Darren Krett

Monday 19 December 2022

VEGA

0

Comments (0)

Darren Krett

Thursday 9 February 2023

Share on:

Post views: 17352

Categories

General

Option implied volatility is a critical concept to understand when it comes to trading options. By understanding how it works, traders can identify opportunities in the market, hedge their positions, and adjust their strategies accordingly. In this blog, we will discuss what option implied volatility is, how to assess and interpret it, and how to use it in your trading.

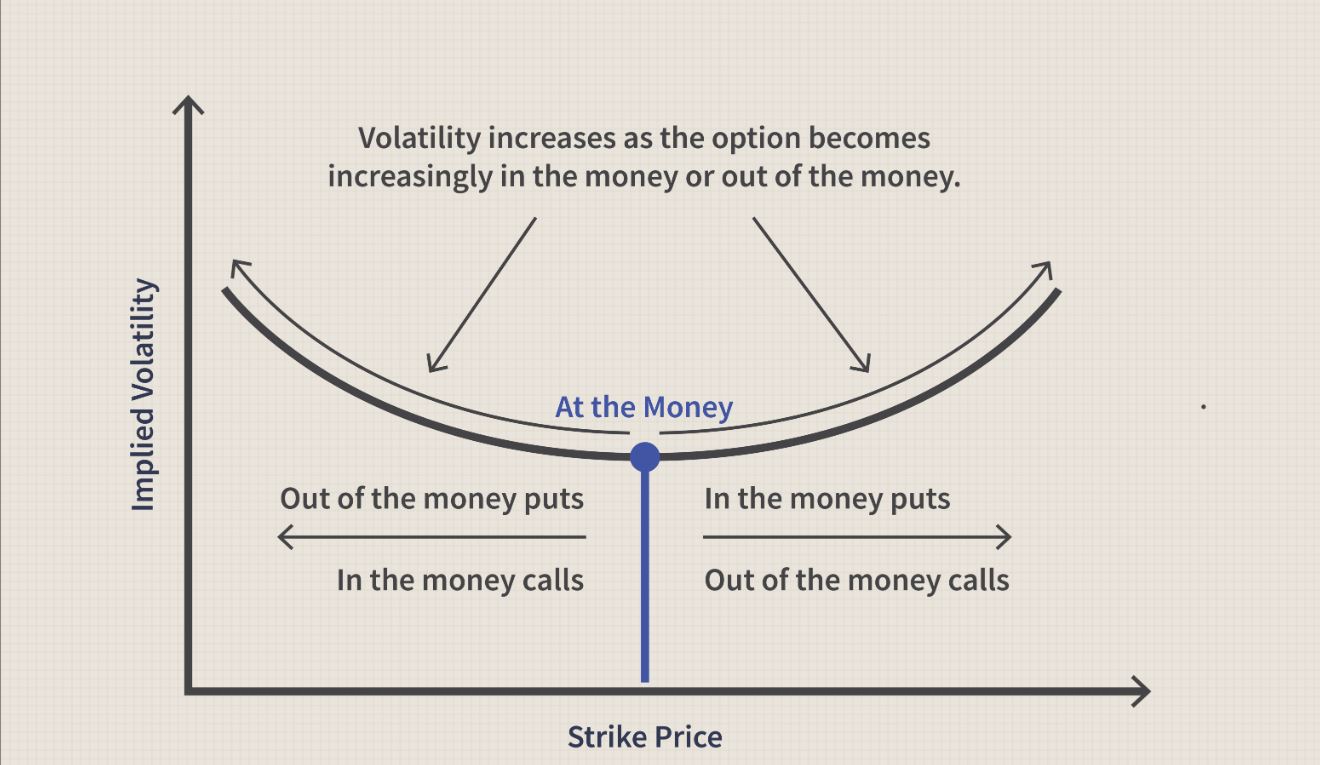

Introduction Option implied volatility is a measure of the expected future volatility of the underlying asset in an option contract. It is calculated using the option's price, strike price, time to expiration, interest rate, and the current price of the underlying asset. This measure reflects the market’s expectation of how much the price of the underlying asset will move. When an option is bought or sold, the market will set an implied volatility level which reflects the expectation of how much the price of the underlying asset will move. This level is used to calculate the option price. A higher implied volatility typically results in a higher option price, while a lower implied volatility can result in a lower option price. Understanding option implied volatility gives traders the ability to identify opportunities in the market, as well as to hedge their positions and adjust their strategies accordingly.

Assessing and Interpreting Implied Volatility

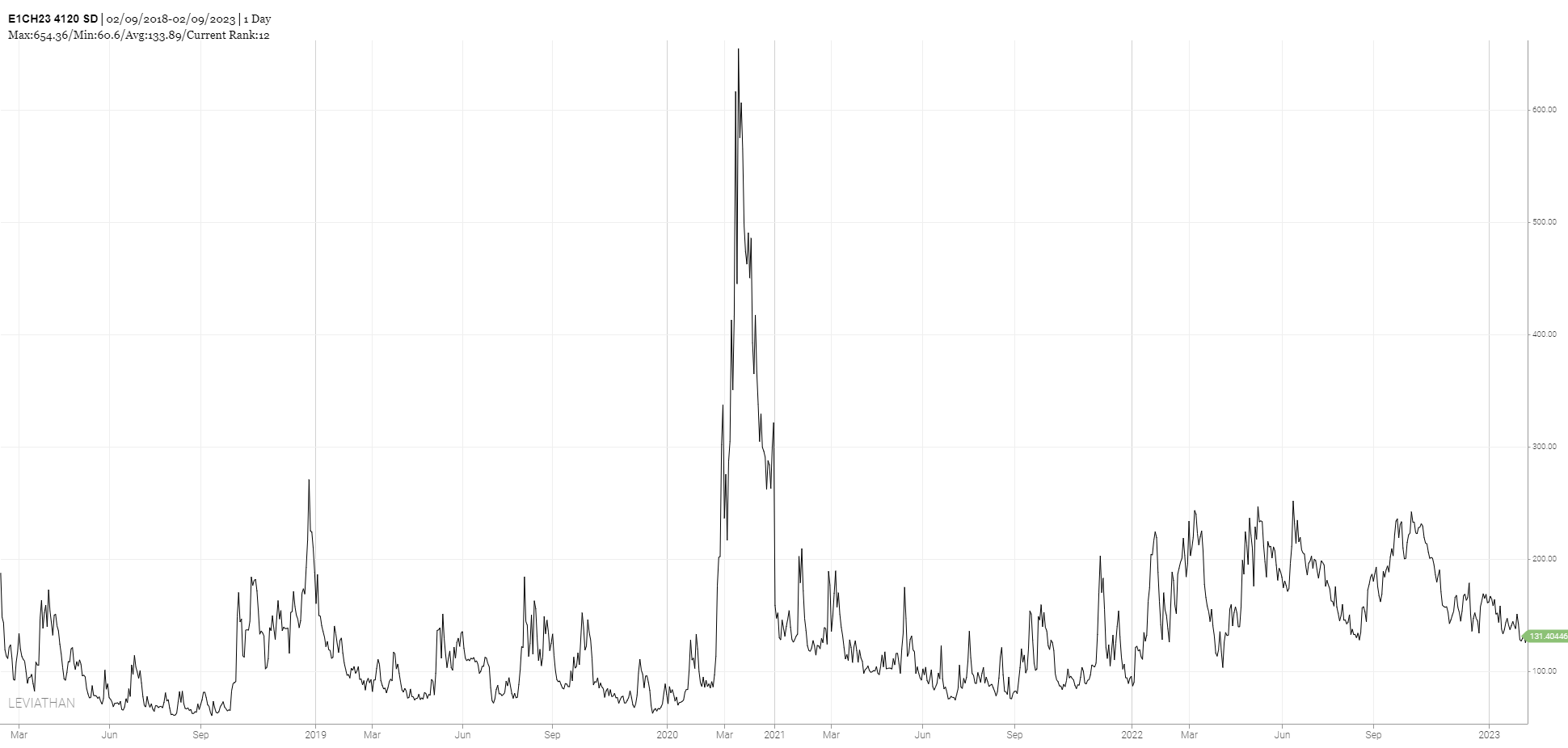

Implied volatility can be assessed by comparing the current level of implied volatility with its historical levels, or by looking at the implied volatility of related options contracts. It typically moves in cycles, with higher levels when markets are more uncertain or volatile and lower levels when markets are more stable. Traders should take these fluctuations into consideration when making decisions about their trades.

Utilizing Implied Volatility

Options traders can use various strategies to take advantage of changes in implied volatility. These include buying options when implied volatility is low and selling options when implied volatility is high. Different types of option trades can be used for different strategies; for example, a trader could buy a long call when implied volatility is low and sell it when it increases, or they could buy a straddle when both call and put options have high implied volatilities.

When deciding which option trade to use, traders should consider factors such as their risk tolerance and market conditions. Additionally, traders should be aware that implied volatilities can be affected by changes in the underlying asset’s price, time to expiration, interest rates, and other factors.

Conclusion

In conclusion, understanding option implied volatility can help traders identify and take advantage of opportunities in the markets, as well as hedge their positions and adjust their strategies accordingly. Knowing how to assess and interpret implied volatility will enable traders to better manage their risk and maximize returns from their trades. By understanding how option implied volatility works, traders can make more informed decisions about their trades and increase their chances of success in the markets.

Conclusion

In conclusion, understanding option implied volatility can help traders identify and take advantage of opportunities in the markets, as well as hedge their positions and adjust their strategies accordingly. Knowing how to assess and interpret implied volatility will enable traders to better manage their risk and maximize returns from their trades. By understanding how option implied volatility works, traders can make more informed decisions about their trades and increase their chances of success in the markets.

Darren Krett

Monday 19 December 2022

0

Comments (0)

Darren Krett

Tuesday 31 January 2023

0

Comments (0)