Darren Krett

Tuesday 12 March 2024

Option Plays for Lennar (LEN) and beyond

0

Comments (0)

Darren Krett

Wednesday 13 March 2024

Share on:

Post views: 6173

Categories

Blog

A  couple to look at today, first up Dollar General..

couple to look at today, first up Dollar General..

The chart is looking quite constructive with the potential of a retracement towards the levels we saw about a year ago...I am going to look out 100 odd days , so focusing on the JUne expiration and look to target a break above the 61.8% fib retracement, while still making money above $204

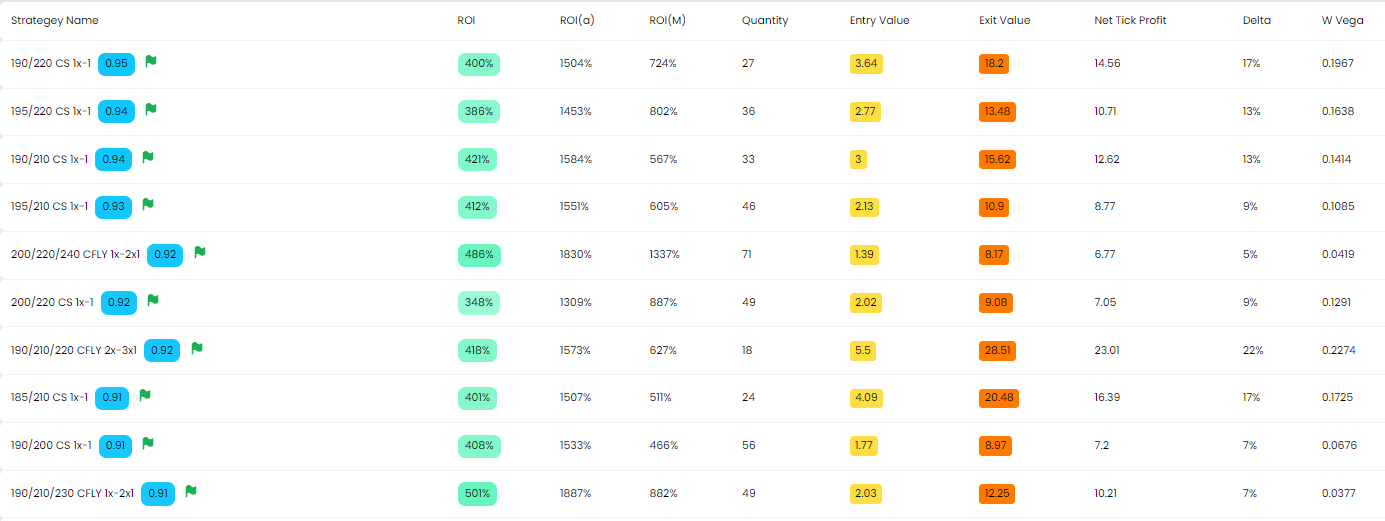

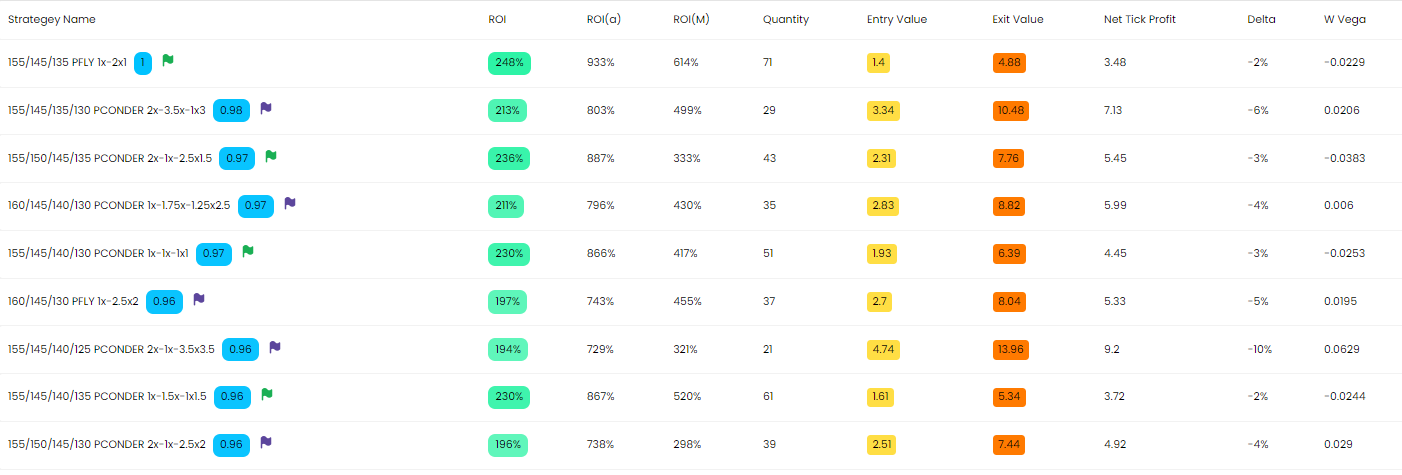

And this is the BB1 list that was generated

And this is the BB1 list that was generated

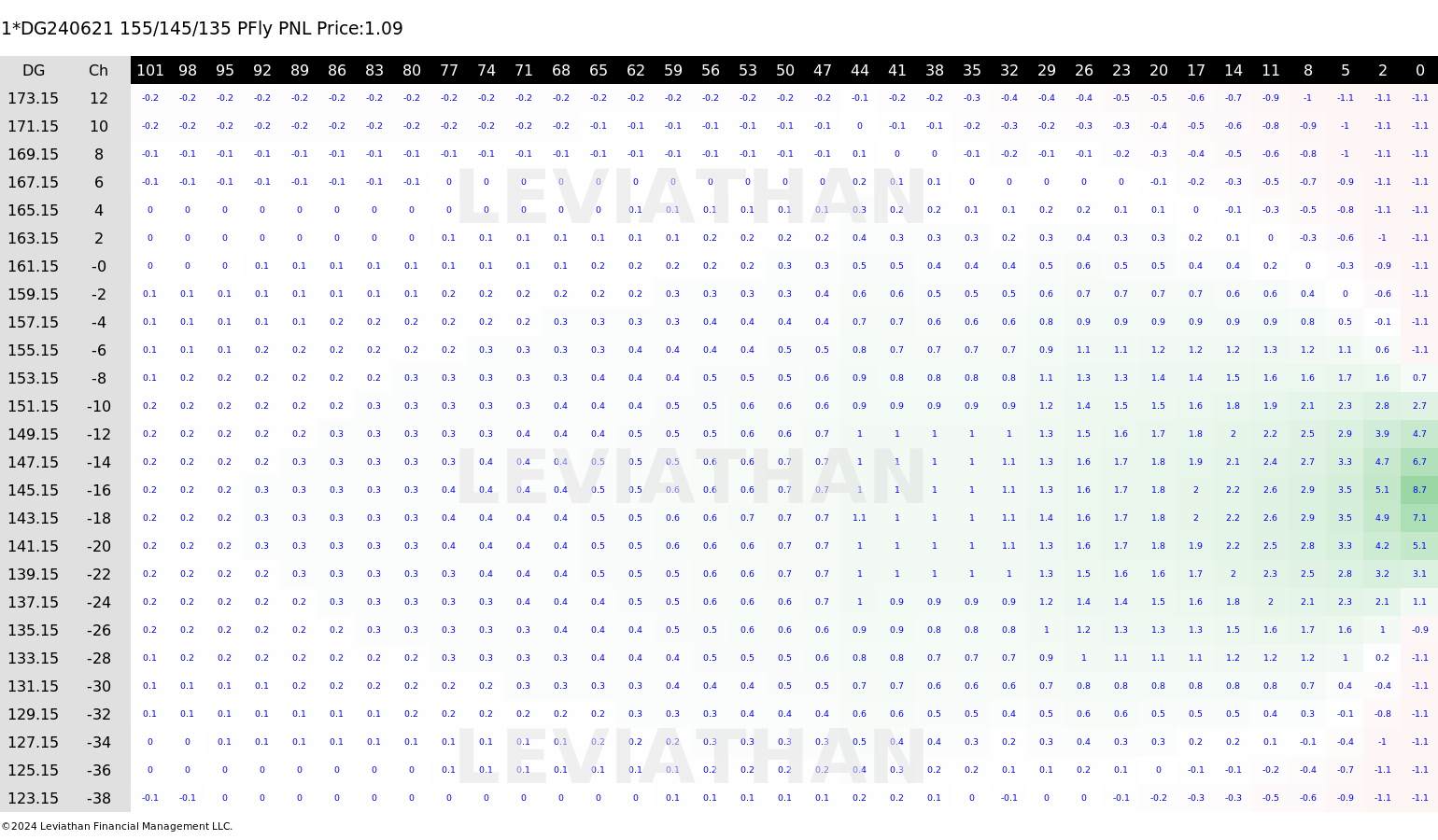

I ended up going with BB1's advice and picking its favorite;

I ended up going with BB1's advice and picking its favorite;

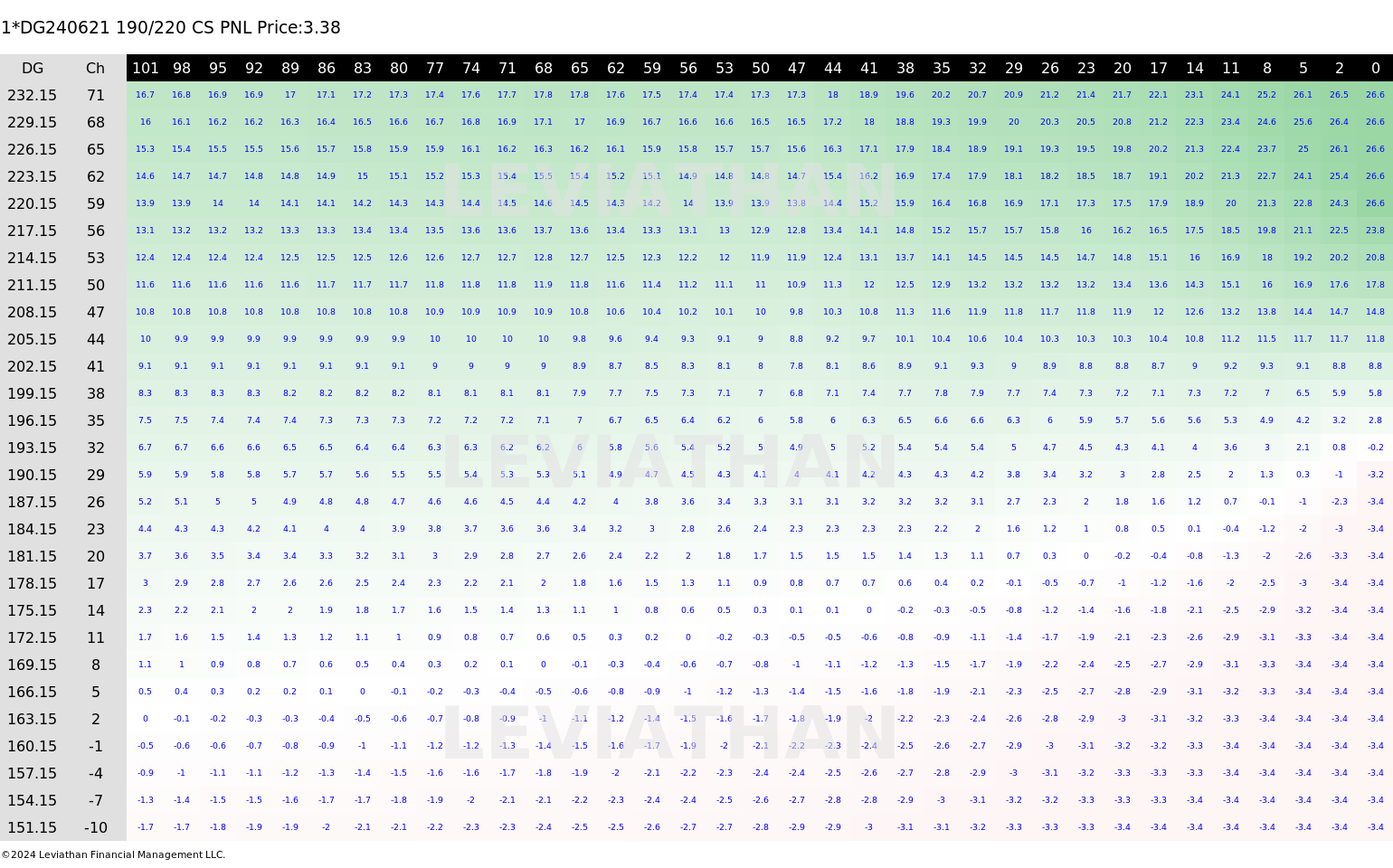

also referred to as a BULL SPREAD, I like how this looks on the heat map

Youll only have to see it go up above $170 before you start making some decent money on this trade and given that we are implying over a $13 move for earnings this has every chance

Youll only have to see it go up above $170 before you start making some decent money on this trade and given that we are implying over a $13 move for earnings this has every chance

Now for the downside...what if it fails and looks to head back to the $145 area

Im using the same expiration

Im using the same expiration

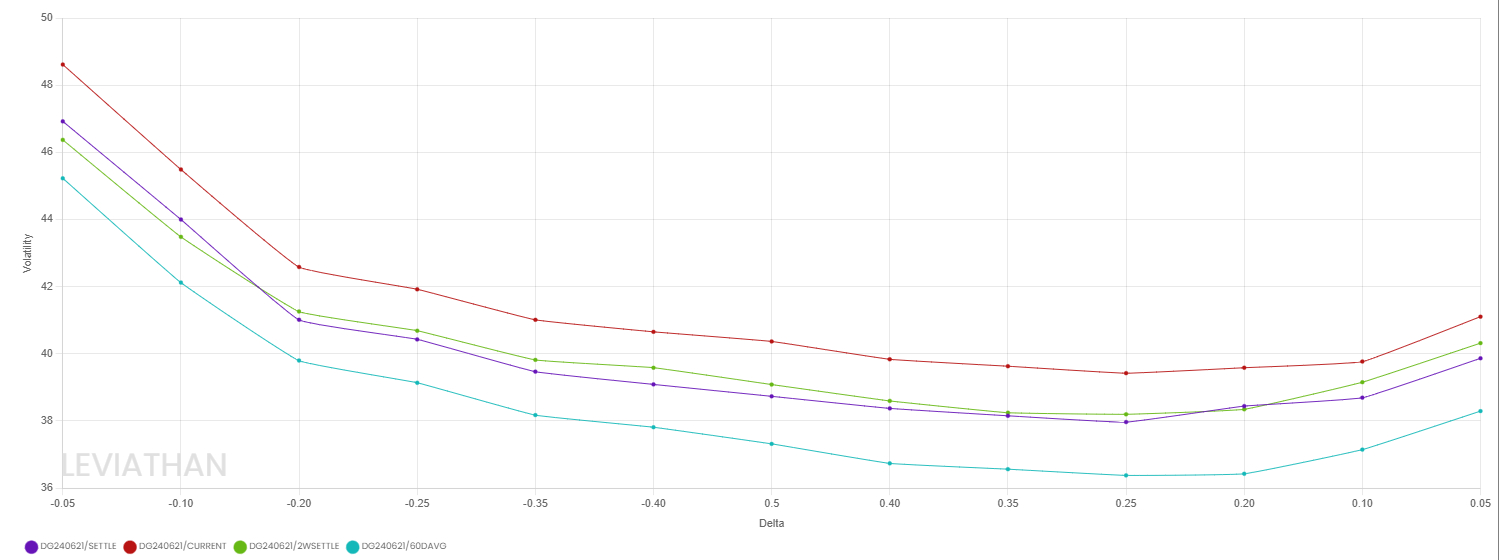

Now the market seems to be pricing in more of a disappointment based on the skews

which in turn looks like the returns for these plays arent as good as I would have hoped , but at least the fly you know your risk

which in turn looks like the returns for these plays arent as good as I would have hoped , but at least the fly you know your risk

So this would be the pick for me as a downside trade, if thats your feeling

Pretty targetted but still gives you a lot of wiggle room short term

Pretty targetted but still gives you a lot of wiggle room short term

and remember...always rather be lucky than good , happy hunting....

Darren Krett

Tuesday 12 March 2024

0

Comments (0)

Darren Krett

Sunday 3 March 2024

0

Comments (0)