Tyler Krett

Tuesday 10 October 2023

Beginner Options Trading Strategies

0

Comments (0)

Tyler Krett

Tuesday 10 October 2023

Share on:

Post views: 8767

Categories

Explore

Intraday option trading is a specialized area within the realm of options trading, focusing primarily on the unique challenges and rewards of short-term trades. With a volatile market, intraday option strategies require a keen eye for detail, swift decision-making, and a robust set of tools to maximize potential gains.

Leviathan Financial Management provides traders with comprehensive backtesting software and strategies tailored specifically for intraday options. Our primary goal is to equip traders with the necessary resources to refine their trading approach, making the most of every intraday trading opportunity.

Intraday trading is a challenging endeavor, demanding quick decision-making, discipline, and a well-thought-out strategy. When it comes to trading options intraday, the complexity and risk level can be even higher, but so can the potential rewards. This article will delve into the world of option intraday strategies, providing insights into what they are, how they work, and key considerations for successful implementation.

Intraday trading refers to the practice of buying and selling financial instruments within the same trading day. The primary goal is to capitalize on short-term price movements and profit from volatility. Intraday traders typically do not hold positions overnight, as they aim to avoid overnight risk.

Options are financial derivatives that grant the holder the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a specified price (strike price) before or on a specific expiration date. Options are versatile instruments that can be used for various trading strategies, including intraday trading.

Option intraday strategies encompass a wide range of techniques and tactics used to profit from short-term price movements in options. These strategies can be broadly categorized into two groups: directional and non-directional strategies.

Long Call or Put: This strategy involves buying call options if you expect the underlying asset's price to rise or buying put options if you expect it to fall. Intraday traders aim to capitalize on the expected price move during the trading day.

Covered Call: In this strategy, traders hold a long position in the underlying asset and sell a call option against it. It's a moderately bullish strategy that can generate income from both the underlying asset and the option premium.

Bull Call Spread and Bear Put Spread: These involve buying one call (bull call spread) or put (bear put spread) and simultaneously selling another call (bull call spread) or put (bear put spread) option with a higher strike price. These strategies aim to profit from directional movements while reducing risk.

Straddle: A straddle involves buying both a call and a put option with the same strike price and expiration date. This strategy is employed when the trader anticipates a significant price move but is uncertain about the direction. Profits come from volatility.

Strangle: Similar to a straddle, a strangle involves buying a call and a put option, but with different strike prices. This strategy is used when traders expect volatility but are unsure about the extent of the price move.

Iron Condor: This is a more complex strategy that combines both call and put credit spreads. It is non-directional and relies on the underlying asset's price remaining within a specified range to generate profits.

*The Key Considerations for Option Intraday Strategies:

Risk Management: Intraday trading can be highly volatile, and options, by nature, have expiration dates. Therefore, it is crucial to implement strict risk management, including stop-loss orders and position sizing, to protect your capital.

Technical Analysis: Technical analysis, which involves studying price charts and indicators, can be a valuable tool for intraday option traders to identify entry and exit points.

Volatility Awareness: Option premiums are influenced by volatility. Be aware of implied volatility and how it can impact your option positions. High volatility can increase option premiums, while low volatility can erode them.

Liquidity Matters: Ensure you trade options with sufficient liquidity to enter and exit positions easily without substantial price slippage.

Constant Learning: The world of options and intraday trading is complex and ever-evolving. Continuous learning and practice are essential to improve your skills.

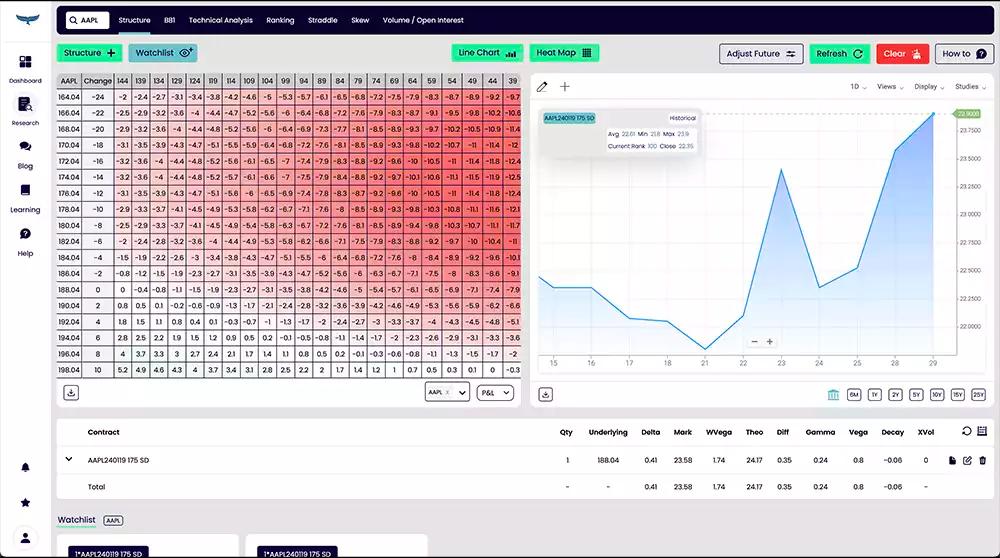

The world of intraday option trading can seem overwhelming, especially given the rapid pace of the market. The key to successful intraday trading lies in recognizing patterns, understanding market volatility, and being prepared to adapt on the fly. By using the right strategies, traders can capitalize on short-term price movements to yield substantial returns. Fortunately, with tools like the options trade profit calculator, traders can quickly gauge the potential profitability of an intraday trade, adjusting their strategy as needed.

Intraday option trading also demands a unique mindset. Unlike longer-term trades, intraday trades require quick thinking and even quicker execution. It's essential to have a clear strategy in place before entering a trade, and more importantly, knowing when to exit. Our option trading simulator allows traders to practice their intraday strategies in real-time market conditions without any risk, helping to hone skills and build confidence.

At Leviathan Financial Management, we pride ourselves on our profound understanding of the intricacies of intraday option trading. We believe that every trader can benefit from refining their trading approach. Our tools and resources, backed by expert analysis, aim to simplify the complexities of intraday trading.

With our best options trading courses, traders can delve deep into the nuances of intraday trading. Our courses provide insights into market behavior, risk management, and strategy optimization, ensuring that every trader is well-equipped to tackle the challenges of intraday option trading.

Intraday option trading is not for the faint-hearted. It's ideally suited for traders who thrive on the adrenaline rush of short-term trades, those who have the time to monitor the markets closely, and individuals with a good grasp of technical analysis. While the potential for significant profits exists, so does the potential for losses.

However, with the right tools and strategies in place, even a beginner can venture into intraday option trading. It's all about understanding the market, being prepared, and continuously learning. Every trade provides a learning opportunity. With consistent effort, intraday option trading can become a profitable endeavor.

Options trading, particularly on an intraday basis, offers endless opportunities for those willing to understand and navigate its complexities. At Leviathan Financial Management, we're committed to empowering traders with the best tools, strategies, and insights to make the most of these opportunities. Join us today, and let us show you the power of intraday option trading.

Option intraday trading can be a profitable endeavor for those who are well-prepared and disciplined. However, it comes with significant risks. Understanding the intricacies of various strategies, implementing risk management techniques, and keeping a close eye on market conditions are crucial for success. Remember that mastering option intraday strategies is a journey that requires patience and dedication, but it can offer substantial rewards for those who are willing to put in the effort.

Tyler Krett

Tuesday 10 October 2023

0

Comments (0)

Tyler Krett

Tuesday 10 October 2023

0

Comments (0)