Darren Krett

Wednesday 31 January 2024

Apple earnings option plays

0

Comments (0)

Darren Krett

Tuesday 27 February 2024

Share on:

Post views: 3281

Categories

Blog

As per usual I will remind you all that I am not here to bullshit you with promises about how you're going to be rich in a day. The point of this is a bit of "pay it forward" and help you make money!

Salesforce numbers are out tomorrow so is there anything worth doing??

are we breaking out or is this the top of the channel? I am torn between this looking like it could break out to the upside or that we are at the top of the channel.

I am going to run 2 different scenarios and leave that choice down to you.

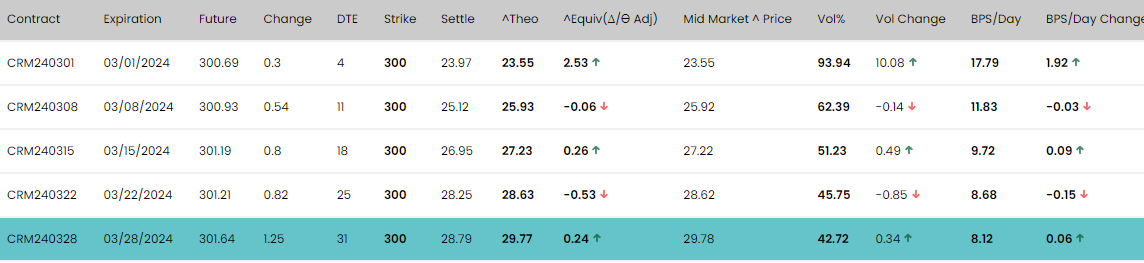

Implied vols

Implied vols

You can see by the straddle page that our expected move for the number is close to $18 whilst you look further out we only have an $8 move per day priced in.

upside targets

upside targets

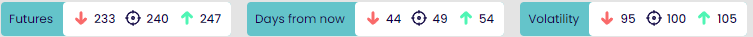

So although it is an "earnings" play I go further out, avoiding short term spikes and seeing of the earnings will set the trend over the next couple of months, so I am looking 112 days out from now to see what can be done.

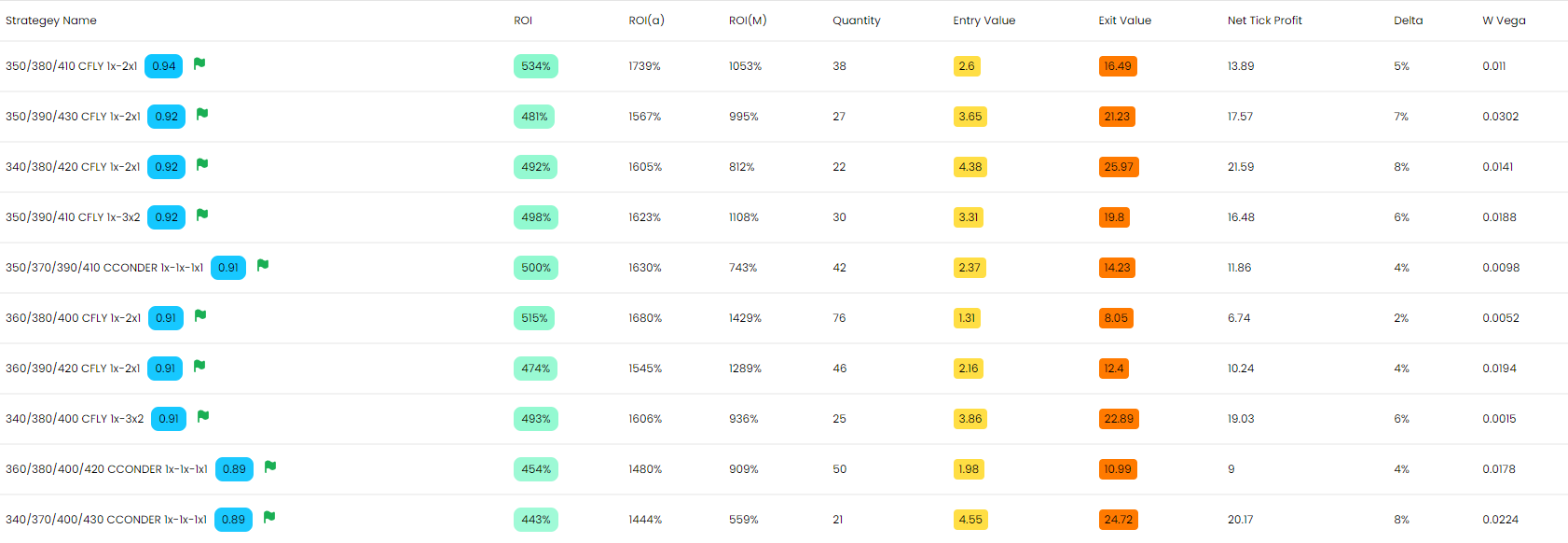

BB1 list

BB1 list

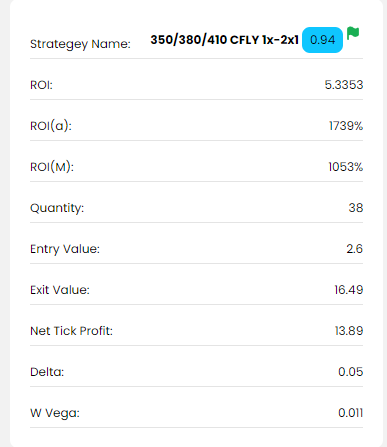

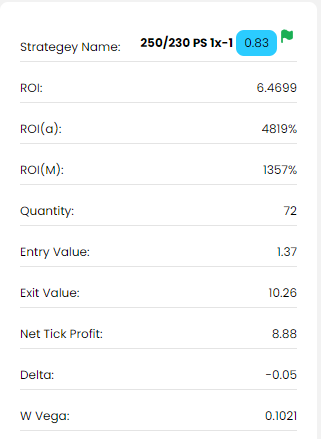

There are a couple of good upside trades here with a good "trade score" ( our version of a risk/reward number)

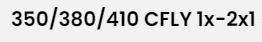

I would go with BB1's first choice and going with the JUNE (EXPIRATION)

Yes, I like trading flies, they are a closed off risk and you know what you can make/lose. Now lets look at the HEAT MAP

Yes, I like trading flies, they are a closed off risk and you know what you can make/lose. Now lets look at the HEAT MAP

You can get in and make money quickly if youre right in direction and totally clean up as time progresses and if wrong you can get out for not too bad a loss too.

You can get in and make money quickly if youre right in direction and totally clean up as time progresses and if wrong you can get out for not too bad a loss too.

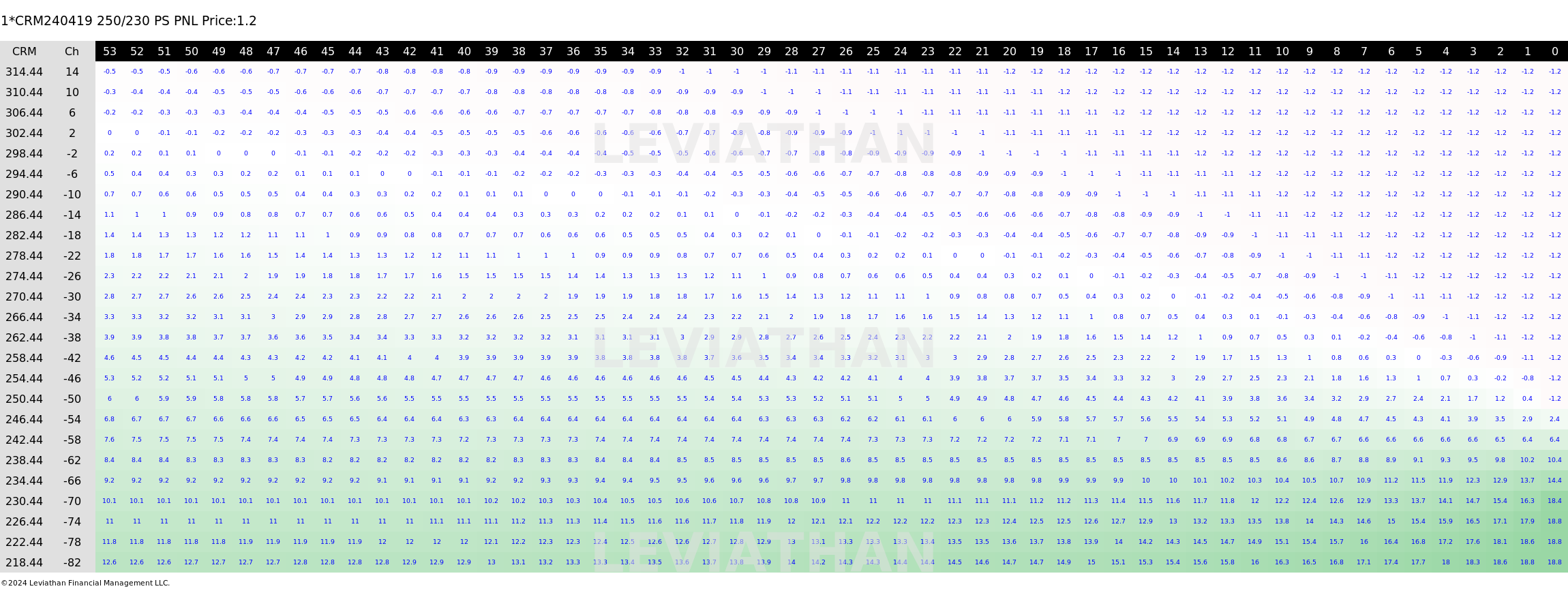

So these are the details for the upside play

Now for the downside.

I am only going 49 days out for this one, as I believe that if it does reject the breakout we will head to the bottom of the channel a bit quicker.

I am only going 49 days out for this one, as I believe that if it does reject the breakout we will head to the bottom of the channel a bit quicker.

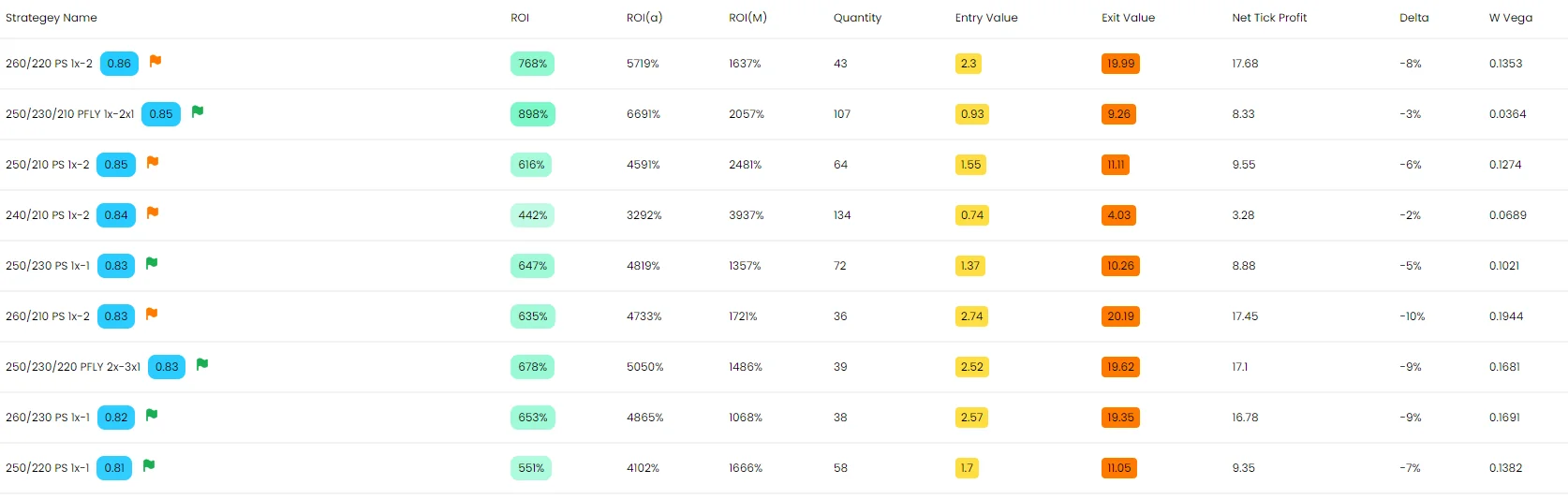

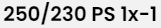

BB1's downside list

Now BB1 is wanting me to buy 1x2 put spreads...it looks at what it perceives as risk, but for you guys I would avoid shorting put premium unless you actually have the view that if it gets down there I WANT to own it. So I am going for the

BB1's downside list

Now BB1 is wanting me to buy 1x2 put spreads...it looks at what it perceives as risk, but for you guys I would avoid shorting put premium unless you actually have the view that if it gets down there I WANT to own it. So I am going for the

It is 5th on the list and I could do the fly that it picked instead, but it just monetizes a little quicker

It is 5th on the list and I could do the fly that it picked instead, but it just monetizes a little quicker

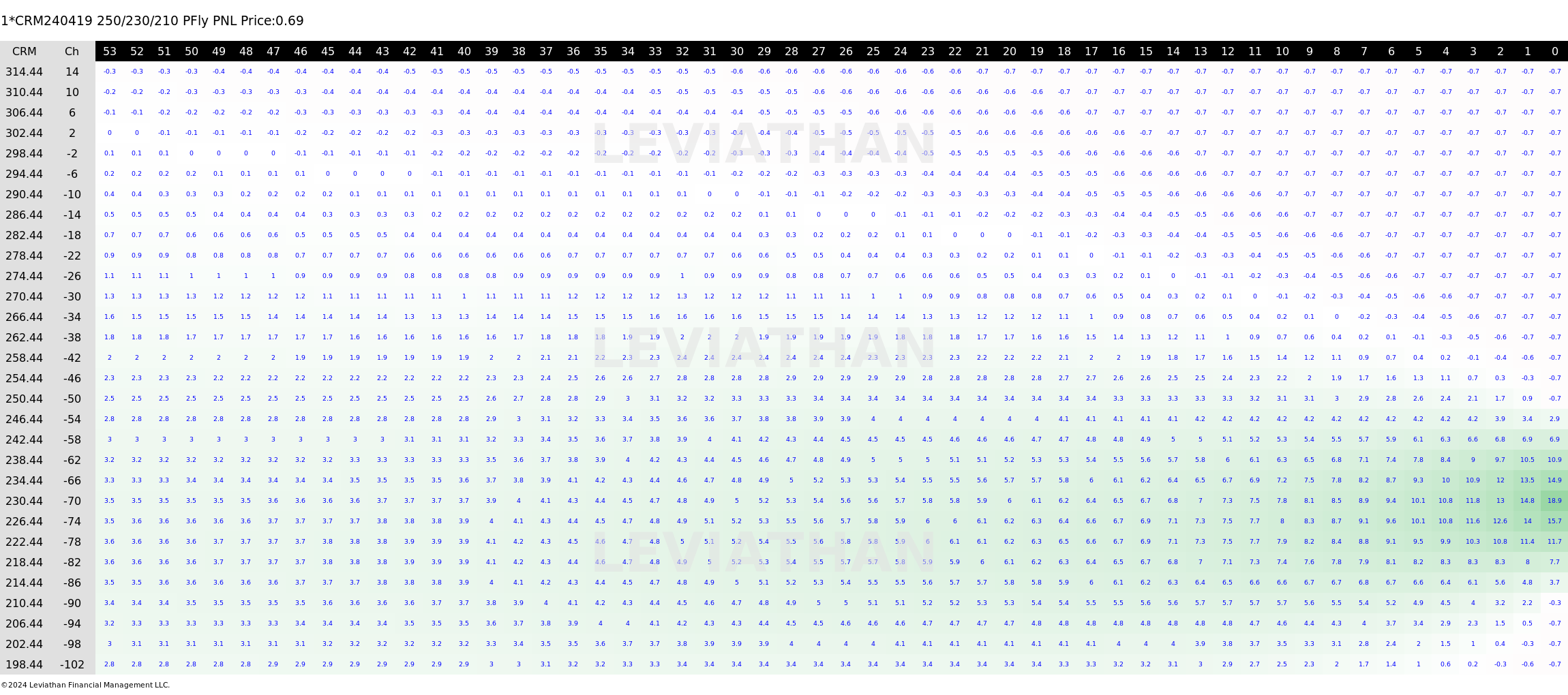

Here is the put fly heat map by comparison

Here is the put fly heat map by comparison

There you have it

....and as I say.. ALWAYS RATHER BE LUCKY THAN GOOD

Darren Krett

Wednesday 31 January 2024

0

Comments (0)

Darren Krett

Tuesday 23 January 2024

0

Comments (0)