Tyler Krett

Wednesday 1 November 2023

Options Trading Calculator

0

Comments (0)

Darren Krett

Friday 22 September 2023

Share on:

Post views: 1830

Categories

Blog

For those who are looking to build wealth and long-term income, investing in the markets is a good idea. One investment option to consider is to invest in option contracts. When you are looking to invest in options, it is important that you use an options visualizer and are aware of the most common options strategies, which can be used to manage risk and build income.

One of the most common trading strategies for an option is buying a long call or long put. When you purchase a long call, you will be purchasing an open call options contract that will allow you to purchase a stock at a specified price in the future. If the price exceeds the specified strike price in the future, you can make a considerable amount of money. For example, if a stock is selling for $12 today, you can purchase a contract to buy it for $15 in the future. If the stock reaches $20, your profit will be $5 per share.

A long put is similar but is placing a bet that the price of the stock will go down in the future. For example, if you purchase a $10 put option on the $12 stock, you will make $2 per share if it falls to $8. Technically, a put option provides you the right to sell a stock at the strike price in the future. An advantage of both long calls and puts is that there is considerable upside.

Another strategy that many people choose to make is a covered call option strategy. With a covered call strategy, you will own a stock and then sell call options on the stock in the future. This can help to generate some passive income on stocks that you already own while also providing some downside protection. However, it will limit the amount of money you can make if the stock spikes in value.

If you are purchasing a volatile stock, you may be concerned about the risk that it declines considerably in value. One of the ways that you can protect against this is by investing in protective put options. With a protective put option, you will buy a put option on a stock that you already own. While it will cost some premium fees, it can be designed to limit your downside while not limiting your upside potential.

A put option is a contract that provides the buyer the right to sell a stock at a predetermined price in the future. For the seller of the put option, it requires them to buy the stock at that predetermined price. While this can provide some risk to the seller of the put option contract, it does also provide some potential income generation. A common strategy is to sell a naked put option on a stock that you are interested in buying.

Theoretically, if you like a stock that trades for $12 today, it may make sense to sell a put option on it at $10. In the worst-case scenario, you will purchase it in the future at a discount compared to today’s price and will collect a premium. However, you could take a large loss if the stock goes down considerably in value.

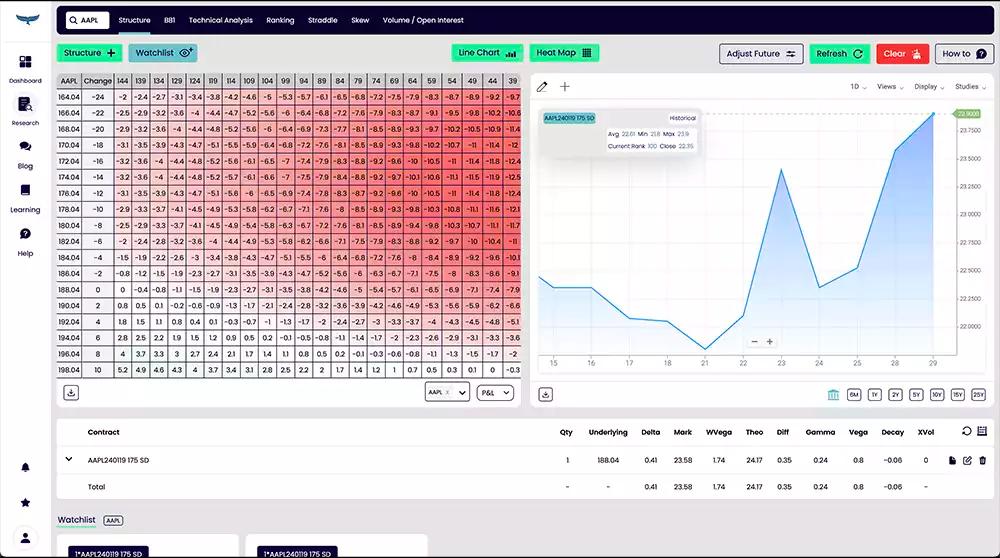

Options continue to be a unique investment strategy. As there is always a lot of risk that comes with buying and selling options, it is important to be careful and knowledgeable about the risks you are taking. One tool that you can use to help evaluate your trading options is an option trading simulator, exclusively offered by Leviathan. This is a tool that will help you compare strategies and determine possible outcomes based on the movement of the underlying stock. As always, it is a good idea to work with an advisor when establishing a new trading strategy. Contact us today to learn more about how our tools can help you trade options.

Tyler Krett

Wednesday 1 November 2023

0

Comments (0)

Tyler Krett

Tuesday 10 October 2023

0

Comments (0)