Darren Krett

Friday 10 February 2023

Delta Neutrality

0

Comments (0)

Stay ahead and keep your mind focused.

Categories

Learning

The Greeks

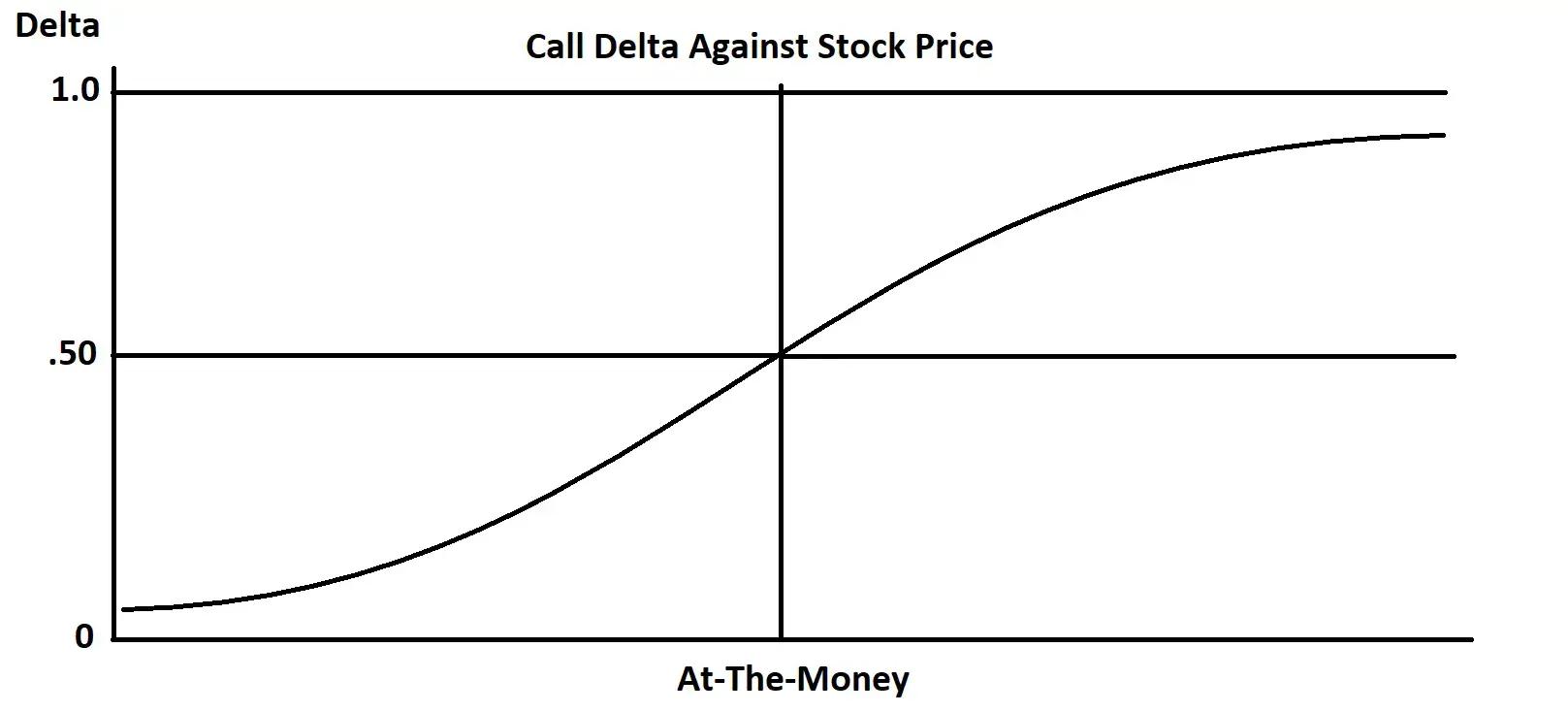

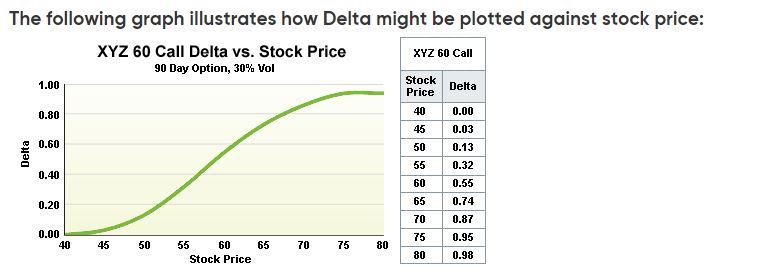

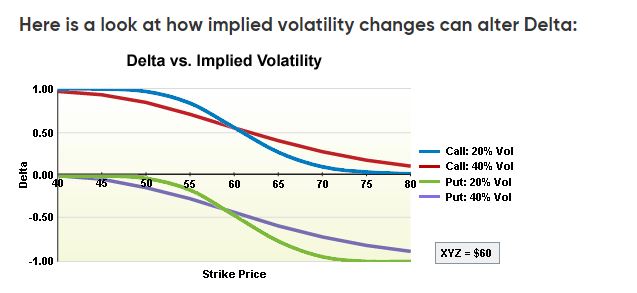

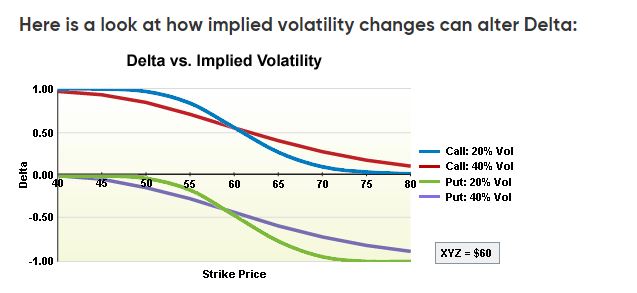

DELTA Definition: The rate of change in the theoretical value of an option over a one-point change in underlying price. Expressed as a percentage, it can also be interpreted as the equivalent amount of underlying that an option represents, or hedge ratio. Calls have positive deltas, puts have negative deltas.

--The Delta has various interpretations: I. The change in the price of the option in response to the change in the price of the underlying contract. A positive delta means that the option's price is positively correlated with the underlying changes (as in the case of a call), and a negative delta means that the option's price is negatively correlated with the underlying changes (as in the case of a put).

Ex: The 100 call is trading for 3.00 and has a +50 delta (with the underlying stock trading at 100) If the price of the stock goes to 101, the call value would increase to 3.50.

II. The equivalent amount of underlying position that the option . represents also used as the effective hedge ratio.

III. Ex: The 100 put has a -50 delta, which means that your exposure in the marketplace is the equivalent of being short (negative delta) .50 or 50% of an underlying contract (in the case of equities, since 100 shares is considered one underlying it is equivalent to being short 50 shares.) If you bought one of these puts and wanted to hedge that exposure, you would need to buy 50 shares in order to delta neutralize your positions. The probability that the option will be ITM or exercised at expiration. (If we ignore the sign of the delta.) Ex: The 100 call, with the stock trading at 100, would have an approximately.50 delta-the call is exactly ATM and has a 50% chance of going in the money.

IV.

The delta of the call and the put at the same strike should add up to

approximately 1.00 (without taking into consideration the sign of

the delta-long or short).

Ex: The 100 call, with the stock trading at 100, would have an

approximately .50 delta-the call is exactly ATM and has a 50% chance

of going in the money. By the same token, the ATM put would also have

a.50 delta, or a 50% chance of ending up in the money. Together, the

two deltas add up to a 100% probability that one or the other will be ITM

at expiration.

Darren Krett

Friday 10 February 2023

0

Comments (0)

Darren Krett

Monday 19 December 2022

0

Comments (0)

Get ahead of the wave and sign up to our socials to get access to exclusive offers, videos, tutorials and latest news.

© 2015 - 2025 Leviathan Financial Management LLC. All Rights Reserved.

Legal Disclaimer: The information provided in the Leviathan website is for informational purposes only. It should not be considered legal or financial advice. You should consult with a financial advisor professional to determine what may be best for your individual needs. Leviathan Financial Management does not make any guarantee or other promise as to any results that may be obtained from using our content. No one should make any investment decision without first consulting his or her own financial advisor and conducting his or her own research and due diligence. To the maximum extent permitted by law, Leviathan Financial Management disclaims any and all liability in the event any information, commentary, analysis, opinions, advice and/or recommendations prove to be inaccurate, incomplete or unreliable, or result in any investment or other losses. Content contained on or made available through the website is not intended to and does not constitute legal advice or investment advice. Your use of the information on the website or materials linked from the Web is at your own risk.