Closing Report

Darren Krett

Tuesday 2 May 2023

END OF DAY REPORT MAY 2nd

"Sell in May and go away" is looking like a good piece of advice at the moment! DONT LOOK UNDER THE HOOD!! Banks get trounced agai

END OF DAY REPORT MAY 2nd

0

Comments (0)

Darren Krett

Friday 2 June 2023

Share on:

Categories

closing report

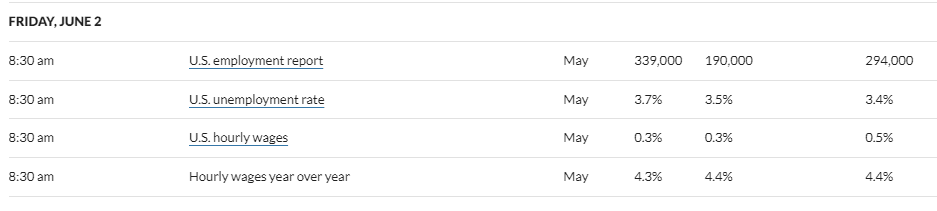

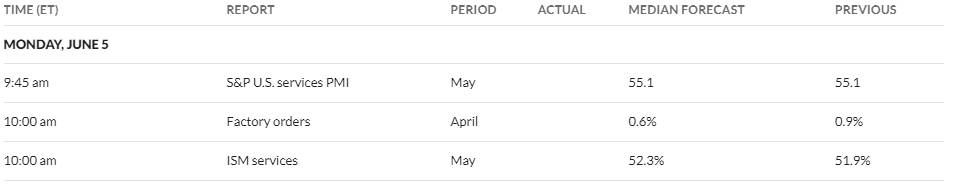

Saudi Energy Minister Abdulaziz decision to ban various news sources from OPEC meeting stemmed from his perception that his market view was not being given a fair airing, he believed that was contributing to falling oil prices, according to FT sources White House says debt ceiling bill may be signed as soon as Saturday Goldman Sachs continue to expect a pause at the June FOMC meeting, reflecting the mixed household survey, the softness in hours worked, and the decline in average hourly earnings growth Iraq minister says OPEC+ wants to maintain stability in the oil market; OPEC+ has proven it reads the market in the right way Fitch says despite debt limit agreement US 'AAA' rating remains on negative watch Although the resolution of the US debt limit impasse allows the government to meet its obligations, Fitch Ratings maintains the Rating Watch Negative. Consider the full implications of the most recent brinkmanship episode and the outlook for medium-term fiscal and debt trajectories. WSJ Timiraos, "Friday’s jobs report does little to clarify the Federal Reserve’s debate over whether to hold rates steady this month. But it underscores the prospect that, if officials do so, they could favor raising rates later this summer." A continuing strong labour market could lead officials to hike rates higher than anticipated. Officials who already favoured a rate hike in June are likely to be more convinced of the need. But some who have argued that the Fed should slow down hikes to study the effects of past moves, could still lean toward skipping a June hike and moving rates up in July if economic activity remains solid.

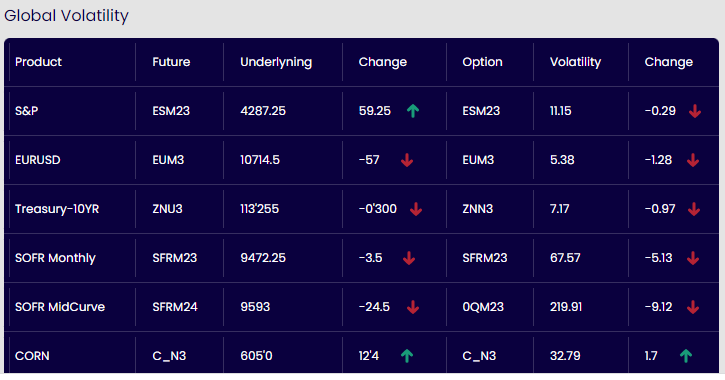

Stocks skyrocketed Friday after the solid +339k (exp. +190k) NFP additions. The Treasury curve bear-flattened, while June Fed pricing was little changed (c. 30% implied hike probability) this is mostly down to this skip idea being bandied around this week because the chances of another hike when including the July meeting increased by 14% to an 80% chance that the Fed will raise rates “one more time”. With the NFP data, although the headline number once again beat expectations the soft earnings growth and the spike in the unemployment rate serving a dovish offset to the headline figure, hike pricing ramped further out the curve, with the 2s10s spread reaching its most inverted levels post-SVB. The Dollar surged on the improved economic outlook and rate differentials. But, that didn't stop the commodity rally, with the improved demand outlook post-NFP accentuated by the Bloomberg reports that China is mulling stimulus for the property sector. For oil, note late Reuters source reports that OPEC+ is mulling a 1mln BPD cut for its confab on Sunday, underpinning the strength. FOR A FREE TRIAL FOR OUR AI OPTIONS ANALYSIS ON EQUITIES AND FUTURES SYSTEM GO TO <a href="https://www.leviathanfm.com/pricing">Here</a>

Darren Krett

Tuesday 2 May 2023

0

Comments (0)

Darren Krett

Thursday 1 June 2023

0

Comments (0)