Darren Krett

Thursday 9 February 2023

Big Boy (BB1)

0

Comments (0)

Darren Krett

Monday 20 February 2023

Share on:

Post views: 21870

Categories

Help

Ranking gives you the ability to analyze current volatilities across multiple expirations and even products and compare them to where they have been across different timeframes in either percentile or Z-score (for a description of percentile and Z-Score, go to https://www.leviathanfm.com/learning/general/percentiles-z-scores), then rank them from cheapest to most expensive.

You can easily select the months you wish to rank in the following table where you can easily select induvial buckets or multiple with just a single click.

You can easily select the months you wish to rank in the following table where you can easily select induvial buckets or multiple with just a single click.

You select the LOOKBACK days in the dropdown which allows you to choose to compare either 90 days back, 120 days, 1year or 5 years to rank the live volatilities within those timeframes.

There are 10 different categories in which to compare.

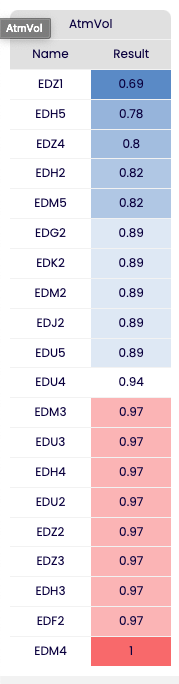

ATM volatility, which will use constant maturity volatility and rank based on the amount of lookback days you select

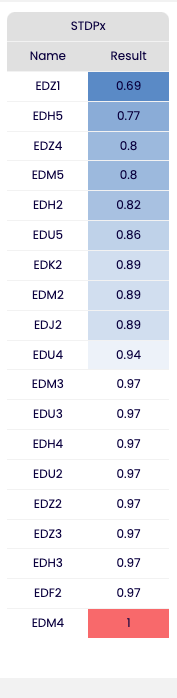

STDPx which compares the ATM constant maturity straddle but in terms of price.

STDPx which compares the ATM constant maturity straddle but in terms of price.

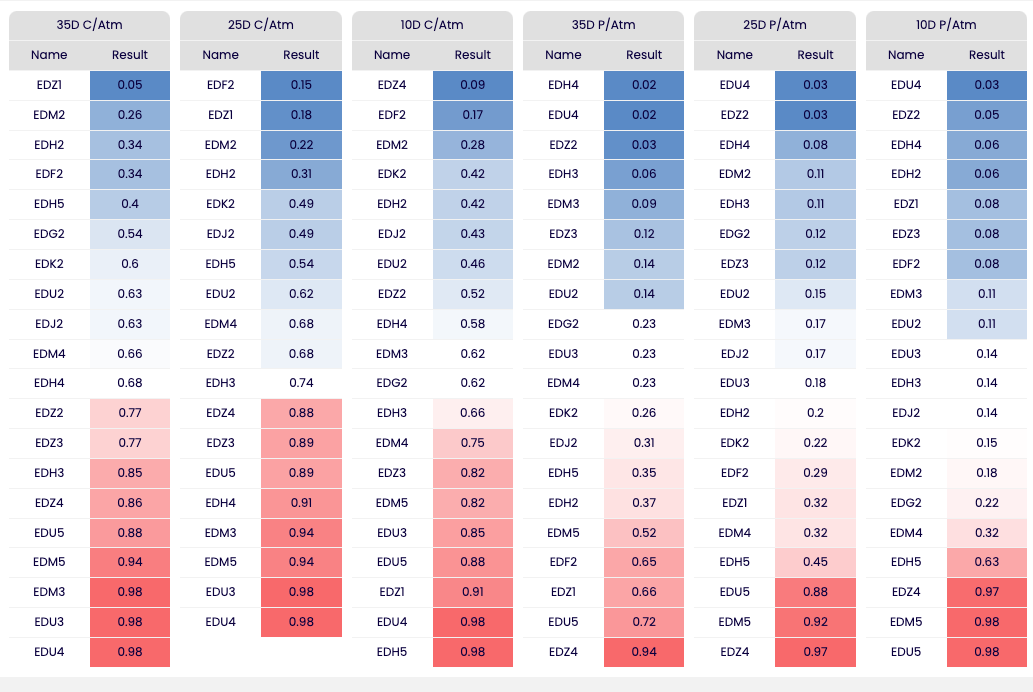

35D C/Atm compares the 35 delta call to ATM in terms of volatility, of which the same can be said for the 25D C/Atm, 10D C/Atm, 35D P/Atm, 25D P/Atm, 10D PC/Atm with the differing deltas and then comparing

35D C/Atm compares the 35 delta call to ATM in terms of volatility, of which the same can be said for the 25D C/Atm, 10D C/Atm, 35D P/Atm, 25D P/Atm, 10D PC/Atm with the differing deltas and then comparing

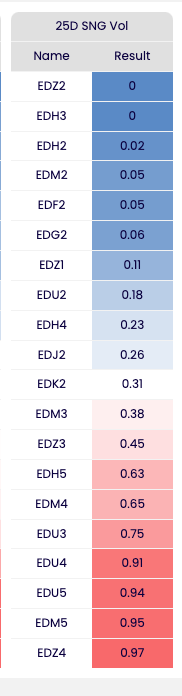

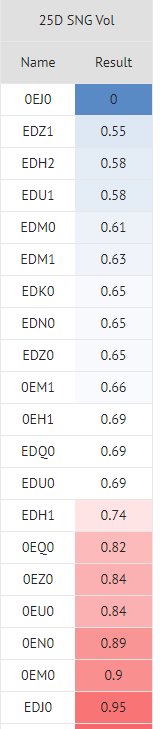

Looks at the 25 delta strangle historically

Looks at the 25 delta strangle historically

25D P / 25D C Looks at the Combo/Reversal/Fence by simply analyzing the put volatility divided by the call volatility over the lookback timeframe you have selected.

25D P / 25D C Looks at the Combo/Reversal/Fence by simply analyzing the put volatility divided by the call volatility over the lookback timeframe you have selected.

Darren Krett

Thursday 9 February 2023

0

Comments (0)