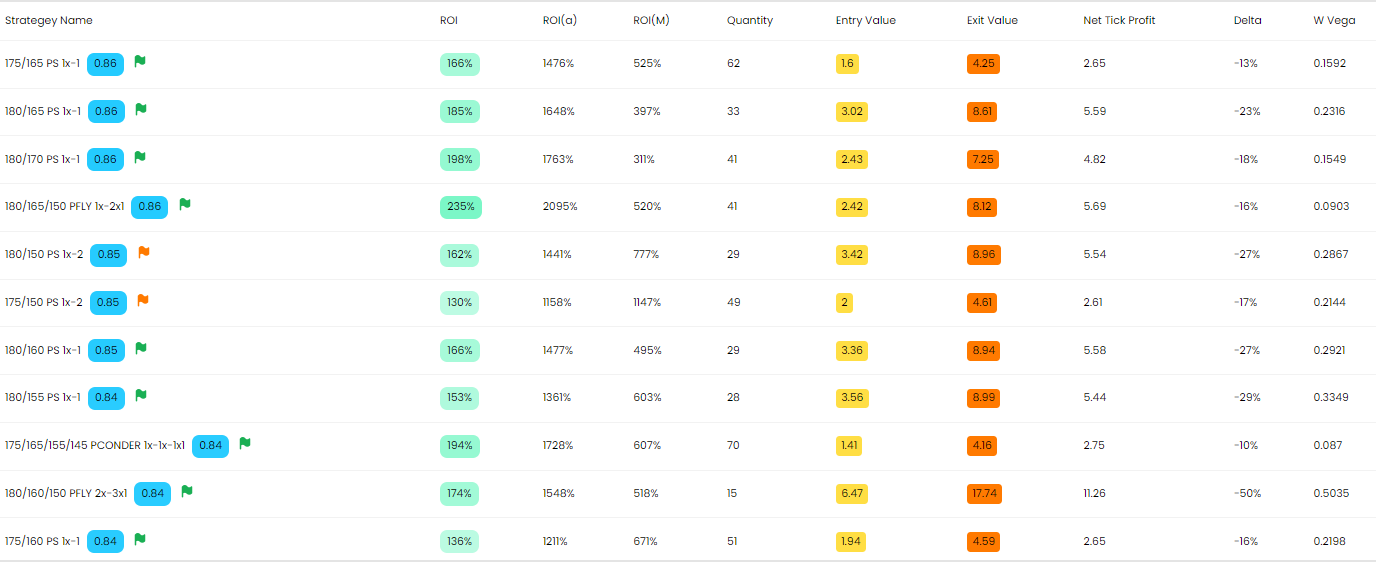

And these were the results

These are the best-value trades, but unless you're a seasoned trader that fully understands risk, I would just opt to filter to "vanilla" trades

These are the best-value trades, but unless you're a seasoned trader that fully understands risk, I would just opt to filter to "vanilla" trades

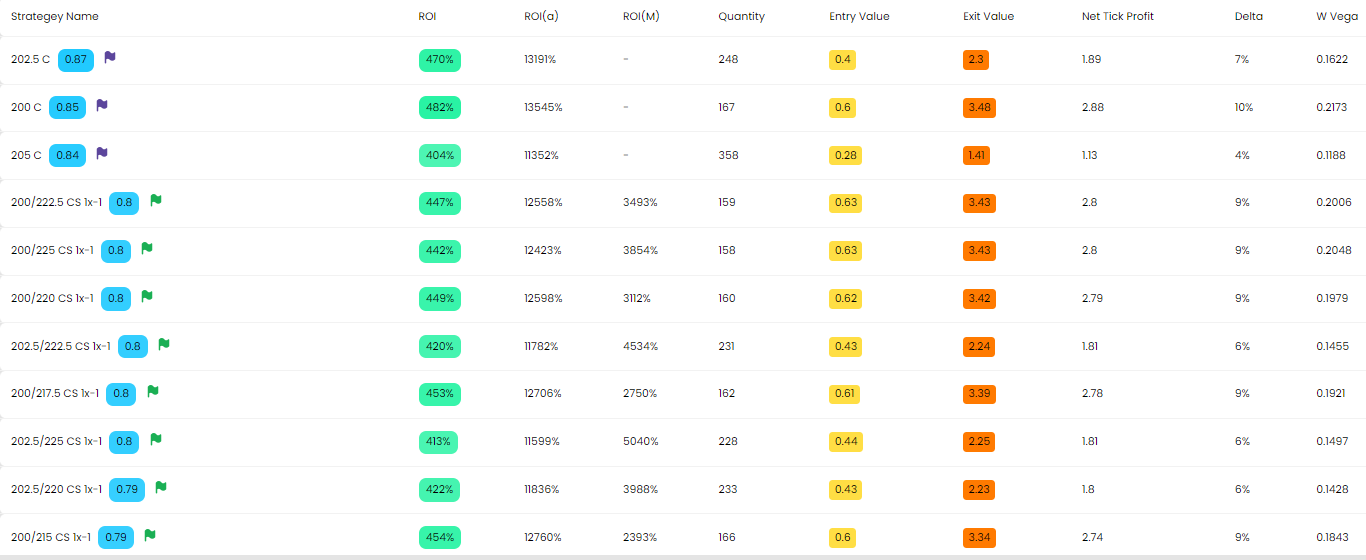

the vanilla option

the vanilla option

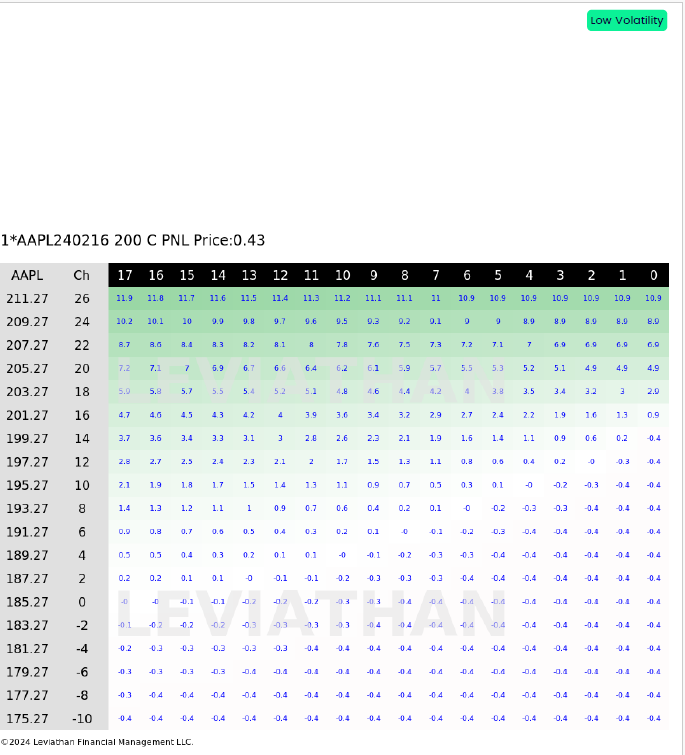

I actually prefer the choice here anyway..no mucking about, just buy the $200 call, even though you are in a 2 week option it will monetize pretty well even tomorrow if we were to shift volatility lower too

For those Android users out there, if we were to break that ascending wedge then we could easily target the $170 area

For those Android users out there, if we were to break that ascending wedge then we could easily target the $170 area

I want to give this one a little more time, so Im looking 40ish days out looking somewhere between

target, anywhere between $165 to $177

target, anywhere between $165 to $177

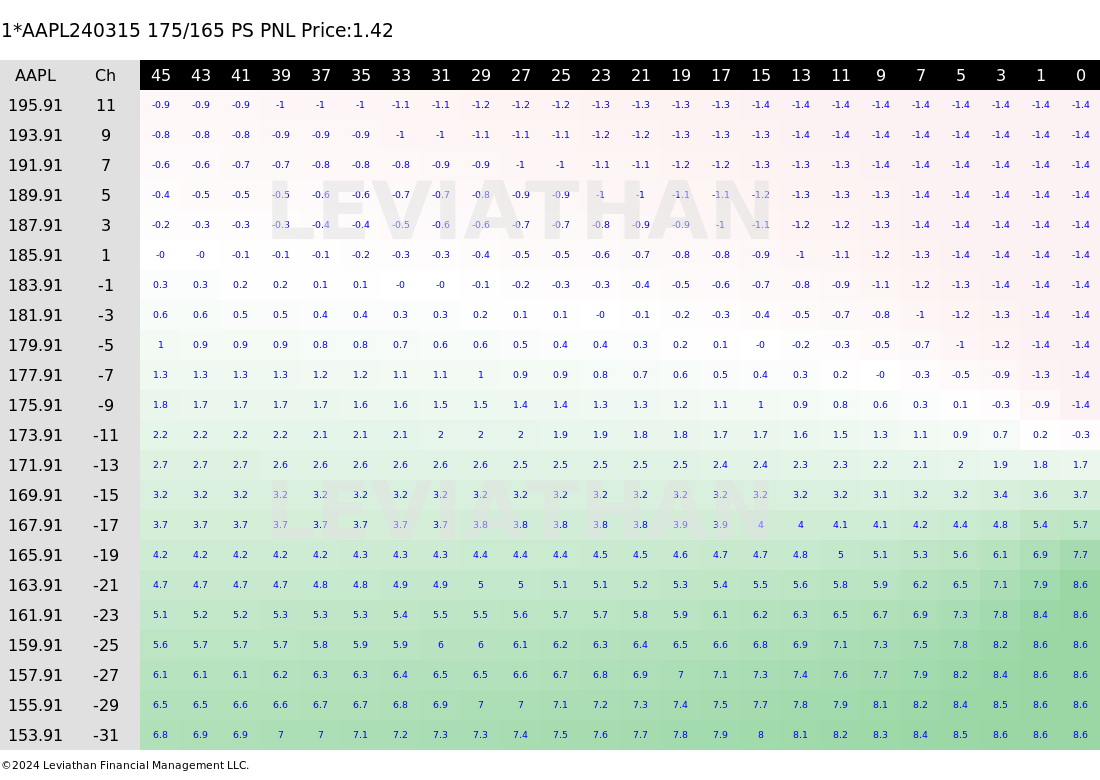

I want to give this one a little more time, so Im looking 40ish days out looking somewhere between $165 to $177 , aiming for $170.

the downside list

the downside list

and again filtering "vanilla" trade, BB likes a pretty simple trade. The 175/165 put spread or bear spread. I like this one as the heatmap shows it monetizes pretty quick and has a lot more "green" than "red"

So there you have it, if you're bearish the 03/15/24 175/165 put spread and if you're bullish, its the 02/16/24 200 call for you.

So there you have it, if you're bearish the 03/15/24 175/165 put spread and if you're bullish, its the 02/16/24 200 call for you.

Best of luck!

0 Comments

Share

Tyler Krett

Wednesday 6 September 2023

0

Comments (0)

Tyler Krett

Wednesday 6 September 2023

0

Comments (0)