Bryan Fitzgerald

Tuesday 1 November 2022

SFRA Skew has been pummeled over the past month...

0

Comments (0)

Darren Krett

Wednesday 2 November 2022

Share on:

Post views: 39484

Categories

Blog

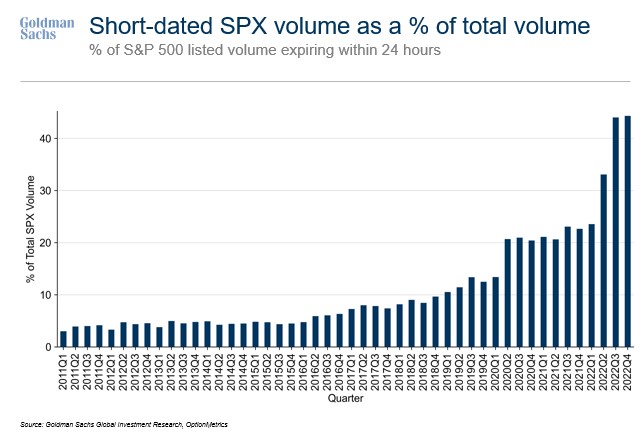

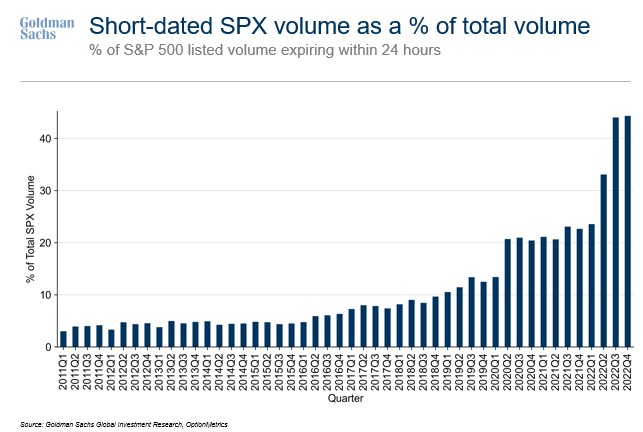

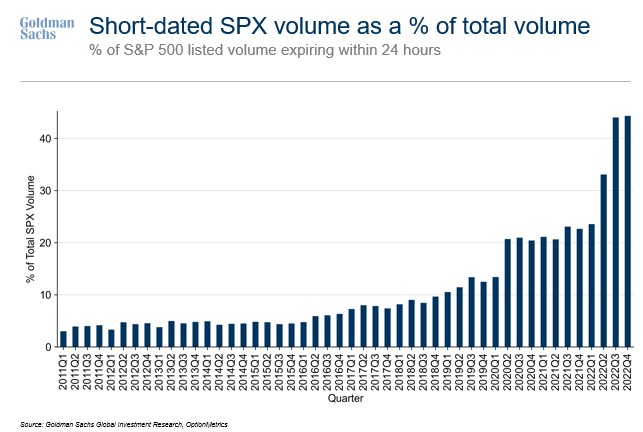

It happens in a flash: The S&P 500 turns on a dime, and piranha-like options traders pile into short-dated contracts in a dash to harvest a quick advantage. Tuesday reprised a pattern that has been visible for months. As the S&P 500 reversed a 1% gain in a violent session right before the Federal Reserve meeting, the turbulence fed a trading frenzy in options that expire within the next 24 hours. Such contracts dominated the ranks of the most traded, making up half of the index’s total volume. Once a popular playbook for day traders seeking quick profits on meme stocks, the risky strategy appears to have grown more popular among retail and institutional investors alike. During the third quarter, S&P 500 options expiring within one day accounted for more than 40% of total volume, almost doubling from six months ago, according to data compiled by Goldman Sachs Group Inc. The rush reinforces concern that derivatives can amplify moves in underlying assets, potentially creating market dislocations. At the same time, it reflects a Wall Street era where stock investors are so keyed to minute-by-minute news flows that intraday volatility builds on itself.

“Initially there was a narrative that this short-duration trading was retail but I do not think that covers the entire story,” said Amy Wu Silverman, an equity derivatives strategist at RBC Capital Markets. “It is a function of the fact that the Fed has been extremely data dependent. This will continue to be a ‘thing’ as long as we remain quite data dependent.” The latest dash comes amid the bear market’s seventh discernible rally of the year. The failure of past ones has snuffed out the previously reigning quick-money strategy: Buying the dip. Tuesday marked the 26th time in 2022 where the S&P 500 erased a gain or loss of at least 1% in a single session. Not since the 2008 financial crisis has the market experienced such frequent swings.

A whiplashing market breeds hedging activity as well as speculative wagers. Also feeding the boom are moves by firms like Cboe Global Markets Inc. to expand option expirations to each weekday. To Brian Donlin, an equity derivatives strategist at Stifel Nicolaus & Co., the ramp-up in the usage of fleeting contracts is a symptom of the futility of having any long-term conviction while inflation data and Fedspeak dominate the discourse. “It’s a relatively new development that has seen adoption because the perfect conditions exist for it. I use them myself,” Donlin said. “We have clear consistent macro data points as catalysts more than ever.” The focus on here and now has gained particular traction with retail investors. According to data compiled by JPMorgan Chase & Co., about 13% of all retail-involved option transactions are one day or less to maturity, compared with 5% in 2020. Read more Wall Street Takes a ‘YOLO’ Page Out of Reddit’s Options Playbook (1) JPMorgan Trading Desk Says Dovish Fed Could Spark 10% S&P Rally With day traders overrunning the market, institutional investors have been forced to adapt by keeping a close tap on retail flows. Nomura Securities International Inc. strategist Charlie McElligott noticed that professionals have recently been taking a page out of retail’s playbook, piling into options right before their expiry. Some market watchers attribute the rush to the need among defensively positioned pros to catch up to a market rally by purchasing bullish call options, a move that helped fuel the S&P 500’s 5% reversal on Oct. 13. Others suggest institutions are utilizing the products to manage portfolio risk during times of turbulence. Whatever the reason, one thing is clear: Short-dated options can expose investors to big profits and losses as they’re more susceptible to changes in the price of the underlying stock or index. Take last Friday, when the S&P 500 jumped more than 2% to close above 3,900. Calls expiring that day with a strike at 3,850 surged to $45.80 from $2.90 -- a stunning gain of 1,479%. On the other hand, puts maturing the next session with an exercise price of 3,750 tumbled 97% to 65 cents, after more than doubling to $24.27 during the previous day. The explosion in short-dated contacts is concerning to Brent Kochuba, founder of SpotGamma. The flow, he says, can inflict large volatility on markets as it forces market makers to actively hedge these positions. “This is a recipe for things to break and it elevates risk,” he said. “The risk, we feel, is that of a major headline or other data point that either catches this short-dated volume offsides, and/or triggers an overwhelming flood of directional volume.”

Bryan Fitzgerald

Tuesday 1 November 2022

0

Comments (0)