Darren Krett

Monday 19 December 2022

Beta

0

Comments (0)

Stay ahead and keep your mind focused.

Categories

Learning

The Greeks

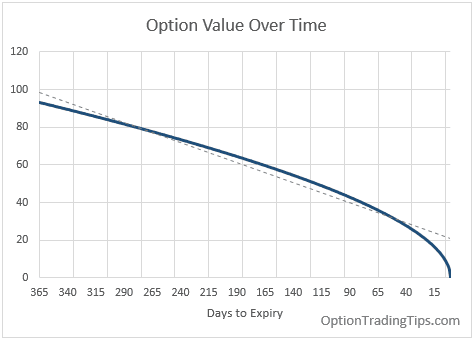

Theta measures the rate at which an option's price decreases as time passes, also known as time decay. Specifically, Theta quantifies the amount by which the value of an option declines with the passage of one day, holding other factors constant.

Key Points about Theta:

Time Decay: Theta represents time decay, which impacts the value of an option as it approaches its expiration date. All else being equal, an option's value diminishes over time, and Theta measures this decline.

Sign of Theta: For long option positions (where you have bought the options), Theta is typically negative. This means that as time progresses, the value of the option decreases. Conversely, for short option positions (where you have sold the options), Theta is positive, reflecting an increase in value as time passes.

Impact by Moneyness: The effect of Theta varies with the option's moneyness:

Theta and Expiration: As the expiration date draws closer, the rate of time decay generally accelerates. For OTM options, the impact of Theta becomes less pronounced as they approach expiration, while ATM options experience a more significant and accelerated decrease in value.

Understanding Theta helps traders anticipate how the passage of time will affect their option positions and make informed decisions about their strategies, particularly when considering the timing of trades and the impact of holding positions over time.

Darren Krett

Monday 19 December 2022

0

Comments (0)

Darren Krett

Wednesday 2 November 2022

0

Comments (0)

Get ahead of the wave and sign up to our socials to get access to exclusive offers, videos, tutorials and latest news.

© 2015 - 2025 Leviathan Financial Management LLC. All Rights Reserved.

Legal Disclaimer: The information provided in the Leviathan website is for informational purposes only. It should not be considered legal or financial advice. You should consult with a financial advisor professional to determine what may be best for your individual needs. Leviathan Financial Management does not make any guarantee or other promise as to any results that may be obtained from using our content. No one should make any investment decision without first consulting his or her own financial advisor and conducting his or her own research and due diligence. To the maximum extent permitted by law, Leviathan Financial Management disclaims any and all liability in the event any information, commentary, analysis, opinions, advice and/or recommendations prove to be inaccurate, incomplete or unreliable, or result in any investment or other losses. Content contained on or made available through the website is not intended to and does not constitute legal advice or investment advice. Your use of the information on the website or materials linked from the Web is at your own risk.