Darren Krett

Sunday 3 March 2024

Option plays for GitHub (GTLB) earnings and beyond

0

Comments (0)

cuong.nguyen

Thursday 17 April 2025

Share on:

Post views: 75

Categories

Blog

If the oncoming Easter break isn’t enough to get you excited, today we have Lockheed Martin’s earning report coming out after market close today and as always there is an opportunity for investors to profit. Whether you are bullish or bearish, below are good options traders to make for each direction that have a good profitability percentage, while minimizing downside risk…this is the point of these posts. I will be able to show you the best option strategies to do, but (FOR NOW) you’ll have to make a directional call yourself. I am trying to guide you as best as possible, I am not here to make promises that cannot be kept.

First, on the bullish side, we are looking at a target of 540, with a September expiration

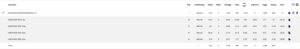

The trade itself is 515/530/545/560 Call Condor, shown below

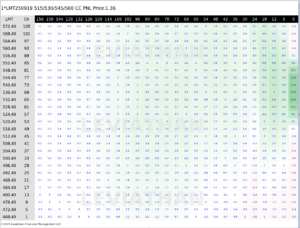

Historically, the cost of this trade is mostly in the middle, but slightly lower than average, shown below:

Historically, the cost of this trade is mostly in the middle, but slightly lower than average, shown below:

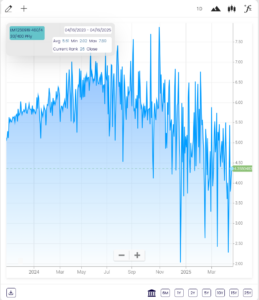

Historically, the price of the underlying LMT equity has varied, ranging from 400 to 614 over the past two years, shown by the chart below:

Historically, the price of the underlying LMT equity has varied, ranging from 400 to 614 over the past two years, shown by the chart below:

Finally, here’s the heatmap of the profitability of the trade, showing the returns and the likelihood the trade results in positive returns

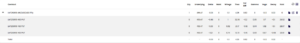

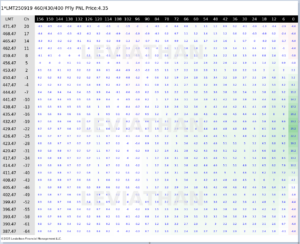

On the flip side, a bearish investor may predict the price of the underlying will decrease. In this case, with a strike of 440, we have the following trade, also with a September expiration:

460/430/400 PutFly, shown below:

On the flip side, a bearish investor may predict the price of the underlying will decrease. In this case, with a strike of 440, we have the following trade, also with a September expiration:

460/430/400 PutFly, shown below:

This trade is relatively cheaper now that is has been for a majority of the past two years, shown below:

The heatmap for the profitability for this trade is shown below:

The heatmap for the profitability for this trade is shown below:

As always, remember it is better to be lucky than good,so best of luck to you.....

Darren Krett

Sunday 3 March 2024

0

Comments (0)

Darren Krett

Wednesday 20 March 2024

0

Comments (0)