Closing Report

Darren Krett

Tuesday 7 March 2023

END OF DAY REPORT March 7th

Get a comprehensive overview on the economic climate in one convenient report.

END OF DAY REPORT March 7th

0

Comments (0)

Darren Krett

Friday 10 March 2023

Share on:

Categories

closing report

- Silicon Valley Bank "SVB" (SIVB): Contagion fears spark a global banking sell-off

- Although it has been suggested that some of the contagion panic seen across larger “systemically important” US banks yesterday was

overdone

- SVB Financial Group (SIVB) plunged 60% on Thursday and even further in pre-market trade before being halted.

- US Treasury Secretary Yellen and financial regulators convened today and expressed reliance in the banking system resilience, says

regulators have effective tools to address this type of event

- Manchester United (MANU) sale deadline has been pushed back to the Summer, according to The Telegraph

- US Treasury Secretary Yellen says prioritisation of debt payments without debt ceiling increase is simply default by another name

- Stocks add to losses as financials dive while dovish aspects of NFP fail to support the market

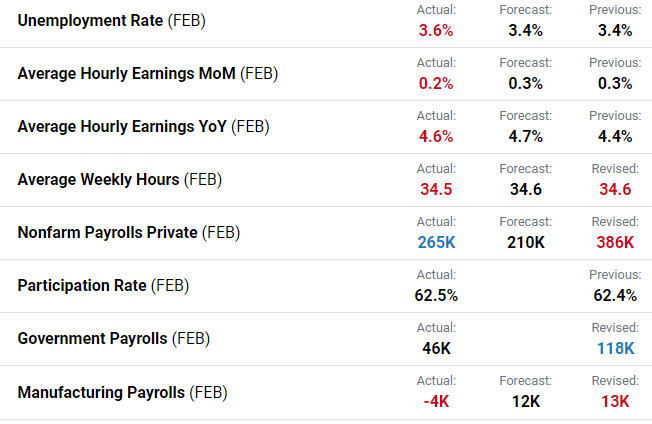

- US Non-Farm Payrolls* (Feb) 311k vs. Exp. 205.0k (Prev. 517.0k, Rev. 504k); two-month net revisions: -34k (prev. +71k)

- US Average Earnings YY* (Feb) 4.6% vs. Exp. 4.7% (Prev. 4.4%)

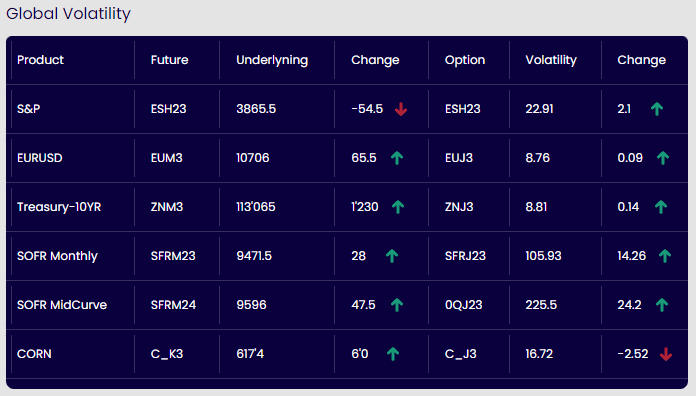

Down the rabbit hole we go…… For the first time since 2007, the two-year Treasury yield has increased by more than 5 percent. But the 10-year yield has barely moved up.By Wednesday, the spread had widened to negative 107 basis points — an extreme pattern seen only once before, in 1980 — when Paul Volcker, then Fed chair, was unleashing shock therapy. There have been 28 instances since 1900 where the yield curve has inverted; In 22 of these episodes, recession has followed. And yet there is precious little evidence so far that we are indeed heading into a recession even if there are signs of rising consumer stress. As Powell noted this week, the labor market is red hot. Worries about distress at Silicon Valley Bank, and potential risks in the broader distress in the banking system have weighed on shares and the debt of financial companies and saw the SFRH4 rally 65 Basis Points off its low ,while the yield on the 2-year Treasury yield fell by more than 20 basis points on Friday to below 4.7%, and headed for its biggest two-day drop since the Great Financial Crisis.Earlier in the day, the 2-year yield declined 27.6 basis points to 4.624%, putting it on pace for the biggest two-day drop since Sept. 29, 2008. But to expect a soft landing with a combination of higher rates and no recession , may be somewhat optimistic. History tells us that when investors start invoking the phrase “this time is different,” they’re also often completely wrong.

Darren Krett

Tuesday 7 March 2023

0

Comments (0)

Darren Krett

Wednesday 8 March 2023

0

Comments (0)