Darren Krett

Monday 31 October 2022

This week's upcoming earnings reports

0

Comments (0)

Darren Krett

Saturday 21 October 2023

Share on:

Post views: 2990

Categories

General

https://youtu.be/LrOwH2lkJIY?si=DkwV3xrTzq_fQNPn

In this week's video we look at option opportunities with the upcoming earnings of Meta (Facebook), Alphabet (Google), Amazon and a rather good opportunity in a Microsoft option strategy while reminding you that we have the Fed's favorite inflation gauge , the PCE numbers at the end of the week too

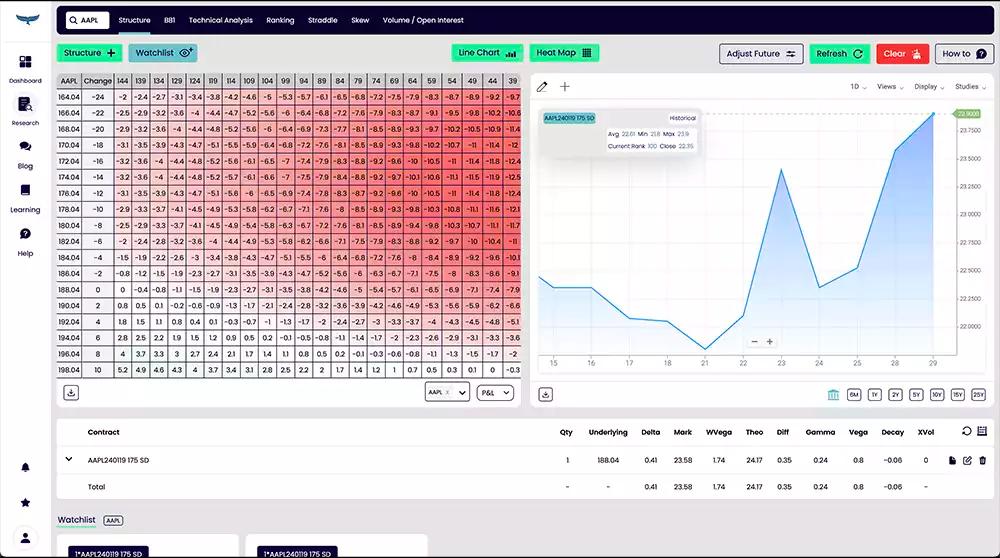

TRANSCRIPT: Hi everyone, Darren at Leviathan Financial with your weekly financial market report. Turning away from the horrible news that's been coming out of Middle East this week, we're going to focus on earnings and trades that you can do to take advantage of potential moves. A couple of weeks ago, we recommended looking at a downside fly in Tesla, getting in at around 30 cents for this particular trade. As we speak now, that's looking rather good. , a dollar and one cent as a theo value. , as, Tesla has indeed come off, coming off 9 percent today, , as people did not like what Musk was saying and the resulting numbers from there. But looking ahead, we are looking for next week, and we have Microsoft, Google, Amazon, and Facebook, / meta, all coming out with their third quarter earnings. So what can we do to take advantage of that? Well, Microsoft, a lot of analysts looking to [00:01:00] upside trades. They're targeting well over 400 on the longer term. I like that chart by the way. , it looks like it's breaking out to the upside and could definitely have a go to the high we saw back in June. So, with that in mind, the high was just over $359. I'm going to target an area price of $360. But I want a bigger landing strip. So $353 to $374 and I want to see that by the end of the year. So, , what was the best trade to do? And looking at these trades here, the one that I like the most giving you a 475 percent return on your money, is this trade here. Call fly , one by four by five, you'd be doing 183 times. So here are the ratios. You'd be buying 183 selling 732 by 915 net, your price is going to be 47 cents, including costs. I love this trade expiring in December. So you've got a little wiggle [00:02:00] room. It's also badly mispriced at the moment. It's in its third percentile looking back over the last, , two years. So this means that like looking back at equivalent trades, similar out of the money, , strategies of this ratio. This is being priced in its third percentile. It's unusually low. It's a good time to take advantage of it. And as you can see here from the heat map, green good, red bad, it will monetize very quickly and looks great to the upside. And if it goes even further, you'll continue to make more and more money. So we like that trade a lot. , we'll look back on that and I would highly recommend doing that one. Next up Facebook on this one as you can see chart doesn't really help you too much. I'm, I actually fancy a little go to test the downside on this one. So We're trading 320. I'm gonna target 285 Between 274 and [00:03:00] 296 I want to be making money With the target price of 285. And what can I do with that? Well, the system ran through it. Regular fly, one by two by one, 42 times buying the 270 put, selling 84 buying 42 of the 310. Your net price is 233. That's why you're doing less of these, a little bit more of an expensive strategy. , price wise, it's just, it's only 69th percentile. So, I think a lot of, , market makers are pricing that that's got a chance to come in as well. , but you know, if you're right, it's still gonna, do pretty well. It'll monetize well on the downside. , ideally though, you want it to kind of stay in that lower area. If that's the case, as you can see here, this is one that's more of a traditional fly. So you want to hold it closer to expiration. Next up, Google. I. I like this trade as well. I don't, just targeting a small downside [00:04:00] move to 127 and on this one I'm looking more shorter term. So instead of a December expiration, November expiry. And the best trade it liked here was a put fly, again ratio 1x4x4, so this time 51 times. You're buying 51 of the highest strike, selling 204 by 204 of the, of the lowest strike, , paying $1.93 net out for this one. , it's a short term trade, again, monetizes well, if you're targeting that area correctly. Um, it's a, it, again, you're hoping that it will target your 135 area. coming up to expiration. So this one's more of a like, this is where it's going to be next month as opposed to what it will be tomorrow. It's, you'll still make a little bit of money on it. , if we do come off a little bit, nothing too aggressive.[00:05:00] But , that was pretty good. But that's why I looked at that more short term. , finally, we've got Amazon. As far as the chart goes. Heading back towards a trend line, but you know, I fancy that for a bit of a retry, another go to the upside as far as charts go. So I'm going to target the 160 area in this one and giving me some wiggle room. I want to make money between 155, 165 at least targeting 160. And, big boy came out. With actually liking some very basic trades here. , maybe just buy a 155 call outright. 94 times as you can see there. The trade I ended up choosing was a call spread just because, you know, it's only 83 cents. , nice, simple, you can do it 120 times. Buying the 155 calls, selling 120 to 170 calls. , this one's fairly priced, but it's in its lower third. So it's good value. And so I would, I quite like this trade. And as you [00:06:00] can see here from the heat map, do very well if we go up and so that will monetize very quickly and you can hold it and it will do better over time as well. Next week, , we have the Fed's favorite number, the PCE index and personal income, , and core PC. This. is Jerome Powell's favorite number to gauge where inflation is. Inflation will guide their, , move on rates, which will in turn affect the stock market and your portfolio. So watch out for that number at the end of, uh, next week. Uh, we did see, and given the rhetoric he, , he came out with today in a speech. that the 10 year is probably gonna have another go or have a go at 5%, a a return that we have not seen for many years. The 30 year bond breach 5% today and close comfortably above that , but the stock market still seems to be holding up pretty well, in the face of all this adversity, which is why. Couple of the trades we looked at for the upside because if it's not going down There's only one way else for it to go. But anyway, we shall see Anyway, good luck trading everyone and have a great weekend

Darren Krett

Monday 31 October 2022

0

Comments (0)

Tyler Krett

Tuesday 10 October 2023

0

Comments (0)