Darren Krett

Sunday 3 March 2024

Option plays for GitHub (GTLB) earnings and beyond

0

Comments (0)

cuong.nguyen

Wednesday 19 February 2025

Share on:

Post views: 1900

Categories

Blog

The Alibaba Group has been on a bit of a rip as of late and with the earnings out tomorrow there’s at least a good chance of some movement. Since the DeepSeek news it has been on a roll,

But when you take a little step back you can see that its rally may still have some legs, especially if Xi is going to give backing to the Chinese tech sector.

So this could go either way, although I am more tempted to go with “the trend is your friend” and go with a bullish play. But to anyone who hasn’t read my blurb before, I do not promise you riches beyond your wildest dreams, the point of these is just to help you make an informed decision, have a view..be it bullish or bearish and then I can show you the best option strategy that not only has the best ROI but and more importantly…mitigates your risk.

Options should be a safer way to trade ,when placed in the right hands, but for the amount of people that actually seem to be participating in the option markets, there seem to be more that are so nervous as to how best to use options, they limit themselves to straight out call or put buying as a pure punt or just call selling to enhance their yields. I am presenting you trades that have a limited risk, that way you know whats on the table and can sleep easier at night.

I am actually going to start with a bearish trade;

I want a bit of time on this, although I have put this as an earnings play, it is more about what happe4ns after the numbers are released, not the initial knee-jerk reaction but what trend is it that comes about after the dust has settled.

With this in mind I have chose the April expiration to focus on. This gives me 59 days till expiration BUT I am looking for you to exit before then. Most of these “systems” suggest option trades when looking at returns right to expiration, which is unrealistic. You are going to either cut or would be stupid not to take some decent profit if the opportunity shows itself.

So we are looking trades that will go to a week before expiry and assume that’s when you will get out.

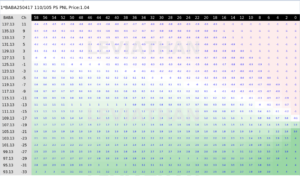

When the system looks at all these potential trades it is basing its rating purely on risk vs reward. SO sometimes the best trades are the simplest ones…. The system quite likes just buying outright puts and finds that best, but I am going to choose the 110/105 put spread (bear spread)

I just like how it looks on the HEATMAP as it monetizes pretty quickly too.

I just like how it looks on the HEATMAP as it monetizes pretty quickly too.

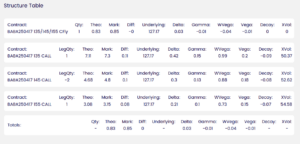

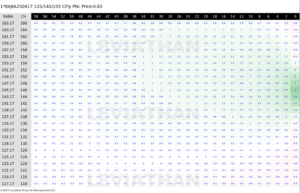

For the bullish case, again going out to the April expiration with an initial target of $145.

In this instance, I am going for BB1’s top pick ,m which is the 135/145/ call fly. this one will do OK on an initial jump but will get a lot better the closer we get to expiry, but if you look at the heatmap you can decide when best to exit, but its pretty cheap at just over $1 (including costs) and I would be happy to see anything around $4.75 to get out.

In this instance, I am going for BB1’s top pick ,m which is the 135/145/ call fly. this one will do OK on an initial jump but will get a lot better the closer we get to expiry, but if you look at the heatmap you can decide when best to exit, but its pretty cheap at just over $1 (including costs) and I would be happy to see anything around $4.75 to get out.

If you have any questions or would even like to run your own scenario, DM me and I will put it through its paces for you.

If you have any questions or would even like to run your own scenario, DM me and I will put it through its paces for you.

And remember, it is always better to be lucky than good! So good luck and happy hunting.

Darren Krett

Sunday 3 March 2024

0

Comments (0)

Darren Krett

Wednesday 20 March 2024

0

Comments (0)