Darren Krett

Friday 10 February 2023

WHY OPTIONS?

0

Comments (0)

Stay ahead and keep your mind focused.

Categories

Learning

Options trading can be highly profitable if done correctly, but without the right tools, traders may struggle to achieve success. Whether you're new to options trading or have years of experience, having the right tools is essential to stay on top of the market and make informed decisions. In this article, we'll explore the top five must-have tools for every options trader.

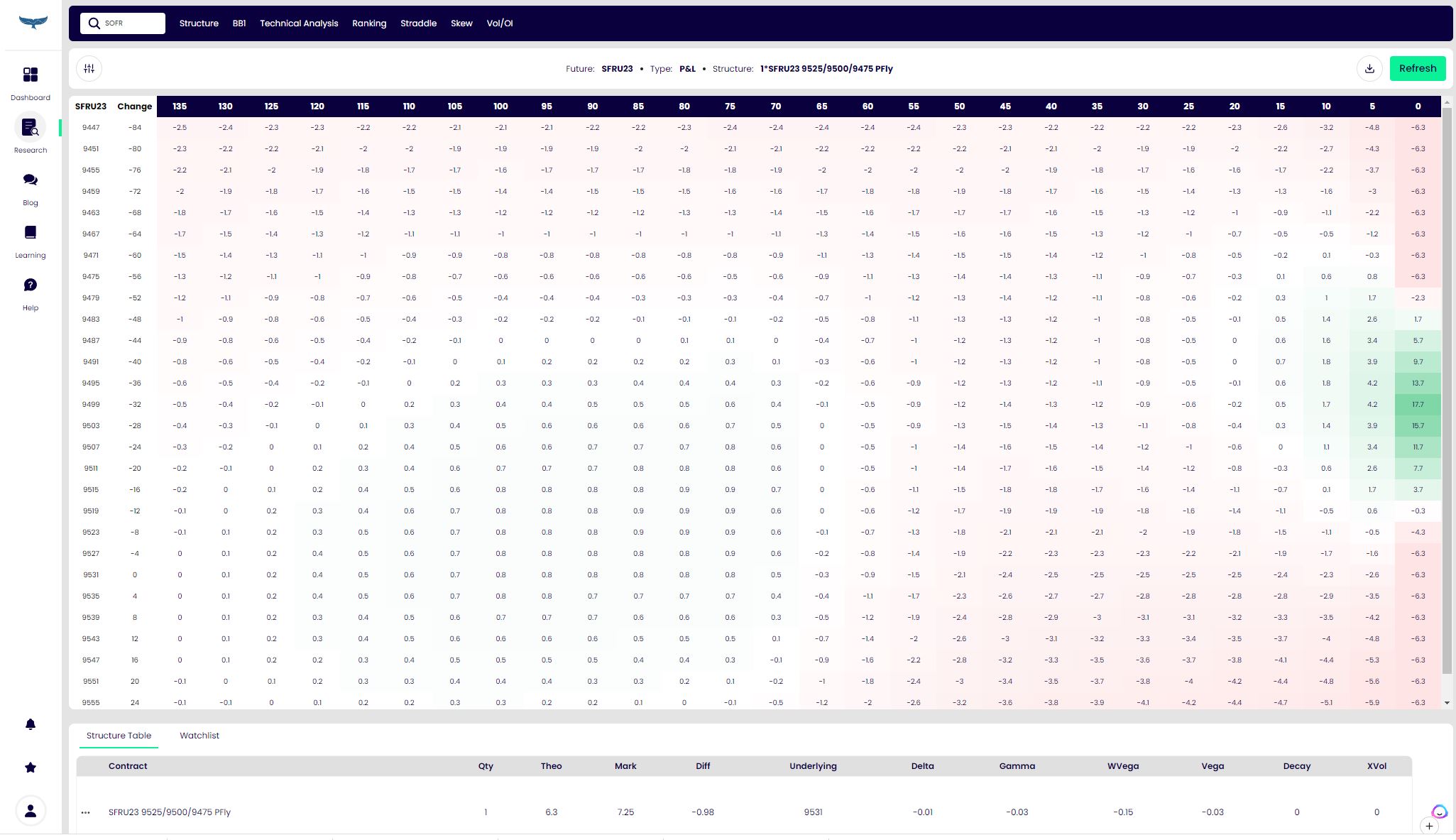

1. Risk Management Tools

Effective risk management is critical to the success of options trading. It is essential to use tools that help manage risk throughout the trading process. Make sure to have a solid risk management strategy in place and don't ignore the importance of managing risk effectively.

Effective risk management is critical to the success of options trading. It is essential to use tools that help manage risk throughout the trading process. Make sure to have a solid risk management strategy in place and don't ignore the importance of managing risk effectively.

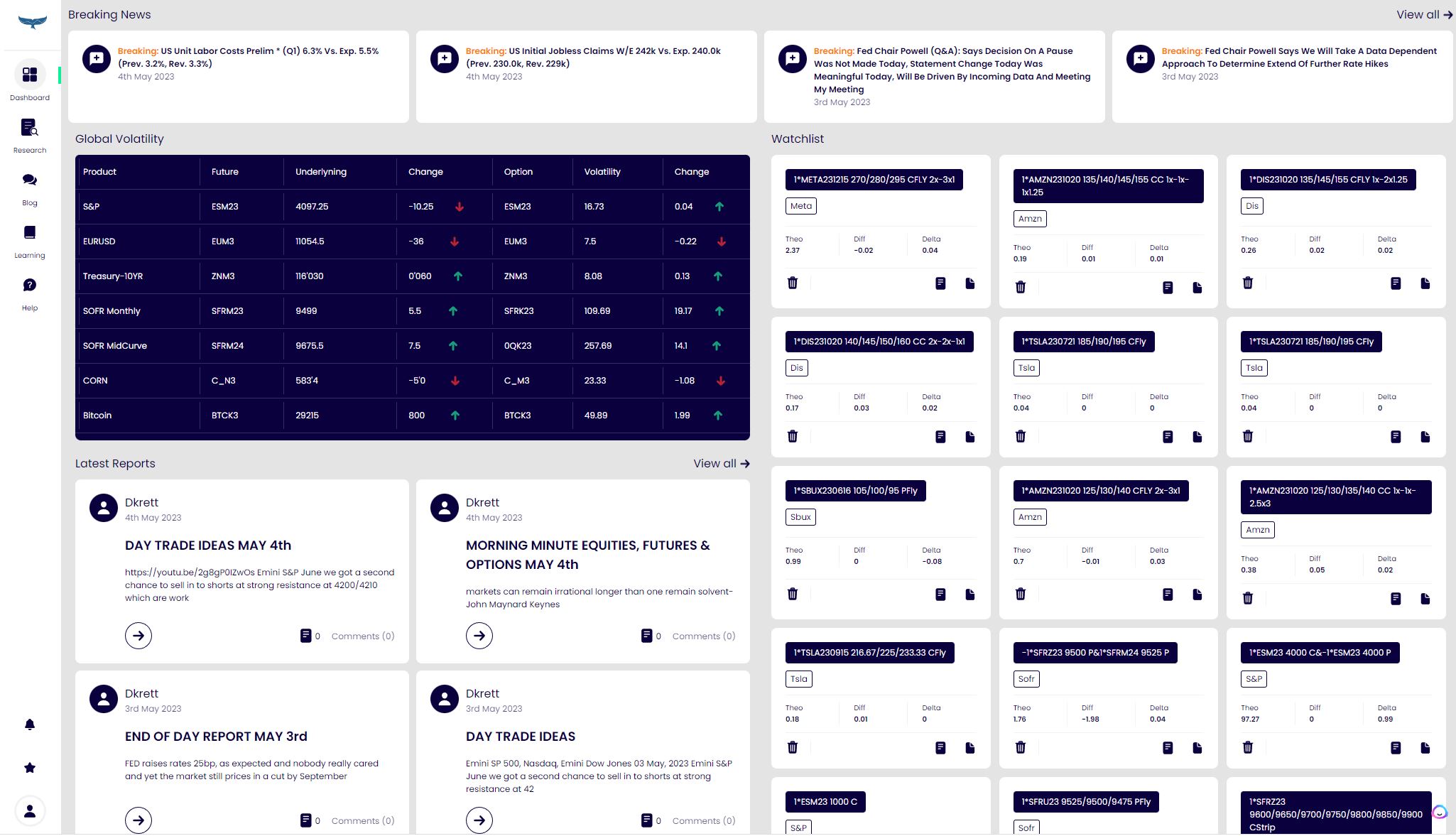

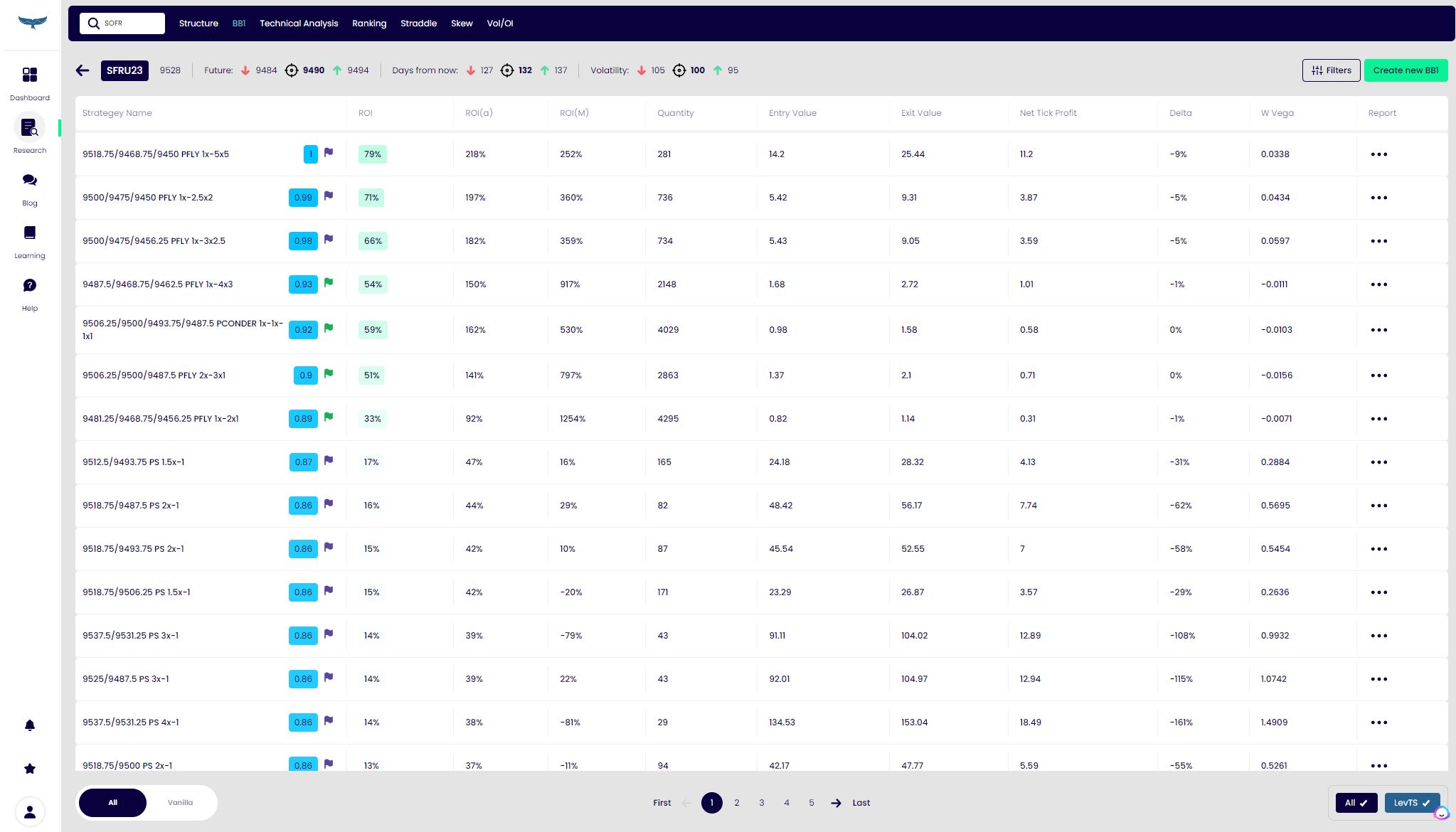

2. Ease of use

It's essential to have a user-friendly, and secure platform that works well with your trading style and strategy. Make sure to choose a platform that allows for easy navigation, has comprehensive technical analysis tools and provides real-time analysis.

It's essential to have a user-friendly, and secure platform that works well with your trading style and strategy. Make sure to choose a platform that allows for easy navigation, has comprehensive technical analysis tools and provides real-time analysis.

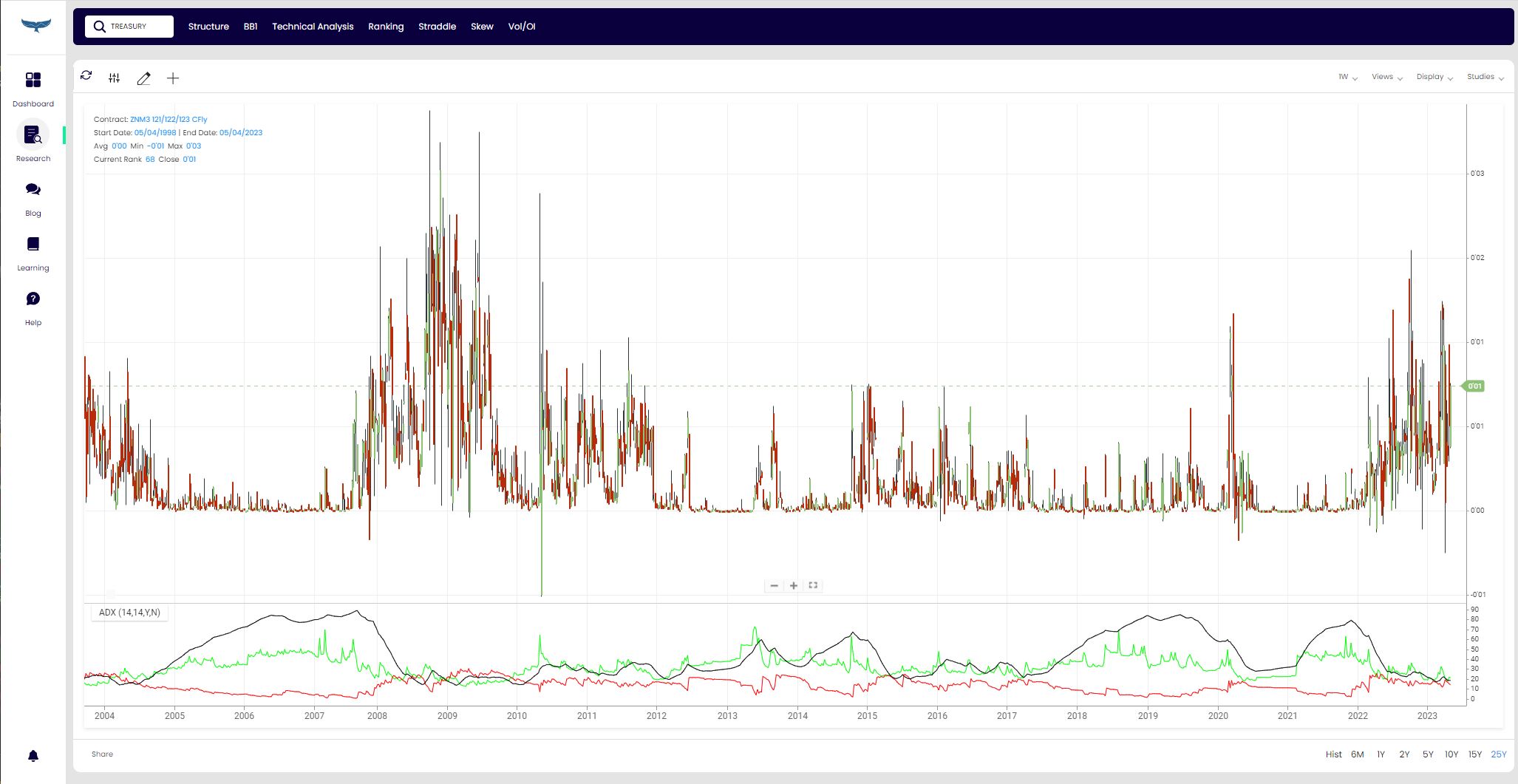

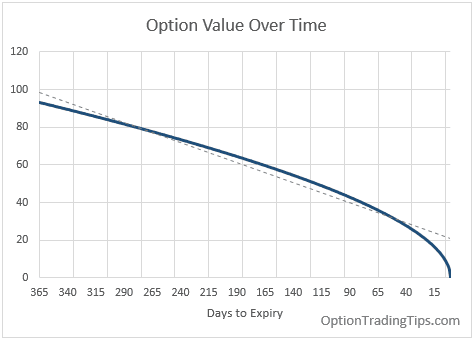

3. Access to historical data

Information is key. It is difficult to find a platform that has historical access to option data that can go back more than 2 years. This information is key when being able to decide the true value of a trade,

Information is key. It is difficult to find a platform that has historical access to option data that can go back more than 2 years. This information is key when being able to decide the true value of a trade,

4. News and Analysis Tools

Market news and analysis are crucial to making informed decisions and staying up to date on the latest trends. News tools and analysis software provide real-time updates and insights into the market, helping traders stay ahead of the curve. Choose a news platform that allows you to customise your updates, track specific keywords, and access comprehensive research and analysis.

Market news and analysis are crucial to making informed decisions and staying up to date on the latest trends. News tools and analysis software provide real-time updates and insights into the market, helping traders stay ahead of the curve. Choose a news platform that allows you to customise your updates, track specific keywords, and access comprehensive research and analysis.

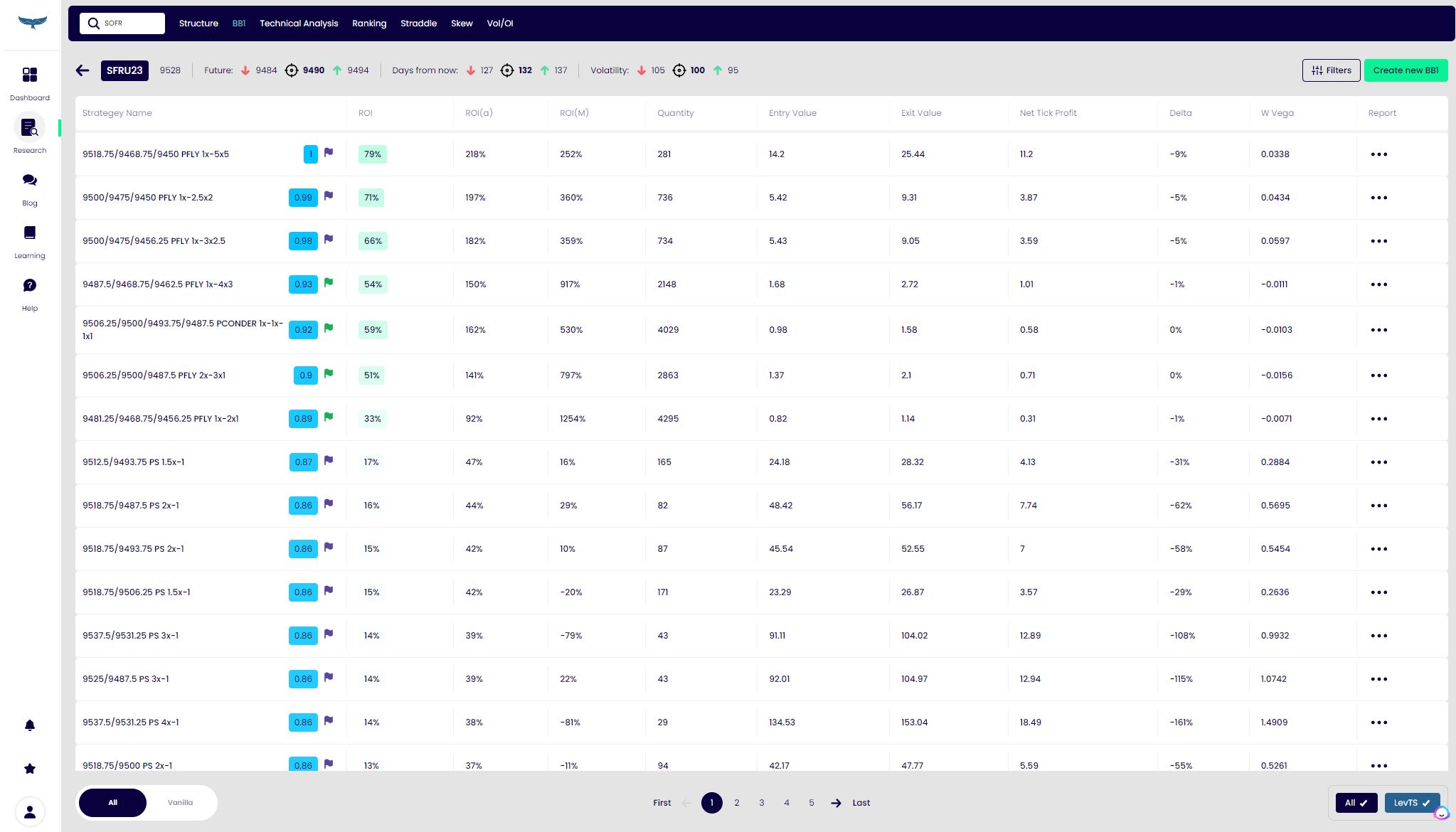

5. Choosing your trade

Even seasoned traders will have trouble knowing which trade is the best one to do in a market where specialists spend years analysing historical option moves and relative values. Try to find a platform that wont just regurgitate basic option strategies, but one that will inform you of the best relative value trades to dso, the ones with the best return and the least risk

Even seasoned traders will have trouble knowing which trade is the best one to do in a market where specialists spend years analysing historical option moves and relative values. Try to find a platform that wont just regurgitate basic option strategies, but one that will inform you of the best relative value trades to dso, the ones with the best return and the least risk

Conclusion

Options trading is a sophisticated and rewarding investment strategy that requires a combination of expertise, timing, and an array of tools. From choosing which is the best trade for YOU, to risk management tools and news and analysis software, the tools we've outlined in this article are essential to help you make informed decisions and achieve success in the world of options trading.

Options trading is a sophisticated and rewarding investment strategy that requires a combination of expertise, timing, and an array of tools. From choosing which is the best trade for YOU, to risk management tools and news and analysis software, the tools we've outlined in this article are essential to help you make informed decisions and achieve success in the world of options trading.

Darren Krett

Friday 10 February 2023

0

Comments (0)

Darren Krett

Monday 19 December 2022

0

Comments (0)

Get ahead of the wave and sign up to our socials to get access to exclusive offers, videos, tutorials and latest news.

© 2015 - 2025 Leviathan Financial Management LLC. All Rights Reserved.

Legal Disclaimer: The information provided in the Leviathan website is for informational purposes only. It should not be considered legal or financial advice. You should consult with a financial advisor professional to determine what may be best for your individual needs. Leviathan Financial Management does not make any guarantee or other promise as to any results that may be obtained from using our content. No one should make any investment decision without first consulting his or her own financial advisor and conducting his or her own research and due diligence. To the maximum extent permitted by law, Leviathan Financial Management disclaims any and all liability in the event any information, commentary, analysis, opinions, advice and/or recommendations prove to be inaccurate, incomplete or unreliable, or result in any investment or other losses. Content contained on or made available through the website is not intended to and does not constitute legal advice or investment advice. Your use of the information on the website or materials linked from the Web is at your own risk.