Darren Krett

Tuesday 31 January 2023

Elements of an Option Price

0

Comments (0)

Darren Krett

Friday 10 February 2023

Share on:

Post views: 9934

Categories

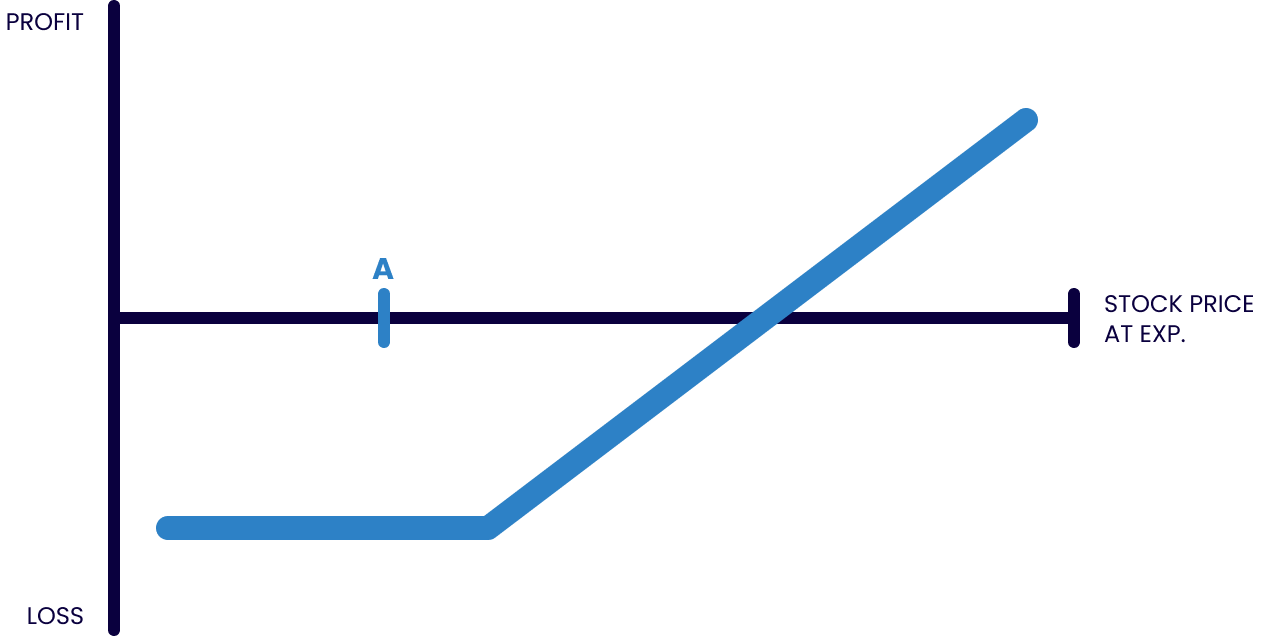

General

Definition: A call option is a contract between a buyer and a seller whereby the instrument at a fixed price on or before a fixed date, should the buyer of the call buyer acquires the right, but not the obligation, to buy a specified underlying wish to exercise the option. The seller of the call assumes the obligation of delivering the instrument should the buyer wish to exercise the option. With prices constantly rising and falling, owning a call option would allow you: the right to buy the underlying asset at a specific price on or before a specific date. It effectively guarantees the maximum price at which you could purchase a particular stock.

If/when the option is exercised, the holder gets a long stock position at the option's strike price.

A call option's pricing discounts future prices in equities . A call is effectively a long forward position with insurance.

The value of a call normally rises when the price of the future goes up.

Should the price of the future decrease below the strike price of the option_ you would not exercise it and your contract would expire worthless. (You trading.)would not want to buy the future at a price higher than where it is currently trading

LONG CALL:

Darren Krett

Tuesday 31 January 2023

0

Comments (0)

Darren Krett

Friday 10 February 2023

0

Comments (0)