Darren Krett

Monday 20 February 2023

Ranking

0

Comments (0)

Darren Krett

Tuesday 21 February 2023

Share on:

Post views: 12736

Categories

Help

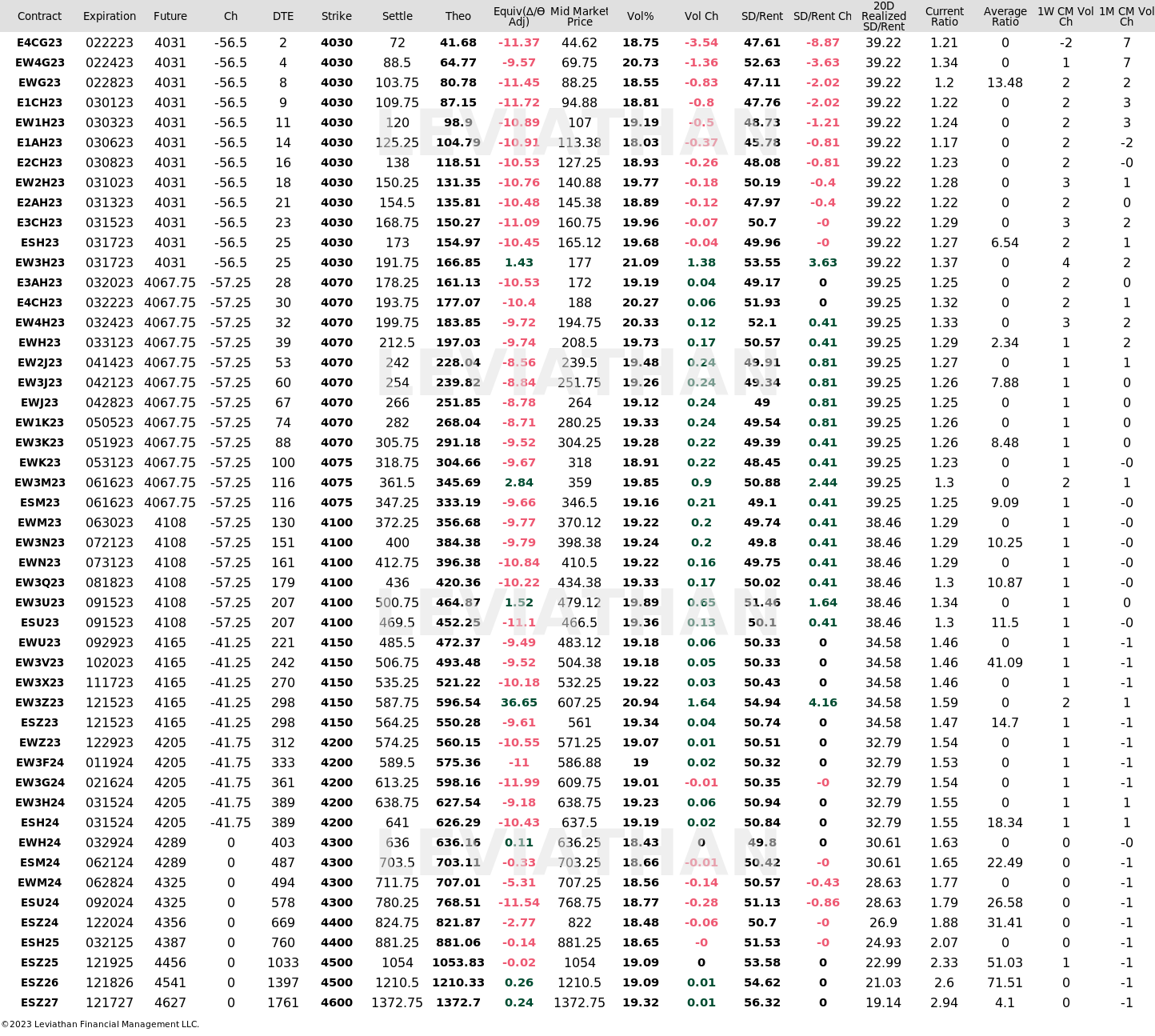

The Implied Vols page gives you a detailed live snapshot of intraday volatility moves whilst also offering an insight as to whether the current level of volatility is relatively cheap or expensive, not just when comparing implied vs realized but also how the current ratio sits Vs where it has been over the last 30 trading days.

To run through what each column represents;

Here is a section of the Implied Vols page showing the first few columns;

contract -

Is the expiration month and product you are looking at

Expiration-

the expiration date of the option contract

Future-

is actually just the underlying

Change-

The first column change will represent the change in the underlying

DTE-

Days to Expiration

Strike-

is the strike price that is the At-The-Money

Settle-

Is the price that the ATM straddle settled at the previous day

^Theo-

is the CURRENT theoretical ATM straddle price

^Equiv(∆/Ɵ Adj) -

is the change in PRICE of the ATM straddle when taking into consideration the move in delta AND Theta

Vol% -

Is the current ATM volatility of the ATM straddle

Vol Change-

Is the change in volatility of the ATM straddle on the day

contract -

Is the expiration month and product you are looking at

Expiration-

the expiration date of the option contract

Future-

is actually just the underlying

Change-

The first column change will represent the change in the underlying

DTE-

Days to Expiration

Strike-

is the strike price that is the At-The-Money

Settle-

Is the price that the ATM straddle settled at the previous day

^Theo-

is the CURRENT theoretical ATM straddle price

^Equiv(∆/Ɵ Adj) -

is the change in PRICE of the ATM straddle when taking into consideration the move in delta AND Theta

Vol% -

Is the current ATM volatility of the ATM straddle

Vol Change-

Is the change in volatility of the ATM straddle on the day

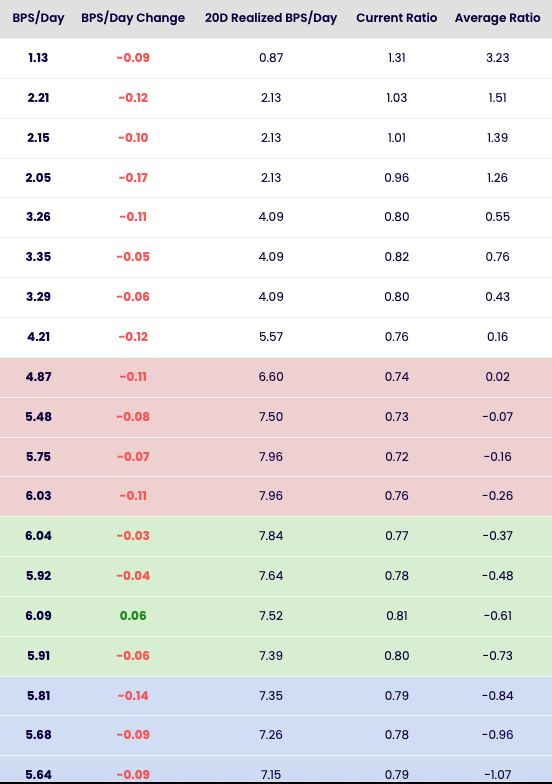

BPS/Day represents BASIS POINTS PER DAY or RENT which shows the expected range in the underlying, calculated from the implied volatility, required to cover the erosion.

The straddle page will also show the 20 day realized volatility represented in Basis Points per day or rent by taking the annualized volatility and converting it to a daily equivalent number. We then take the ratio of Implied over Realized, however it is not enough to know just what the ratio is (even if the number is below 1 you should theoretically be able to cover the erosion) which is why we have added the average of which that ratio( implied over realized) has been over the last 20 business days.

Although the straddle page updates live on our server side it is required to “refresh” the page here to get updated volatilities.

Darren Krett

Monday 20 February 2023

0

Comments (0)

Tyler Krett

Wednesday 14 December 2022

0

Comments (0)