Blog

Darren Krett

Wednesday 22 February 2023

Morning Report Feb 22nd

Morning Report Feb 22nd

0

Comments (0)

Darren Krett

Wednesday 22 March 2023

Share on:

Categories

closing report

- Politico sources, on reports that Treasury was looking at whether regulators could guarantee uninsured bank deposits across the country without seeking congressional approval, said

“The administration does not view the move as necessary — full stop.”

- ECB's Lane says if the ECB baseline holds up, then absolutely there is more to do

- Bank of Spain says global financial sector tensions have created new adverse shock of yet uncertain magnitude and persistence; uncertainty will likely have adverse effect on economy in

coming quarters

- ECB's Rehn says ECB will prioritize pricing stability over financial stability

- ECB's Panetta says a string of shocks has created uncertainty for economies around the world; monetary policy should be data-dependent and adaptable. And it requires us to shape our

communication on the basis of our monetary policy reaction function.

- ECB officials claim vindication on rate hike amid price risks, according to Bloomberg, adds officials are increasingly confident the EZ banking system has withstood financial turmoil,

allowing them to resume rate hikes in due course

- FED RAISES BENCHMARK RATE 25 BPS TO 4.75%-5% TARGET RANGE

- FED MEDIAN FORECAST SHOWS RATES AT 5.1% END-`23, 4.3% END-`24

- "The Committee anticipates that some additional policy firming may be appropriate"

- Fed Chair Powell says FOMC does not know the extent of the impact of tighter credit conditions; do not see the impact just yet, that argues for being alert when considering future rate

hikes

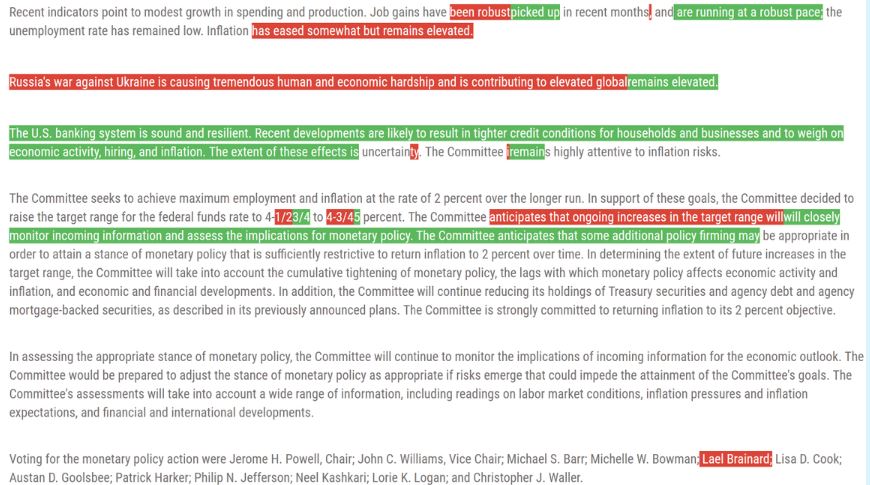

• Federal Open Market Committee votes unanimously to raise benchmark rate by 25 basis points, as forecast, to target range of 4.75%-5%; second straight hike of that size following

December’s 50 basis-point hike and the four straight 75 basis-point moves before that

• “Dot plot” of rate forecasts shows 5.1% median estimate for end-2023, unchanged from last update in December; end-2024 projection rises to 4.3% from 4.1%

• Statement says FOMC “anticipates that some additional policy firming may be appropriate,” omitting prior language forecasting “ongoing increases” in main rate

• Fed says US banking system is “sound and resilient” but the financial turmoil is “likely to result in tighter credit conditions for households and businesses and to weigh on economic

activity, hiring and inflation” to an uncertain extent; also removes reference to inflation having eased, instead saying it “remains elevated”

• FOMC continues pace of balance-sheet runoff, also known as quantitative tightening, leaving in place monthly caps of $60 billion for Treasuries that are allowed to mature without being

reinvested and $35 billion for mortgage-backed securities

So has JPow threaded that needle once again? He has said in the presser that if they have to raise rates further then they will, so there has been a degree of flexibility shown. They are aware that there is a potential for the banks to have other "canaries" but are prepared to do whatever is required to fix an issue if it turns out to be bigger than expected.

Personally, I think it still feels like "2007" rather than "2008" as what SVB did, in the large part, was the same as a lot of other banks have done, but if the Fed is to guarantee ALL deposits, which although (at this stage) they refuted as just a rumor, implies that if it came to it, they would.

In the meantime, volatility has cratered across the board and I expect to see the same again tomorrow

https://www.federalreserve.gov/monetarypolicy/files/fomcprojtabl20230322.pdf

Darren Krett

Wednesday 22 February 2023

0

Comments (0)

Darren Krett

Tuesday 7 March 2023

0

Comments (0)