Darren Krett

Wednesday 31 January 2024

Apple earnings option plays

0

Comments (0)

Darren Krett

Wednesday 13 March 2024

Share on:

Post views: 5169

Categories

Blog

So where can this one go?

top of the range?

looking at the chart I would fancy a bit of a retracement here, but I am going to start off with "the trend is your friend" and see where the bullish scenario comes in like...Been generally looking at June expirations so going to stick with that for this

top of the range?

looking at the chart I would fancy a bit of a retracement here, but I am going to start off with "the trend is your friend" and see where the bullish scenario comes in like...Been generally looking at June expirations so going to stick with that for this

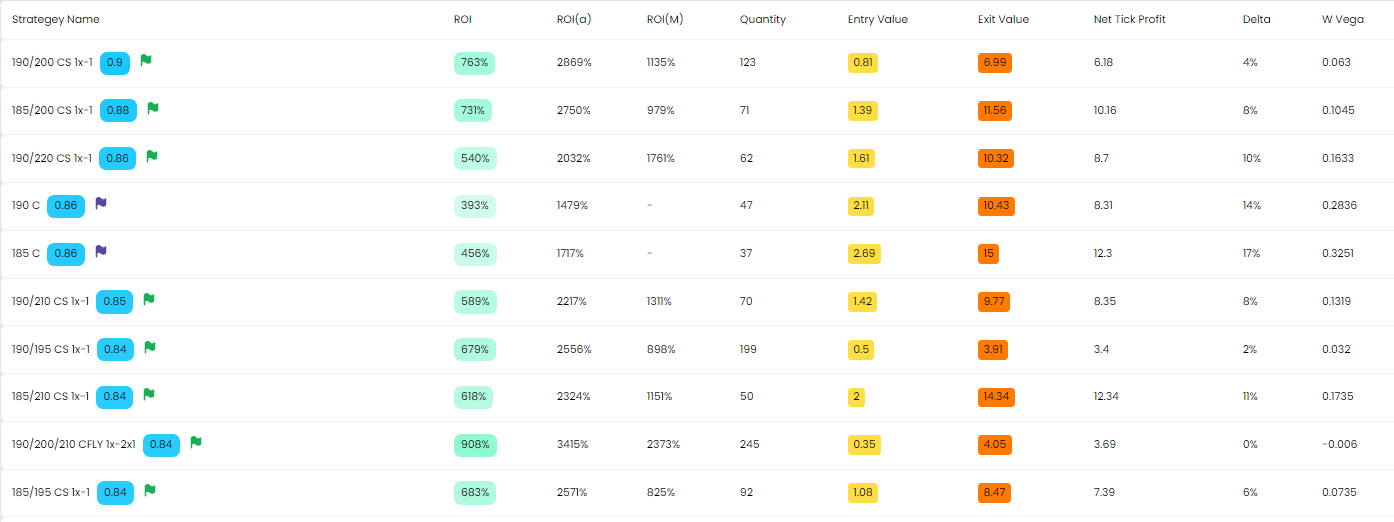

BB1 liked the call (bull) spreads here and even picked out a couple of outright calls.

BB1 liked the call (bull) spreads here and even picked out a couple of outright calls.

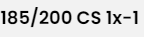

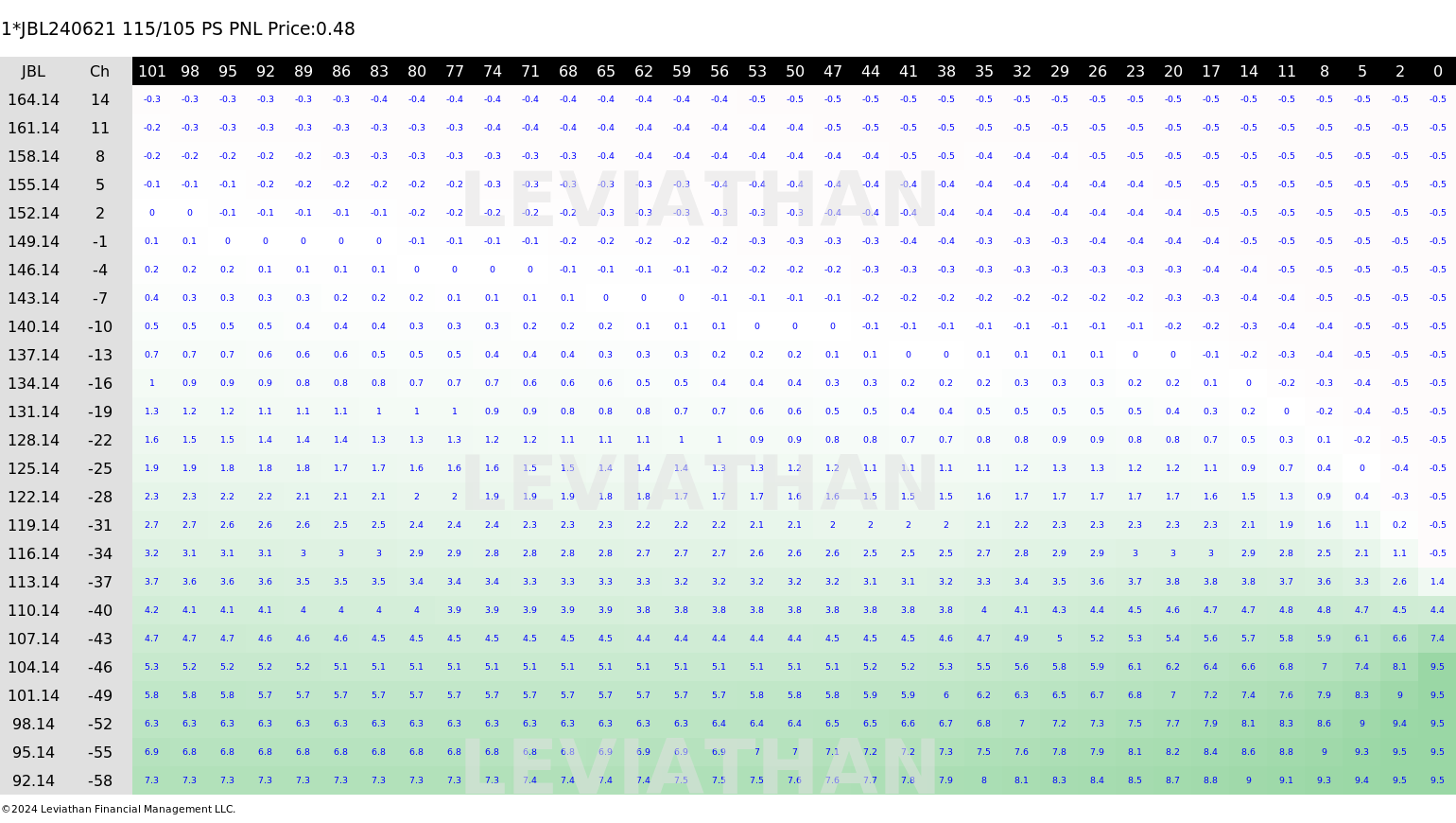

I just decided to go with this one...mostly because I am a bit risk adverse on this scenario but it looks OK on the heatmap

Now for the downside...looking to taarget the bottom of the range...

and so we are looking between $100 to $109

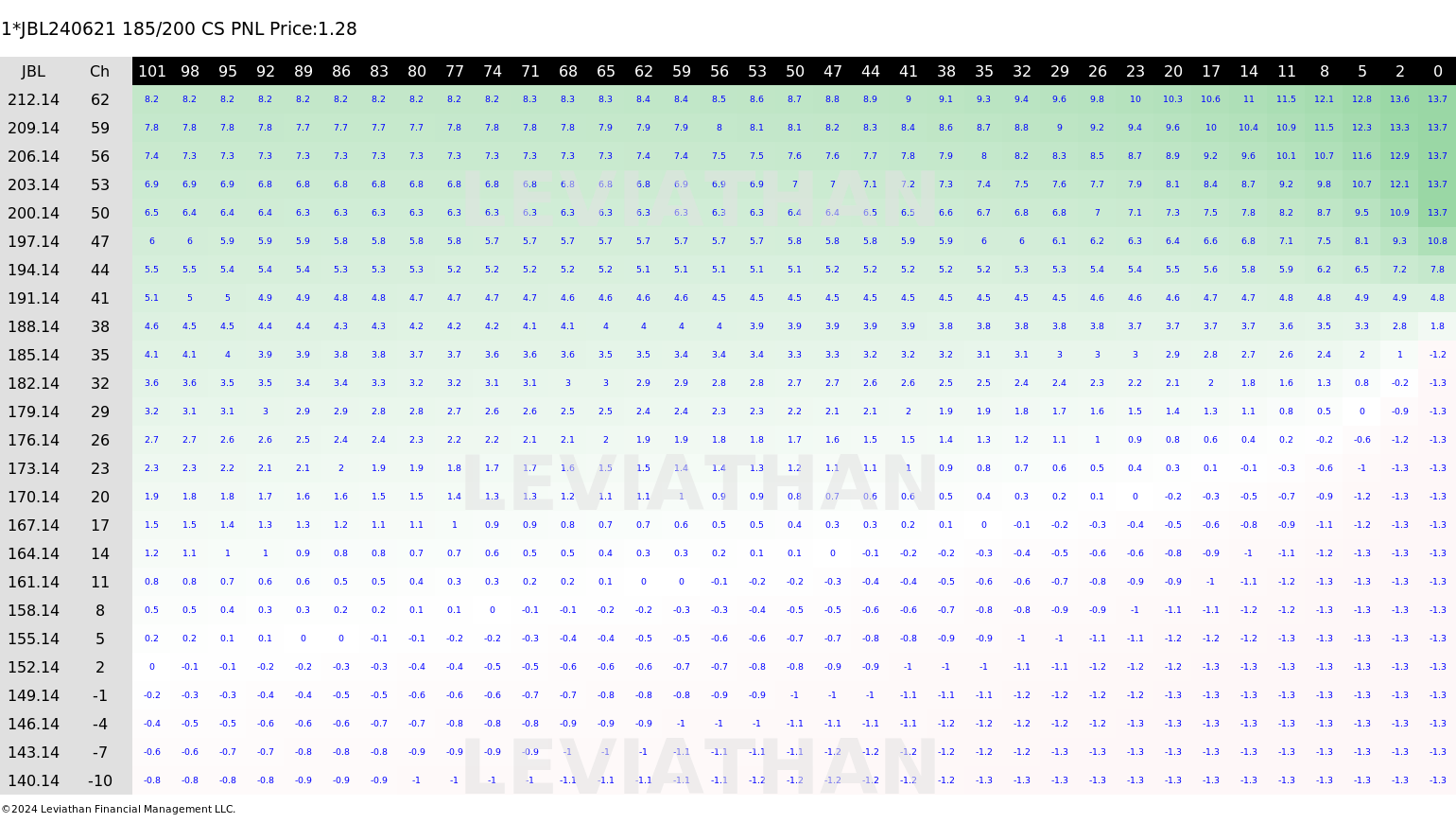

Funnily enough BB1 picked out a few 1x2s and trees as the best risk reward BUT I am going to omit those because I dont want to recommend trades that have potentially unlimited risk...so with that ibn mind I chose this one

Funnily enough BB1 picked out a few 1x2s and trees as the best risk reward BUT I am going to omit those because I dont want to recommend trades that have potentially unlimited risk...so with that ibn mind I chose this one

It still has a great return profile and get anywhere near the target and it's happy days!!

It still has a great return profile and get anywhere near the target and it's happy days!!

Looking like just a $1.44 expected move from the earnings though

Looking like just a $1.44 expected move from the earnings though

Another reason I want to take a slightly longer term look on this but generally I dont like the short term plays anyway my preference is to go for the put (bear) spread on this one.

And remember, it is always better to be luvky that good

Darren Krett

Wednesday 31 January 2024

0

Comments (0)

Darren Krett

Tuesday 23 January 2024

0

Comments (0)