Bryan Fitzgerald

Tuesday 1 November 2022

SFRA Skew has been pummeled over the past month...

0

Comments (0)

Darren Krett

Wednesday 2 November 2022

Share on:

Post views: 13941

Categories

Blog

A hard winter is coming in Britain, not only for the living but also the undead. The spike in borrowing costs generated by the short-lived Truss government could very well accelerate a wave of liquidations among the country’s expanded population of zombie companies. The shakeout, while painful for those who lose jobs and see investments fail, may ultimately prove an overdue tonic for a listless economy. Zombies, a phenomenon first widely observed in the post-bubble era of 1990s Japan, are indebted companies with persistently low profitability and investment levels that earn just enough to stay in business. In normal times they can be expected to fail, though in depressed conditions can be kept afloat by a combination of low interest rates, government fiscal support and bank forbearance. In the decade-and-a-half of ultra-low rates that followed the global financial crisis, the Japanese experience has proliferated, with academic research showing an increase in zombies across the world. The proportion rose to 15% in 2017 from 4% in the late 1980s, according to one paper from the Bank for International Settlements that examined listed non-financial companies in 14 advanced economies. The UK has been moreaffected than most, with the government’s emergency-loan programs during the pandemic injecting a final spurt of growth into their ranks. Onward, a Conservative think tank, estimates that an additional 1% to 4% of companies had become “zombified” since March 2020, raising the share to more than 20% of the total. When an entire economy is on life support, the undeserving and possibly unsalvageable get raised up along with healthy companies suffering only temporary distress. A reckoning looks to be at hand, though. The picture was turning uglier even before the market turmoil of the past two months, as inflation prompted policy makers to normalize interest rates. A Bank of England measure of average bank finance costs for small and medium-sized companies (which account for the majority of zombies) rose to 4.2% at the end of August, from a low of 1% in May 2020

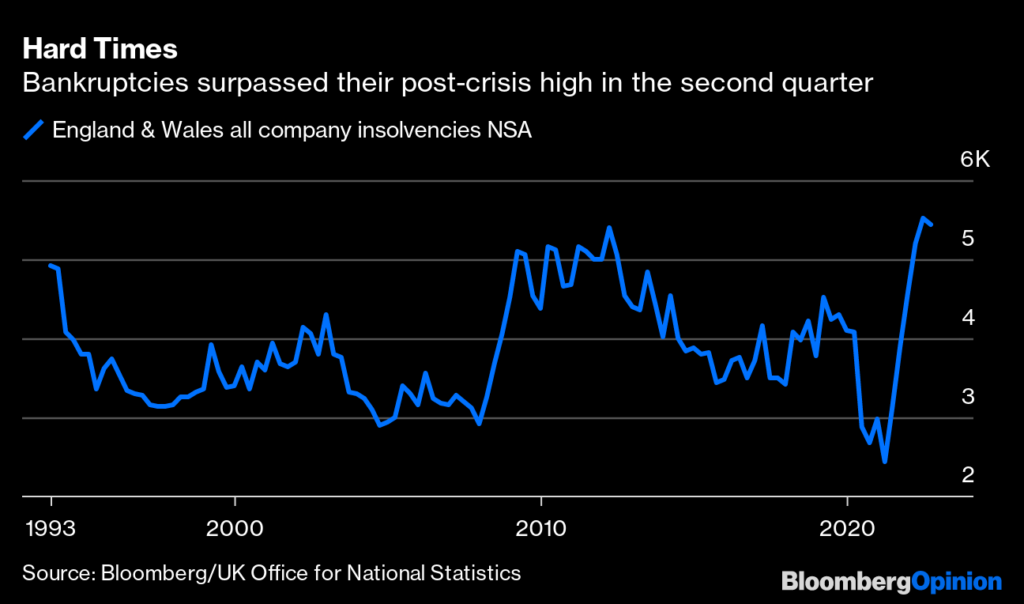

For the past two quarters, corporate bankruptcies have been running at higher than their previous post-crisis peak reached in the first three months of 2012. Don’t be surprised if that number goes higher. The two-year sterling swap rate jumped to a peak of 5.87% in late September, according to data compiled by Bloomberg. While it has come back to about 4.6%, that’s still higher than before the ill-conceived package of unfunded tax cuts put forward by the then-finance minister, Kwasi Kwarteng, on Sept. 23.

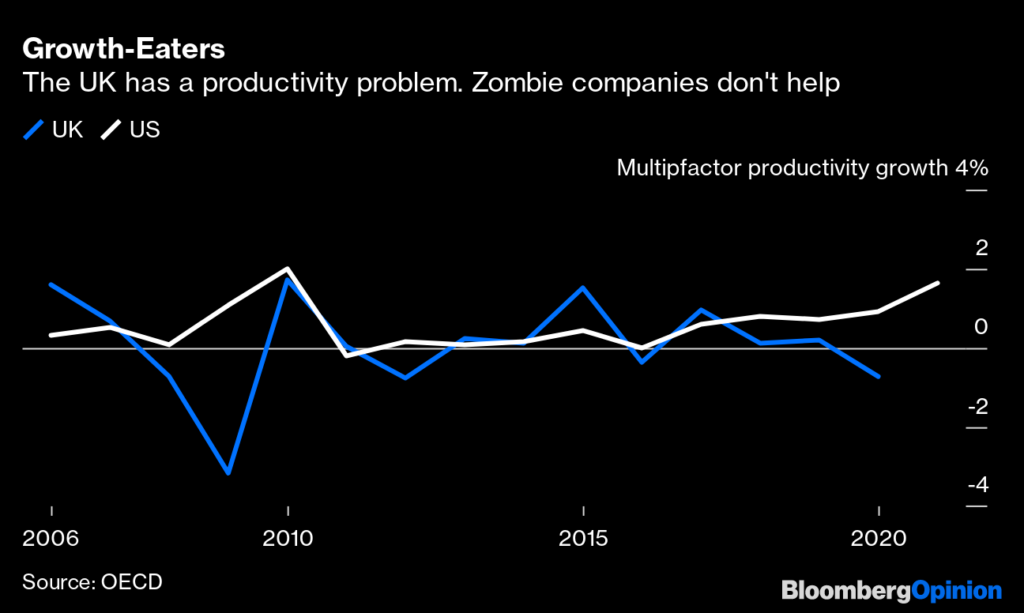

There are reasons to be sanguine about this process, though, at least to some degree. Zombie companies, it should go without saying, are a drag on the economy. They monopolize assets and workers that could be more productively employed elsewhere, driving up costs for healthier companies and causing a misallocation of capital. One sign of dysfunction: UK unemployment is at its lowest in almost half a century and a shortage of workers is driving up wages, despite an economy that’s teetering on the brink of recession. The harm done by zombies is an idea intimately linked to that of “creative destruction,” the term coined by Austrian economist Joseph Schumpeter in his 1942 book Capitalism, Socialism, and Democracy. The engine of capitalist innovation requires death as well birth. This is a turbulent and painful process for those who lose their jobs, such as the horse-and-cart driver who is displaced by the development of the automobile. But the liquidation and redeployment of resources powers a ceaseless progression of efficiency and value creation. Most of the time. Ultimately, the price of money is the arbiter of what works and what doesn’t in a capitalist economy. It's axiomatic that a firm consistently earning less than its cost of capital is value-destructive, even if it’s capable of surviving in a low-growth, just-getting-by existence. This is the consequence of the prolonged depressed interest rates that tend to follow financial crises and imploding asset booms, as in Japan and in much of the developed world after 2008. When the bar is too low, everyone gets a pass. The UK has been plagued by low productivity growth since the financial crisis, the subject of much hand-wringing by economists and policy makers. The growing prevalence of zombie companies may well have something to do with that. Returning interest rates to a more normal level that raises the bar for corporate survival has the potential to revive some of this lost economic dynamism.

Granted, the pace of the process matters. An increase in finance costs that is too steep and abrupt would imperil plenty of fundamentally sound companies and threaten to drive the economy into another extended slump, bringing the problem full circle. What constitutes a genuine zombie is also open to debate: Crude metrics can capture startup or temporarily distressed firms that have a good chance of going on to thrive. Researchers in Finland found that one-third of zombie companies as commonly defined are growing, and two-thirds recover to become healthy. Don’t mourn for the loss of businesses stuck in a perpetual funk that can’t survive without assistance, though. Within reason, the return of market discipline is a development to be welcomed.

Bryan Fitzgerald

Tuesday 1 November 2022

0

Comments (0)

Darren Krett

Wednesday 2 November 2022

0

Comments (0)