Vomma

Stay ahead and keep your mind focused.

Categories

Learning

The Greeks

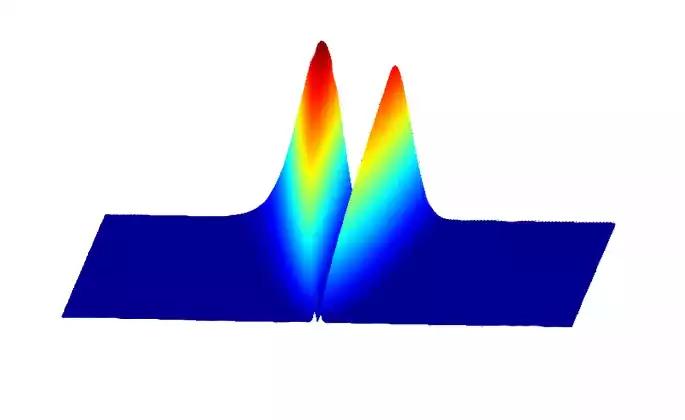

Vomma is the rate at which the vega of an option will react to volatility in the market. It is a second-order derivative for an option’s value. Vomma demonstrates the convexity of vega. A positive value for vomma indicates that a percentage point increase in volatility will result in an increased option value which is demonstrated by vega’s convexity.

Understanding the Sensitivity of Vega to Changes in Implied Volatility

Vomma, also known as Volga, is a lesser-known but significant Greek in options trading. It specifically measures how an option's vega, which represents the sensitivity of the option's price to changes in implied volatility, reacts to fluctuations in implied volatility itself. Essentially, Vomma quantifies the rate at which vega changes with respect to changes in implied volatility.

Conceptual Understanding:

Second Derivative of Option Price:

Vomma is essentially the second derivative of an option's price concerning changes in implied volatility. While vega measures the first-order sensitivity of an option's price to changes in implied volatility, Vomma goes a step further by capturing how this sensitivity itself changes as implied volatility shifts. Sensitivity to Volatility Fluctuations:

Vomma provides insight into how the option's vega reacts to fluctuations in implied volatility. A higher Vomma value indicates that the option's vega is more sensitive to changes in implied volatility. In other words, the option's price is expected to exhibit larger swings in response to volatility fluctuations.

Impact on Option Prices:

Options with higher Vomma values are more sensitive to changes in implied volatility. Therefore, as implied volatility increases or decreases, the option's price will experience more significant changes compared to options with lower Vomma values. Volatility Trading Strategies:

Traders and investors can use Vomma to design volatility trading strategies. Options with higher Vomma values might be preferred when anticipating significant changes in implied volatility. Moreover, traders might adjust their positions based on changes in Vomma to capitalize on potential opportunities arising from volatility fluctuations. Risk Management:

Understanding Vomma helps in better risk management, especially in volatile market conditions. Traders can assess the impact of volatility changes on their options positions and adjust their strategies accordingly to mitigate risk.

Factors Influencing Vomma:

Maturity of Options:

Generally, longer-dated options tend to have higher Vomma values compared to shorter-dated options. This is because longer-dated options have more time for volatility to impact their prices, leading to increased sensitivity. Strike Prices and Moneyness:

At-the-money options typically have higher Vomma values compared to out-of-the-money or in-the-money options. This is because at-the-money options are more sensitive to changes in implied volatility. Market Conditions:

Vomma can vary depending on prevailing market conditions. In times of heightened uncertainty or significant market movements, Vomma values may increase as options become more sensitive to changes in implied volatility.

Conclusion:

Vomma is a valuable tool for options traders and investors, providing deeper insights into the impact of implied volatility fluctuations on option prices. By understanding Vomma and incorporating it into their analysis, traders can make more informed decisions, devise effective trading strategies, and manage risk more effectively in dynamic market environments.

Subscribe to our latest news and stay updated !!!

Get ahead of the wave and sign up to our socials to get access to exclusive offers, videos, tutorials and latest news.

Support

Company

Products

© 2015 - 2025 Leviathan Financial Management LLC. All Rights Reserved.

Legal Disclaimer: The information provided in the Leviathan website is for informational purposes only. It should not be considered legal or financial advice. You should consult with a financial advisor professional to determine what may be best for your individual needs. Leviathan Financial Management does not make any guarantee or other promise as to any results that may be obtained from using our content. No one should make any investment decision without first consulting his or her own financial advisor and conducting his or her own research and due diligence. To the maximum extent permitted by law, Leviathan Financial Management disclaims any and all liability in the event any information, commentary, analysis, opinions, advice and/or recommendations prove to be inaccurate, incomplete or unreliable, or result in any investment or other losses. Content contained on or made available through the website is not intended to and does not constitute legal advice or investment advice. Your use of the information on the website or materials linked from the Web is at your own risk.