Darren Krett

Wednesday 2 November 2022

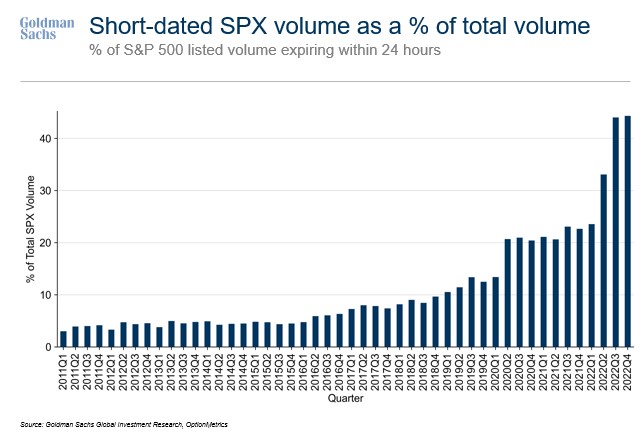

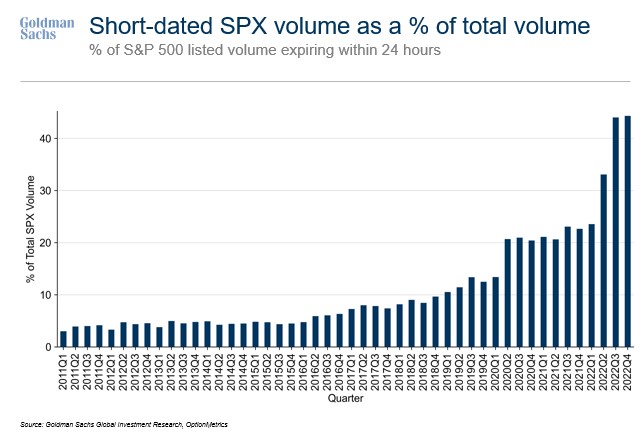

SHORT DATED OPTIONS ARE KING

0

Comments (0)

Stay ahead and keep your mind focused.

Categories

Learning

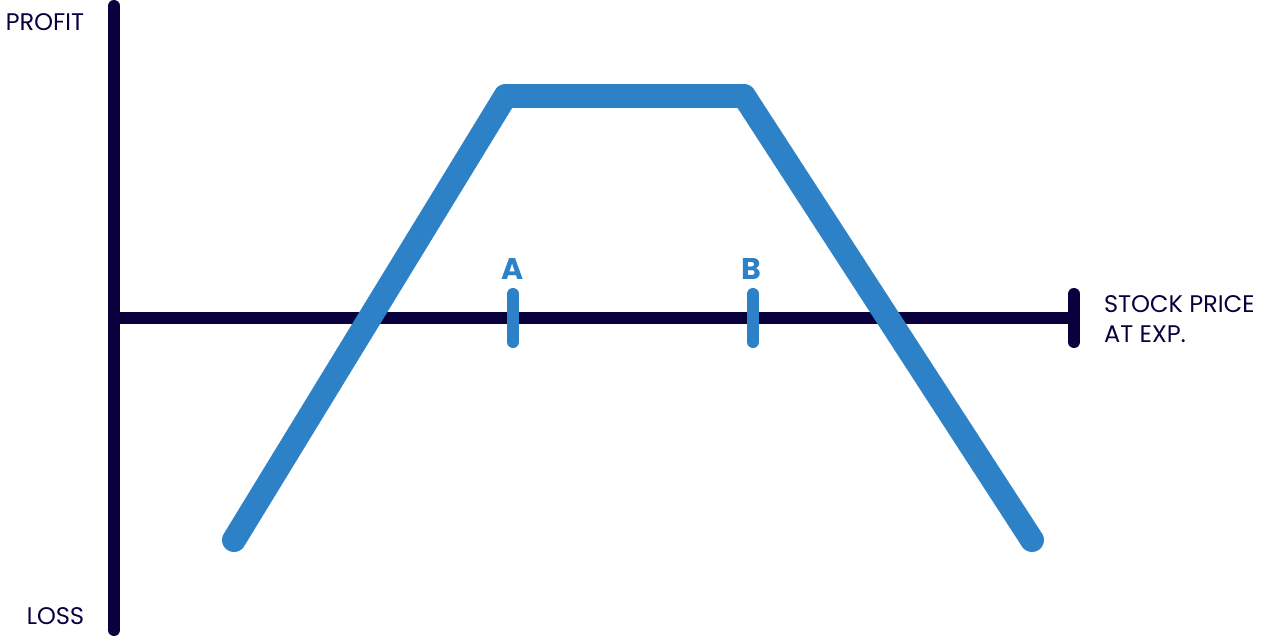

A strangle trade is where you buy an Out-The-Money put whilst simultaneously buying an OUT-THE-Money call or vica-versa

A strangle trade is where you buy an Out-The-Money put whilst simultaneously buying an OUT-THE-Money call or vica-versa

If you are short strangles, it is a strategy that profits when the stock stays between the short strikes as time passes, as well as any decreases in implied volatility. The short strangle is an undefined risk option strategy.

Max Profit: Credit received from opening trade

How to Calculate Breakeven(s):

With strangles, it is important to remember that you are working with truly undefined risk in selling a naked call. We focus on probabilities at trade entry, and make sure to keep our risk / reward relationship at a reasonable level.

Implied volatility (IV) plays a huge role in our strike selection with strangles. The higher the IV, the wider our strangle can be while still collecting similar credit to a strangle with closer strikes that is sold in a lower IV environment. If we choose to keep our strikes closer to the stock price, a higher IV environment will yield a much larger credit, as IV is essentially a reflection of the option prices.

Darren Krett

Wednesday 2 November 2022

0

Comments (0)

Darren Krett

Wednesday 7 June 2023

0

Comments (0)

Get ahead of the wave and sign up to our socials to get access to exclusive offers, videos, tutorials and latest news.

© 2015 - 2025 Leviathan Financial Management LLC. All Rights Reserved.

Legal Disclaimer: The information provided in the Leviathan website is for informational purposes only. It should not be considered legal or financial advice. You should consult with a financial advisor professional to determine what may be best for your individual needs. Leviathan Financial Management does not make any guarantee or other promise as to any results that may be obtained from using our content. No one should make any investment decision without first consulting his or her own financial advisor and conducting his or her own research and due diligence. To the maximum extent permitted by law, Leviathan Financial Management disclaims any and all liability in the event any information, commentary, analysis, opinions, advice and/or recommendations prove to be inaccurate, incomplete or unreliable, or result in any investment or other losses. Content contained on or made available through the website is not intended to and does not constitute legal advice or investment advice. Your use of the information on the website or materials linked from the Web is at your own risk.