Darren Krett

Sunday 3 March 2024

Option plays for GitHub (GTLB) earnings and beyond

0

Comments (0)

Darren Krett

Wednesday 24 April 2024

Share on:

Post views: 9597

Categories

Blog

I am thinking of doing a study channel or AMA for people who want to ask questions about option trading (I have been doing this professionally since 1986) but if you regards are interested in that then DM me, if there is interest then I will do it....

Anyway, on with Microsoft...

Chart doesnt look that great TBH, but it could quite easily retest the trendline (what is now resistance) before falling back again...again, the point of these articles is to show you the best option trade based on your directional view and NOT like one of those BS outfits that run different scenarios to expiration. The AI system I use stresses every type of combination and looks it at today through to generally a week before expiration (because that's realistically what you do), although you can customize that part too.

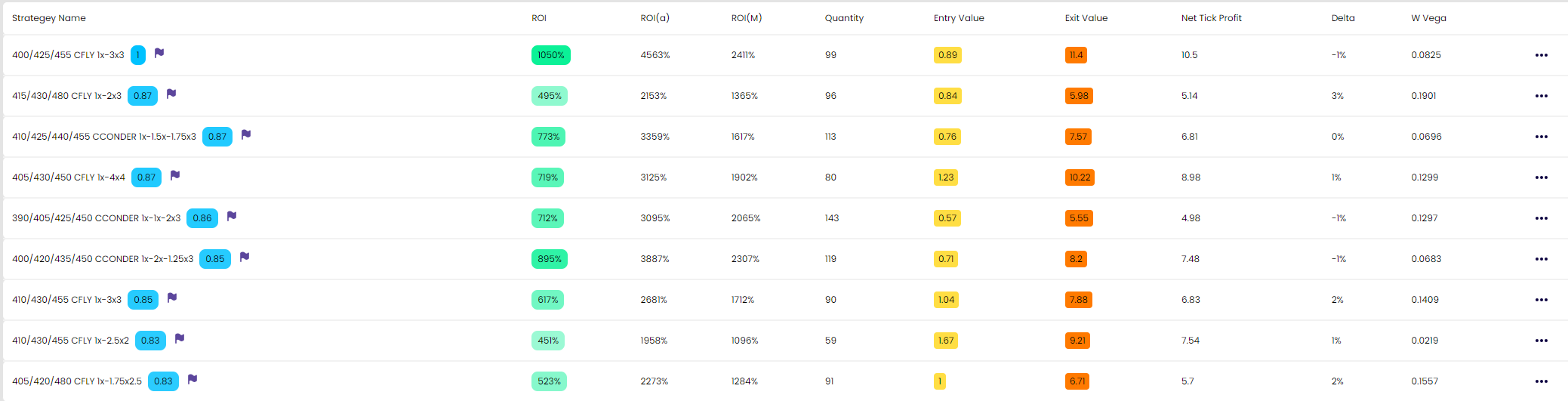

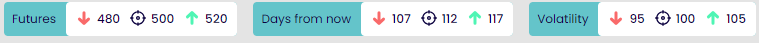

So around 84 days from now to retest the $425 area what does it like?

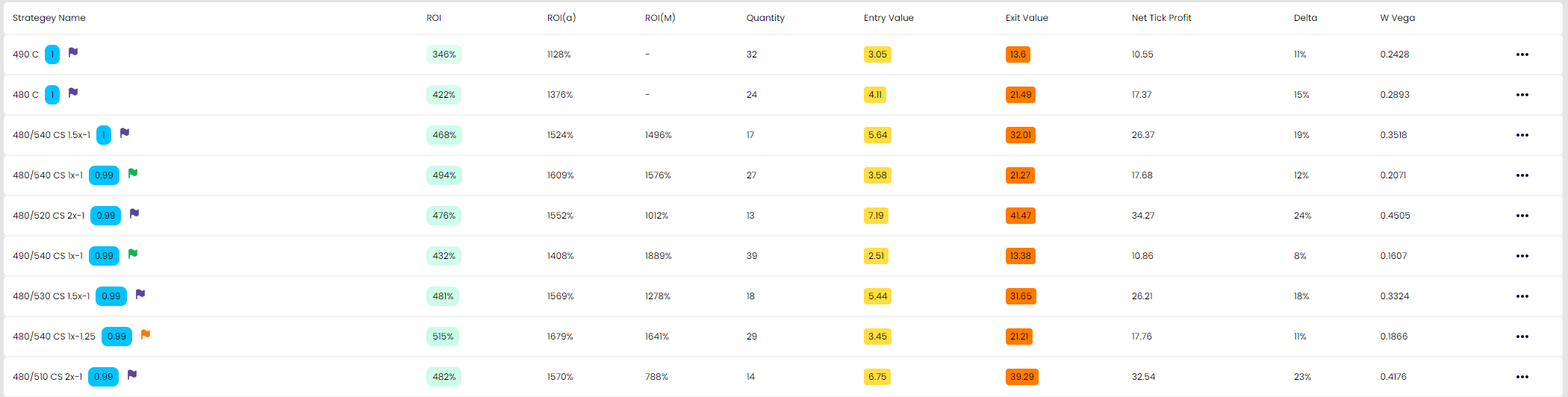

youll have to expand this image to get a good look at it

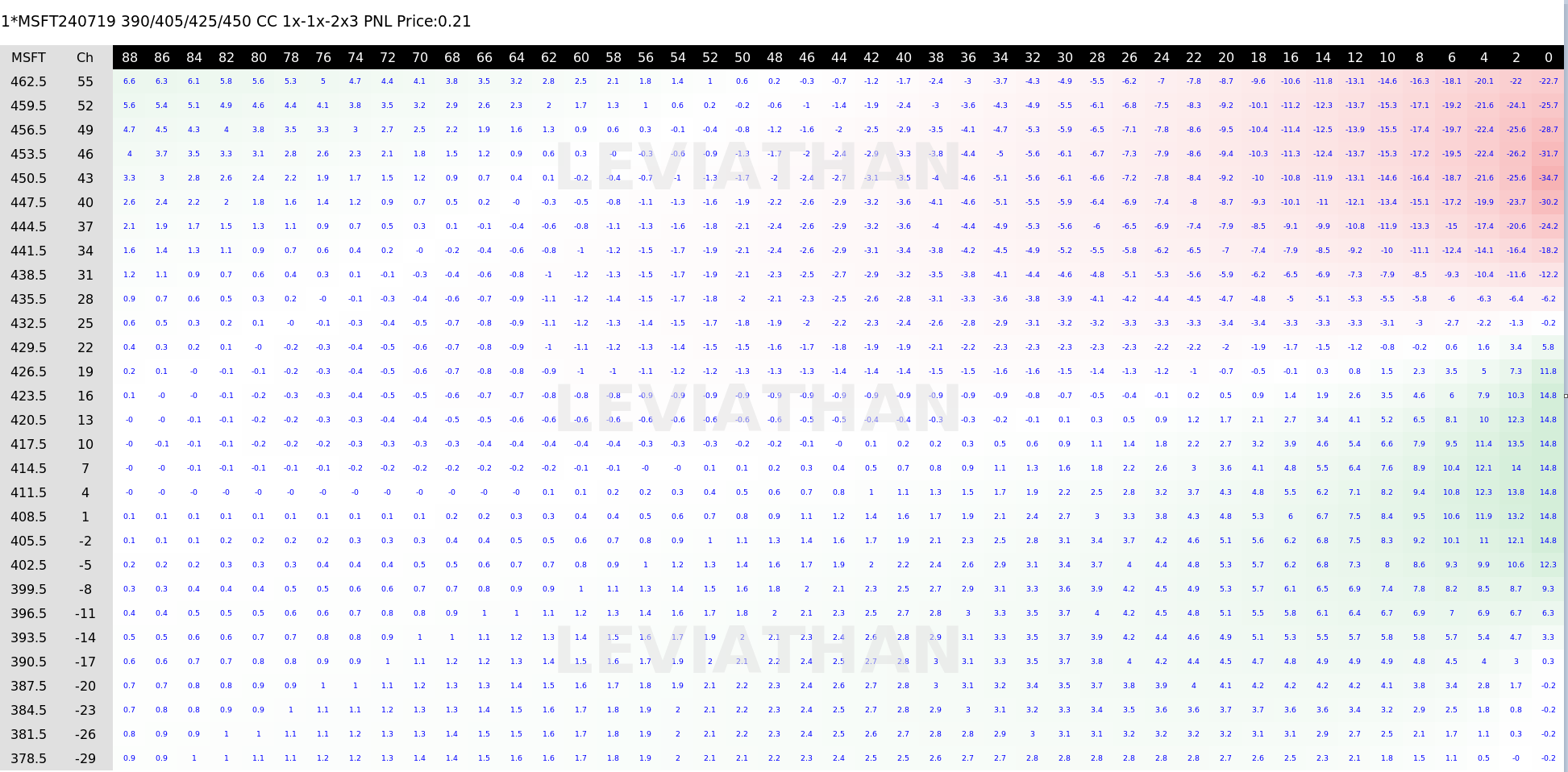

youll have to expand this image to get a good look at it

So this is where you are not going to be looking to run this to your target date unless you are right in your sweet spot. Now I quite like this one because you have some extra units up top , JIC it decides to take off to the moon

So in this condor you'll be buying the 390 call 1 time, selling the 405 call 1 time, selling the 425 call twice, buying the the 450 call 3 times and for $1000 investment you can do this trade 143 times.

If you take a look at the heatmap above you can see how it will work for you over time and why you probably want to be out of this early.

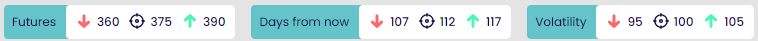

For a continuation of the bear trend I targeted to make money anywhere between $360 to $390 looking for $375 as the sweet spot.

Out of this list I like the

Out of this list I like the

Not the greatest trade in the world but still pretty good in terms of risk/reward.

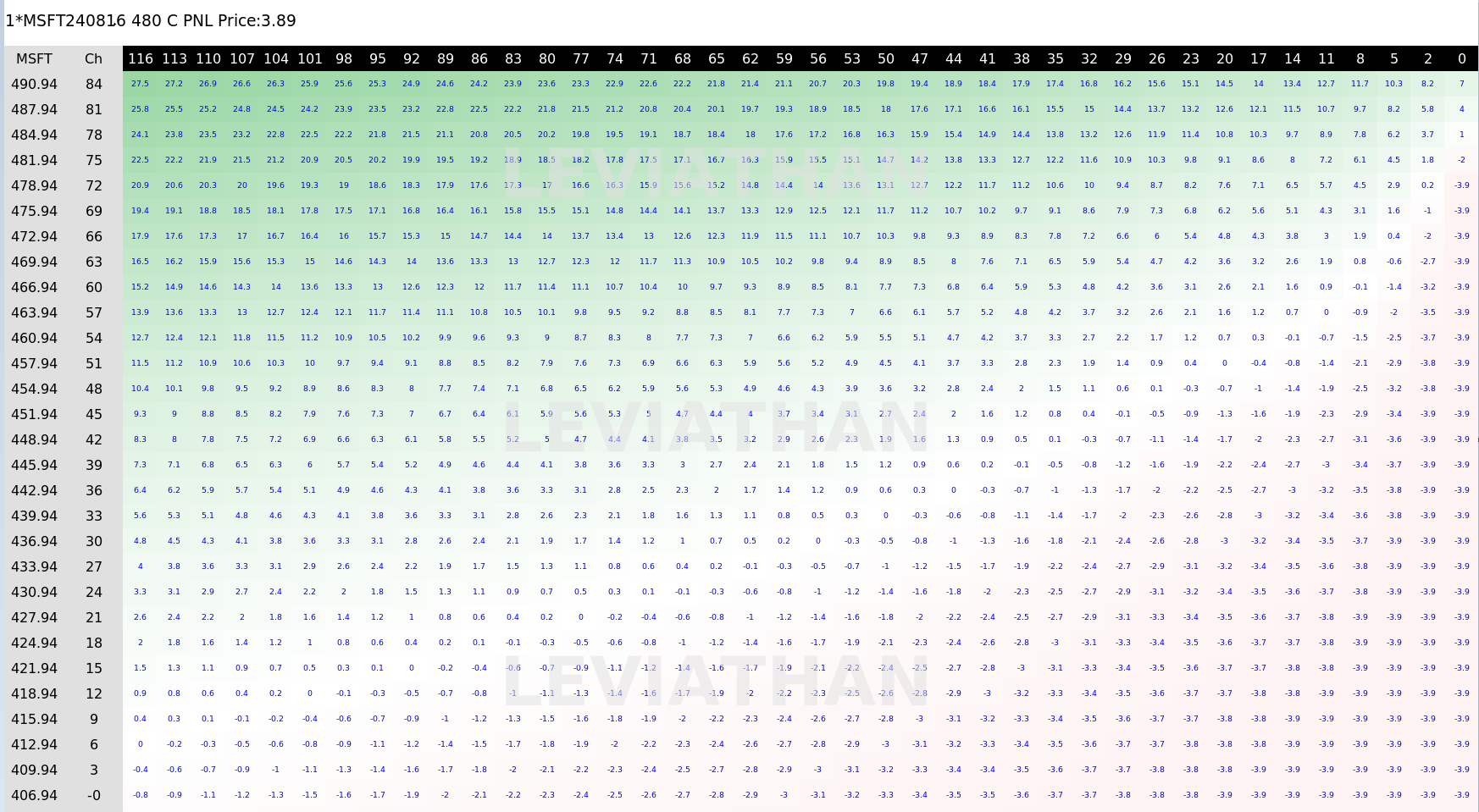

Now we looked at a small upmove and a bearish trade so lets look at a bullish scenario

Going to give this a bit of time in the hope that the trend post earnings will take us back into that uptrend

Going to give this a bit of time in the hope that the trend post earnings will take us back into that uptrend

Interesting that BB1 just decided buying calls if we are looking that far out is the best risk/reward trade

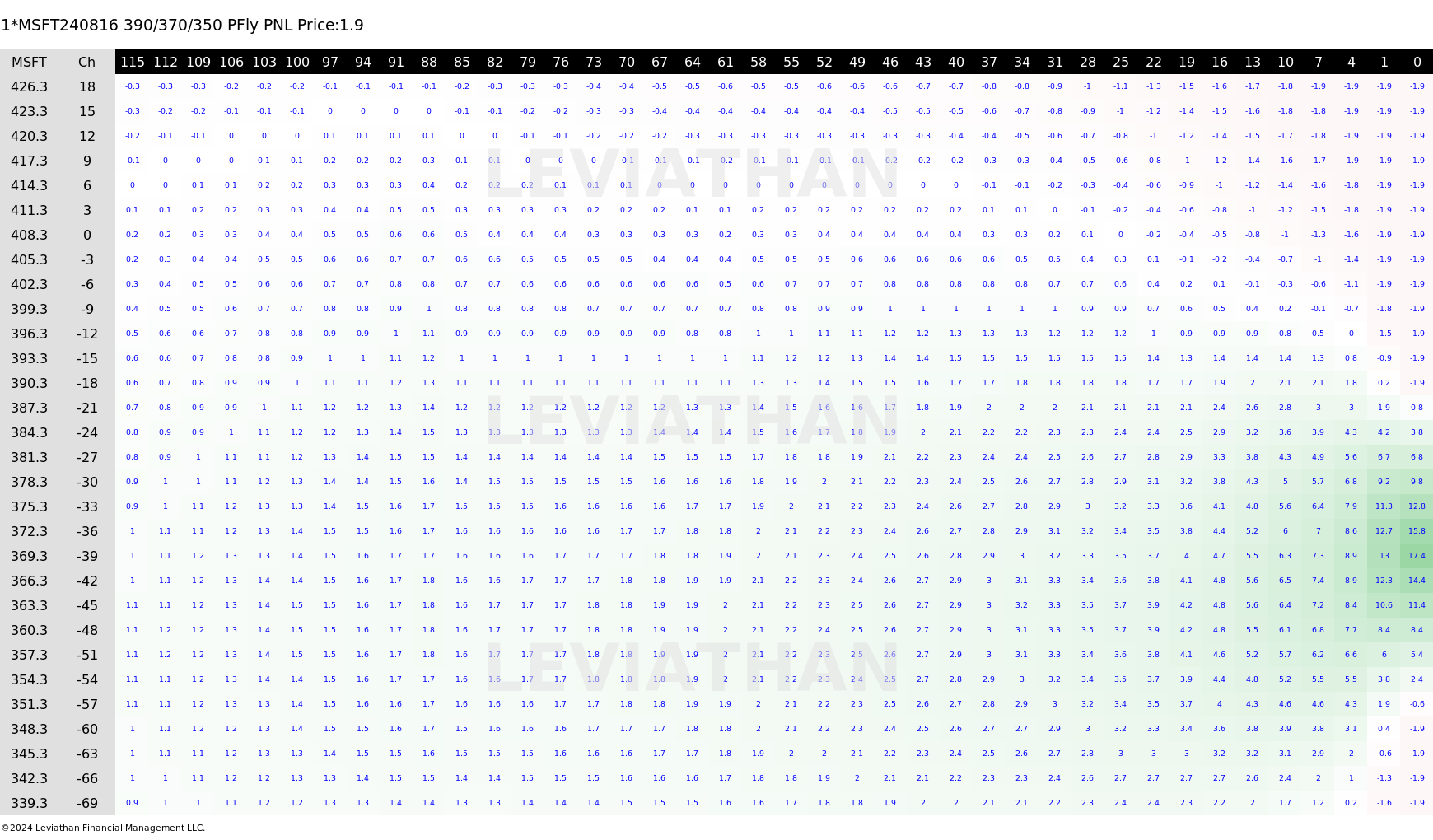

And JIC you wanted to know what the heatmap looks like....

And JIC you wanted to know what the heatmap looks like....

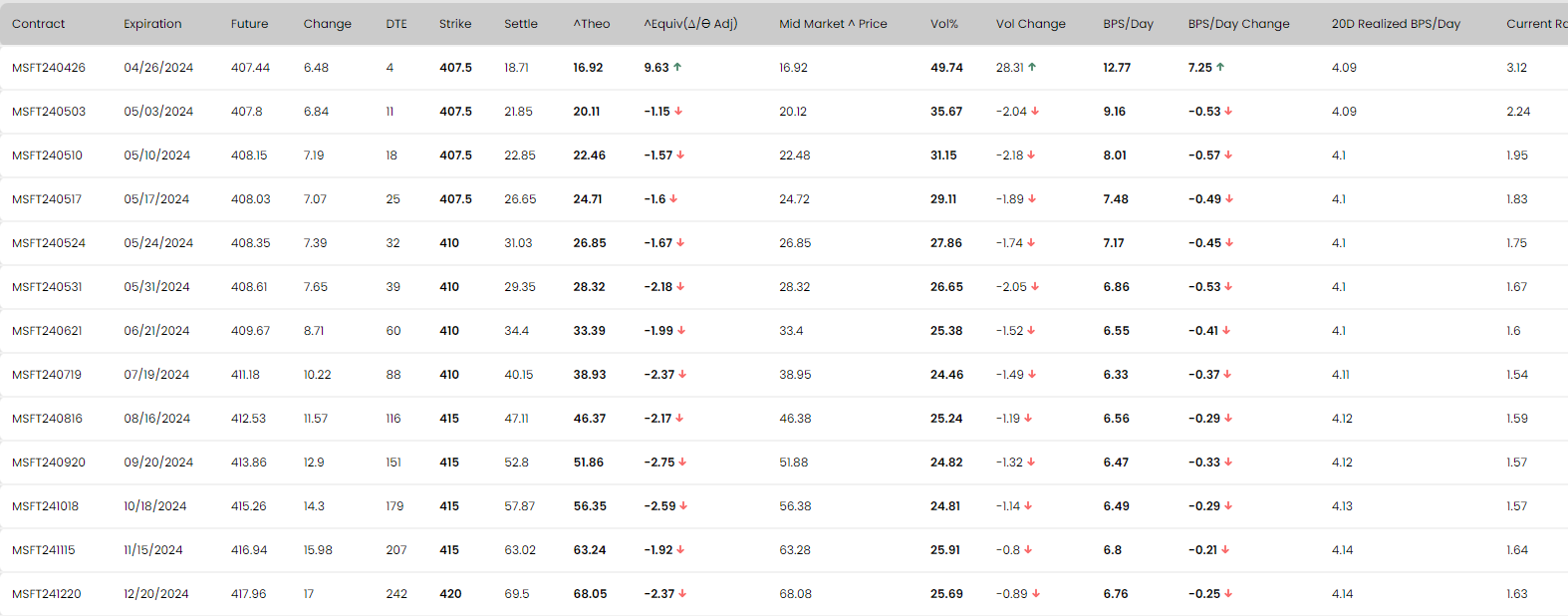

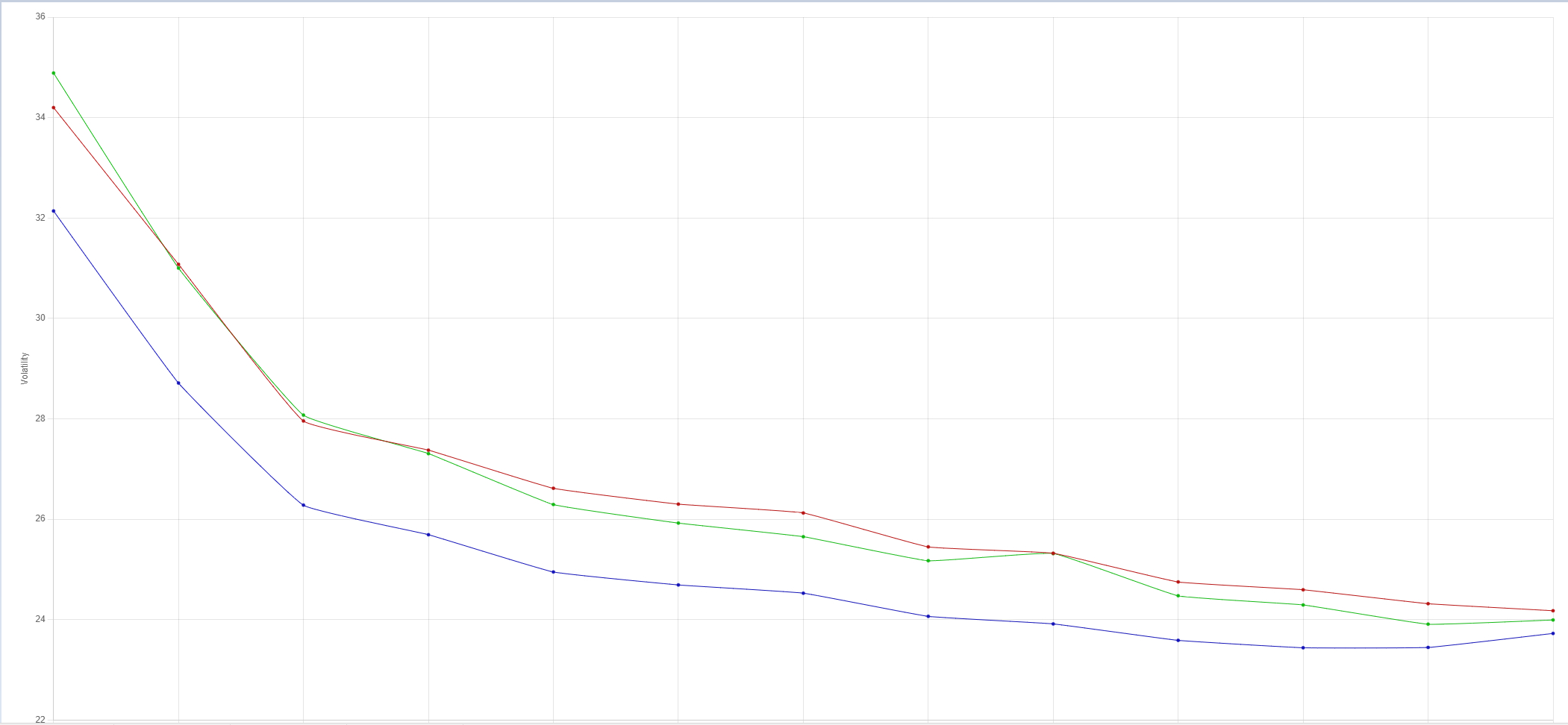

Here are the implied vols and it seems that we are pricing in a fairly aggressive move of $15.60 range (about 3.8%) as opposed to a regular $7.5 range.

skews are implying a grind higher with a little tilt to downside risk, no surprising when looking at the chart. So if you are interested in an AMA about option trading I will consider it based on the responses I get and as always, remember it is better to be lucky than good. Happy hunting traders...

So if you are interested in an AMA about option trading I will consider it based on the responses I get and as always, remember it is better to be lucky than good. Happy hunting traders...

PS: If you have anything you'd like me to run a scenario for you on (like I think this can go "here" in "this timeframe", then let me know and I will send you a report.

Darren Krett

Sunday 3 March 2024

0

Comments (0)

Darren Krett

Wednesday 20 March 2024

0

Comments (0)