Darren Krett

Friday 6 October 2023

Weekly Market Series

0

Comments (0)

Darren Krett

Friday 17 November 2023

Share on:

Post views: 3503

Categories

Blog

Hello everyone, Darren from Leviathan financial management. , welcome to your weekly playbook for November the 17th.

Firstly & most important thing to know is that next week is the Thanksgiving holiday here in the U S. So we're going to be light on numbers. The markets will probably be thin and whippy as we head into a holiday weekend. People will go away to meet their families for that weekend here in the US, it is pretty much as big as Christmas. So bear that mind for European guys.

Anyway, we still have numbers that are due out and I am going to look at NVIDIA.

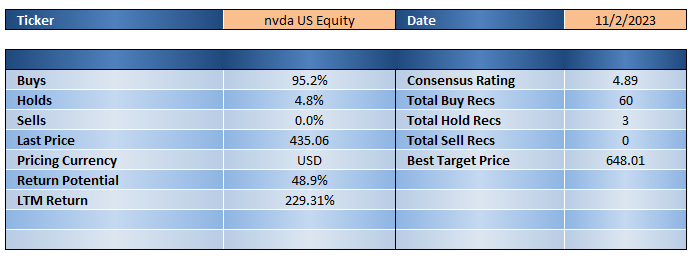

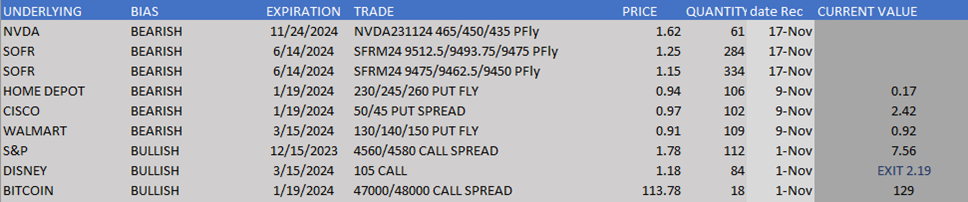

Nvidia, bit range bound at the moment. , but I am given the recent rally in the stock market, going for a downside play.

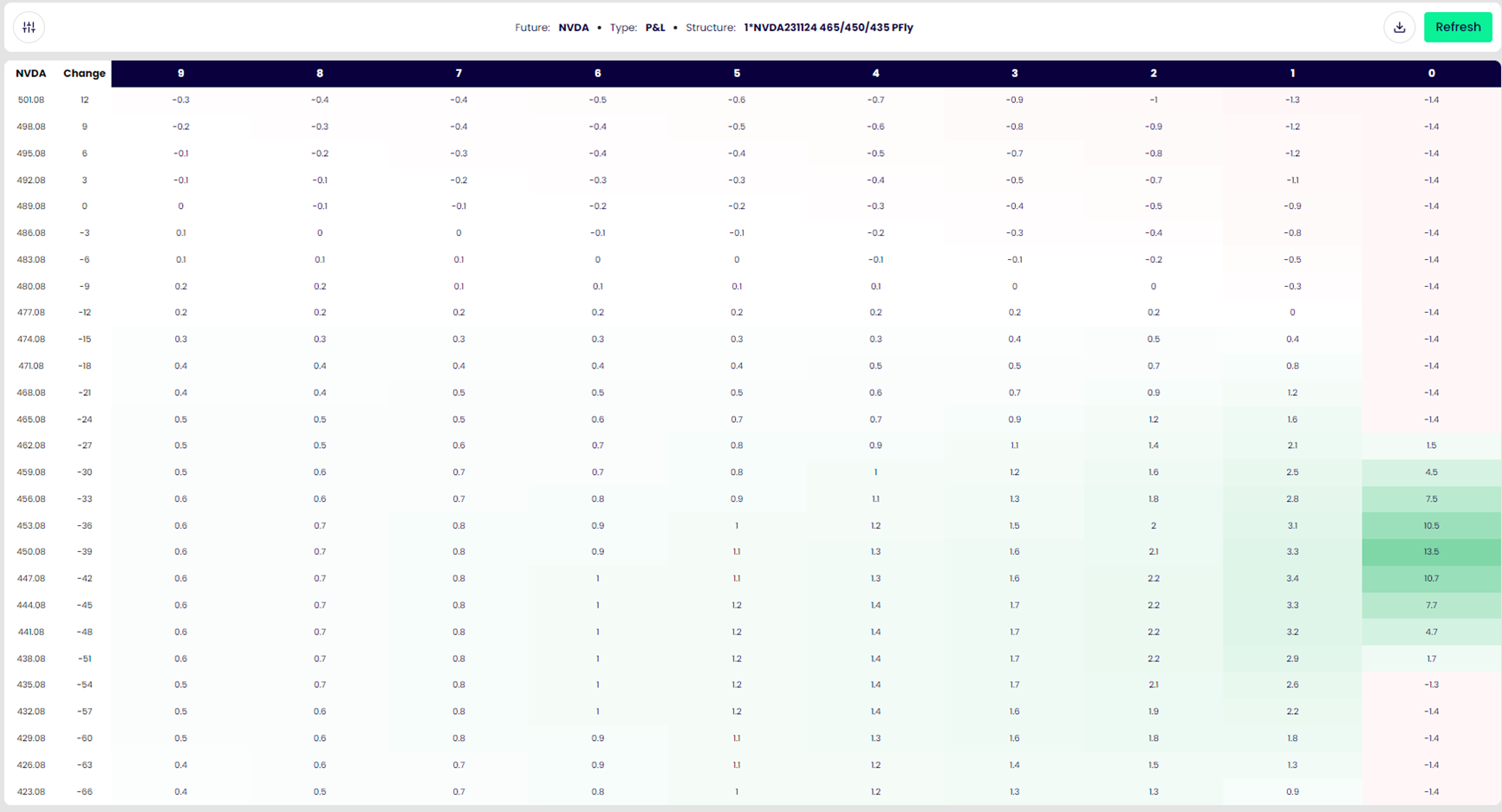

We have, , analysts always bullish.  They're looking for higher numbers, but I am going to target the $450 area , it's an earnings play so I am focusing on a 10 day play. And, but I want to give myself the best chance of winning. So even if the market just downturns, we're probably gonna like make money on this trade.

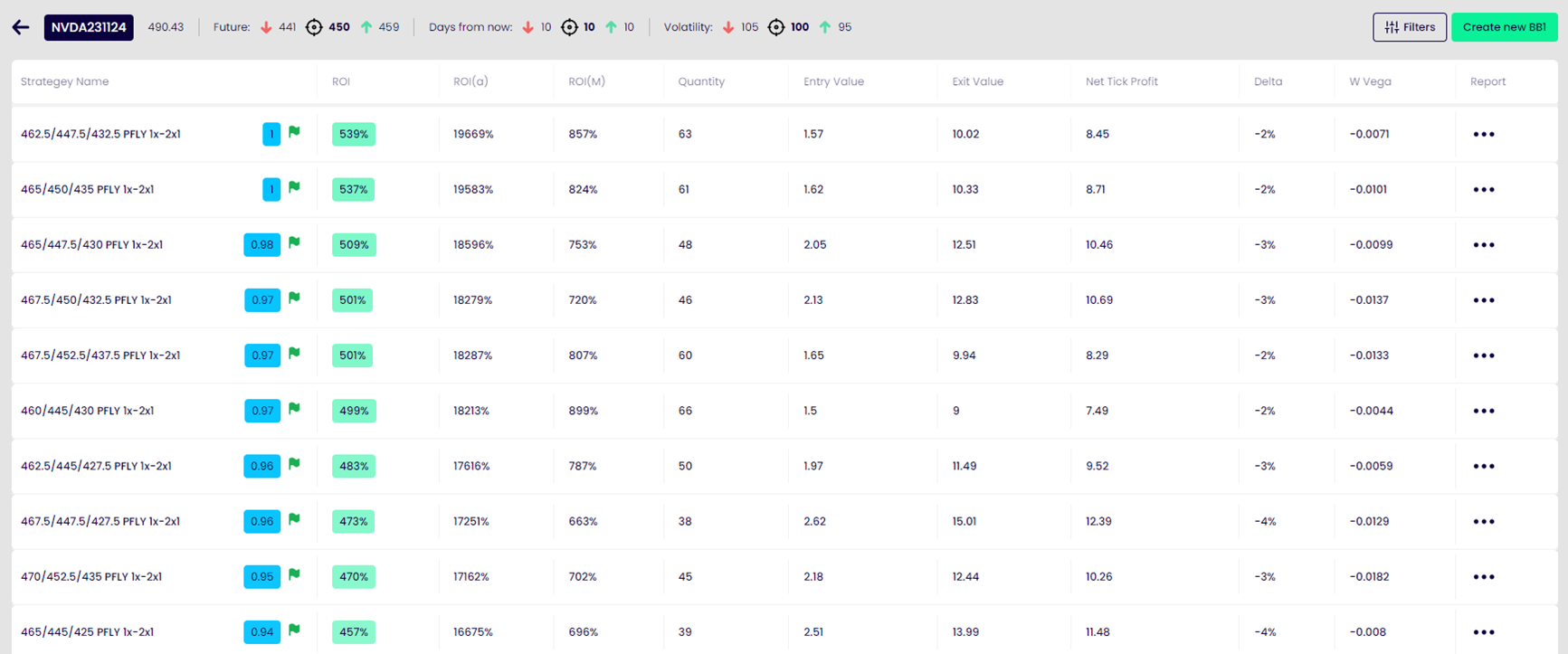

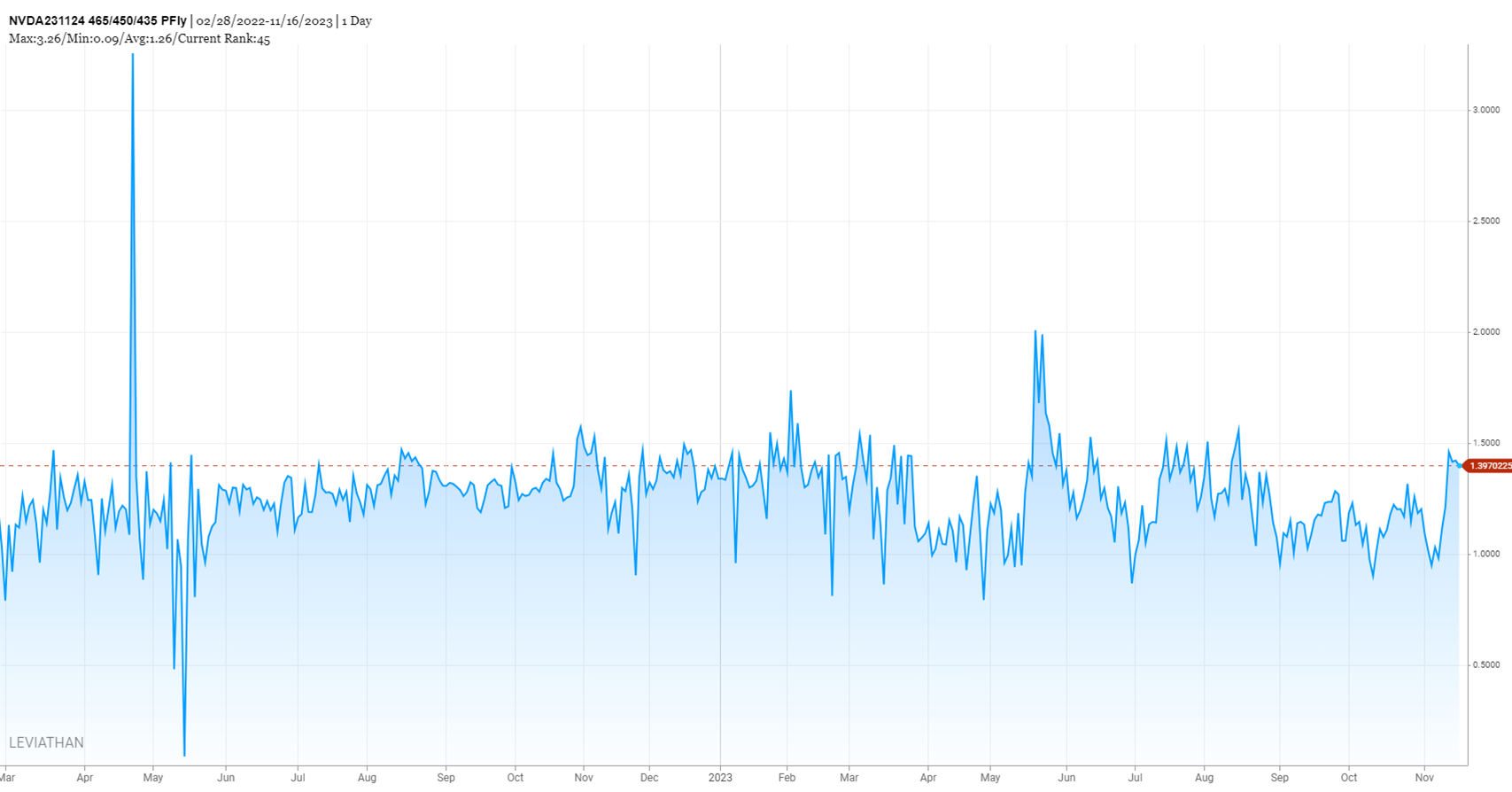

They're looking for higher numbers, but I am going to target the $450 area , it's an earnings play so I am focusing on a 10 day play. And, but I want to give myself the best chance of winning. So even if the market just downturns, we're probably gonna like make money on this trade. it is not a swing for the fences type of trade so with that in mind, the trade that I picked was the 435/450/465 put fly, expiring in November. It's currently fair value.

it is not a swing for the fences type of trade so with that in mind, the trade that I picked was the 435/450/465 put fly, expiring in November. It's currently fair value. It's not, expensive or cheap relatively speaking, but it will monetize quickly for you as we go down and if it stays around the area, which it could quite easily do if it stays in that trend line, then you will make money going forward.

It's not, expensive or cheap relatively speaking, but it will monetize quickly for you as we go down and if it stays around the area, which it could quite easily do if it stays in that trend line, then you will make money going forward.

Next I'm gonna focus on interest rates, short term interest rates, more specifically.  the talk has been about whether the Fed is on hold now, and how long will it be on hold going forward. Well, it would seem that the Fed, , indicated that that is it for now. But the markets are anticipating a lot of cuts for next year, which gives opportunity to take 2 possible opposing stances.

Earlier this year, we were pricing in cuts. As early as September. Clearly that didn't pan out and once again we are pricing in over 100 basis points of rate cuts, next year. Which may seem a little aggressive.

For those of you who are not used to this product, SOFR (The Secured Overnight Financing Rate) is a broad measure of the overnight cost of borrowing cash collateralized by Treasury securities, it is traded on the CME. , It will price the rate by contract a 100 minus whatever the current rate is.

So if, for example, if we expect rates to stay at five and a half percent, then you would expect an expiration in that future contract of 94.50. There are lots of many moving parts to this. But in this instance, if you're looking at the rate market to remain unchanged, which is currently 5.38% the we would expect the SOFR futures to be, 9462 .

So what if they do not cut rates or if they only begin to start cutting in June of next year, are there any trades you can put on to make a decent return on?

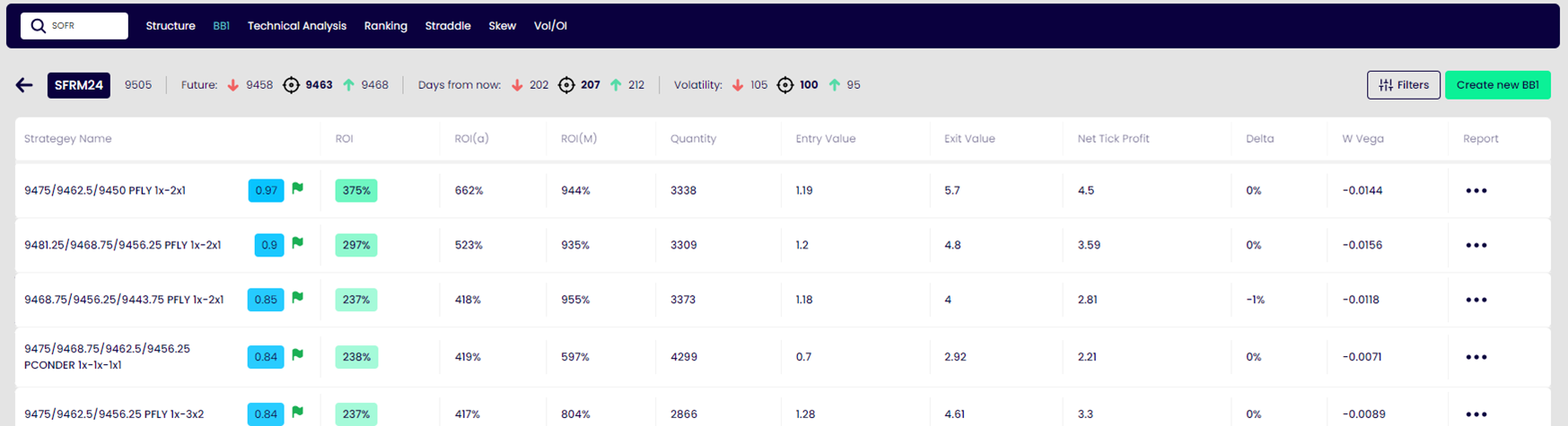

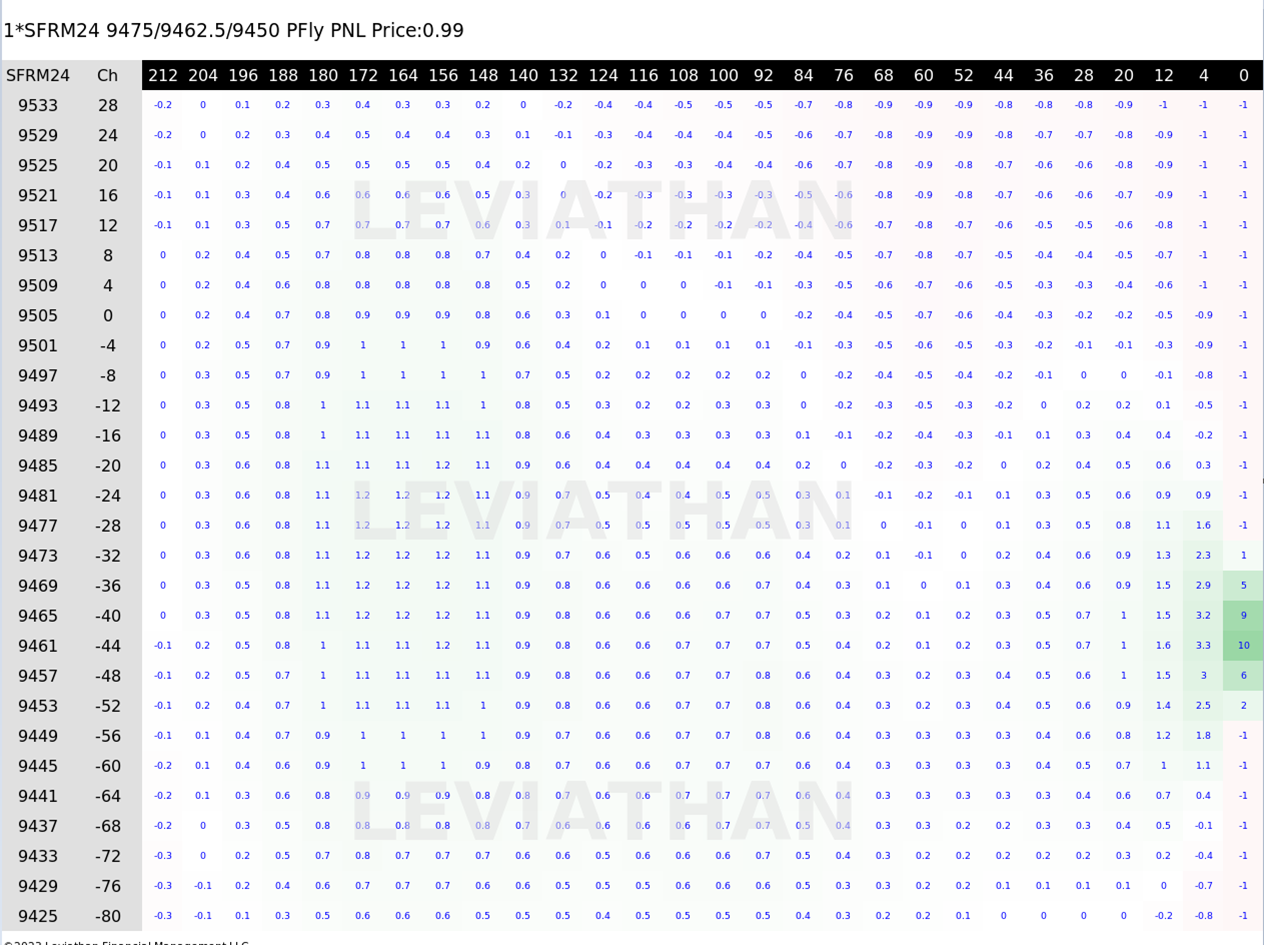

We asked big boy to look at these scenarios and for rates unchanged it likes the SOFR JUNE 9450/9462.5/9475 PUT FLY You're looking at a 370 percent return.

the talk has been about whether the Fed is on hold now, and how long will it be on hold going forward. Well, it would seem that the Fed, , indicated that that is it for now. But the markets are anticipating a lot of cuts for next year, which gives opportunity to take 2 possible opposing stances.

Earlier this year, we were pricing in cuts. As early as September. Clearly that didn't pan out and once again we are pricing in over 100 basis points of rate cuts, next year. Which may seem a little aggressive.

For those of you who are not used to this product, SOFR (The Secured Overnight Financing Rate) is a broad measure of the overnight cost of borrowing cash collateralized by Treasury securities, it is traded on the CME. , It will price the rate by contract a 100 minus whatever the current rate is.

So if, for example, if we expect rates to stay at five and a half percent, then you would expect an expiration in that future contract of 94.50. There are lots of many moving parts to this. But in this instance, if you're looking at the rate market to remain unchanged, which is currently 5.38% the we would expect the SOFR futures to be, 9462 .

So what if they do not cut rates or if they only begin to start cutting in June of next year, are there any trades you can put on to make a decent return on?

We asked big boy to look at these scenarios and for rates unchanged it likes the SOFR JUNE 9450/9462.5/9475 PUT FLY You're looking at a 370 percent return.

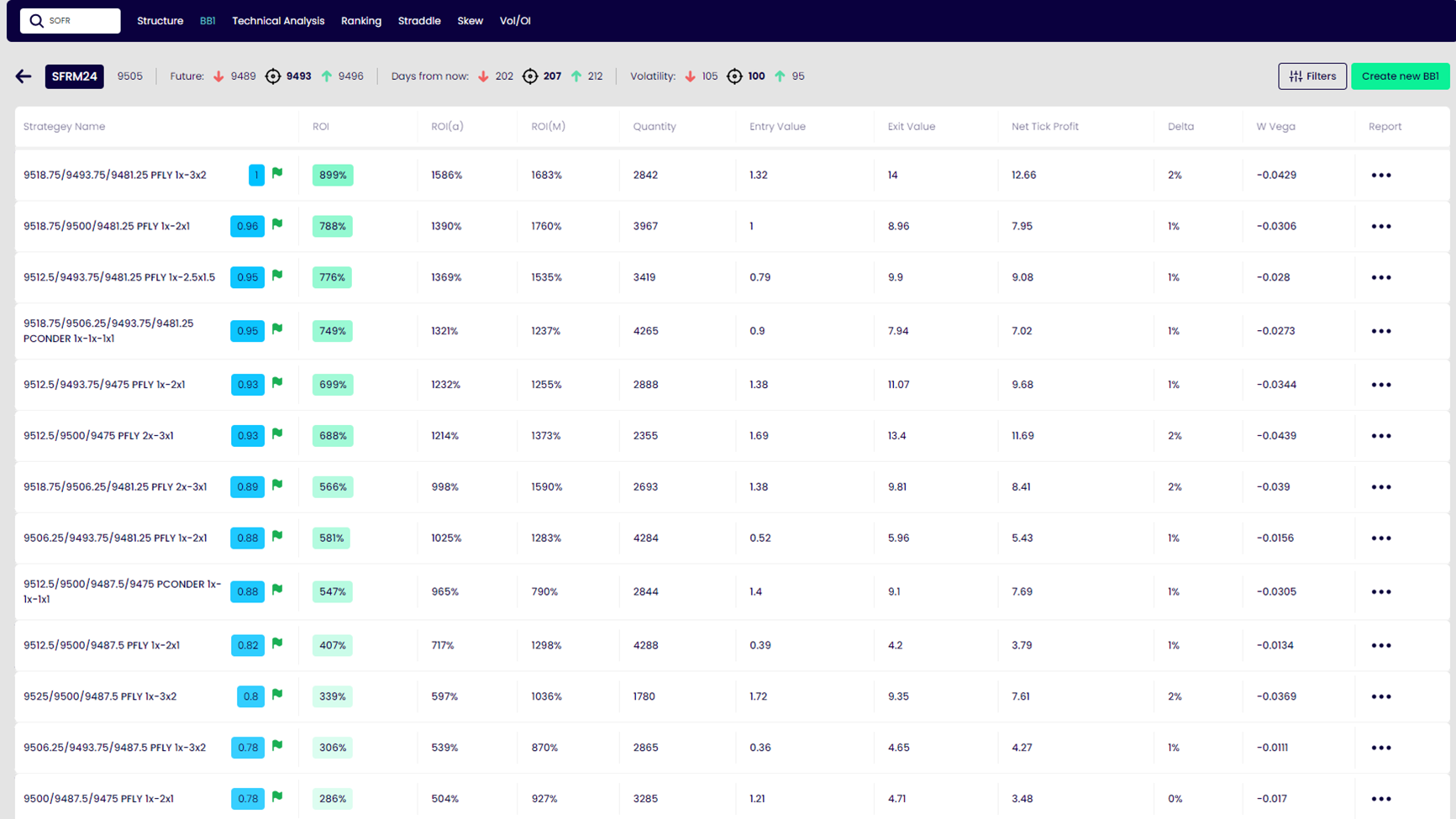

But what if you think that we are going to get one cut by June, which seems very possible , then we can ask Big Boy once again, what is the best trade.

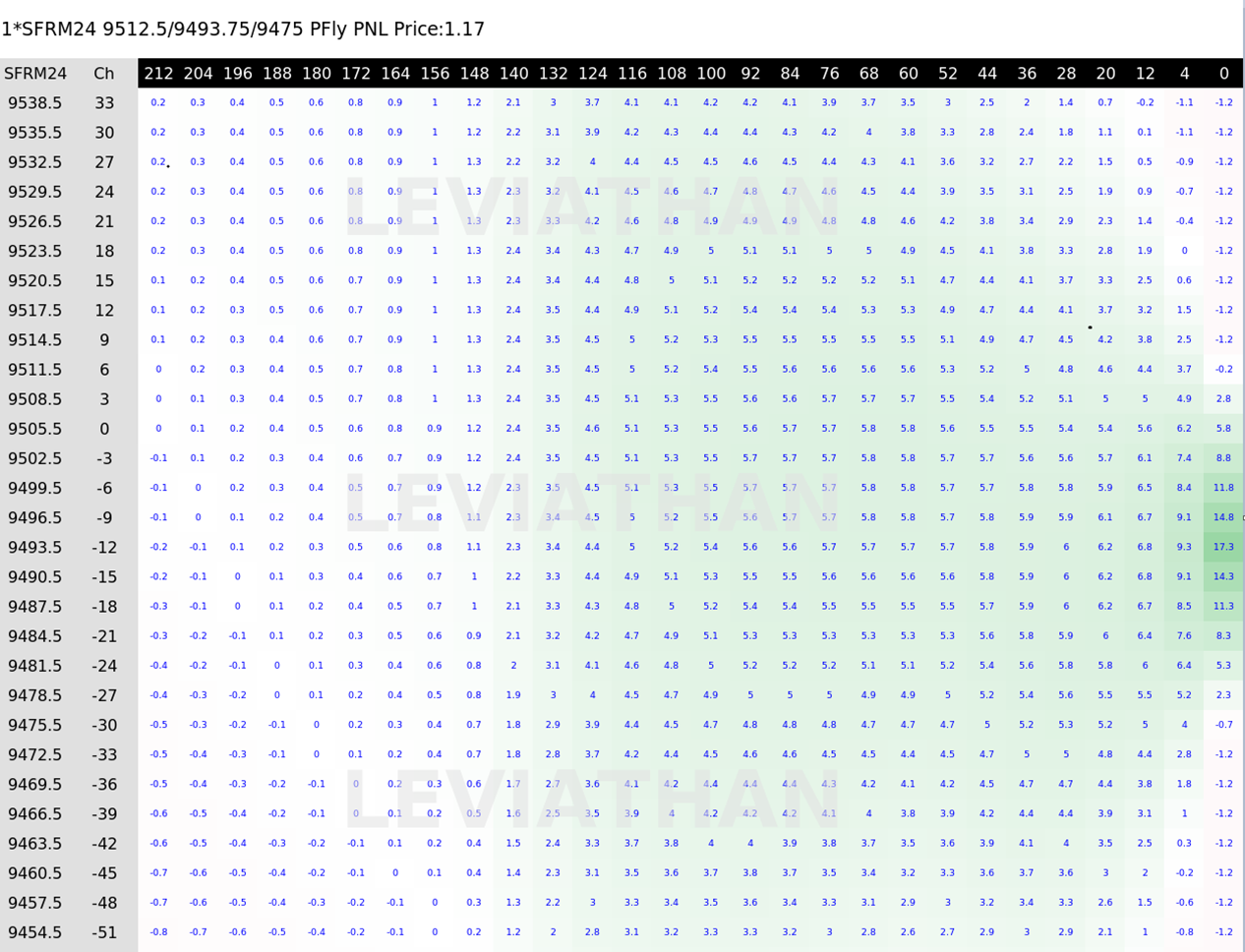

But what if you think that we are going to get one cut by June, which seems very possible , then we can ask Big Boy once again, what is the best trade. And then based off of that view we like the 9475/9493.25/95.125 put fly for 1 tick. 1 tick in this particular futures market is valued at $25

It is a great trade for the implication that we are going to cut one time before June. Based on the where we are in terms of the economic cycle the realistic odds of either of these ideas is more than reasonable. That you can get over a 500% return is a great return on investment.

And then based off of that view we like the 9475/9493.25/95.125 put fly for 1 tick. 1 tick in this particular futures market is valued at $25

It is a great trade for the implication that we are going to cut one time before June. Based on the where we are in terms of the economic cycle the realistic odds of either of these ideas is more than reasonable. That you can get over a 500% return is a great return on investment. So, looking back over the trades that we're looking at this week, we've got NVIDIA, a bearish trade, the 435/450/465 put fly,

for SOFR. If you think rates are going to be unchanged, then, , go for the 9450/ 9462. 5/9475 put fly paying just over a tick for that. And if you think they're going to cut just once,, then go for the 9475/9493.25/95.125 put fly put fly at one and a quarter ticks. These are including costs and are, depending on your view, great returns.

So, looking back over the trades that we're looking at this week, we've got NVIDIA, a bearish trade, the 435/450/465 put fly,

for SOFR. If you think rates are going to be unchanged, then, , go for the 9450/ 9462. 5/9475 put fly paying just over a tick for that. And if you think they're going to cut just once,, then go for the 9475/9493.25/95.125 put fly put fly at one and a quarter ticks. These are including costs and are, depending on your view, great returns.

Going back looking at the trades we recommended recently , Home Depot, actually rallied along with the market, so our put fly actually sucked. that's, that wasn't good, but, , the Cisco 45/50 put spread, that absolutely killed it. We suggested buying that at 94 cents, it's now $2.42.

The Walmart put fly we suggested is scratch. we were bullish on the S& P & the call spread that was, we suggested buying at 178 is now 756.

Disney we suggested closing out of that we bought it at 118, the 105 call and we sold it at 219. And then finally the Bitcoin, uh, 47, 000, 48, 000 call spread.

That's also up. Now we suggested buying that $113, now $129, so overall we've done pretty well if you've been actually listening to our suggestions.

Going back looking at the trades we recommended recently , Home Depot, actually rallied along with the market, so our put fly actually sucked. that's, that wasn't good, but, , the Cisco 45/50 put spread, that absolutely killed it. We suggested buying that at 94 cents, it's now $2.42.

The Walmart put fly we suggested is scratch. we were bullish on the S& P & the call spread that was, we suggested buying at 178 is now 756.

Disney we suggested closing out of that we bought it at 118, the 105 call and we sold it at 219. And then finally the Bitcoin, uh, 47, 000, 48, 000 call spread.

That's also up. Now we suggested buying that $113, now $129, so overall we've done pretty well if you've been actually listening to our suggestions.

Next week we have little in the way of economic news but we do have durable goods. But obviously the main focus is going to be the fact that it's Thanksgiving holiday followed by Black Friday. So expect thin, whippy markets. The reason that I switched my focus to interest rates is because they're slightly longer term view trades And that I would suggest avoiding. , short term plays next week just because the major market participants are probably going to be away

That's all from me. Everyone, be lucky. Have a great weekend. And as always, good luck trading.

So expect thin, whippy markets. The reason that I switched my focus to interest rates is because they're slightly longer term view trades And that I would suggest avoiding. , short term plays next week just because the major market participants are probably going to be away

That's all from me. Everyone, be lucky. Have a great weekend. And as always, good luck trading.

Darren Krett

Friday 6 October 2023

0

Comments (0)

Darren Krett

Tuesday 28 March 2023

0

Comments (0)