Darren Krett

Sunday 3 March 2024

Option plays for GitHub (GTLB) earnings and beyond

0

Comments (0)

Darren Krett

Monday 15 April 2024

Share on:

Post views: 9496

Categories

Blog

So this Thursday we have Netflix once again….did David Benioff and D.B. Weiss’ adaptation of the Three Body Problem, boost or hurt the streaming giant….

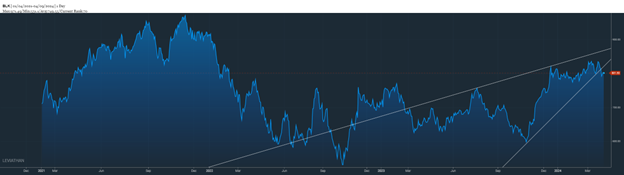

a grind higher but are we about to move?

a grind higher but are we about to move?

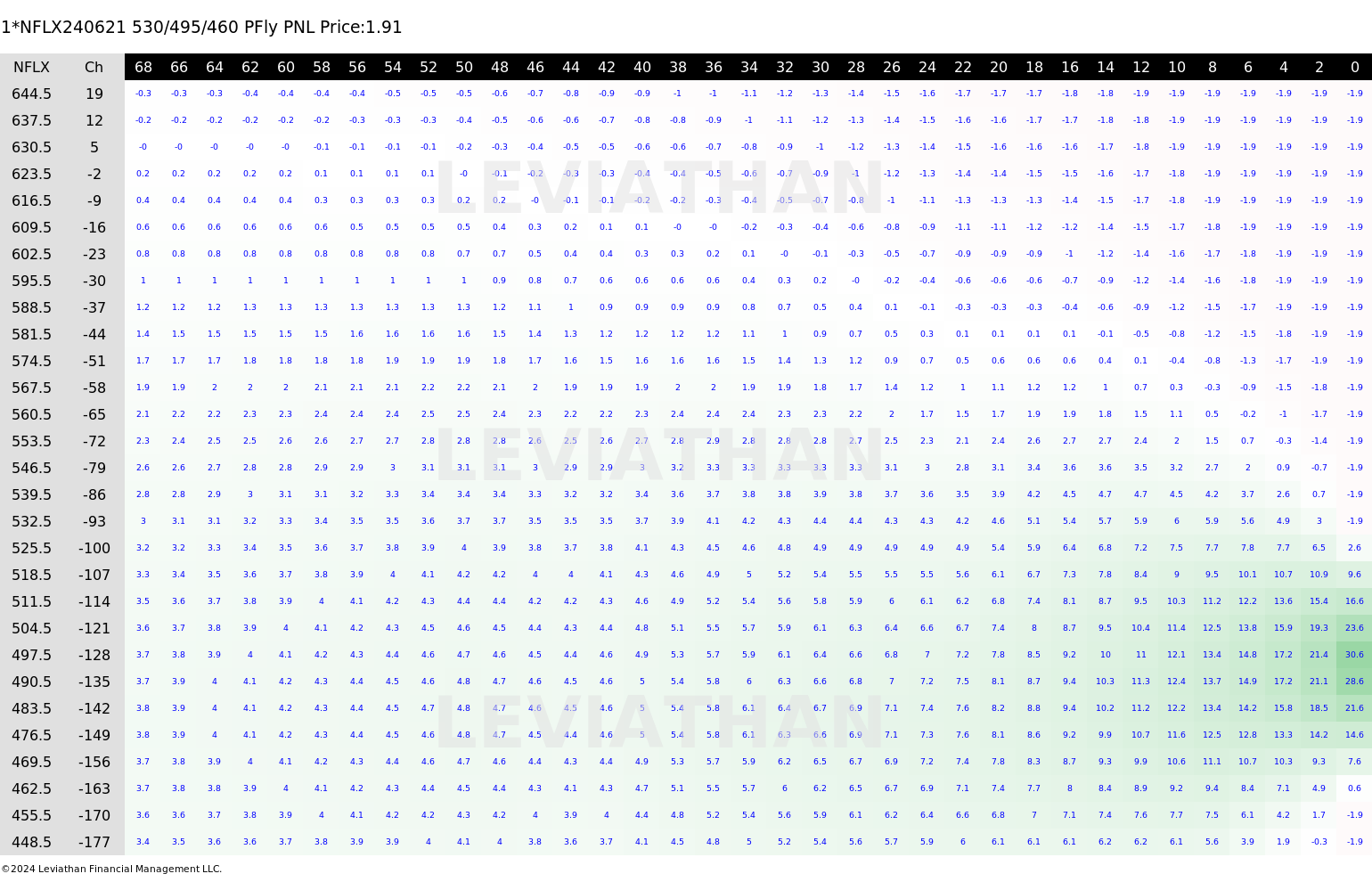

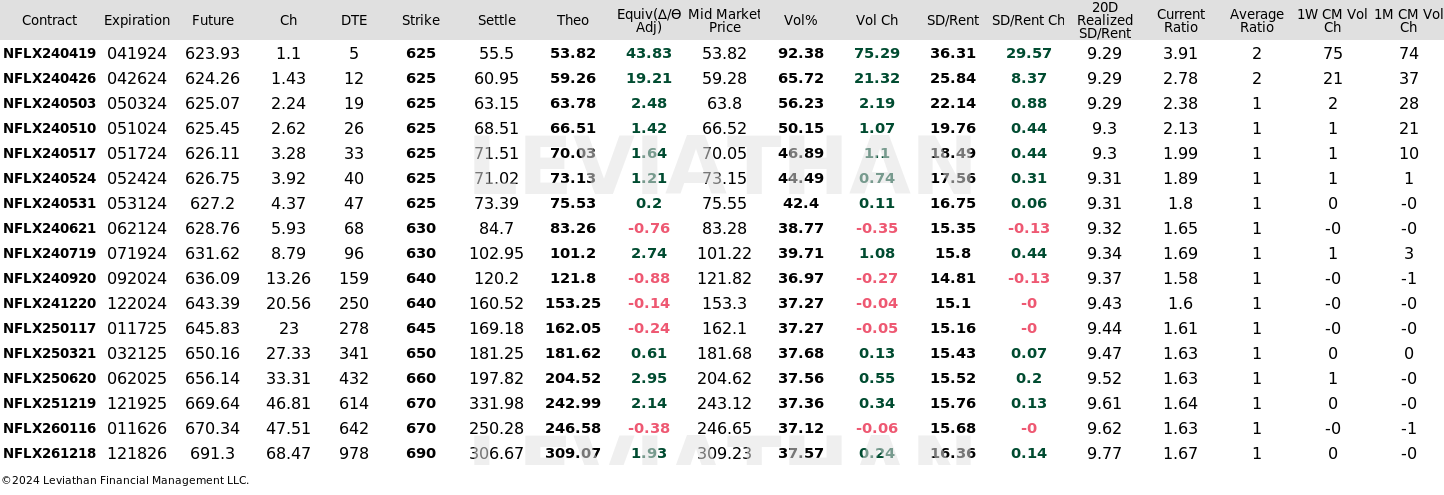

After the previous jump after earnings we have been slowly grinding higher (last time out we got in and out of an upside call fly) it does look like we could be gearing up for a move. Either a challenge to the previous highs back in 2022 or a retracement to the pre-breakout level prior to the previous earnings]…so $500 or $700..I am going to use those target prices and see what BB1 comes up with.

For those who are new to reading my stuff…we are NOT looking to run this to expiration, so it is a more realistic scenario AND I am not going to hold your hand and tell you exactly what to do, even if I have my own bias. The point of these articles are to show you the BEST option trade depending on your view, be it either bullish or bearish. So lets start with “bullish”…..

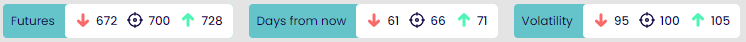

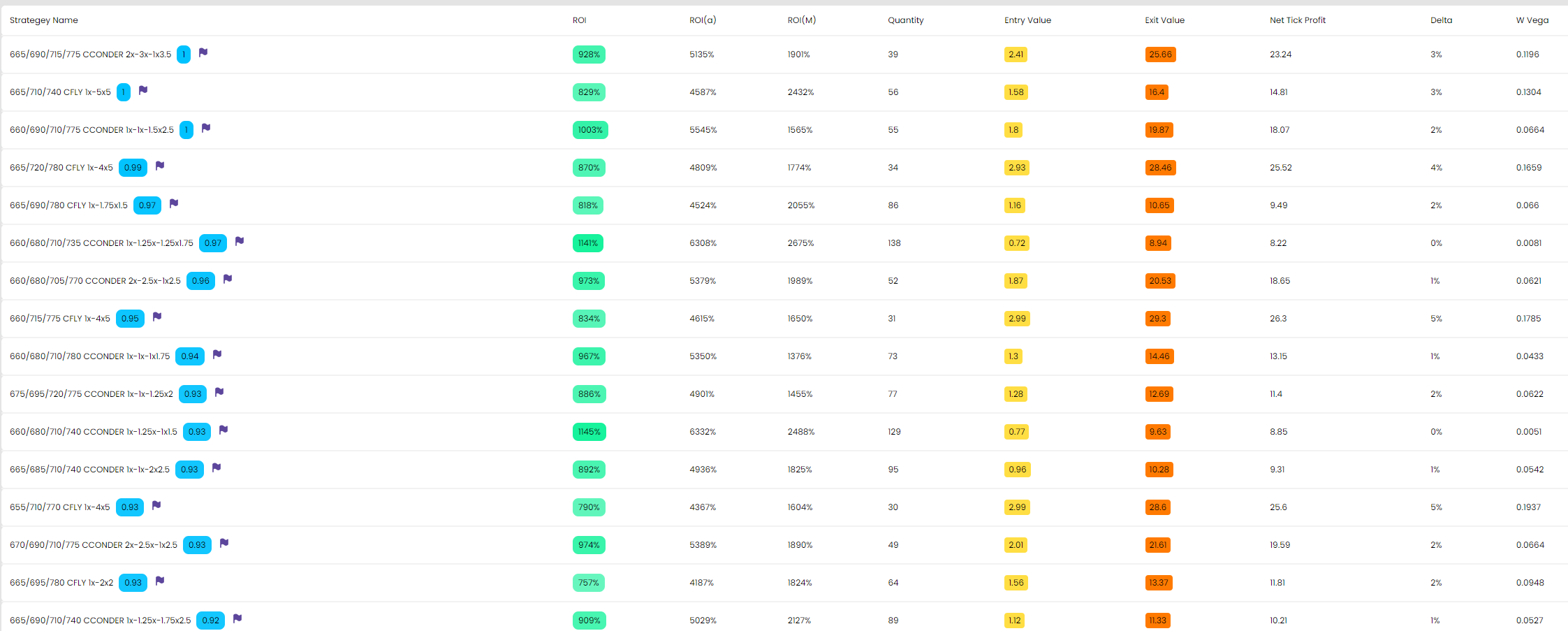

66 days from now targeting $700ish

66 days from now targeting $700ish

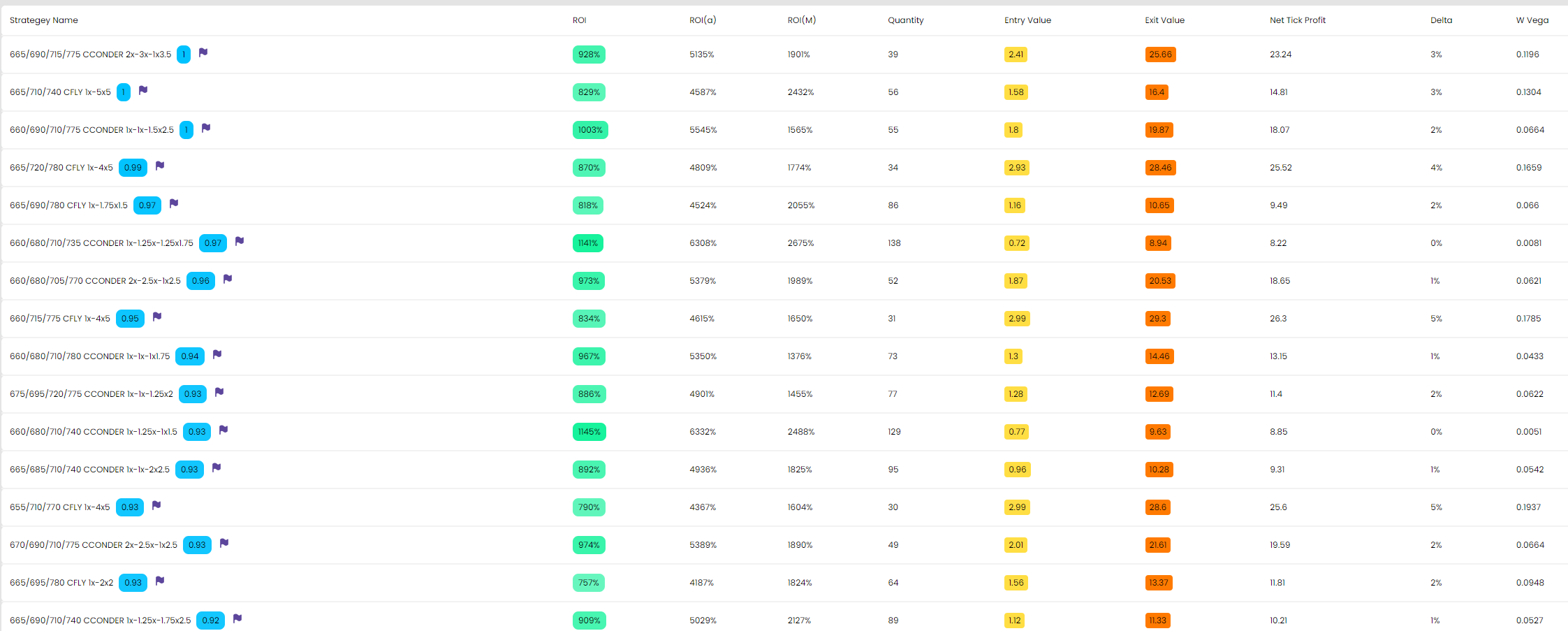

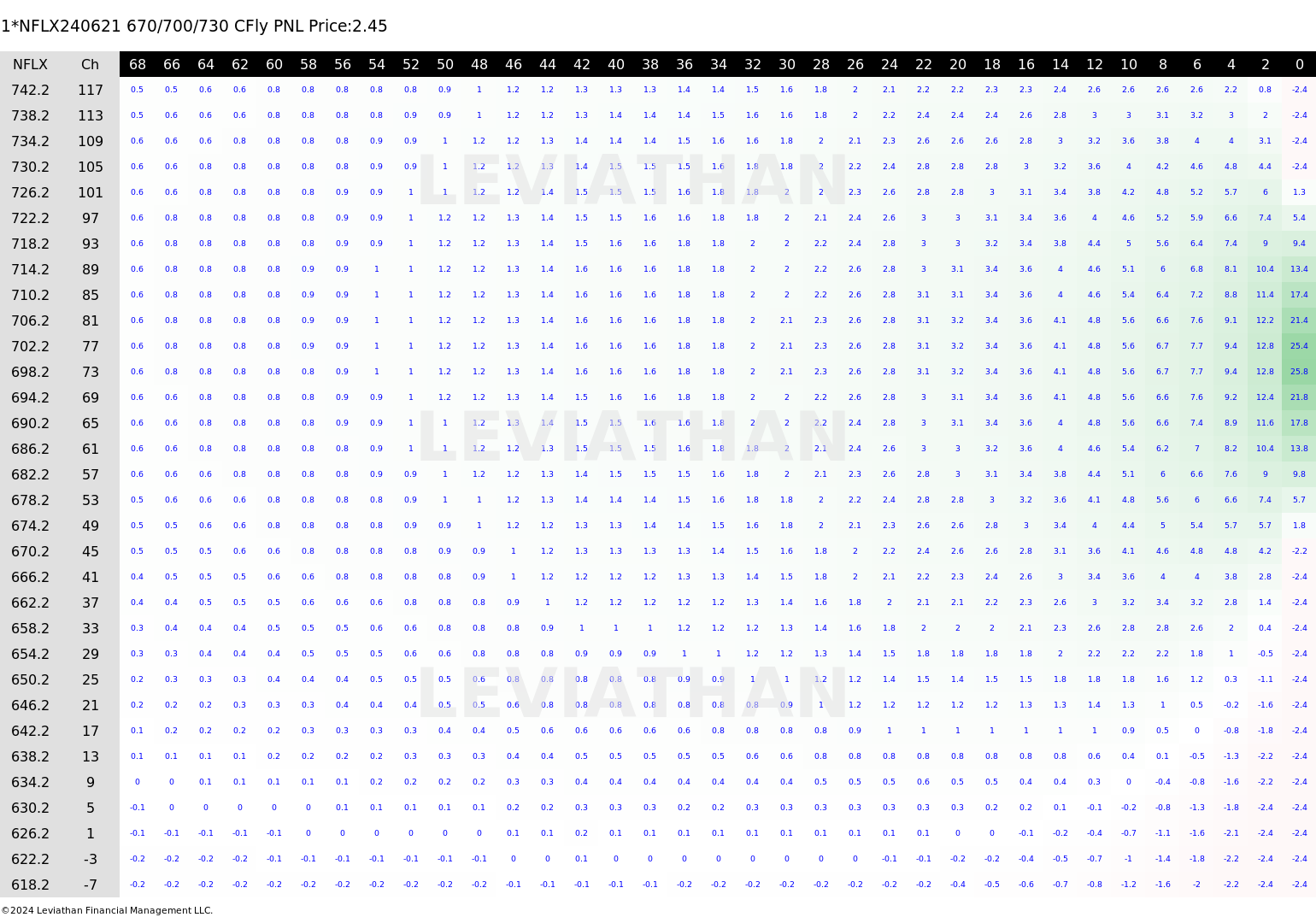

Now the initial list has some fairly funky ratios but I am going to opt for the safer one on the vanilla list.

I like this fly, It monetizes well, you will see a quick return on it on an initial jump but will do really well if we follow the pattern we did after the Q1 earnings.

I like this fly, It monetizes well, you will see a quick return on it on an initial jump but will do really well if we follow the pattern we did after the Q1 earnings.

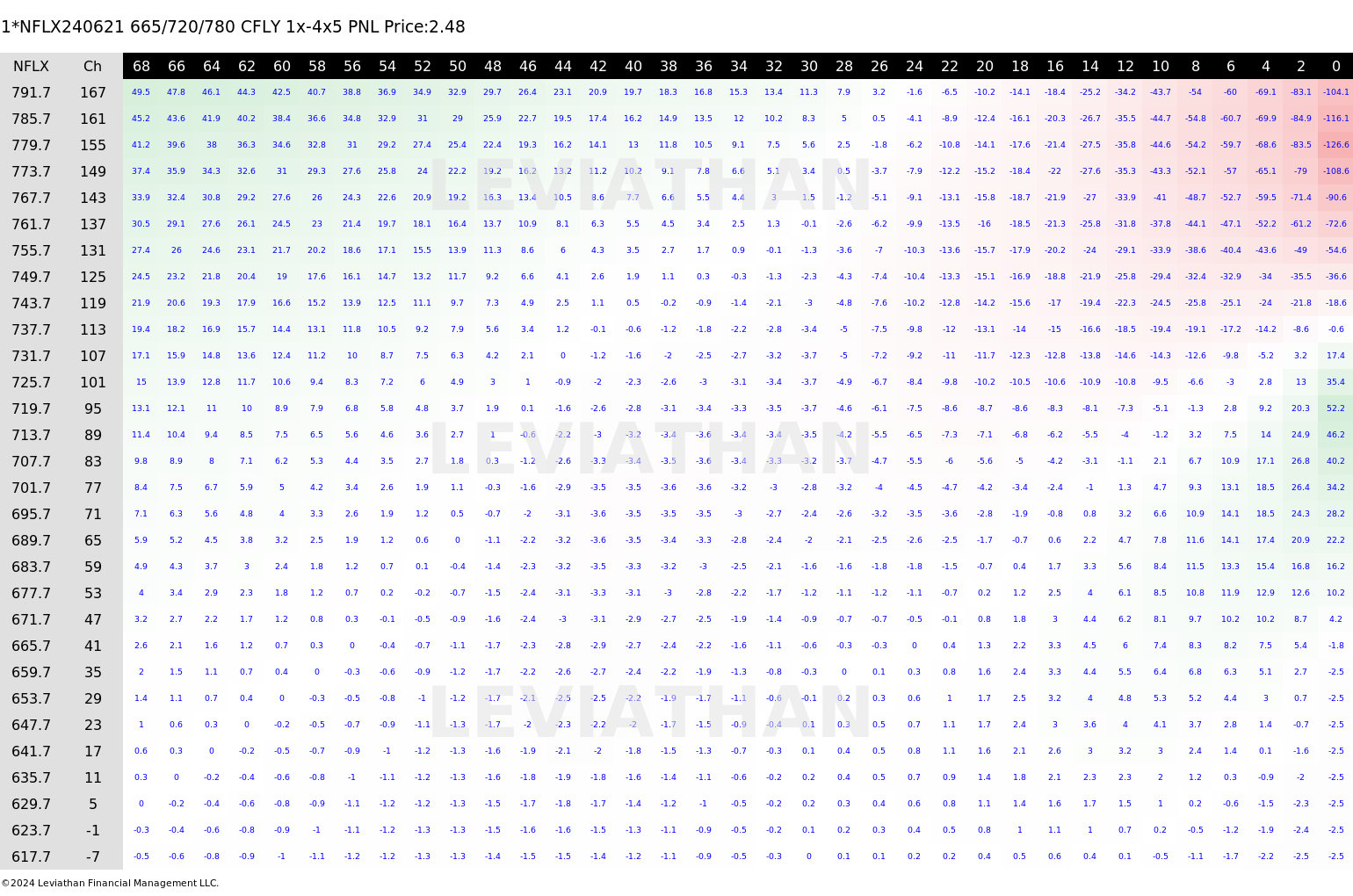

I also did want to show you BB1 run with the more colourful choices…..this ratio fly will monetize way quicker but will have more risk the longer you hold onto it, a good trade, just be aware it is on a way shorter timeframe. (665/720/780 call fly ratioed 1x4x5)

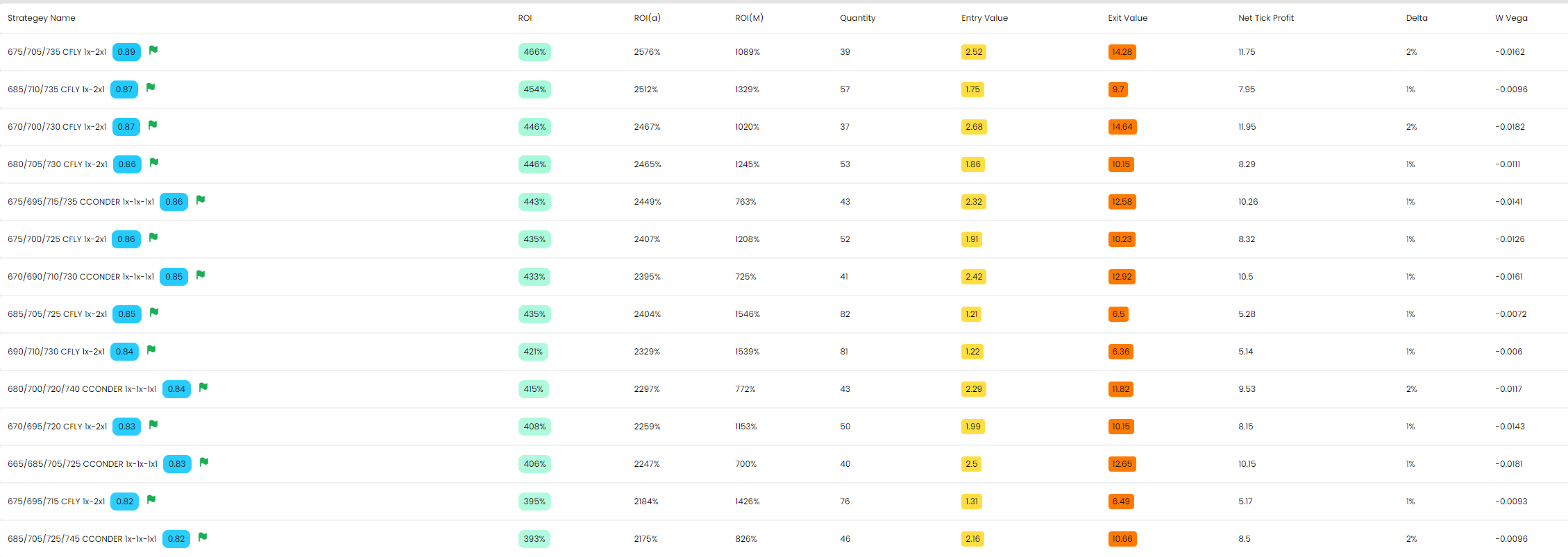

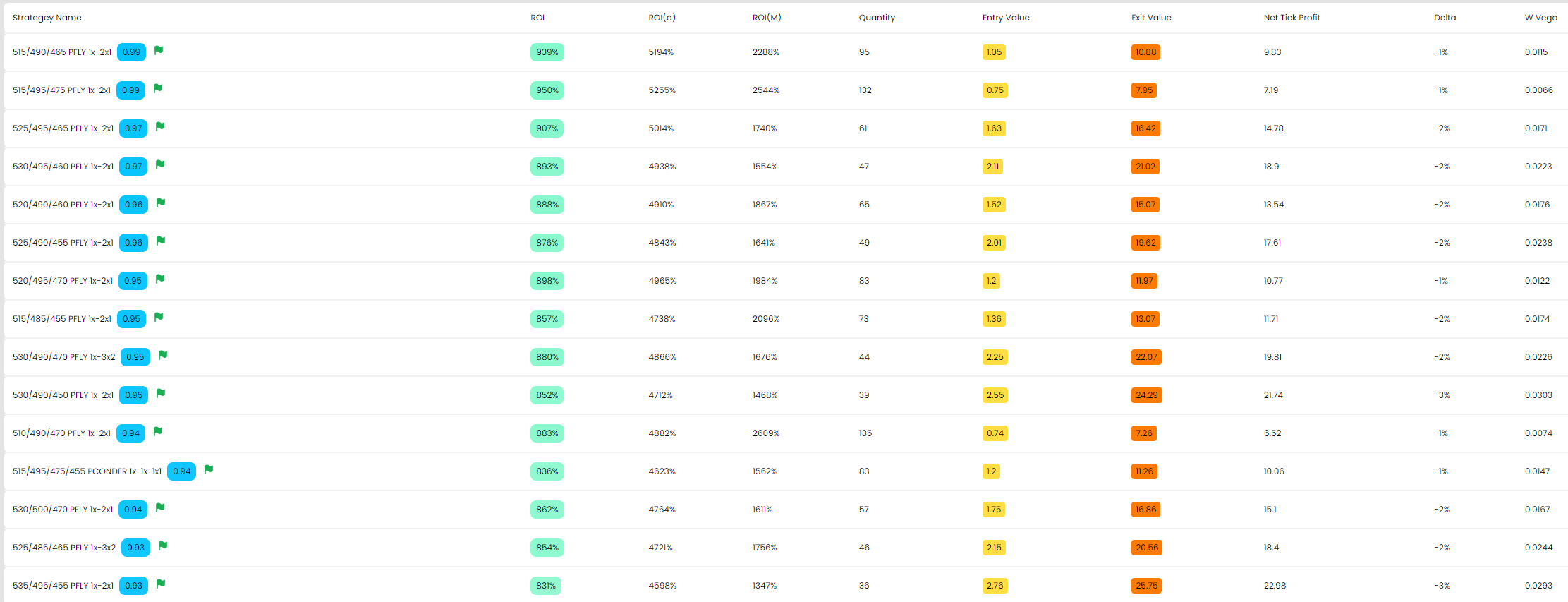

Now for the downside…”it was all a big mistake.”

Now for the downside…”it was all a big mistake.”

So there are some very nice returns to be had here. We don’t need to filter much here and just go straight for this particular put fly.

Looks lovely on the heat map which is the most important thing.

Looks lovely on the heat map which is the most important thing.

AS expected, volatility is pumped for the expected number this week, and we are going to be looking at a $30 range for this week so as you can see from the heat maps a sweep in either direction of that magnitude will help your trade a great deal.

As always remember it is better to be lucky than good…happy hunting traders!

As always remember it is better to be lucky than good…happy hunting traders!

Darren Krett

Sunday 3 March 2024

0

Comments (0)

Darren Krett

Wednesday 20 March 2024

0

Comments (0)