Darren Krett

Wednesday 7 June 2023

CALL OPTIONS

0

Comments (0)

Darren Krett

Friday 9 June 2023

Share on:

Post views: 3674

Categories

Option Strategies

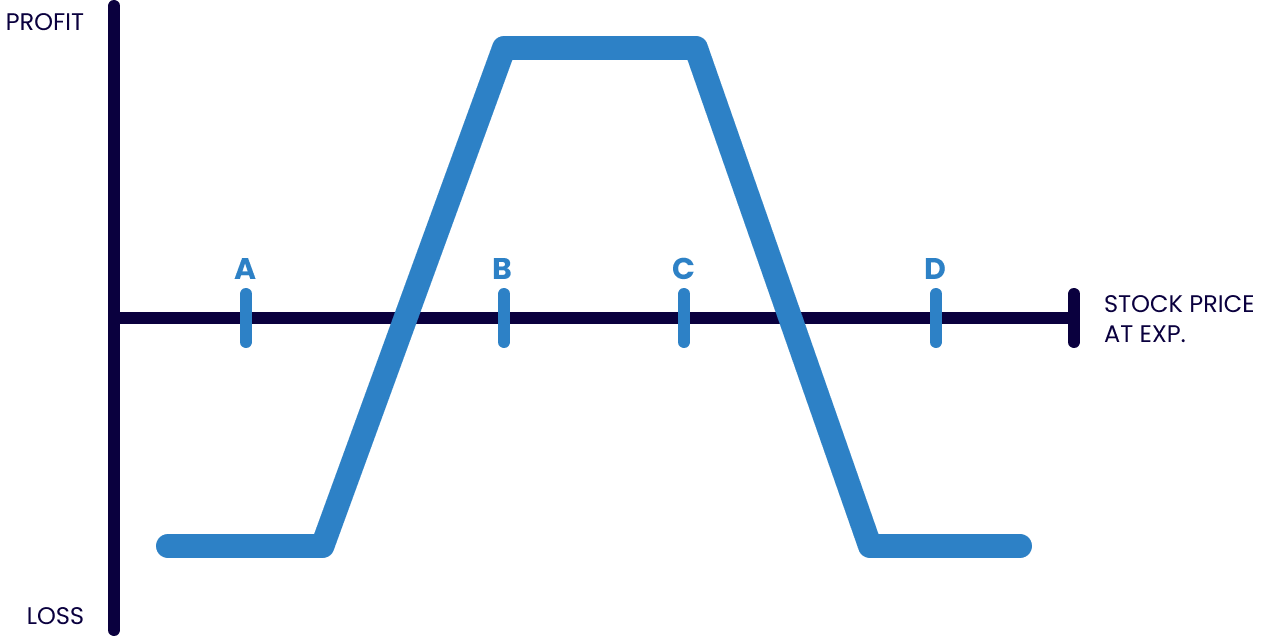

This structure can simply be described as tying off the open ended risk involved in a Call Tree.

In the earlier example of the 100/125/150 Call Tree, we would just buy an additional Call above our 2 short 125 and 150 Calls.

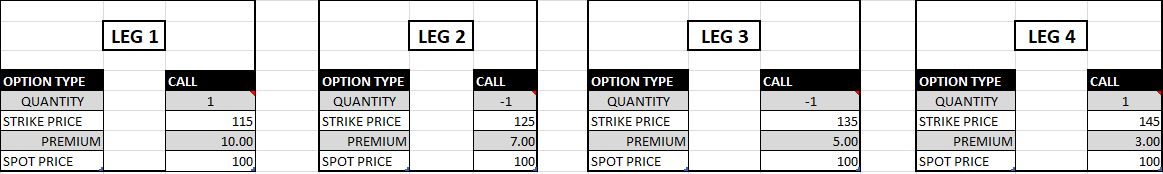

Any strike above it would work, but let’s keep it equidistant for discussion and do the 100/125/150/175 Call Condor. The end structure would be long 1x the 100 Call/short 1x the 125 Call/short 1x the 150 Call/ long 1x 175 Call. The Max profit is same as that of a Call spread, the Strike differential less the premium paid for the structure. By adding the upper Call, the Max Loss is now limited to the Premium paid for the Condor. The great thing about the equidistant Call Condor is it is usually fairly cheap to purchase, albeit more expensive than a Fly due to the wider profitable landing zone. The bad things are that is doesn’t usually pick up in price until expiration nears and it is very hard to pick an exact target price. If you buy a 100/125/150/175 Call Condor for $7, your break evens are 107 to 168. That is a nice wide landing zone, but if the market lands outside of 107 to 168, you start losing your premium paid.

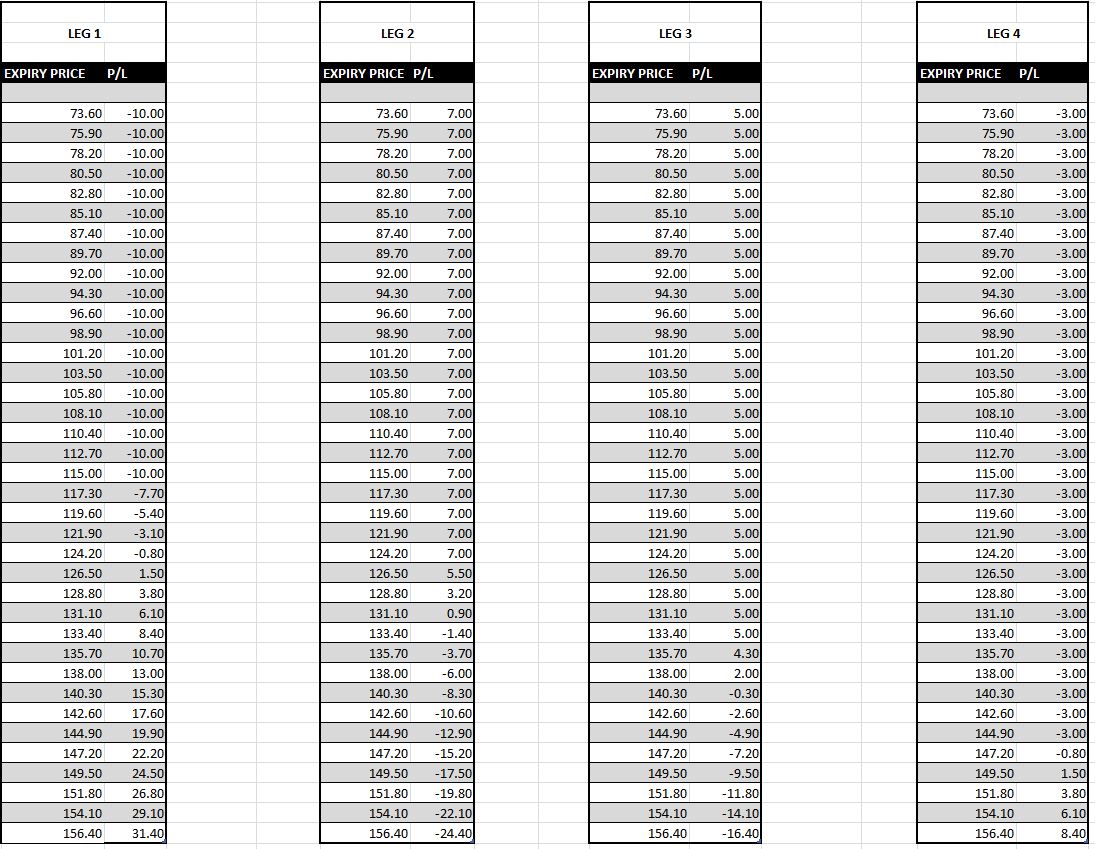

Throughout the learning section I will advise you to manually do an expiration Profit & Loss table. This allows you to visualize exactly what it is that you are doing and is something all beginner traders do to start learning about strategies.

YOU then just need to work out each individual leg profit and loss then net it out in a graph

Darren Krett

Wednesday 7 June 2023

0

Comments (0)

Darren Krett

Friday 9 June 2023

0

Comments (0)