Morning Report

Darren Krett

Tuesday 11 April 2023

Morning Report April 11th

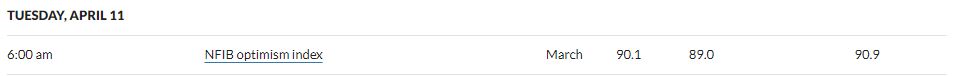

Welcome back from the Easter break, a few Fed speakers but eyes will be on the CPI tomorrow

Morning Report April 11th

0

Comments (0)

Darren Krett

Tuesday 11 April 2023

Share on:

Categories

closing report

China's Military continues to carry out actual combat training in the waters around Taiwan, via Chinese State Media At the end of last week, China initiated large-scale drills around Taiwan in response to the talks between high-level US and Taiwan officials. On Monday, April 10th China announced the drills had concluded. Fed's Williams says some core services inflation ex-housing hasn't budget yet so Fed has its work cut out; too soon to see changes in credit conditions and availability; one more hikes is a reasonable starting place We see some slowing in demand for labour but it is still high; job growth is still quite strong. Inflation is still a way above the 2% goal, seeing it come down mostly in goods and commodities. Not seeing strong signs of changes in credit conditions and availability happening yet. Hikes will be data-dependent. Fed is somewhat restrictive on policy right now. Bank failures have added uncertainty to the outlook. If inflation ends up stickier, will have to adjust policy appropriately. If inflation comes down, Fed will have to lower rates. Shrinking of balance sheet is going very smoothly; don't think Fed needs to adjust b/s policy "anytime soon". Fed's Goolsbee (voter) says right monetary policy approach calls for "prudence and patience"; needs to assess the potential impact of financial stress on real economy Fed needs to watch for tighter credit conditions and account for headwinds when setting monetary policy. Given uncertainty over financial headwinds, "we need to be cautious". Fed needs to be careful about raising rates too aggressively. Markets and financial issues should not drive Fed actions. Supervisory and regulatory tools, not rate cuts, are the principal defense against financial stress. Current monetary policy and tighter credit conditions can work in tandem to help cool inflation. Fed must recognize that the combination of tighter credit and monetary policy can hit sectors and regions differently than if monetary policy was acting on its own. Moments of financial stress are a particularly bad time to risk a US default in the fight over the debt limit. Google says it is introducing a new live TV experience where users can browse over 800 free TV channels

Consolidation in advance of Wednesday’s CPI data as those markets still closed yesterday rejoined the fray to play catch-up. Still feeling that there are people who have this week off too as its been a pretty muted session with one of the tightest trading ranges we have seen for a while.

| Ticker | Event | Release Date | Range Last Time Out | Range Move Average | Max Move | Min Move | Volatility Previous Day | Volatility Day Of | Volatility Move | Volatilty +1 day |

|---|---|---|---|---|---|---|---|---|---|---|

| S&P | C.P.I. | 04/12/23 | 82.75 | 93.75 | 238.25 TICKS | 37 TICKS | 24.21% | 22.55% | -1.66% |

Darren Krett

Tuesday 11 April 2023

0

Comments (0)

Darren Krett

Monday 10 April 2023

0

Comments (0)