Darren Krett

Friday 10 February 2023

WHY OPTIONS?

0

Comments (0)

Darren Krett

Friday 5 May 2023

Share on:

Post views: 4550

Categories

Uncategorized

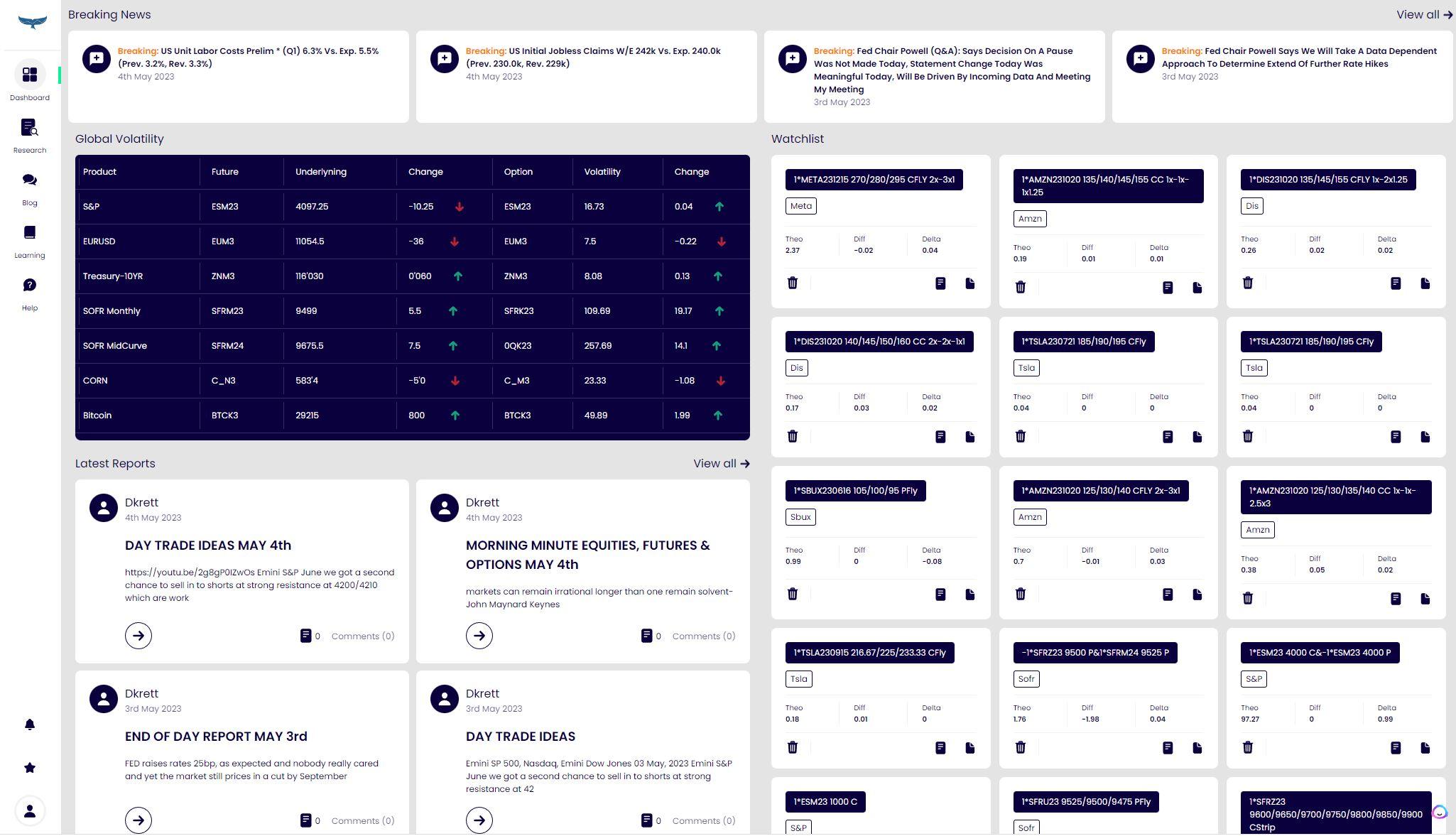

Options trading is an ever-evolving and exciting arena that has the potential to provide investors with high returns when done correctly. Traders rely on their intuition and analytical skills to identify the best opportunities available in the market. Among these skills, analytics plays an integral role in the decision-making process by providing traders with the necessary insights to make informed decisions.

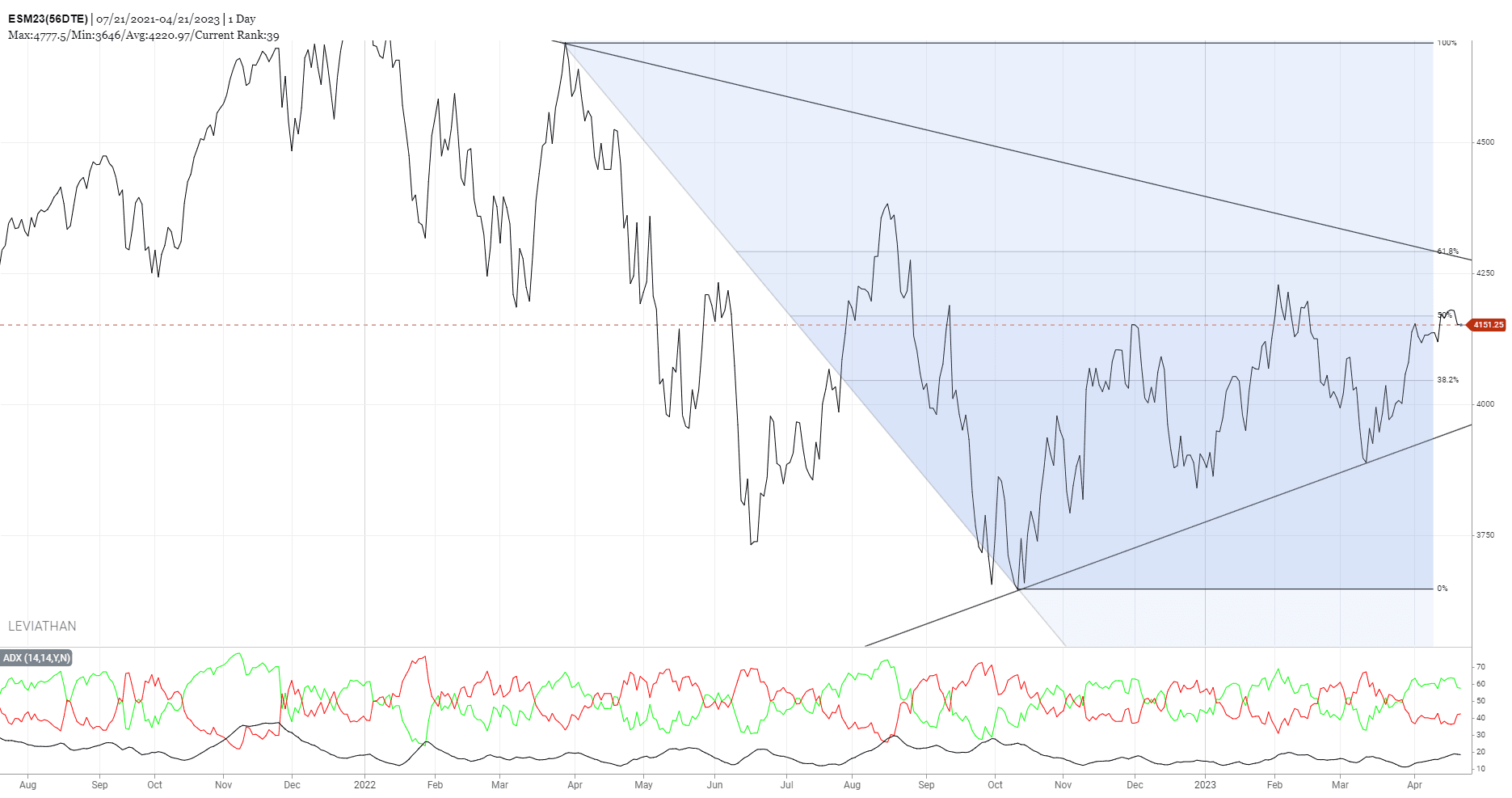

Understanding Market Trends

Options trading can be extremely profitable for investors if they know how to analyse market trends. Analysing market trends enables traders to understand how the market is behaving and to take advantage of potential profit opportunities. Analytics provides traders with real-time data to help them identify the right opportunities and predict future trends accurately.

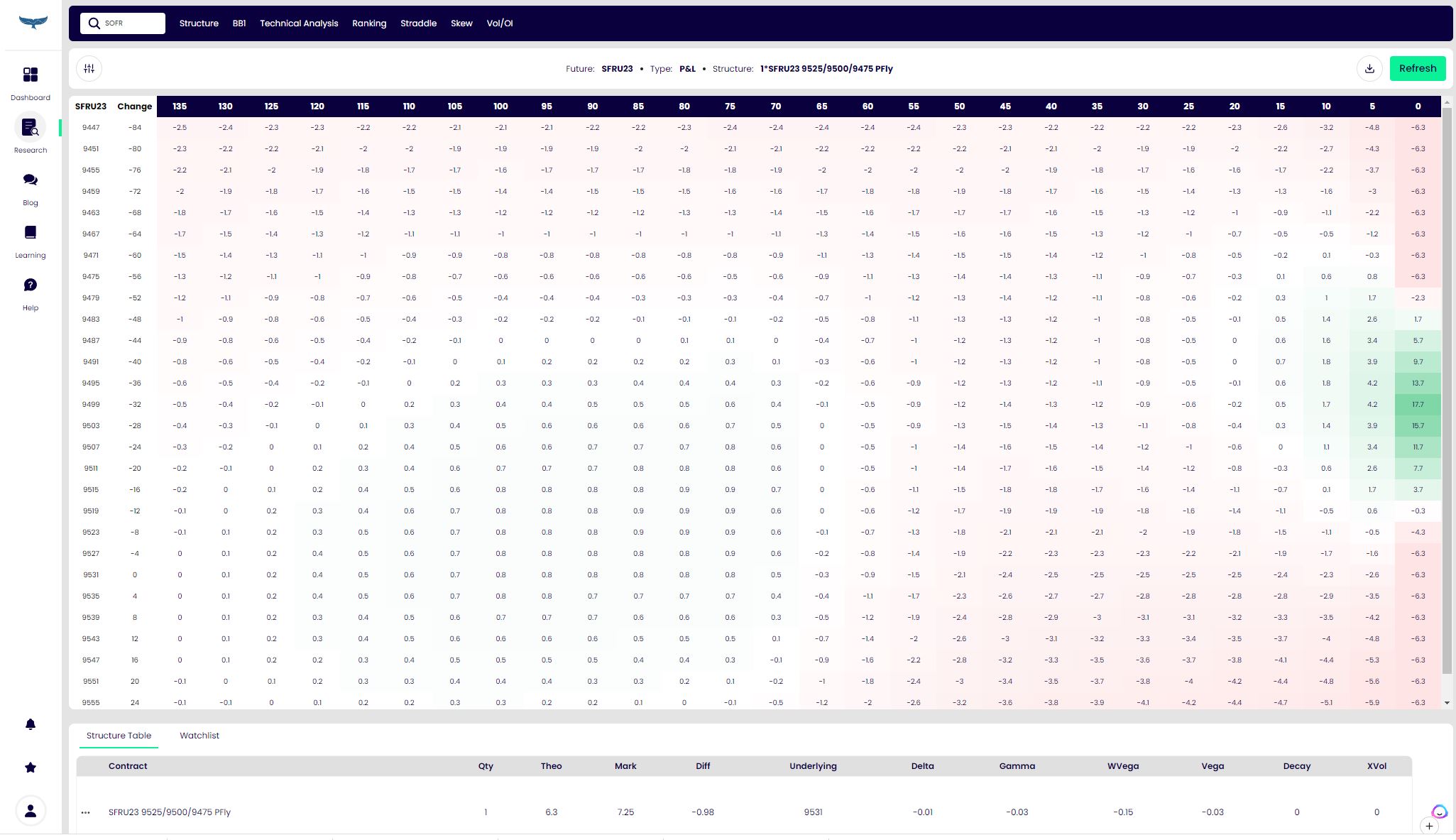

Predictive Analytics/Risk Management

Predictive analytics is becoming an increasingly popular tool in the world of options trading, enabling traders to predict the likelihood of where things could occur in the future not only can help you make money, but more importantly, allow you to understand where your risk may lie. Also, by analysing past performance data, traders can predict the direction of the market and initiate trades that are most likely to be profitable.

Options trading, like any other form of investment, comes with its fair share of risks. Effective risk management is critical to the success of options trading, and this is where analytics comes into play. By utilising analytics tools, investors can monitor their positions in real-time, track a trade's performance and implement early warning systems to anticipate potential risks.

Optimize Use of Capital

Analytics also helps traders optimise the use of capital by identifying opportunities that offer the most potential returns. By analysing various market conditions and assessing the level of risk involved, analytics can help investors make more informed decisions on how to allocate their capital.

Conclusion

Analytics is the backbone of successful options trading and is essential to making informed decisions, understanding market trends, and managing risk. By embracing data-driven decisions and utilising advanced analytics tools, traders can unlock the full potential of options trading and increase their chances of success significantly.

Darren Krett

Friday 10 February 2023

0

Comments (0)

Darren Krett

Friday 5 May 2023