Darren Krett

Monday 19 December 2022

Beta

0

Comments (0)

Stay ahead and keep your mind focused.

Categories

Learning

The Greeks

When delving into the world of options trading, it's crucial to understand the various Greeks, each of which provides insight into different dimensions of risk and opportunity. One of the often overlooked but essential Greeks is Rho. This Greek measures an option's sensitivity to changes in interest rates. In this blog post, we'll explore what Rho is, how it impacts options pricing, and why it's important for traders.

Rho represents the rate of change in an option's value with respect to a 1% change in interest rates. Essentially, Rho quantifies how much the price of an option is expected to change when the prevailing interest rate changes by one percentage point.

To understand Rho, let's consider an example. Suppose you have a call option with a Rho of 0.05 and a current price of $1.25. If interest rates increase by 1%, the value of the call option would rise to approximately $1.30, assuming all other factors remain constant. This increase reflects the positive Rho value indicating that the option's price moves in the same direction as the interest rate.

Conversely, put options typically have a negative Rho. If you hold a put option with a Rho of -0.04 and the option is priced at $1.50, a 1% rise in interest rates would decrease the option’s value to around $1.46. This decrease illustrates that put options generally lose value as interest rates rise.

Rho is particularly important for long-term options and those that are at-the-money. Here’s why:

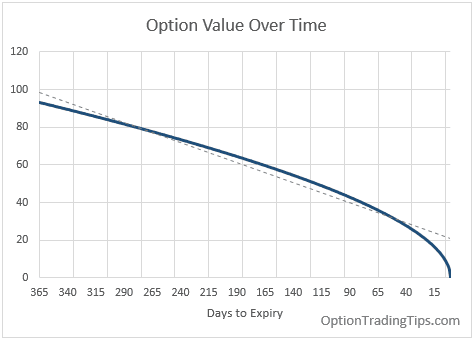

Long-Term Options: Options with longer times until expiration are more sensitive to changes in interest rates. This sensitivity arises because the interest component of the option’s premium plays a more significant role over a longer duration.

At-the-Money Options: These options are most sensitive to changes in interest rates because their intrinsic value is highly influenced by small shifts in the underlying asset's price, and consequently, by the cost of carrying the asset.

While interest rates might not change as frequently as other market variables, their impact on options can be significant, especially during periods of economic uncertainty or central bank policy changes. Here are a few scenarios where understanding Rho can be beneficial:

Like all Greeks, Rho has its limitations. It is less significant for short-term options as their prices are less affected by interest rate changes. Moreover, Rho does not provide information about the direction or magnitude of underlying price changes or volatility.

Understanding Rho is an essential part of advanced options trading, providing insights into how interest rate changes can affect option prices. While it may not be as commonly discussed as Delta, Gamma, or Vega, Rho plays a crucial role, especially for long-term options and strategic portfolio management. By incorporating Rho into your analysis, you can make more informed trading decisions and better manage interest rate risks.

Darren Krett

Monday 19 December 2022

0

Comments (0)

Darren Krett

Monday 19 December 2022

0

Comments (0)

Get ahead of the wave and sign up to our socials to get access to exclusive offers, videos, tutorials and latest news.

© 2015 - 2025 Leviathan Financial Management LLC. All Rights Reserved.

Legal Disclaimer: The information provided in the Leviathan website is for informational purposes only. It should not be considered legal or financial advice. You should consult with a financial advisor professional to determine what may be best for your individual needs. Leviathan Financial Management does not make any guarantee or other promise as to any results that may be obtained from using our content. No one should make any investment decision without first consulting his or her own financial advisor and conducting his or her own research and due diligence. To the maximum extent permitted by law, Leviathan Financial Management disclaims any and all liability in the event any information, commentary, analysis, opinions, advice and/or recommendations prove to be inaccurate, incomplete or unreliable, or result in any investment or other losses. Content contained on or made available through the website is not intended to and does not constitute legal advice or investment advice. Your use of the information on the website or materials linked from the Web is at your own risk.