Darren Krett

Monday 19 December 2022

Vera

0

Comments (0)

Stay ahead and keep your mind focused.

Categories

Learning

The Greeks

Beta is a measure of an asset's volatility in relation to the overall market or a designated benchmark, such as a stock index. It is a key concept in portfolio management and risk analysis, providing insights into how a particular asset moves in relation to the broader market.

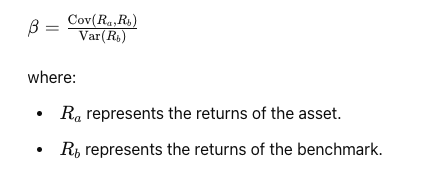

Beta is calculated by comparing the returns of an asset to the returns of the benchmark over a specific period. Mathematically, Beta is the covariance of the asset's returns with the benchmark's returns divided by the variance of the benchmark's returns:

Beta is widely used in portfolio management to assess the risk and volatility of individual securities in comparison to the market:

While Beta is primarily a stock market concept, it can also be relevant in options trading for managing risk and hedging strategies:

By understanding Beta, investors and traders can better manage their portfolios, align their investment strategies with their risk tolerance, and make more informed decisions in relation to market movements.

Darren Krett

Monday 19 December 2022

0

Comments (0)

Get ahead of the wave and sign up to our socials to get access to exclusive offers, videos, tutorials and latest news.

© 2015 - 2025 Leviathan Financial Management LLC. All Rights Reserved.

Legal Disclaimer: The information provided in the Leviathan website is for informational purposes only. It should not be considered legal or financial advice. You should consult with a financial advisor professional to determine what may be best for your individual needs. Leviathan Financial Management does not make any guarantee or other promise as to any results that may be obtained from using our content. No one should make any investment decision without first consulting his or her own financial advisor and conducting his or her own research and due diligence. To the maximum extent permitted by law, Leviathan Financial Management disclaims any and all liability in the event any information, commentary, analysis, opinions, advice and/or recommendations prove to be inaccurate, incomplete or unreliable, or result in any investment or other losses. Content contained on or made available through the website is not intended to and does not constitute legal advice or investment advice. Your use of the information on the website or materials linked from the Web is at your own risk.