Darren Krett

Friday 5 May 2023

DAY TRADE IDEAS MAY 5th

0

Comments (0)

Darren Krett

Wednesday 10 May 2023

Share on:

Post views: 4705

Categories

Equity Index

Emini S&P June trapped in a frustrating, volatile, trendless sideways pattern, holding

a 150 point range as we wait for some direction from today’s CPI number.

Nasdaq June we have a potential double or even triple top sell signal...as long as we

hold the recovery highs at 13330/370.

Emini Dow Jones June shot higher to to test what should be strong resistance at

33800/900. Shorts need stops above 34000.

Update daily by 06:00 GMT.

Today’s Analysis.

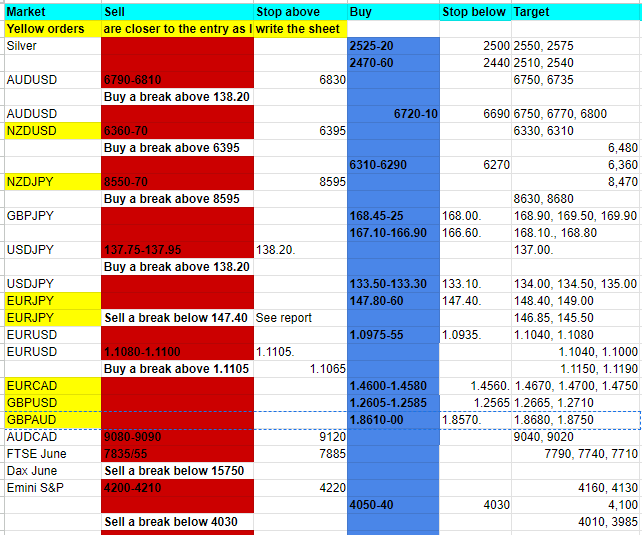

Emini S&P June again meets strong resistance at 4200/4210. Shorts can target minor

support at 4130/20 perhaps as far as the May low at 4075/65. We should find strong

support at 4050/40 this week. Longs need stops below 4030.

A break lower is a sell signal targeting 4010/50, perhaps as far as 3090/85.

A break above 4230 is a buy signal.

Nasdaq June all over the place but going nowhere so it is tough to find reliable

trading levels in this mess, but a break above 13390 triggers a test of the 100 week

& 500 day moving averages at 13460/480.

Having rejected the the recovery highs at 13330/370 we can target minor support at

13250/220, perhaps as far as better support at 13160/140. If you try to scalp this

level with a long position, stop below 13100. A break lower can target 12950/900.

Emini Dow Jones June unexpectedly shot higher to strong resistance at 33800/900. A

high for the day exactly here in fact on Monday.

Shorts need stops above 34000. A break higher could retest 34300/360

Targets for shorts are 33700, 33550 (with a low for the day exactly ere yesterday),

perhaps as far as 33350. Below 33300 look for a retest of last week’s low at

33050/33000.

Emini S&P June trapped in a frustrating, volatile, trendless sideways pattern, holding

a 150 point range as we wait for some direction from today’s CPI number.

Nasdaq June we have a potential double or even triple top sell signal...as long as we

hold the recovery highs at 13330/370.

Emini Dow Jones June shot higher to to test what should be strong resistance at

33800/900. Shorts need stops above 34000.

Update daily by 06:00 GMT.

Today’s Analysis.

Emini S&P June again meets strong resistance at 4200/4210. Shorts can target minor

support at 4130/20 perhaps as far as the May low at 4075/65. We should find strong

support at 4050/40 this week. Longs need stops below 4030.

A break lower is a sell signal targeting 4010/50, perhaps as far as 3090/85.

A break above 4230 is a buy signal.

Nasdaq June all over the place but going nowhere so it is tough to find reliable

trading levels in this mess, but a break above 13390 triggers a test of the 100 week

& 500 day moving averages at 13460/480.

Having rejected the the recovery highs at 13330/370 we can target minor support at

13250/220, perhaps as far as better support at 13160/140. If you try to scalp this

level with a long position, stop below 13100. A break lower can target 12950/900.

Emini Dow Jones June unexpectedly shot higher to strong resistance at 33800/900. A

high for the day exactly here in fact on Monday.

Shorts need stops above 34000. A break higher could retest 34300/360

Targets for shorts are 33700, 33550 (with a low for the day exactly ere yesterday),

perhaps as far as 33350. Below 33300 look for a retest of last week’s low at

33050/33000.

AUDUSD has now stablised a new range from 6580/70 up to 6790/6810. A high for the day exactly

here on Monday so we remain in the 2 month range.

Shorts hit my target & minor support at 6750/45. I suggested we take at least some profit here as

this market can reverse for no reason in the sideways range. A low for the day exactly here as

expected.

If you still have a portion of the short position you need a break below 6740 to target 6735, perhaps

as far as a buying opportunity at 6720/10. Longs need stops below 6690.

Shorts on a retest of resistance at 6790/6810 need stops above 6830. A break higher is a buy signal

for this week targeting 6860/70 & 6915/25.

NZDUSD only reached 6359 after my buy signal, not as far as my 6380/90 target for profit taking.

If you still have a portion of the short position you need a break below 6740 to target 6735, perhaps

as far as a buying opportunity at 6720/10. Longs need stops below 6690.

Shorts on a retest of resistance at 6790/6810 need stops above 6830. A break higher is a buy signal

for this week targeting 6860/70 & 6915/25.

NZDUSD only reached 6359 after my buy signal, not as far as my 6380/90 target for profit taking.

I am going to suggest a short today at 6360/70, stop above 6395. A break higher is a buy signal & can

target 6480/90.

Shorts at 6360/70 target support at 6310/6290 for profit taking. Longs need stops below 6270.

NZDJPY retests the upper trend line of the 4 month range at 8550/70. Shorts need stops above 8595.

Targets is 8470/50.

A break above 8595 should be a buy signal targeting 8630/40 & 8680/90.

A break above 8595 should be a buy signal targeting 8630/40 & 8680/90.

Please email me if you need this report updated or Whatsapp: +66971910019

Darren Krett

Friday 5 May 2023

0

Comments (0)

Darren Krett

Thursday 4 May 2023

0

Comments (0)