Tyler Krett

Tuesday 10 October 2023

Weekly Options Trading Strategies

0

Comments (0)

Tyler Krett

Tuesday 10 October 2023

Share on:

Post views: 12015

Categories

Explore

Starting with options trading can be a challenging experience for many. The myriad of strategies, the volatility of the market, and the necessity to make quick decisions often intimidate the beginner. However, with the right tools and knowledge, you can navigate the intricate world of options trading confidently. Leviathan Financial Management provides comprehensive tools and strategies tailored specifically for those embarking on this journey.

Options trading can be an exciting and potentially lucrative venture for those willing to learn the ropes. However, it can also be a daunting world for beginners. With a plethora of strategies to choose from, understanding the basics is crucial before diving in. In our future Leviathan option courses we'll explore some essential options trading strategies for beginners to help you get started on the right foot and gain mastery of trading options, whilst also showing you how important Leviathan software can help your decisions.

Before delving into option strategies, let's briefly clarify what options are. An option is a financial derivative that gives you the right, but not the obligation, to buy or sell an underlying asset at a specified price (strike price) before or on a specific date (expiration date). There are two primary types of options:

Call Option: This gives the holder the right to buy the underlying asset at the strike price before or on the expiration date.

Put Option: This gives the holder the right to sell the underlying asset at the strike price before or on the expiration date.

With this basic understanding, let's explore some beginner-friendly options strategies.

Covered Call Strategy The covered call strategy is one of the most straightforward options strategies for beginners. It involves two simple steps:

a. Buy a stock (100 shares per contract). b. Sell a call option on that stock.

The covered call strategy allows you to generate income by collecting the premium from selling the call option while still holding the stock. It's a conservative strategy that is often used by investors looking to earn additional income from their stock holdings.

Protective Put Strategy The protective put strategy is a defensive move for stock investors concerned about potential price declines. Here's how it works:

a. Buy a stock. b. Buy a put option on the same stock.

The put option gives you the right to sell the stock at the strike price. This strategy acts as insurance against potential losses if the stock's price drops. While it involves an upfront cost (the put option premium), it provides a degree of protection for your investment.

Long Call Strategy The long call strategy is a bullish approach. It's used when you expect the price of the underlying asset to rise. Here's how to execute it:

a. Buy a call option on a stock or index. b. Wait for the underlying asset's price to increase.

If the asset's price rises significantly, the value of the call option will also increase, allowing you to sell it for a profit. However, if the asset's price doesn't move as expected, you can lose the premium paid for the call option.

Long Put Strategy Conversely, the long put strategy is a bearish approach. It's used when you expect the price of the underlying asset to fall. The steps are simple:

a. Buy a put option on a stock or index. b. Wait for the underlying asset's price to decrease.

A successful long put strategy can be profitable as the price of the underlying asset falls. However, if the price doesn't decline as expected, you may lose the premium paid for the put option.

Bull Put Spread Strategy The bull put spread is a more advanced strategy but can be employed by beginners with some practice. This strategy involves the following steps:

a. Sell a put option with a higher strike price. b. Buy a put option with a lower strike price.

The goal of this strategy is to profit from a modestly bullish outlook on the underlying asset. By selling a put option with a higher strike price, you receive a premium. If the asset's price remains above both strike prices, you keep the premium as profit.

Success in options trading, especially for a beginner, hinges on understanding its foundational principles. These range from grasping the basic terminologies to comprehending the impact of market volatility. Every option strategy, be it a weekly option trading strategy or a long-term one, stems from these foundational concepts. A strong beginner option trading strategy that you can follow can open the door to a world of opportunities.

Further, trading isn't just about knowledge - it's about discipline, patience, and continuous learning. As markets evolve, so do the strategies. For a beginner, staying updated and continuously adapting is crucial. Thankfully, with resources like Leviathan Financial Management, beginners have access to strategies that are time-tested and innovative.

Expert option traders have traversed the path that every beginner is currently on. Their insights, derived from years of experience, can provide invaluable guidance. A beginner might wonder about the difference between high probability options trading strategies and other methods. It's the expert insights that shed light on these distinctions.

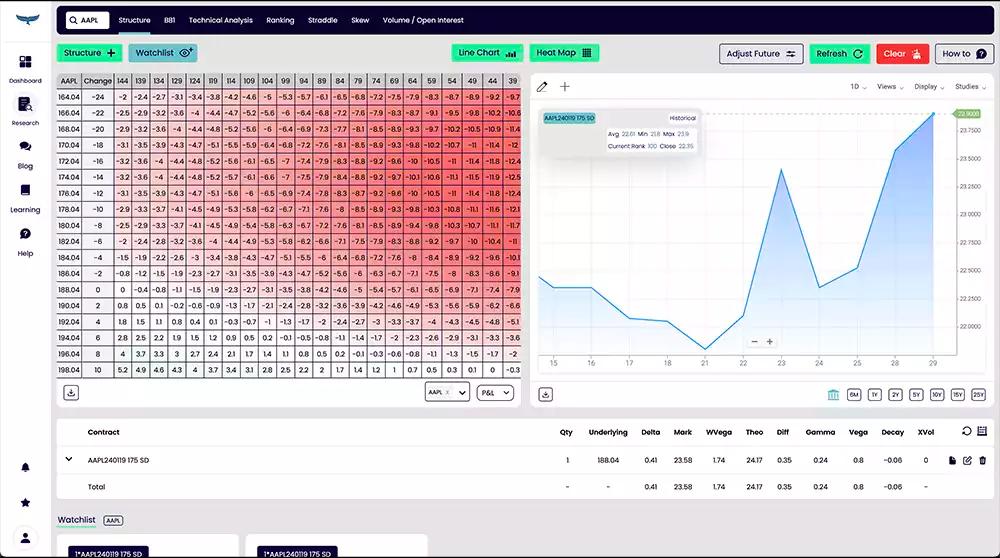

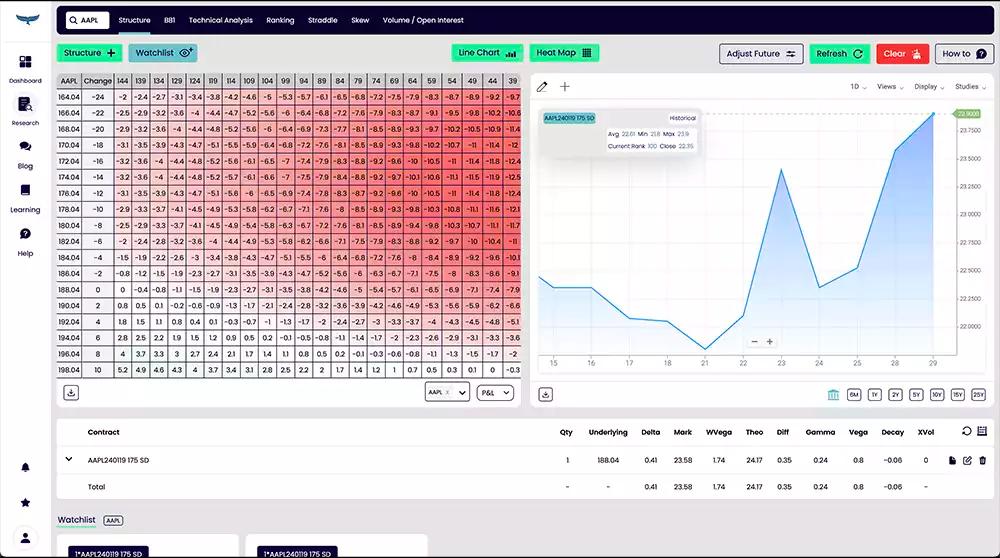

By aligning yourself with expert insights and tools like BB1, you can avoid common pitfalls and fast-track your learning process. Whether it's managing risks or identifying the best entry and exit points, the knowledge shared by seasoned traders is gold. Remember, in the world of options trading, strategy is key, and learning from the best can significantly shape your trading journey.

Trading options offers a multitude of benefits, especially for a beginner. Options provide flexibility that traditional stock trading doesn't. They allow traders to hedge their positions, generate additional income, or even speculate on price movements with a relatively lower capital investment.

In addition, options trading provides the potential for high returns, especially when executed with a robust strategy. The myriad of strategies available, from simple call-and-put buying to more complex multi-leg strategies, ensures that traders can tailor their approach based on their risk appetite and market outlook. With tools like stock options software, even beginners can efficiently analyze and optimize their strategies.

The journey into options trading is exciting and filled with both opportunities and challenges. At Leviathan Financial Management, we understand the unique challenges beginners face. That's why our tools and strategies are designed to provide a structured learning path.

With our comprehensive suite of resources, beginners can refine their approach, leverage expert insights, and ultimately, chart their success in the dynamic world of options trading. Explore, learn, and grow with Leviathan Financial Management, your trusted partner in options trading. Give us a call today!

Options trading can be an essential addition to your investment toolkit, but it's essential to start with a solid understanding and comprehension of basic strategies. The strategies mentioned in this article serve as a foundation for beginners to build upon. As you gain experience,knowledge and wisdom you can explore more complex options strategies by utilizing Leviathan software. But always remember that risk management and thorough research are key to successful options trading. Start small, practice become savvy and continue learning to refine your skills and by using Leviathan, you can gain comprehension and understanding to make informed trading decisions in the dynamic world of options.

Embark on your options trading journey with confidence using beginner options trading strategies by Leviathan Financial Management LLC. Learn the fundamentals, understand risk management, & implement strategic approaches to kickstart your successful options trading experience. Visit our website to learn more about our services & tools!

Tyler Krett

Tuesday 10 October 2023

0

Comments (0)

Tyler Krett

Tuesday 10 October 2023

0

Comments (0)