End of day Equity, ETF and Futures report April 20th

HIGHLIGHTS

US banks are reportedly facing a shift of hundreds of billions in assets to the EU at ECB request, according to Bloomberg; details light

Fed's Mester reiterates Fed will need to hike policy rate to over 5% and hold there for a while; inflation still too high, Fed has more work to do;

Fed is much closer to the end of the rate-hike journey Extent of future hikes depend on how economy performs. Sees welcome progress in balancing demand and supply in economy. Watching to see impact of tighter financial conditions on economy;

how they evolve could influence future rate hike view. Stresses in banking sector have eased, but Fed will act if needed.

Expects to see meaningful progress in lowering inflation this year. Reiterates view that inflation is to ease to 3.75% this year. Reiterates view that unemployment rate is to rise to 4.50%-4.75%

Fed's Bowman (voter) says Fed is focused on lowering inflation and strong labour market has made finding workers extremely difficult

Fed's Logan (voter) says inflation has been much too high and to assess if we have made enough progress, watching for further, sustained improvement in inflation

Fed's Mester, in Q&A, says Fed has come a long way in tightening policy; rates are the active tool of monetary policy, not the balance sheet Fed is aiming for a soft landing in the economy. Economy is on track for very slow growth, wouldn't take a big shock to generate a recession

Russian Foreign Minister Lavrov, when asked about the future of the Black Sea grain deal, says almost nothing has been done to address Moscow's concerns

SUMMARY

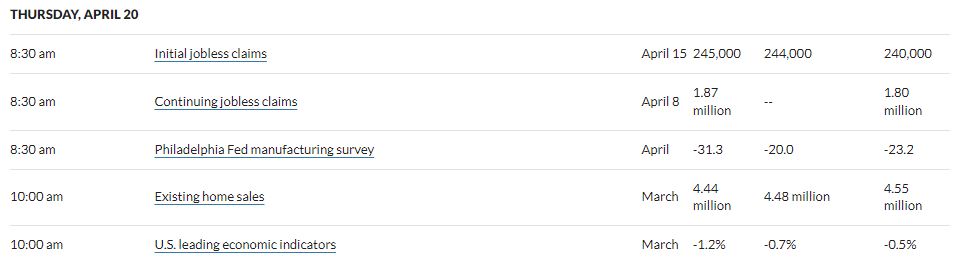

The Buck popped to its best levels of the session not long before the latest IJC updates and Philly Fed survey hit the wires, with the DXY extending to 102.120 from a prior high of 102.040, but weekly and continued claimant counts both topped consensus, while the headline business index missed expectations by some distance and fell deeper into negative territory. Meanwhile Tesla is having a bit of a torrid time as it drop 10.2%!!!!!(at time of writing) after disappointing results yesterday along with unconvincing rhetoric from Elon Musk.