Darren Krett

Sunday 3 March 2024

Option plays for GitHub (GTLB) earnings and beyond

0

Comments (0)

Darren Krett

Wednesday 6 March 2024

Share on:

Post views: 3495

Categories

Blog

As a reminder, the purpose of these posts is to show you the best risk/reward trades, which will mean avoiding the swing for the fences front month trades. We are looking to be able to capture the trend, post earnings.

So let us begin...

right in the middle of the channel

right in the middle of the channel

The top of the channel comes in around $900 with the bottom around $600. Although I personally like Costco, I will suggest one for the bulls and another for the bears.

69 days out from now

69 days out from now

Yes 69 days from now and targeting $900 , however, I wanted to be able to start making money well before then

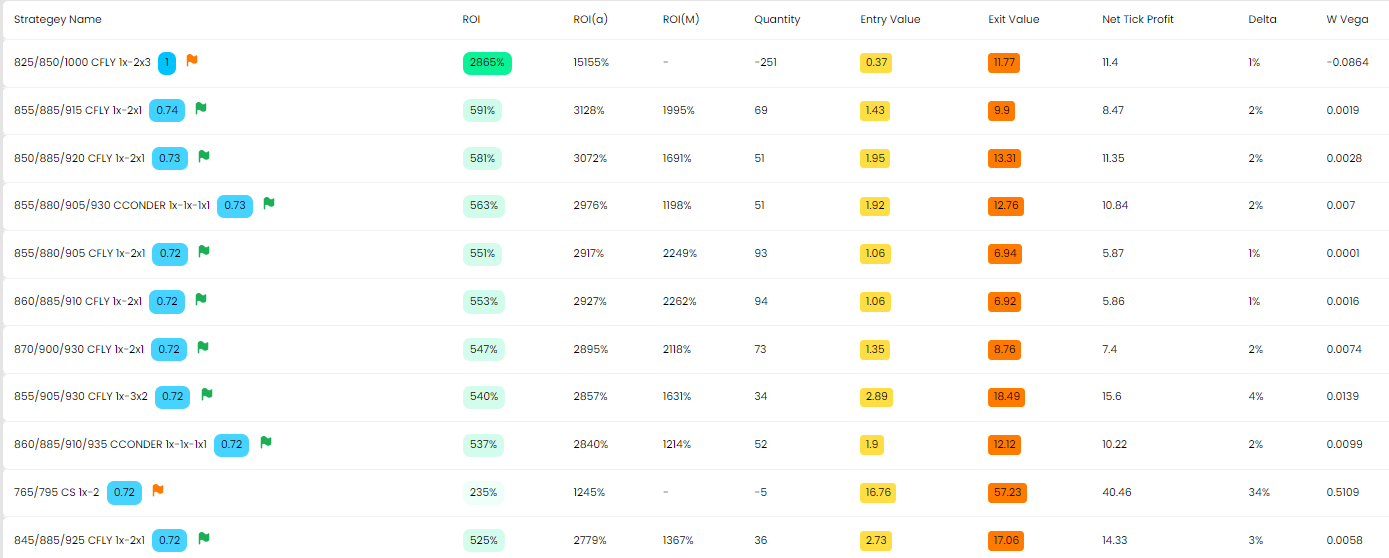

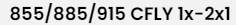

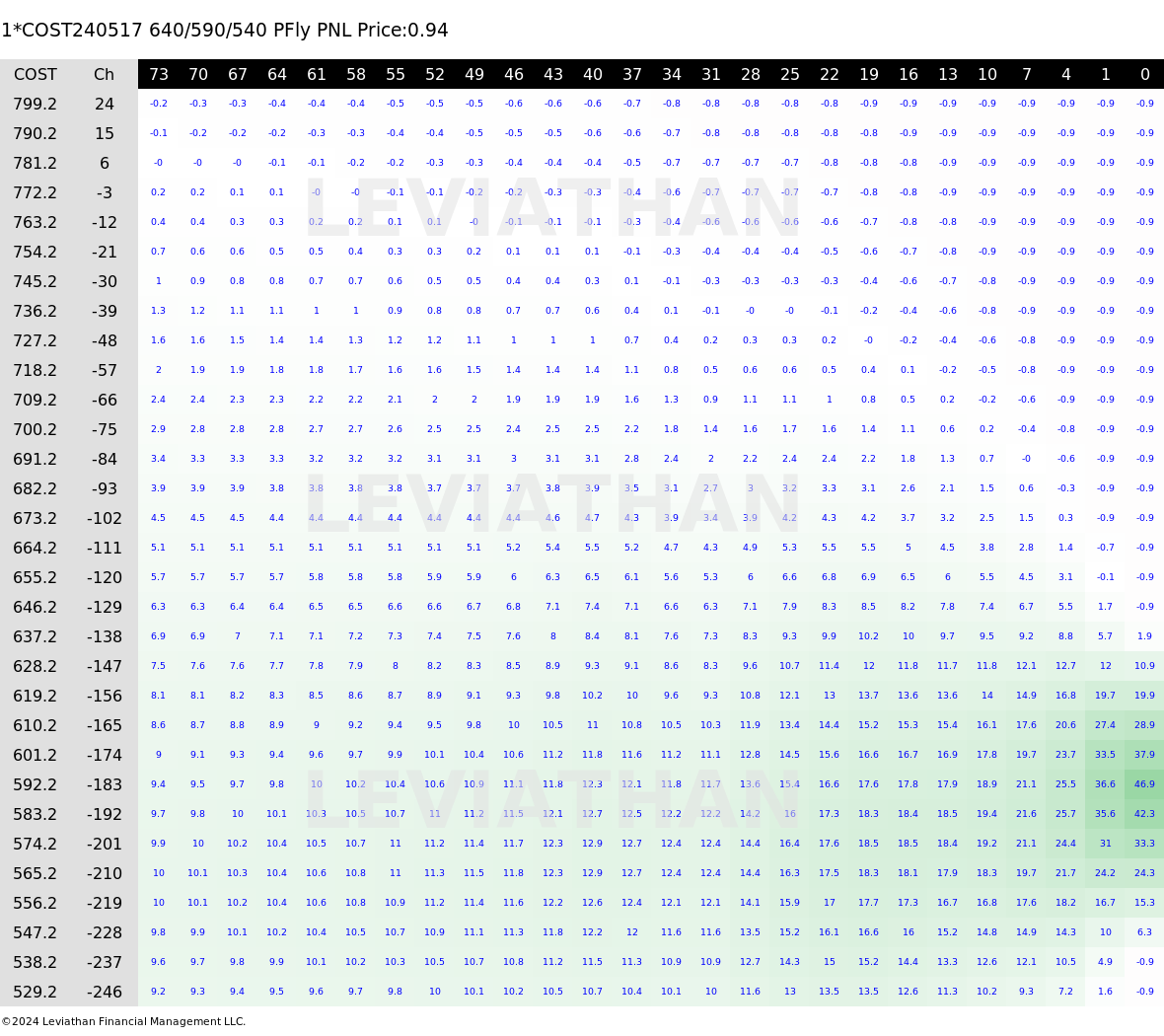

After BB1 went through its 1 billion iterations, this is what it came up with. I have chosen to go with the 2nd one on the list..

I prefer it to the other fly as this one is a bit simpler and easier to manage.

I prefer it to the other fly as this one is a bit simpler and easier to manage.

You will make money very quickly on a rally and there is a lot of green on the heatmap

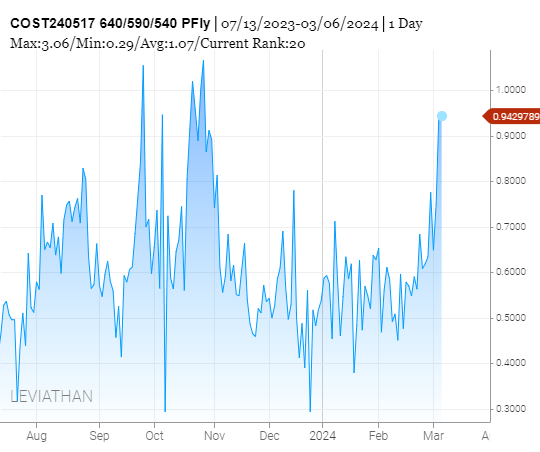

Also this particular out-the-money equivalent fly is relatively cheap, sitting in its 10th percentile, so even more of a reason to make it a good upside play.

Now for the downside....

Now for the downside....

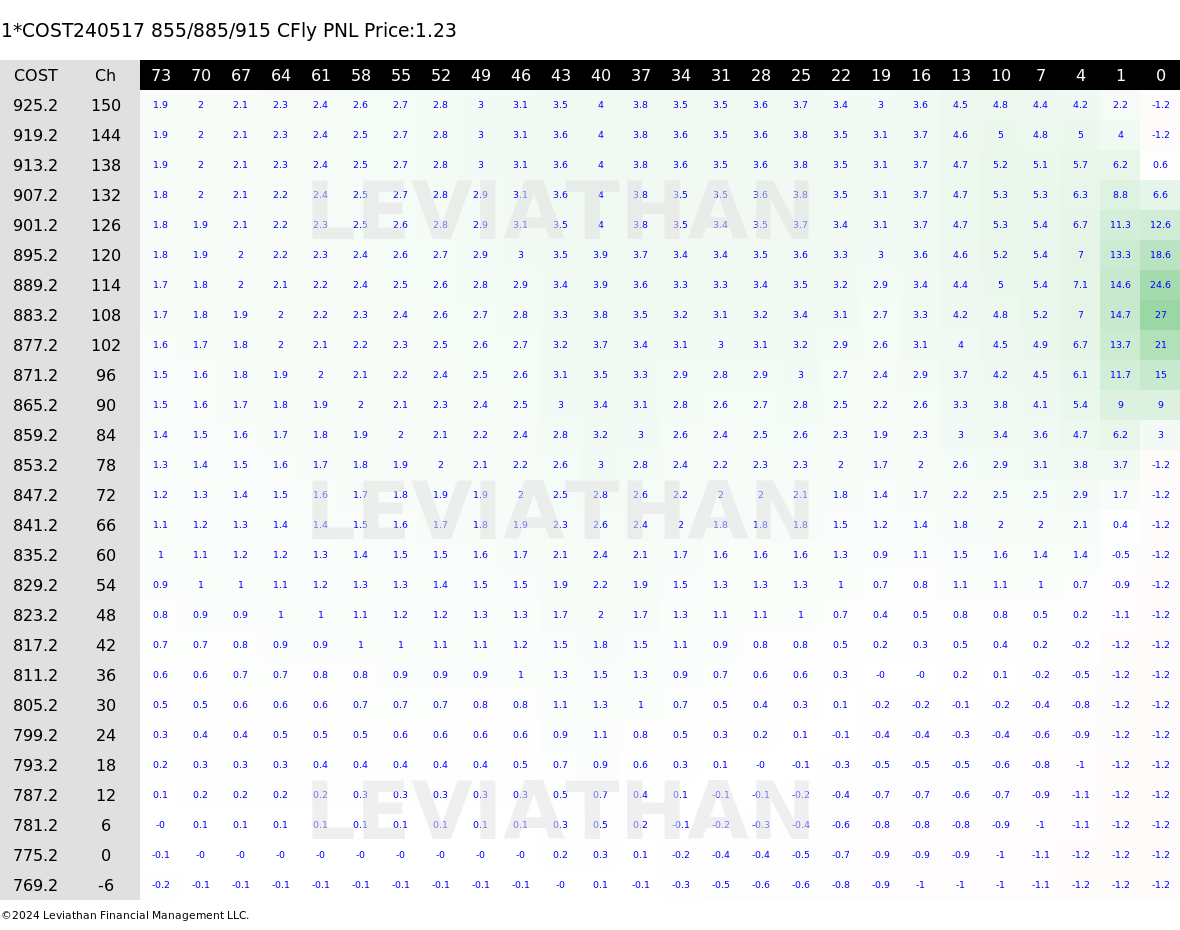

Targeting $600 and once again 69 days out , give or take (so using the May expiration)

I was actually a little surprised with the returns you can get from these plays, even if the Trade Scores aren't quite as high. I went for BB1's top pick and went for this put fly.

Upside will suck, but it monetizes pretty quickly on the down move so you wont have to wait long to be profitable.

Not quite as good as the relative call fly, this one is still in its 20th percentile  so again offering a good value trade.

The upside will suck, but it monetizes pretty quickly on the down move so you won't have to wait long to be profitable..

so again offering a good value trade.

The upside will suck, but it monetizes pretty quickly on the down move so you won't have to wait long to be profitable..

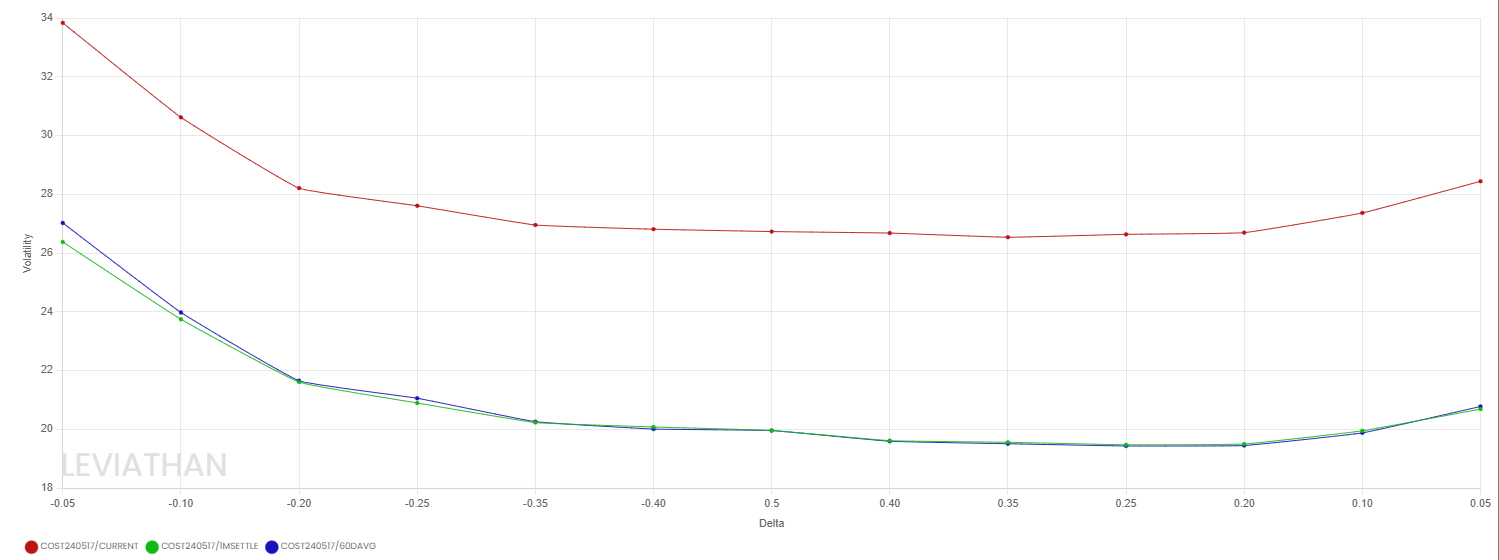

May implied volatility is still pretty pumped compared to the 60 day average and where it was a month ago, so beware on just trying to buy OTM options even as far out as here.

And once again, remember always rather be lucky than be good...happy hunting traders!

May implied volatility is still pretty pumped compared to the 60 day average and where it was a month ago, so beware on just trying to buy OTM options even as far out as here.

And once again, remember always rather be lucky than be good...happy hunting traders!

Darren Krett

Sunday 3 March 2024

0

Comments (0)

Darren Krett

Wednesday 31 January 2024

0

Comments (0)