Darren Krett

Thursday 18 May 2023

Share on:

Post views: 6312

DOOMSDAY SCENARIO, Here’s what could happen if the debt ceiling is breached ?

Categories

Trends

WHAT IS THE DEBT CEILING EXACTLY?

The whole concept of a debt ceiling itself was built by federal lawmakers during World War One. It gave the U.S. Treasury the ability to issue bonds without congressional approval, but only if the total debt of the federal government stayed under a specified “ceiling”. Now every government has debt ceilings but only the US and Denmark set it as an absolute figure. A more widely accepted approach is setting the maximum of what governments can spend as a percentage of the GDP. Poland, for example, has a constitutional limit of 60% of its gross domestic products and a budget cannot be approved in case this limit has been breached.

Anyway, back to the US, its debt limit (which currently sits at $31.4 trillion), and if you have listened to recent comments by Treasury Secretary Janet Yellen, the government could reach this figure in just about two weeks time. Congress has raised the debt limit dozens of times in the past, but in recent years the maneuver has become harder to negotiate due to the deep political divide in Washington and across the country.

IT IS NOT "NOTHING"

The utterly clueless former US president endorsed the default if Democrats do not cave in and downplayed the potentially catastrophic impact of the stand-off saying that “it could be really bad, it could be maybe nothing”. He is wrong. A failure to raise the debt limit would be simply disastrous, not only for the US but globally, too. Negotiations are ongoing, while the Republicans demand deep cuts to government programmes in the coming 10 years whilst the Democrats are offering modest reductions in the next two years. What is a no go from the Democrats is the repeal of the tax credits on clean energy, which is part of Joe Biden’s Inflation Reduction Act. Debt relief on student loans is another “sacred cow” for the current administration. Differences might be narrowed, and a compromise could be found in applying savings from unspent Covid funds to a possible agreement and in hastening the process of issuing permits for big investment projects.

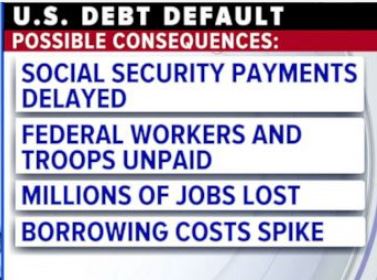

SO WHAT HAPPENS IF WE DO DEFAULT?

If there was ever a default, even if it only lasts for a brief period of time, it would guaranteed to push the US into recession,it would destroy household wealth and lead to significant job losses. Consumer and business confidence would deteriorate, the credit rating of the US government would be downgraded and consequently interest rates would increase, and lending would become more expensive. The economy would contract. The federal government would be forced to delay and/or reduce payments for benefits and services, including Social Security and Medicare and tax refunds would not arrive in time. International implications would be severe, too. The global financial system would be destabilized, confidence in the dollar would decline, supply chains would be disrupted possibly resulting in a global recession. Treasurys holders include pension funds, mutual funds, banking institutions, individuals, state and local governments and insurance companies, as well as foreign governments consider U.S. government debt as a sure thing, that building into their portfolios, the, the status of U.S. Treasury rates as a risk-free rate, the system would completely freeze up.

I honestly do not even fathom what could happen to the treasury market if it were to default on its interest payments on Treasury bonds, something that historically has been considered a risk-free investment.

If there was ever a default, even if it only lasts for a brief period of time, it would guaranteed to push the US into recession,it would destroy household wealth and lead to significant job losses. Consumer and business confidence would deteriorate, the credit rating of the US government would be downgraded and consequently interest rates would increase, and lending would become more expensive. The economy would contract. The federal government would be forced to delay and/or reduce payments for benefits and services, including Social Security and Medicare and tax refunds would not arrive in time. International implications would be severe, too. The global financial system would be destabilized, confidence in the dollar would decline, supply chains would be disrupted possibly resulting in a global recession. Treasurys holders include pension funds, mutual funds, banking institutions, individuals, state and local governments and insurance companies, as well as foreign governments consider U.S. government debt as a sure thing, that building into their portfolios, the, the status of U.S. Treasury rates as a risk-free rate, the system would completely freeze up.

I honestly do not even fathom what could happen to the treasury market if it were to default on its interest payments on Treasury bonds, something that historically has been considered a risk-free investment.

ODDS ARE THAT THEY WILL FIND A SOLUTION

The market seems confident that an agreement will be found, and this optimism is reflected in the performance of the S&P (which is currently trading at the upper part of the range we have been stuck in since last year). However, the cost of insuring against a US default, (the price of the 1-year credit default swap), has gone from 15bp at the beginning of the year up to 169bp today! Yesterday came the Republican House Speaker pledged to avoid default and said that a deal by the end of this week is possible. If true, then the seeds of a sustained rally are possibly being sowed with the S&P finally breaking out to the upside. On one hand, Republicans are keeping the US and the global economy hostage. They are using, as always, the debt ceiling as a political leverage. On the other, raising debts indefinitely is economically unsustainable, to just throw another “log on the fire” is NOT a solution. Whether there is a long-term solution by either abolishing the debt limit in its entirety so it is no longer used as a political football or by establishing a fiscal framework with forward-looking spending and debt targets doesn’t really matter currently What is absolutely essential, is that a consensus is reached within a short period of time or the consequences will be nothing short of disastrous.