Darren Krett

Friday 10 February 2023

Darren Krett

Monday 24 April 2023

Share on:

Post views: 7465

Categories

Stocks

So Wells Fargo likes the House of Mouse! So what is the best option play?

with an upside target of $147 whilst currently trading around $101.50

Well this gives us plenty of upside to play with and BB1 has come up with a couple of "corkers"!

When we run the AI scenario analysis, after it has finished we can easily filter the trades to show wither premium only or even ones with "positive tails" in case you are completely wrong.

After calculating 1.2billion different scenarios the top of the risk/reward list is the following;

We started off filtering for the plain vanilla stuff, the idea being to filter for the easiest trades to understand and trade. Your risk is just what you're paying out and that is all!

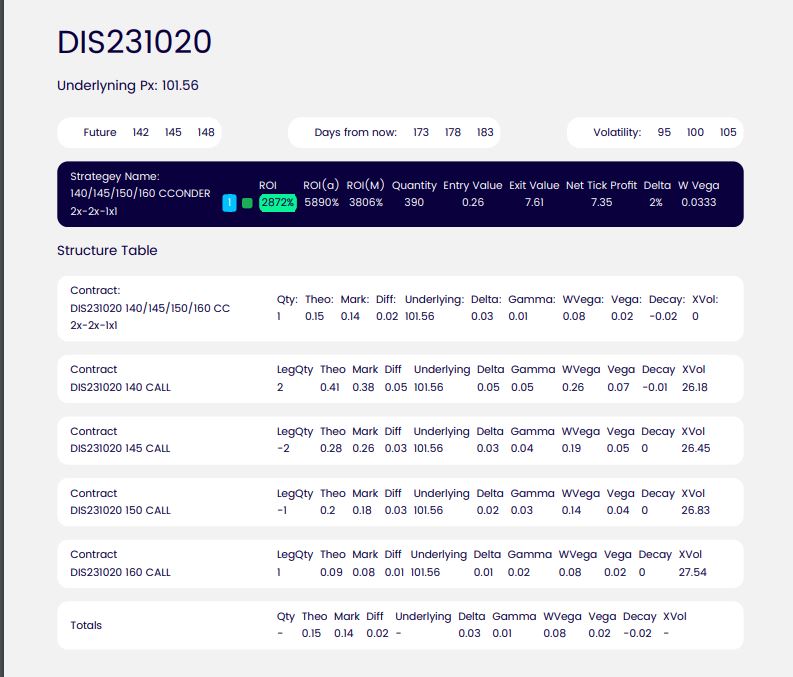

It chose a ratioed condor targeting a price of $145 (+/- 2% of that target), 178 days from now (+/- 5 days)

10/20/23 expiration date +780 140 calls/ -780 145 calls/ -390 150 calls/ -390 160 calls, paying out net 26 cents (after costs)

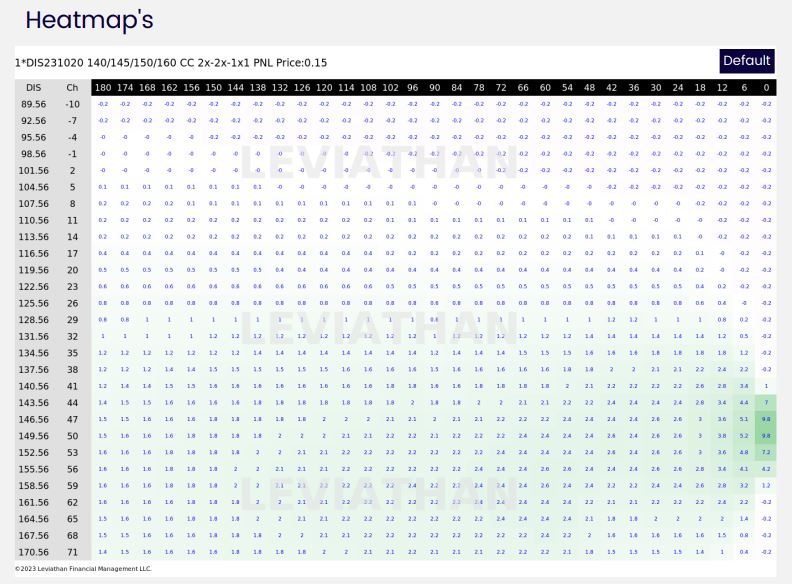

So what does the forward looking P&L look like?

OVER A 2800% RETURN!!!!!!! With "green" being good and "red" being bad, its easy enough to see why the system picked this one

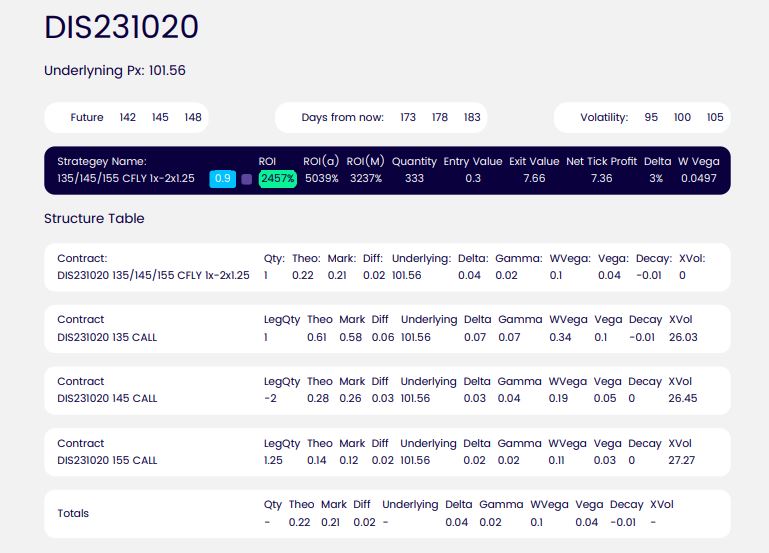

As it generated multiple choice we thought to look at what is normally a unicorn" , can we structure a trade that has a positive tail if things dont go according to plan...well in this case, yes; this one is slightly more complex in that we need to work out the correct executionable quantities. It chose THE 10/20/23 Expiration and a 1x2x1.25 call fly 333 times, however , as we cannot trade in .25 quantities we need to multiply that by 4 so 4x8x5 and divide the volume you have to do by 4, so in this case 83 of that ratio(the returns will be identical)

-666 10/20/23 145 call +416 10/20/23 155 call

at a price of 30 cents**

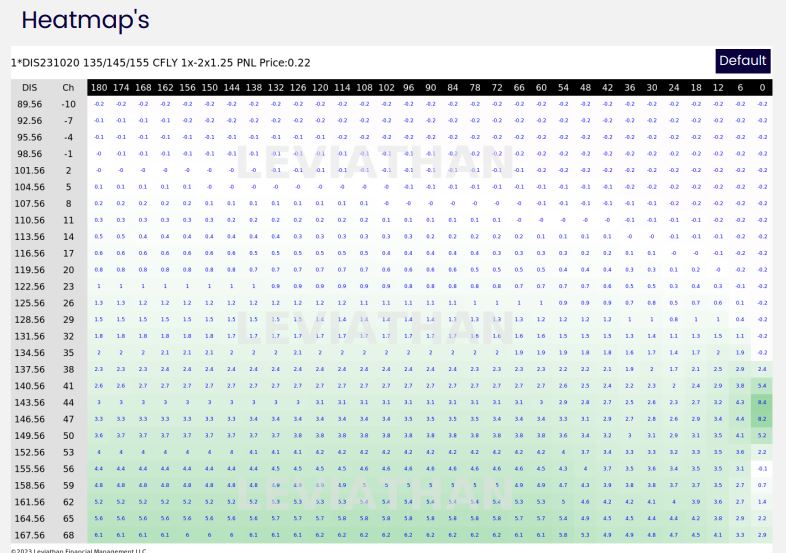

Now in this case the "extra" call gives you a forward looking profile like this;

With a 2400% return if youre correct with some extra upside baked in too, we will see who does better when we get there...I know where my money is.

Any questions please PM me

Darren Krett

Friday 10 February 2023

Darren Krett

Tuesday 31 January 2023

0

Comments (0)