End of day report April 4th

HIGHLIGHTS

- JPMorgan CEO Dimon annual letter says if US has high inflation for longer, Fed may have to raise rates higher than most expect; says the odds of a recession have increased Says the current crisis is not over yet, and even when it is over, there will be

repercussions for years to come.

Not clear when the current crisis will end. Current crisis not like 2008; current crisis involves fewer players and fewer issues that need to be resolved.

Says erratic stress tests capital requirements and constant uncertainty around future regulations damage the banking system without making it stronger.

- Russian Deputy Foreign Minister says Moscow will reveal in due course measures to respond to Finland's accession to NATO, according to Al Jazeera

SUMMARY

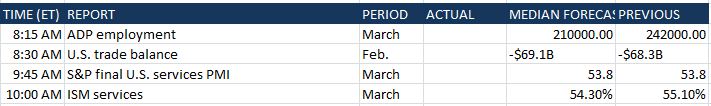

Because talks of a recession have gone on for a while without any sign of actually happening when the JOLTs report today showed a softer labor market investors were a little skittish. Jami Dimon's annual JPM letter in which he was pretty clear that he didn't think the crisis was over and on top of that, the Fed may have to raise rates higher than expected was not exactly bullish either, but we have ADP tomorrow (see table) and the NFP to look forward to. Other than that, we are dealing with the Trump show again, so I for one, will be switching off the TV and doing something more interesting instead...