Darren Krett

Thursday 4 May 2023

The Truth About Options Trading

0

Comments (0)

Darren Krett

Friday 5 May 2023

Share on:

Post views: 5465

Categories

Trends

As the options market continues to grow and evolve, traders are faced with an increasingly complex landscape.

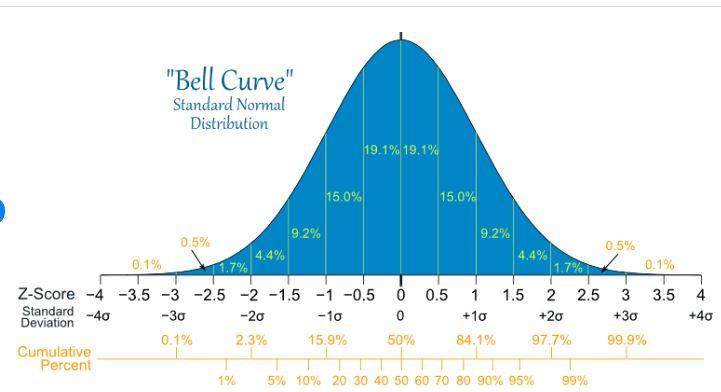

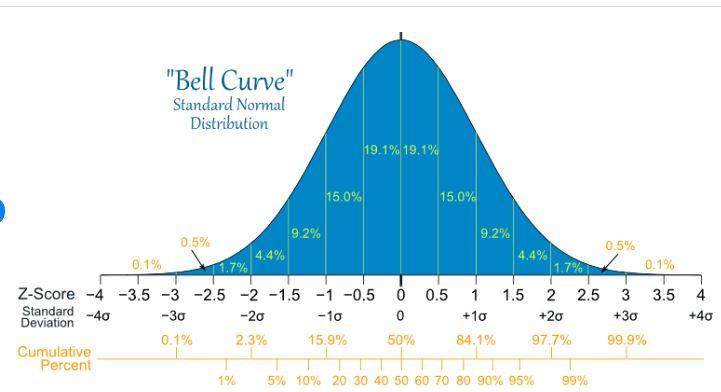

When you trade stocks it is very 2 dimensional.If it goes up, you win…if it goes down, you lose. Now imagine you are living in a hypothetical 2 dimensional world. If a sphere passes through your world you have no idea its a sphere. You would just see a circle that starts as a dot, gets bigger until it reaches its maximum diameter and then get smaller again until it disappears.You would have no fucking idea what a sphere even looks like, let alone know that one has just passed through your house.

Options are like being in a 3 dimensional world where you can see the sphere, you can move through space, forward backward, up and down. Imagine if you were a a 2 dimensional being in your 2 dimensional world but were able to perceive in 3 dimensions! You would have such an advantage over everyone else in that 2 dimensional world. And that is what it is to know how to trade options, but these days it is not something you can do on your own, There are so many different options and strategies available,different ways of expressing your opinion and also risk. It is IMPOSSIBLE to make informed decisions without having a top grade analytics system available to you. One that can not only help you decide how best express your view but also allow you to properly assess your risk

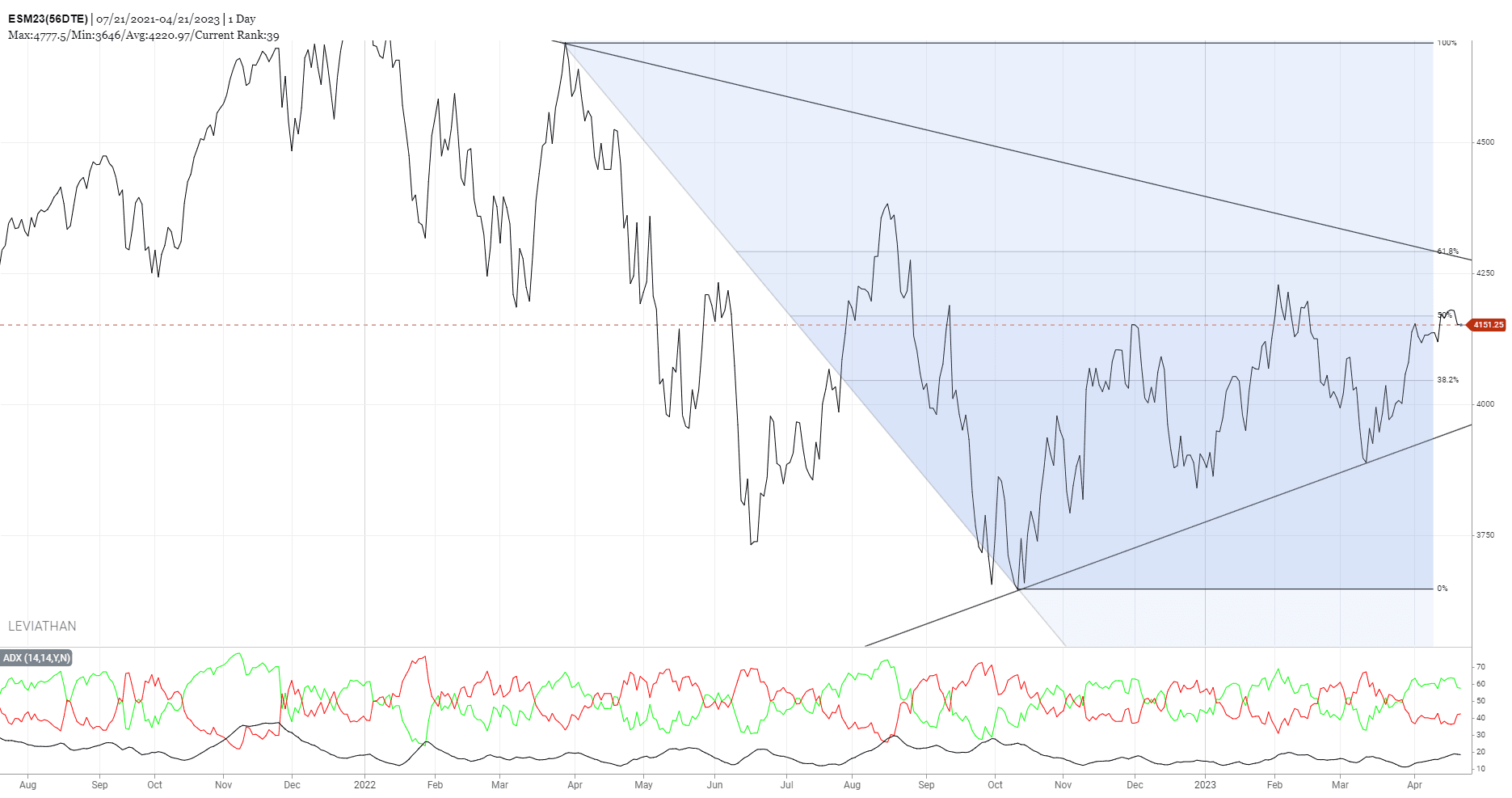

Access to historical data: Most option based platforms do not backtest option strategies properly which makes it very difficult for you guys to properly evaluate exactly what to do. While most systems can provide short term historical data it requires a real heavy lifter to be able to provide you data that can go back a long time, back to the 90s , where you can do comparisons as to how things moved in times of stress. This can include information on underlying stock prices, option prices, and other key metrics. By analyzing this data, traders can backtest any type of option combination and make more informed trading decisions.You will know where your risk is and if the trade you are about to enter is over or undervalued. This is something you need a system to evaluate on your behalf and to do that it requires a wealth of historical data.

Pick your trading strategy: It is difficult, once you have your view to know how to express it. Using the 2d/3d analogy, you need to understand how things in the option world can move. You may think a stock is on the rise, buy a call only to see it lose value when the market goes up. You need a system that will be able to show you the best strategy for your view but also easily display where things might go wrong. Ease of use: Trying to be that 3d guy in the 2d world is very difficult. Assuming that there was a 4 dimensional world, it is very difficult for us to perceive it. A good system will do that work for you. It should be easy to use, a few clicks here and there and you will have all the information at your fingertips.You should be able to create customized dashboards that display the data and metrics that are most relevant to your trading strategies. Be able to save strategies so you can glance at them whenever any news comes out,This can help traders to quickly identify not only potential opportunities but to make and enter trades more efficiently.

Real-time market data: Many analytics platforms provide real-time market data, allowing traders to stay on top of market movements and adjust their strategies accordingly. This can be especially important in fast-moving markets where minute-to-minute changes can have a significant impact on trading outcomes and where you need to see the dynamics of how an option position changes with different types of moves.

Improved risk management: Finally, the most important part of option trading is to be able to understand risk. What happens if Iam wrong, what to I do? There was a very sadd story of a young kid a couple of years ago, who committed suicide, not because he lost money,but only because he didnt understand what he had on and that in fact he hadnt lost anything at all. A good analytics platform should help traders to fully understand what they have on and to better manage risk by providing them with more accurate and comprehensive data. This can help traders to identify potential risks and take steps to mitigate them before they become a problem and keep you up to date when and how things will move in a forward looking way.

If you're an options trader you need a system that does all the above, why not try a free trial of Leviathan's options trading platform? With advanced analytics tools and a user-friendly interface, Leviathan's platform can help you make more informed decisions and improve your overall trading outcomes. Sign up for a free trial today and experience the benefits for yourself!

Darren Krett

Thursday 4 May 2023

0

Comments (0)

Darren Krett

Thursday 4 May 2023

0

Comments (0)