Darren Krett

Friday 10 February 2023

Delta Neutrality

0

Comments (0)

Darren Krett

Monday 20 February 2023

Share on:

Post views: 11384

Categories

The Greeks

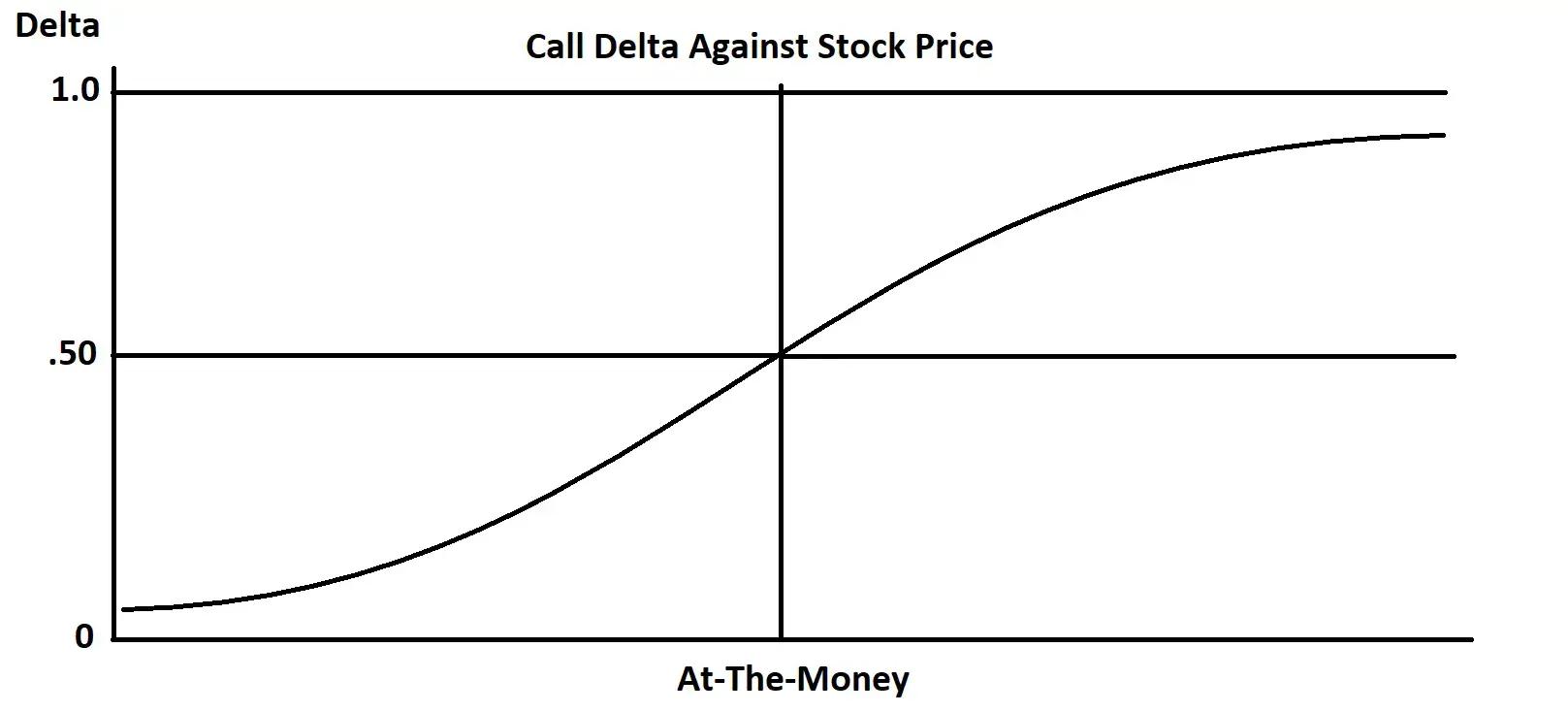

GAMMA I. Definition: An option's gamma represents the change in its delta in response to an underlying price increase/decrease. The delta is not static and changes as it goes from out-of-the money to in-the-money. The gamma is also known as the delta of the delta

Ex: The 100 call has a +.50 delta. The gamma of the 100 call is .02. This means that for every one point move in the underlying stock price, the delta will change by .02. If the stock went from 100 to 101, the delta of the call would now he +.52. If the stock went down from 100 to 99, the delta of the call would become +.48.

Gamma is valuable for those who are long options (long gamma),

and a liability for those who are short options (short gamma).

Ex: The deltas of long options (a long gamma position) have a positive

correlation with the underlying in the sense that when the underlying

trades higher, the long gammas (+options) manufacture positive

deltas-you effectively get longer underlying as the market rallies.

When the underlying trades lower, the positive gammas of your long

option position manufacture negative deltas-you get shorter underlying

as the market breaks. The opposite holds true for short options, which is a negative gamma position, whose deltas have a negative correlation to

the underlying.

Ex: The deltas of long options (a long gamma position) have a positive

correlation with the underlying in the sense that when the underlying

trades higher, the long gammas (+options) manufacture positive

deltas-you effectively get longer underlying as the market rallies.

When the underlying trades lower, the positive gammas of your long

option position manufacture negative deltas-you get shorter underlying

as the market breaks. The opposite holds true for short options, which is a negative gamma position, whose deltas have a negative correlation to

the underlying.

II. Gamma is used by traders to judge how quickly deltas will change in order to adjust hedges or estimate price changes of options.

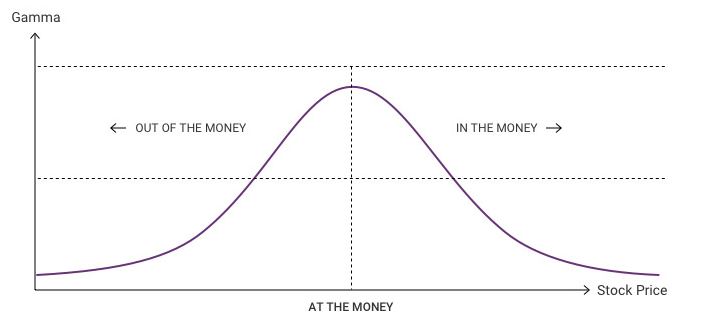

III. Gamma is greatest for options that are at the money. The gamma of an option will decrease as it moves either further in-the-money or out-of-the-money.

IV. The gamma of an option that is at or near the money rises as the option approaches expiration.

V. The gamma of an option that is far enough in or out of the money falls as the option approaches expiration.

Darren Krett

Friday 10 February 2023

0

Comments (0)

Darren Krett

Monday 20 February 2023

0

Comments (0)