Darren Krett

Friday 10 February 2023

WHAT IS THE "UNDERLYING"?

0

Comments (0)

Stay ahead and keep your mind focused.

Categories

Learning

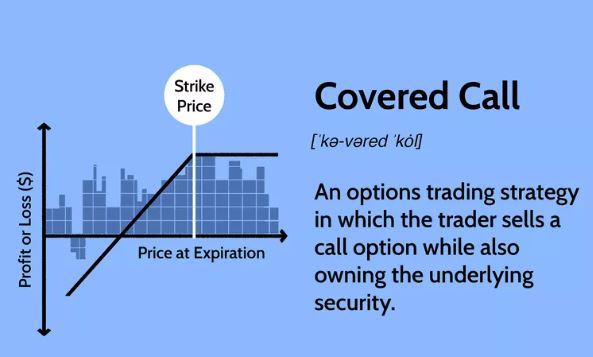

o Most common options strategy in use

o Can be used to increase the rate of return of a position o Reduces downside risk by reducing capital tied up o Can be used to sell a position when waiting for a rally

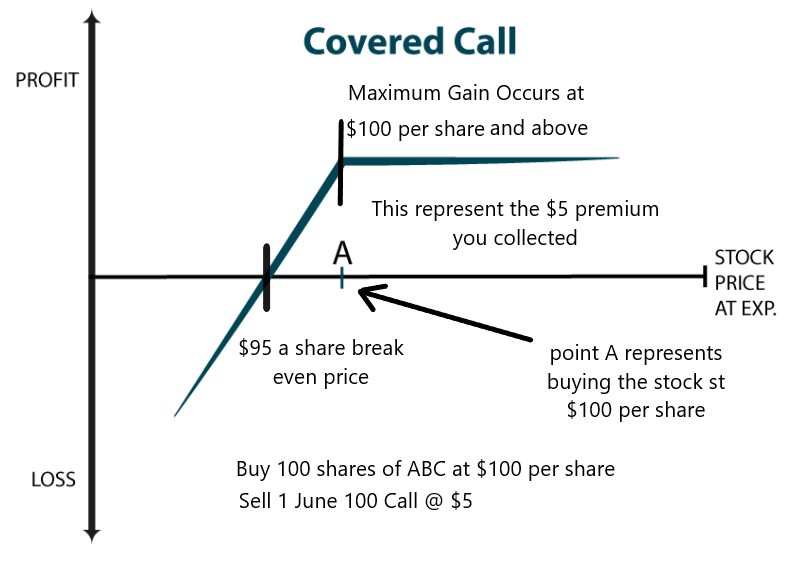

2 possible outcomes:

o Underlying is above the strike of the call and the option is assigned Underlying is below the strike price and the option expires worthless giving you opportunity to sell again in a further out month Flexibility to close the position in advance if: o Your expectations for the underlying have changed and you want to sell it at its current market price o You upwardly revise your target for the underlying

3 things to keep in mind:

o Your satisfaction with the effective selling price

Underlying could reach target and fall back by expiration

o You need to cover the short call if you want to sell future ahead of

time-possibly at a loss-or maintain the risk of uncovered calls

Darren Krett

Friday 10 February 2023

0

Comments (0)

Darren Krett

Friday 10 February 2023

0

Comments (0)

Get ahead of the wave and sign up to our socials to get access to exclusive offers, videos, tutorials and latest news.

© 2015 - 2024 Leviathan Financial Management LLC. All Rights Reserved.

Legal Disclaimer: The information provided in the Leviathan website is for informational purposes only. It should not be considered legal or financial advice. You should consult with a financial advisor professional to determine what may be best for your individual needs. Leviathan Financial Management does not make any guarantee or other promise as to any results that may be obtained from using our content. No one should make any investment decision without first consulting his or her own financial advisor and conducting his or her own research and due diligence. To the maximum extent permitted by law, Leviathan Financial Management disclaims any and all liability in the event any information, commentary, analysis, opinions, advice and/or recommendations prove to be inaccurate, incomplete or unreliable, or result in any investment or other losses. Content contained on or made available through the website is not intended to and does not constitute legal advice or investment advice. Your use of the information on the website or materials linked from the Web is at your own risk.