Darren Krett

Wednesday 22 March 2023

Fed Statement comparison

0

Comments (0)

Darren Krett

Wednesday 14 June 2023

Share on:

Post views: 3770

Categories

Interest Rate

The FOMC is expected to leave rates unchanged at 5.00-5.25%.

The accompanying 'Dot Plot' will go a long way in addressing the unchanged decision as a 'pause' or a 'skip', where the absence of an increase to the 2023 median rate dot will struggle to see the 'skip' nomenclature hold ground, reflecting diminishing power amongst the hawks.

Doves will be hesitant to back guidance around further hikes over fears of a future event in the banking sector, a view that appears more in line with the Fed hierarchy than not.

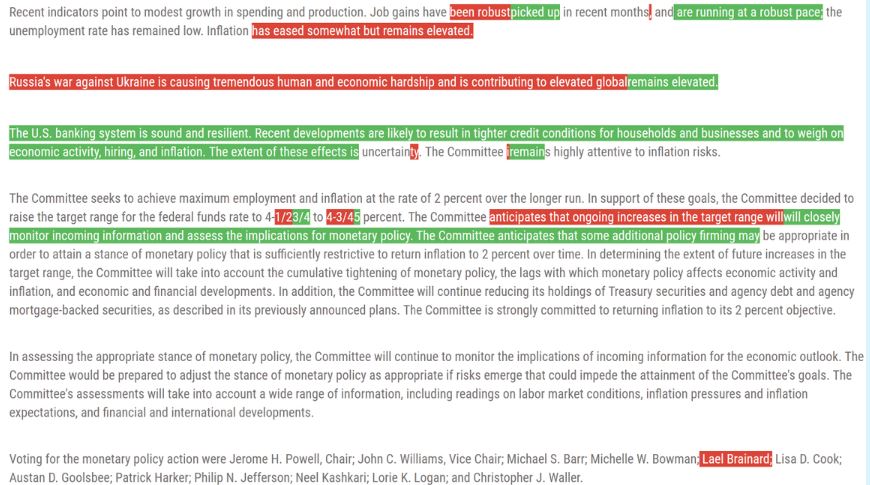

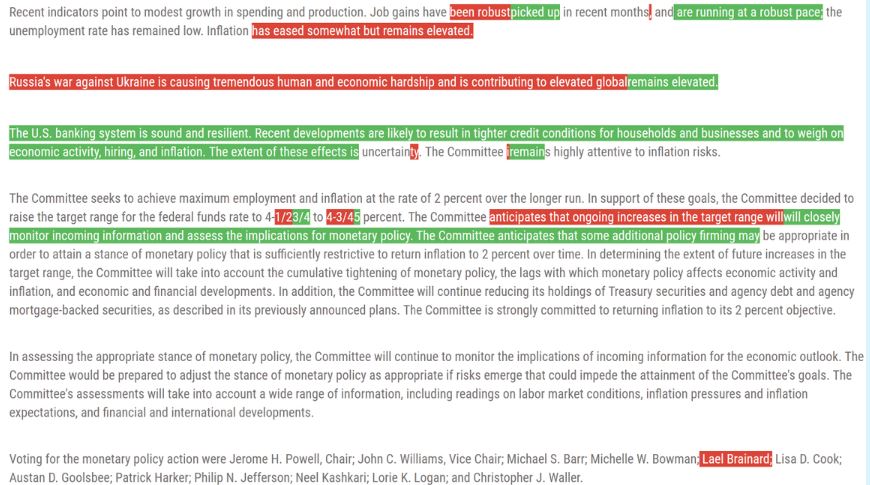

The FOMC is expected to keep its target Fed Funds range unchanged at 5-5.25%, according to the majority of economists, while markets are currently implying a 25% risk of a 25bps hike and almost fully pricing in a hike for the July meeting. The statement will most likely continue to affirm that "additional policy firming may be appropriate", with little changes expected. Expectations over whether the Fed would hike or pause/skip have been erratic heading into the confab given resilient economic data supporting hike calls from hawks, but the voting member majority have ultimately signalled against a hike in order to assess cumulative tightening so far and the impact of recent bank failures - a notion that Fed Vice Chair nominee Jefferson formalised on the eve of the FOMC blackout period. But, while Board leadership are mainly on the same page, the growing rift between hawks and doves may become more evident, with Bloomberg's economist survey showing nearly 40% of expect a hawkish dissent on Wednesday. A failure to convince the hawks that the June FOMC is a skip would likely be the trigger for a dissent.

The May CPI report will be released just as the FOMC two-day meeting begins on Tuesday and serves as a significant event risk. Wall Street consensus sees Core CPI Y/Y falling to 5.3% from 5.5%, with the M/M seen flat at +0.4%. Some economists have made their unchanged June Fed rate meeting forecasts contingent on the inflation data coming in line as expected, so any upside surprises Tuesday (particularly in the Fed-favoured core services ex-housing derivation) will no doubt push up the probability of a hike on Wednesday, if not reinforce hawkish guidance at the very least with the report adding to the solid non-farm payrolls additions in May. On the other hand, doves may instead point to the lagging nature of CPI data and instead point to the softening of indicators such as ISMs and PMIs, the recent pick-up in initial jobless claims, and the spike in the unemployment rate (and falling hours worked) as all warranting a pause in aggregation. DOT PLOT: The Fed will also release its updated edition of the Summary of Economic Projections ('Dot Plot') after the prior release at the March FOMC. Bloomberg's economist survey, conducted between June 2nd-7th, sees no change expected to the 2023 year-end rate of 5.1% (money markets are almost fully priced for a hike in July followed by a cut in December), although if the Fed wants to ramp its hawkish guidance, there is a sizeable minority who expect an increase to 5.3%. Beyond there, consensus sees the 2024-end forecast raised to 3.8% from 3.6%, 2025 seen at 3.1% from 3.0%, and the long-run ('neutral') rate is seen unchanged at 2.5% - keep an eye on any upward pressure in the long-run dot as many question whether if we now have a higher neutral interest rate, particularly as where the Fed may land at comes more into focus as the end of the rate hiking cycle comes into sight. Economists also expect upgrades to 2023's growth forecast to 0.6% from 0.4%, cuts to the 2023 unemployment rate to 4.2% from 4.5%, and a nudge higher in Core PCE to 3.7% from 3.6%.

5.1% in 2023 (unchanged vs. March), 4.4% in 2024 (prev. 4.3%), 3.1% in 2025 (unchanged), 2.5% in longer run (unchanged) CHANGE IN REAL GDP: 0.6% in 2023 (prev. 0.4% in March), 1.2% in 2024 (unchanged), 1.9% in 2025 (unchanged), 1.8% in longer run (unchanged). UNEMPLOYMENT RATE: 4.2% in 2023 (prev. 4.5% in March), 4.5% in 2024 (prev. 4.6%), 4.5% in 2025 (prev. 4.6%), 4.0% in longer run (unchanged) PCE INFLATION: 3.3% in 2023 (unchanged vs. March), 2.5% in 2024 (unchanged), 2.1% in 2025 (unchanged), 2.0% in longer run (unchanged) CORE PCE INFLATION: 3.7% in 2023 (prev. 3.6% in March), 2.6% in 2024 (unchanged), 2.1% in 2025 (unchanged).

While there have been no further ruptures from the banking sector after the fallout from the SVB failure, it's the fears that something might occur going forward which is driving significant caution from doves, particularly as bank reserves continue on their downward trajectory; the TGA rebuild only adds to those uncertainties. Indeed, there are likely to be several who are reluctant to give any guidance towards further hikes, and a failure to increase the 2023 rate dot will see Powell struggle to frame an unchanged rates decision on Wednesday as part of the nascent 'skip' narrative that hawks have been pining for (given they can't garner enough votes for a hike). Markets are more than likely to see that scenario as a 'pause' and begin to ponder more meaningfully when we can expect cuts.

The surprise hikes by the RBA and then the BoC recently have raised some fears that the Fed could follow suit. However, that seems unlikely in the near term, absent an upside surprise to CPI, with money markets relatively unchanged for the June meeting. Nonetheless, there has been a greater unwind of cuts priced into next year in the wake of the surprise hikes. While the Fed is unlikely to change its course on a dime due to shifts in other

Darren Krett

Wednesday 22 March 2023

0

Comments (0)

Darren Krett

Wednesday 2 November 2022

0

Comments (0)