END OF DAY REPORT EQUITIES, FUTURES & OPTIONS MAY 22nd

HIGHLIGHTS

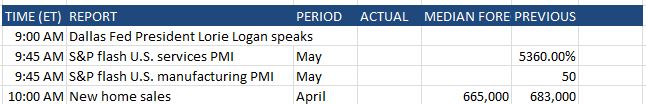

Fed's Kashkari (voter) says not seeing evidence yet that banking stress is doing our work for us on inflation; June meeting is a close call; was above 5.25% in March SEPs; may need to go north of 6%, but not clear - CNBC interview Reiterates that services inflation seem "pretty darn" entrenched. Doesn't want to speculate on measures Fed could take in an emergency debt default scenario.

Fed's Bullard (non-voter) says base case remains relatively slow growth for the rest of this year and into 2024; SEP median of 5.1% was based on slow growth and inflation improvements that have not occurred; calls for perhaps 50bps more hikes "this year" Recession probabilities are probably overstated.

Want to fight inflation while the labour market is strong. Companies are still scrambling for workers; job growth remains above trend. Core measures of inflation have not changed much in recent months. If inflation is not controlled the Fed will have to do "a lot more", should err on side of doing more. Not anticipating any changes to QT any time soon

Bullard has indicated his terminal rate forecast lies around 5.75%. On May 5th, Bullard said (here and here) he believes policy is at the low end of the 'sufficiently restrictive' zone despite the committee thinking it is now in that area.

Fed's Daly wants to see if policy tightening is affecting the economy; focused on whole dashboard of incoming data Daly did start by noting it is prudent to refrain from commenting on Fed policy action. Banking stresses have calmed and banks are in solid shape. Want to see ongoing slowing in supercore inflation.

Fed must be very data dependent right now and still lots of data to get before June FOMC. Tighter conditions may be akin to one to two rate hikes. Fed must be on watch for slowing economy. Inflation expectations are well anchored. Does not know how deep and long credit tightening will be. FOMC deciding meeting by meeting is a more prudent path. Global tightening cycle has slowed activity less than expected

ECB's Villeroy says the primary question is not how much further to hike, but how large the pass-through of what is already in the pipe; believe ECB will be at terminal no later than September In the current tightening cycle, the lag of policy transmission could be at the upper end of a one- to two-year range. Services are likely to become the dominant inflation source. Deceleration in rate hikes from 50bps to 25bps was wise and cautious. Need to monitor the pass-through of the substantial and exceptionally rapid past hikes. ECB clearly already in restrictive territory. ECB could hike or pause in next three meetings.

Fed's Bostic (non-voter) says he is comfortable waiting a little bit to see how the economy plays out after Fed has done a lot of tightening already, policy acts with a lag Will take decisions on a meeting-by-meeting basis.

US House Speaker McCarthy says we don't have a deal; decisions have to start being made, thinks they can make it all happen by debt deadline

ECB's de Cos (dove) says bank still has some way to go to tighten monetary policy; rates will have to remain in restrictive territory for extended period to achieve inflation goal Rate hikes' full impact on inflation is not to be felt until 2024

SUMMARY

very quiet rangebound session as we await news from the debt ceiling negotiations for some direction.