Darren Krett

Tuesday 23 January 2024

OPTION PLAYS FOR TESLA EARNINGS

0

Comments (0)

Darren Krett

Friday 19 April 2024

Share on:

Post views: 9897

Categories

Blog

EmailNewsFeed

After they put out their sales disaster we were pretty bearish and suggested 2 trades, the July 140/150/160 put fly for 95 cents which is now $1.05 and the August 100/115ps for $1.45 which is now $2.40, (both including costs)…

IT is still not looking healthy and with a weak looking S&P I can see this continuing lower unless they can pull some magic rabbit out the hat.

At the beginning of the month we put in the the following targets…$152 with about 102 days to run and $103 with 133 days to run…I am going to refresh & run the $103 target scenario given that it was the 2023 low, to see what BB1 comes up with.

IT is still not looking healthy and with a weak looking S&P I can see this continuing lower unless they can pull some magic rabbit out the hat.

At the beginning of the month we put in the the following targets…$152 with about 102 days to run and $103 with 133 days to run…I am going to refresh & run the $103 target scenario given that it was the 2023 low, to see what BB1 comes up with.

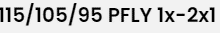

With now 116 days to go we are again NOT looking to run this trade till expiration so there isn’t much as good as there was a couple of weeks ago, however there are a couple of put flys that are worth looking at.

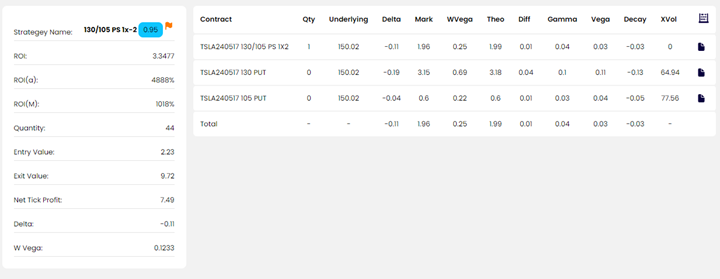

Just going to go for BB1’s top pick and have a little deep-dive

buying this thing for around 94 cents INCLUDING costs would seem like a very reasonable punt although you may have to sit on it for a bit to truly monetize it

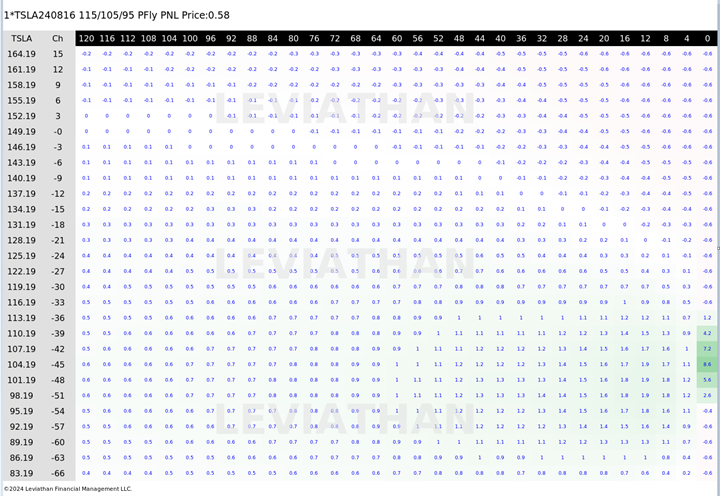

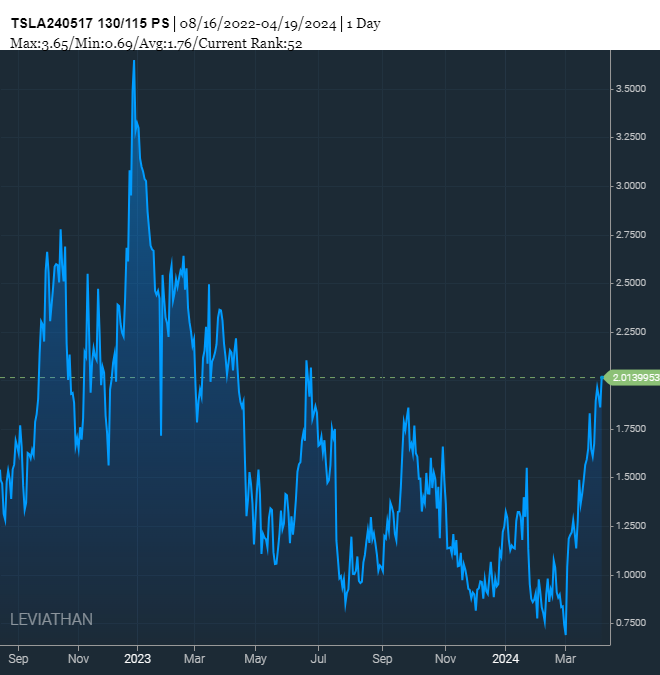

This chart shows the same equivelant out-the-money fly, going back 2 years.

This chart shows the same equivelant out-the-money fly, going back 2 years.

Now what that is showing is the value of a $10 wide put fly that has 116 days to expiration and is exactly $49.76 Out-the-money to show the true value of the current fly….we achieve this by linear fitting the volatilities and strikes to get an exact daily value of that particular fly. In this instance it is in its 44th percentile so kinda fair value but not terrible.

Now what that is showing is the value of a $10 wide put fly that has 116 days to expiration and is exactly $49.76 Out-the-money to show the true value of the current fly….we achieve this by linear fitting the volatilities and strikes to get an exact daily value of that particular fly. In this instance it is in its 44th percentile so kinda fair value but not terrible.

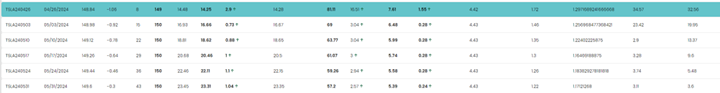

If you see the list BB1 still likes that 100/115 put spread too but I feel that I may have missed the boat on that as I can now only buy 37 spreads for my $1000 investment given the price increase from earlier this month. Now I decided to go a little shorter term and had a look at potential trades with about a month to go. I DO NOT recommend swinging for a 0DTE option as they are basically a total punt and you may as well go to the racecourse. 25 days is reasonable for the market to digest and a trend to form.

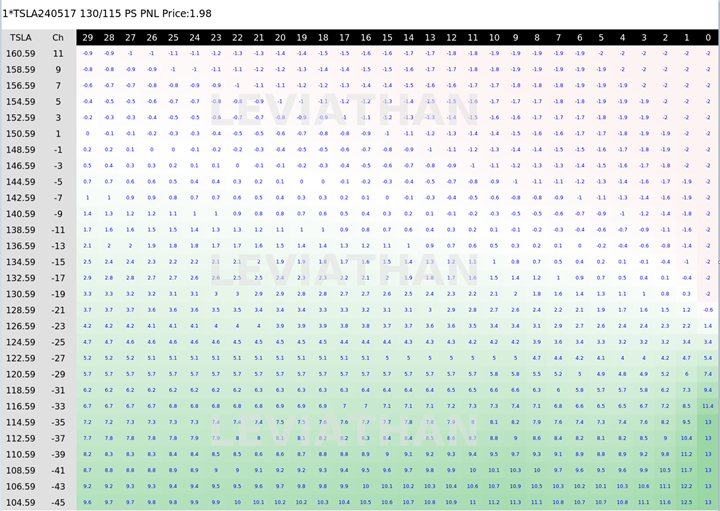

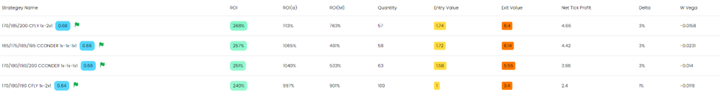

So looking for a $114 to $126 range , which seems very reasonable, what did it come up with.

Highlighting the top 6 trades here , I would opt for a 3rd on the list ,

So looking for a $114 to $126 range , which seems very reasonable, what did it come up with.

Highlighting the top 6 trades here , I would opt for a 3rd on the list ,  the

looking at this for around $2

the

looking at this for around $2

It will monetize quickly and for $2 is a good play and on a lookback is bang on fair value.

It will monetize quickly and for $2 is a good play and on a lookback is bang on fair value.

Now for those of you on the r/THETAGANG I would be remiss if I didn’t look at the top trade of the list.

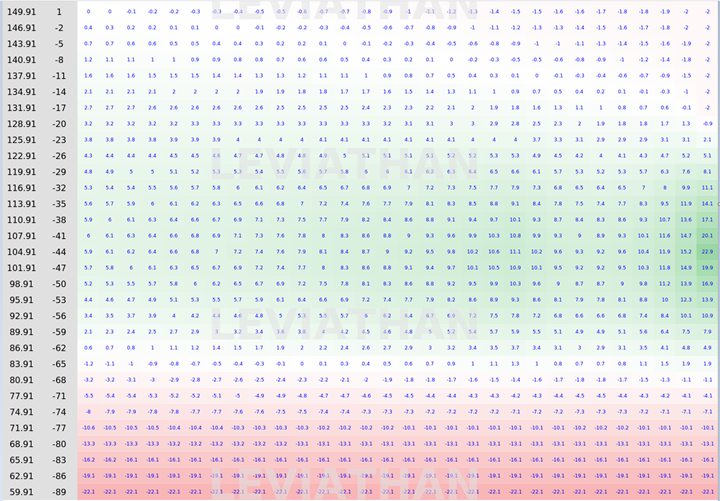

Now for those of you on the r/THETAGANG I would be remiss if I didn’t look at the top trade of the list. Here is the breakdown and the heatmap

Here is the breakdown and the heatmap

Are you getting in for less…YES…will you make more money if your target price is correct YES….can you lose your house if things totally crash…also Yes, which is why I shy away from these trades, especially if you’re a noob.

The point of these posts is to help show you the best option trades to do and although I personally may have a bias they are supposed to be agnostic as to direction. At the end of the day, we could see a complete turnaround and go back into the range & challenge $180 to $200 again. So I should do an upside run too.

Are you getting in for less…YES…will you make more money if your target price is correct YES….can you lose your house if things totally crash…also Yes, which is why I shy away from these trades, especially if you’re a noob.

The point of these posts is to help show you the best option trades to do and although I personally may have a bias they are supposed to be agnostic as to direction. At the end of the day, we could see a complete turnaround and go back into the range & challenge $180 to $200 again. So I should do an upside run too.

No there is nothing too compelling here TBH

No there is nothing too compelling here TBH

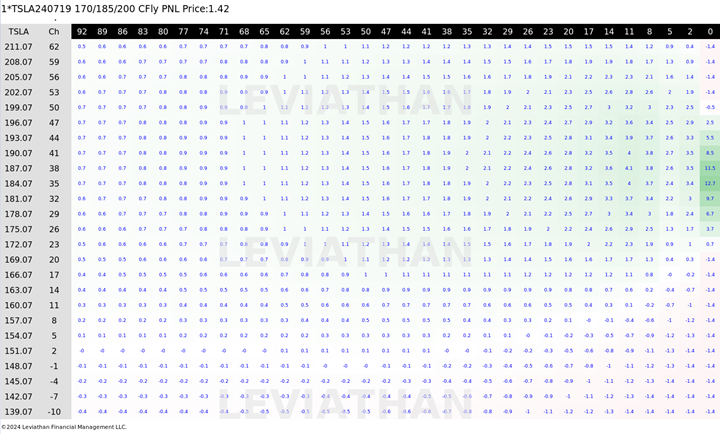

Although that 170/185/200 call fly doesn’t look too bad to get in at $1.75 and out at $6.40 BB1 is giving it a pretty low trade score

Although that 170/185/200 call fly doesn’t look too bad to get in at $1.75 and out at $6.40 BB1 is giving it a pretty low trade score

I mean it’s OK but looks like you’ll have to wait a bit to see this one work for you..but will do well if we just go back into the wedge pattern.

Looking like we are expecting a $7.60 range for the earnings , so it may very well be the case that the bad news is already out there so small than we have seen in the past.

As always, remember it better to be lucky than good, happy hunting everyone.

Darren Krett

Tuesday 23 January 2024

0

Comments (0)

Darren Krett

Tuesday 2 April 2024

0

Comments (0)