Darren Krett

Friday, 9 June 2023

CALL TREE (Also called a Call Ladder)

0

Comments (0)

Stay ahead and keep your mind focused.

Categories

Learning

Option Strategies

A Put Tree is very similar to a Put Spread 1x2.

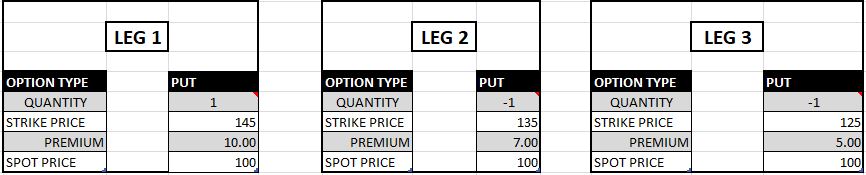

The only real difference is instead of having 2 of the lower strike Put, that strike will be distributed among 2 strikes. For example: the 125/100 Put Spread 1x2 would now be changed to the 125/100/75 Put Tree. This structure still allows the buyer to cheapen the Put Spread, however by a lesser amount. It also lessens the risk profile as there is a greater distance to reach the short Put Strike. The Max profit is same as that of a Put spread, the Strike differential less the premium paid (or collected) for the structure.

The loss side is much more difficult to explain because you essentially have two separate trades on. You own a Call Spread and you are short a Call.

If you think about the Max loss potential on both trades they are as follows: The long Put Spread max loss is only the premium you paid for the structure, but the max loss for being short a Put is unlimited. Therefore, in theory, your possible max loss on a Put Tree is also unlimited. In order to win on a Put Tree, the market needs to grind higher at a slow pace towards your short Strike. If it moves lower too fast, you will feel market to market pain as your 2 short Puts will gain in price more quickly than your 1 long Put.

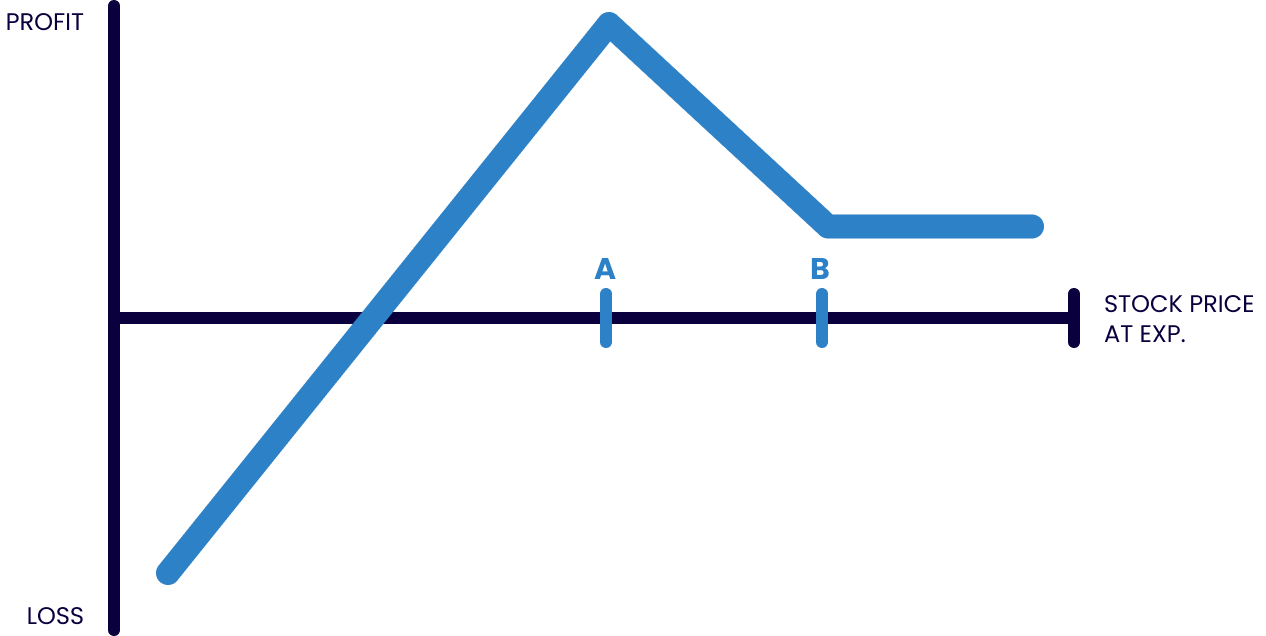

Here is your expiration Profit & loss graph

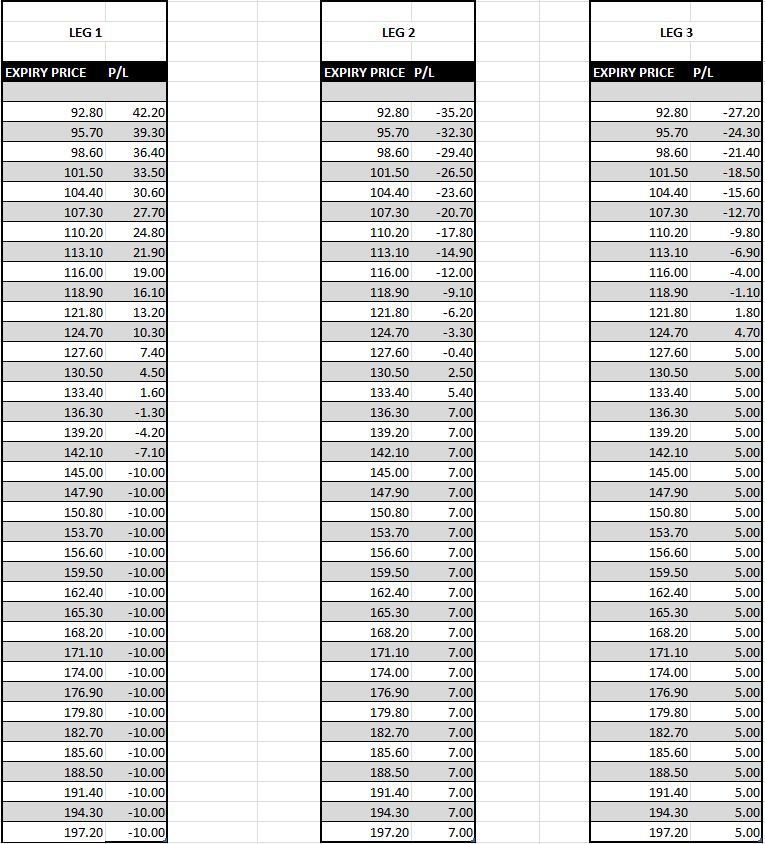

Throughout the learning section I will advise you to manually do an expiration Profit & Loss table. This allows you to visualize exactly what it is that you are doing and is something all beginner traders do to start learning about strategies.

YOU then just need to work out each individual leg profit and loss then net it out in a graph

Darren Krett

Friday, 9 June 2023

0

Comments (0)

Darren Krett

Thursday, 8 June 2023

0

Comments (0)

Get ahead of the wave and sign up to our socials to get access to exclusive offers, videos, tutorials and latest news.

© 2015 - 2024 Leviathan Financial Management LLC. All Rights Reserved.

Legal Disclaimer: The information provided in the Leviathan website is for informational purposes only. It should not be considered legal or financial advice. You should consult with a financial advisor professional to determine what may be best for your individual needs. Leviathan Financial Management does not make any guarantee or other promise as to any results that may be obtained from using our content. No one should make any investment decision without first consulting his or her own financial advisor and conducting his or her own research and due diligence. To the maximum extent permitted by law, Leviathan Financial Management disclaims any and all liability in the event any information, commentary, analysis, opinions, advice and/or recommendations prove to be inaccurate, incomplete or unreliable, or result in any investment or other losses. Content contained on or made available through the website is not intended to and does not constitute legal advice or investment advice. Your use of the information on the website or materials linked from the Web is at your own risk.