Darren Krett

Sunday 3 March 2024

Option plays for GitHub (GTLB) earnings and beyond

0

Comments (0)

Darren Krett

Thursday 14 March 2024

Share on:

Post views: 5218

Categories

Blog

Heading into the weekend and we still have Adobe earnings to look forward to tomorrow….

Once again, I will look at both bullish and bearish strategies and let you pick your side by giving you as much RELEVANT information as possible.

not a huge help here...

not a huge help here...

Looking at the chart here we are right in the middle of the trend channel that started back in 2022, so really could go either way. The upside target in the channel is around $688 while the bottom comes in around $450. My hope being that the number will set the trend for the next couple of months to either side AND limiting your risk so that you don’t blow all your cookies in one punt.

So lets start off with the downside…I am going to give it a little time as usual so looking at the June expiration.

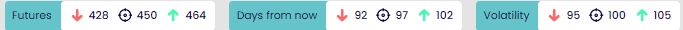

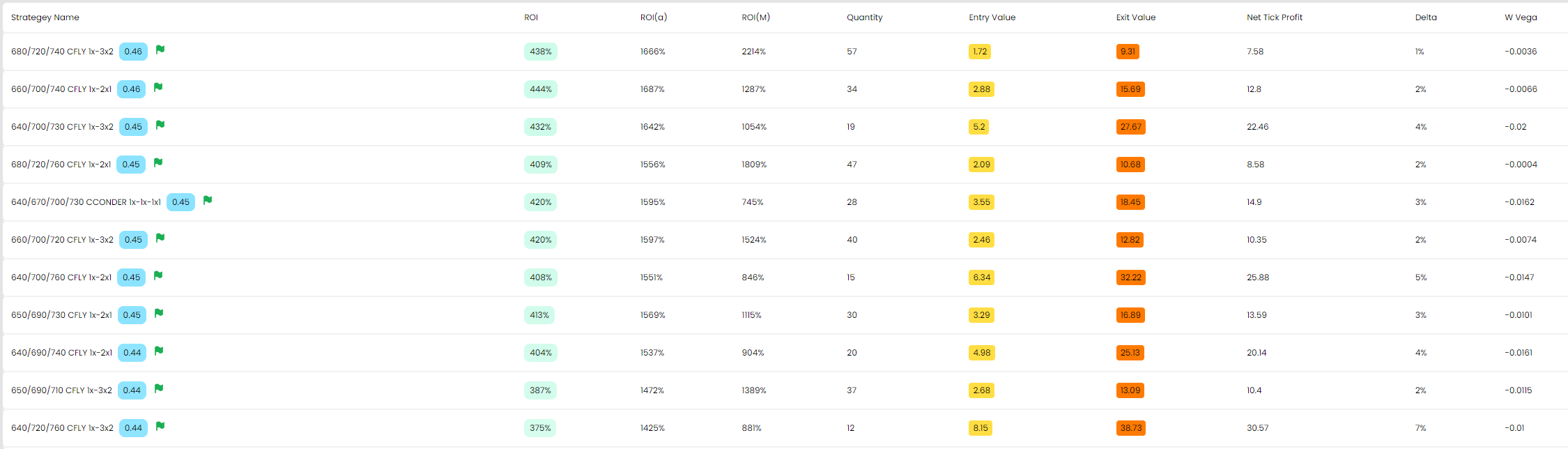

THe unfiltered list came up with a few interesting ratio trades..

Now even though this trade is in June expiration, if you really want a more short term play , then this ratio fly monetizes quickly, but if youre intending to run in for a longer time then you really have to nail the target

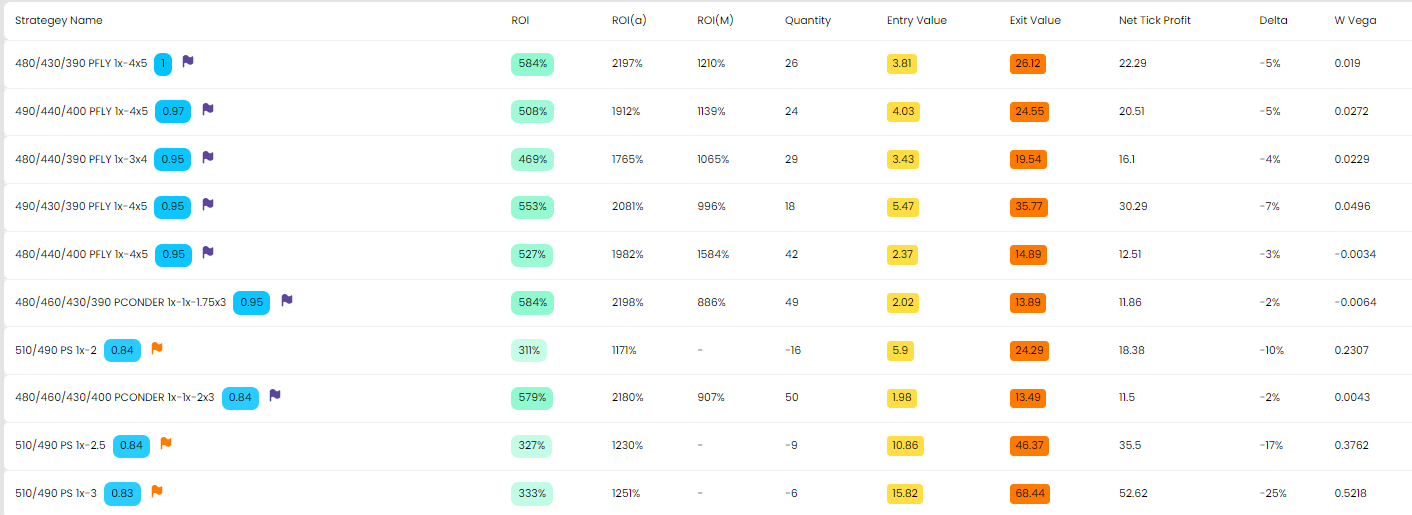

If you look at the heatmap below you'll see that splotch of red in the bottom right, which tells me holding on to this in a bear market up to expiration would not be a good idea

If you look at the heatmap below you'll see that splotch of red in the bottom right, which tells me holding on to this in a bear market up to expiration would not be a good idea

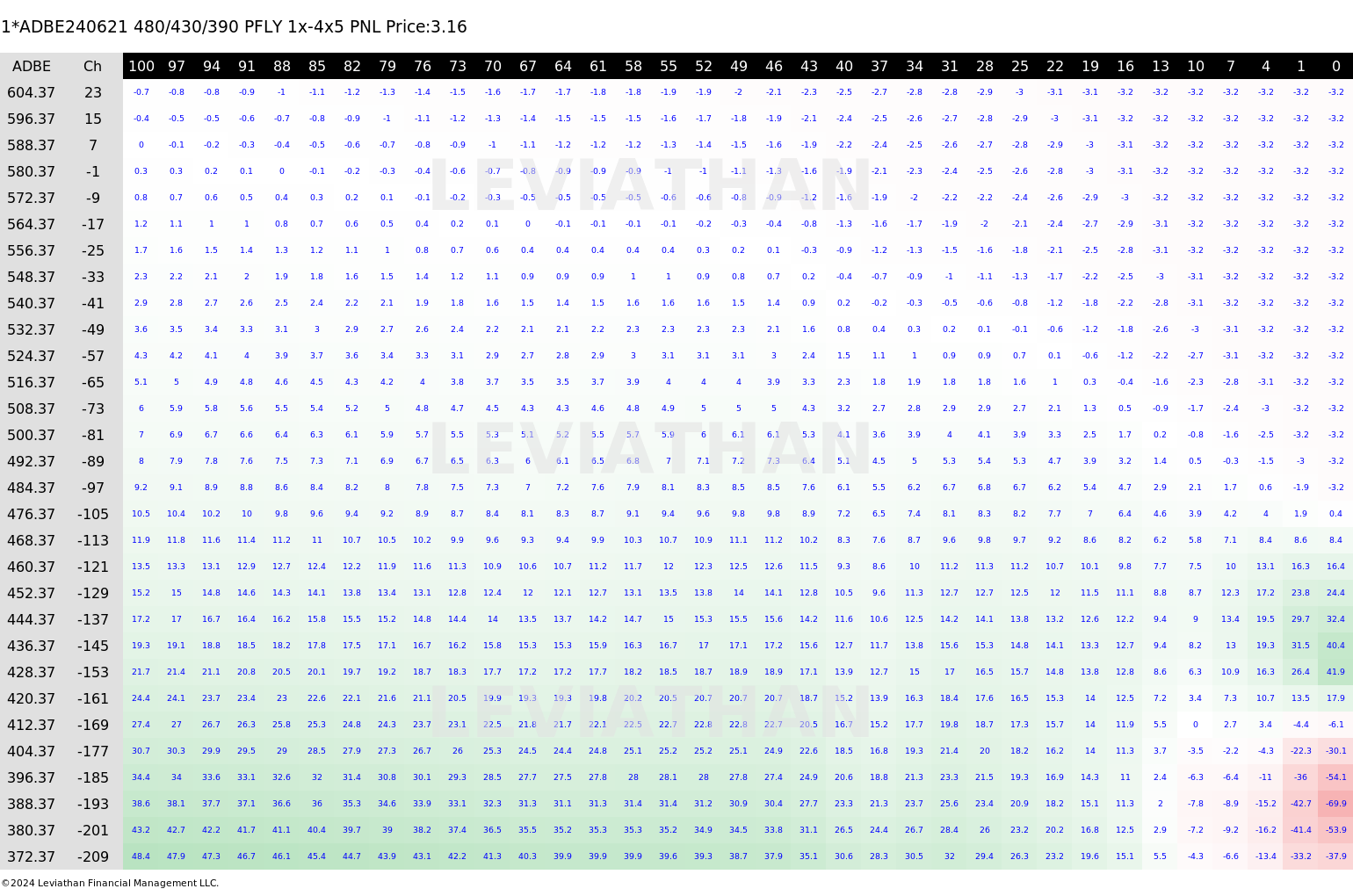

BUT it does do well on a shorter term play. For something more vanilla, BB1 suggests just buying the outright puts

BUT it does do well on a shorter term play. For something more vanilla, BB1 suggests just buying the outright puts

these are not cheap, so you'll have less to buy, but you can see the comparisons on the heatmap for the put below

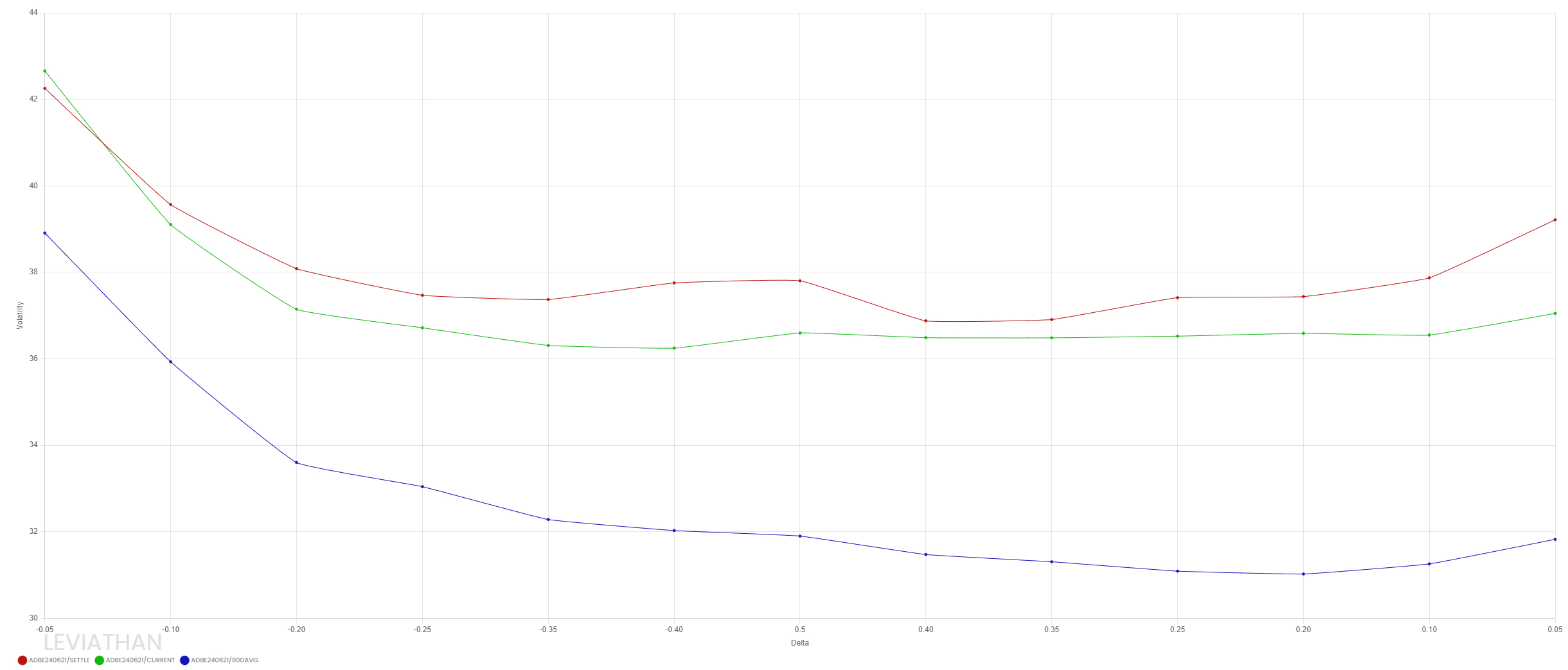

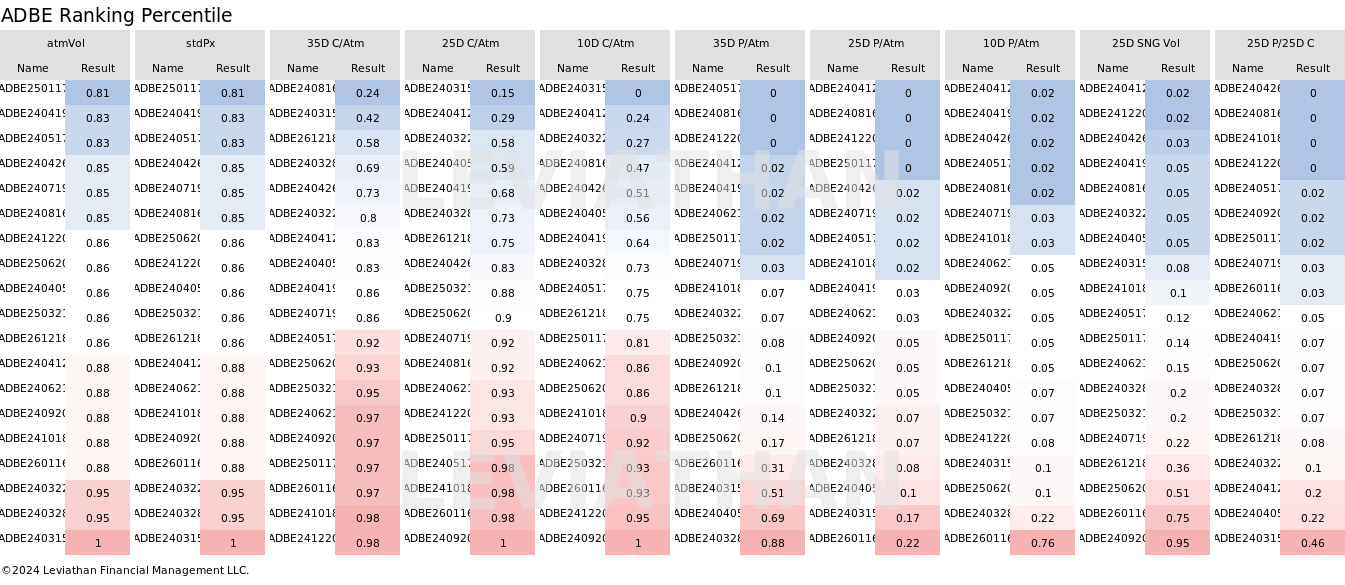

You can see that the skew is a fair bit flatter than the 90 day average, so the puts are relatively cheap to the ATM as you can also see in the ranking table below...but again..a lot of premium

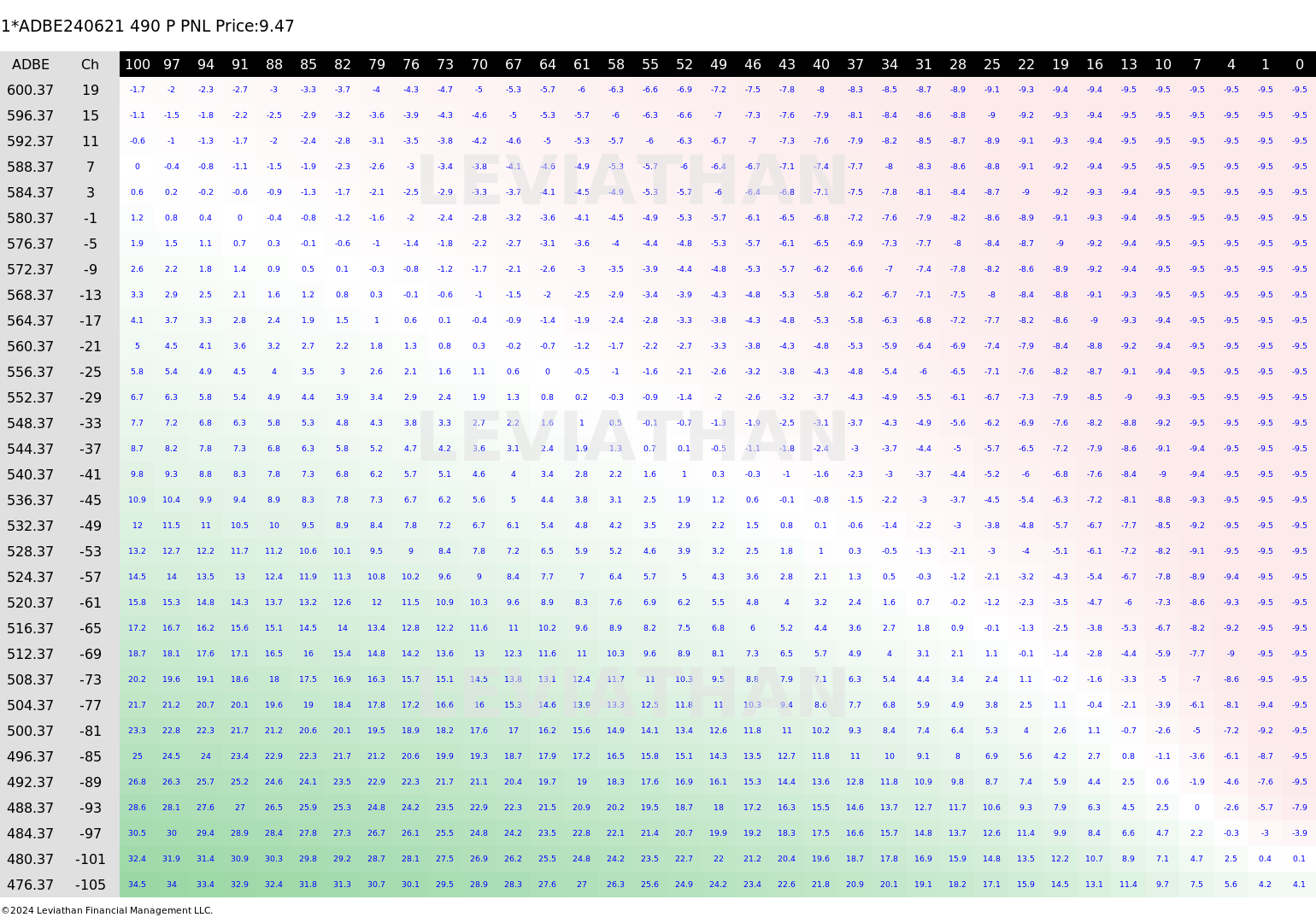

Now, how about the upside..

Now, how about the upside..

Going for the top of that channel but with a fairly wide range

Going for the top of that channel but with a fairly wide range

I am going to opt for the 2nd on the list as it will monetize the fastest

this one at $260ish is more like it

this one at $260ish is more like it

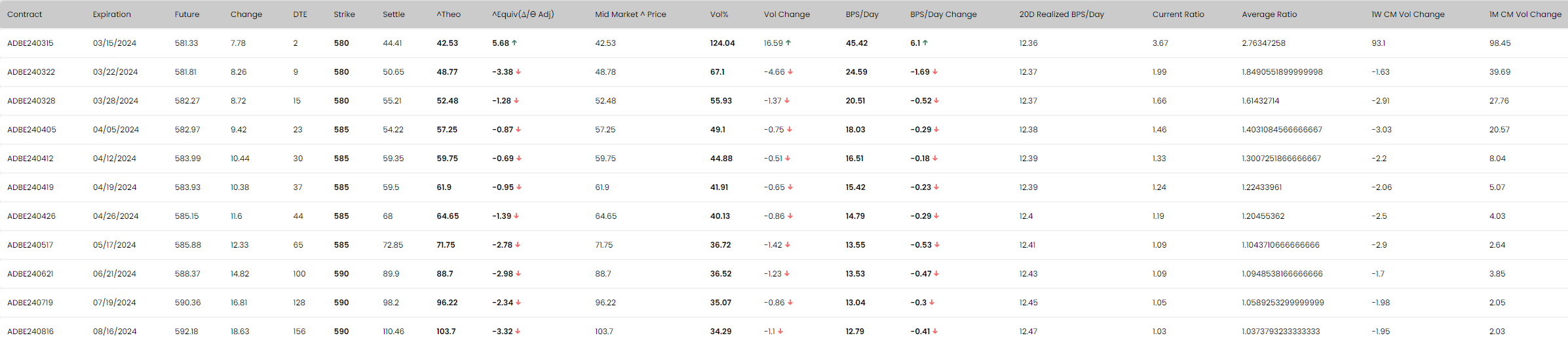

If you take a look at the implieds we are looking for a $45 range tomorrow which is a bit agressive

So my feeling here is that while a lot of you like this stock to play in, the premiums are a little expensive , so adhere to the quantities on the list as they are based on $1000 of margin, you just have to adjust the amount of contracts that you do, while still looking for similar returns as you would on a smaller amount of premium, however as I also know how difficult it can be to cut a loser commit to this only if you have a lot of conviction on the trade...

So my feeling here is that while a lot of you like this stock to play in, the premiums are a little expensive , so adhere to the quantities on the list as they are based on $1000 of margin, you just have to adjust the amount of contracts that you do, while still looking for similar returns as you would on a smaller amount of premium, however as I also know how difficult it can be to cut a loser commit to this only if you have a lot of conviction on the trade...

So remember it is always better to be lucky than good and I wish you all happy hunting

Darren Krett

Sunday 3 March 2024

0

Comments (0)

Darren Krett

Wednesday 6 March 2024

0

Comments (0)